Author: James Organ | Posted On: 16 Jan 2026

Australian building approvals

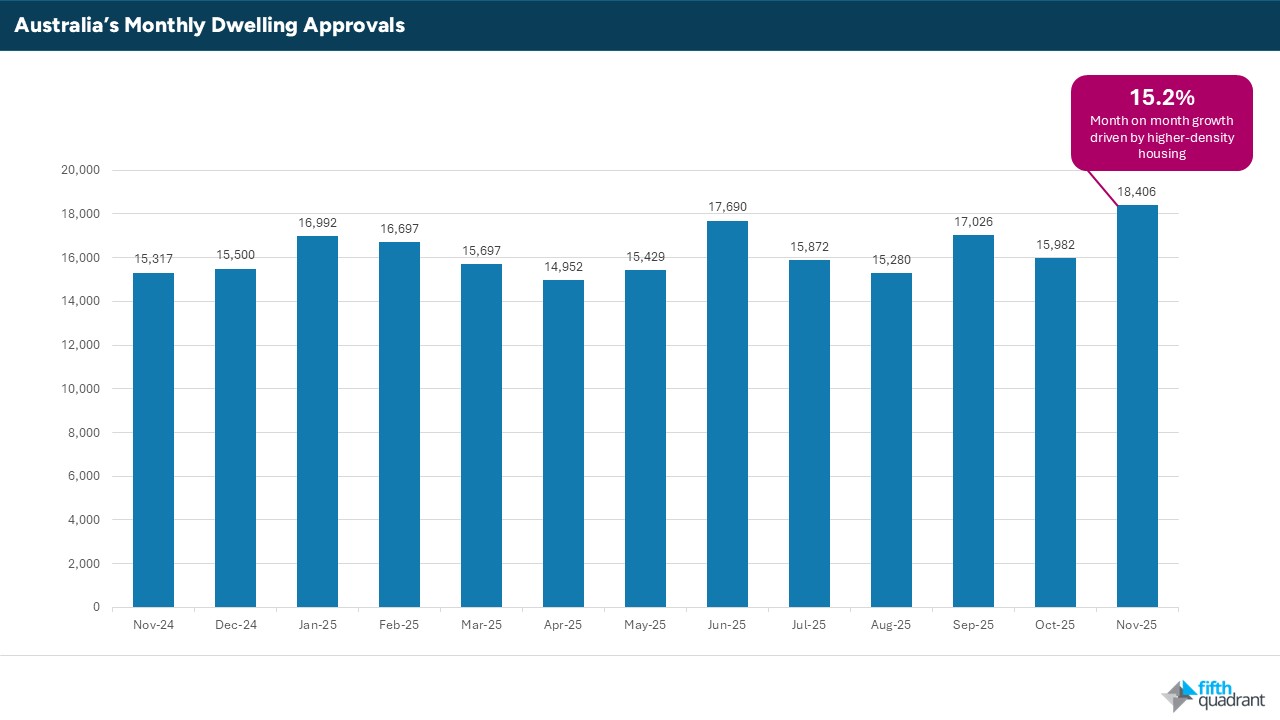

Australian building approvals had a strong rebound with dwelling approvals in November 2025, up 15.2% month on month, signals renewed momentum in residential construction after a prolonged period of weakness. On the surface, this is welcome news for policymakers and the construction sector alike, particularly given persistent concerns about housing undersupply. However, a closer look at the composition of approvals suggests that the key challenge ahead is not demand, but delivery.

The growth in approvals is being driven almost entirely by higher density housing. Approvals for private sector dwellings excluding houses jumped 34.1% in November, while approvals for detached houses were largely flat. This divergence reflects both affordability pressures and policy settings that increasingly favour medium and high density development, especially in metropolitan areas along the east coast.

This shift matters because it highlights a growing disconnect between approvals and the industry’s ability to convert those approvals into completed dwellings at scale and at speed. Australia’s residential construction sector continues to face deep structural constraints, including persistent labour shortages, elevated and volatile input costs, and long standing productivity challenges. As a result, rising approvals do not automatically translate into rising completions, particularly for more complex higher density projects.

Where modular and prefab fit

Modular and prefabricated construction aligns closely with the type of housing now gaining approval momentum. Apartments, build to rent developments, student accommodation and social housing are all well suited to off site manufacturing due to their scale, repetition and need for faster delivery timelines. These segments also place a premium on cost certainty and build quality, both of which are theoretically strengthened by industrialised construction methods.

In theory, modular construction can:

- Shorten build times, modular and prefab construction can shorten overall build times by enabling parallel on site and off site activity.

- Reduce reliance on scarce on-site labour by shifting work into factory environments.

- Improve cost certainty and build quality by limiting exposure to weather delays and on site inefficiencies

- Lower waste and emissions, supporting broader sustainability and productivity objectives.

Taken together, these benefits directly address many of the constraints currently limiting Australia’s ability to turn approvals into completed homes.

Why adoption is still low

Despite these advantages, uptake of modular and prefabricated construction in Australia remains limited. The barrier is not technical feasibility, but structural and institutional inertia.

- Risk-averse development and finance models favour traditional construction methods that lenders, valuers & investors understand well.

- Financing and valuation frameworks are poorly adapted to off-site manufacturing, particularly where a large share of project value is created before modules are delivered to site. This can create funding gaps and increase perceived risk.

- Manufacturing capacity remains sub-scale, keeping costs higher than they could be, limiting economies of scale and keeping unit costs higher than they could be.

- Planning and regulatory inconsistency across jurisdictions also slows approvals for non traditional builds, adding time and uncertainty.

- Perception issues persist, despite modern modular outcomes being materially different from legacy prefab solutions.

Why this may start to change

The current approvals mix is increasing pressure to rethink delivery models. As higher density approvals rise, particularly in constrained urban markets along the east coast, speed, certainty and labour efficiency become more critical to project viability. Delays and cost overruns are harder to absorb, and traditional construction methods are increasingly exposed.

At the same time, government focus on housing supply, productivity uplift and emissions reduction is increasingly aligned with off site construction. Policy settings, procurement models and institutional familiarity may gradually shift as the delivery challenge becomes more acute.

The November data tells us what is being approved. Whether Australia can translate that pipeline into completed dwellings at pace may depend less on demand conditions, and more on whether modular and prefabricated construction can finally move from niche to normal.

At Fifth Quadrant, we work with developers, manufacturers, financiers, and policymakers across the built environment to turn complex market dynamics into practical insight. Our market research spans housing demand, construction supply chains, adoption of new building methods, and the structural forces shaping delivery outcomes. If you would like to explore our work in the built environment, or discuss how tailored market research can support your strategic decisions, view our latest insights or get in touch with the team to start a conversation.

Posted in Built Environment