Author: Ben Selwyn | Posted On: 27 Jan 2026

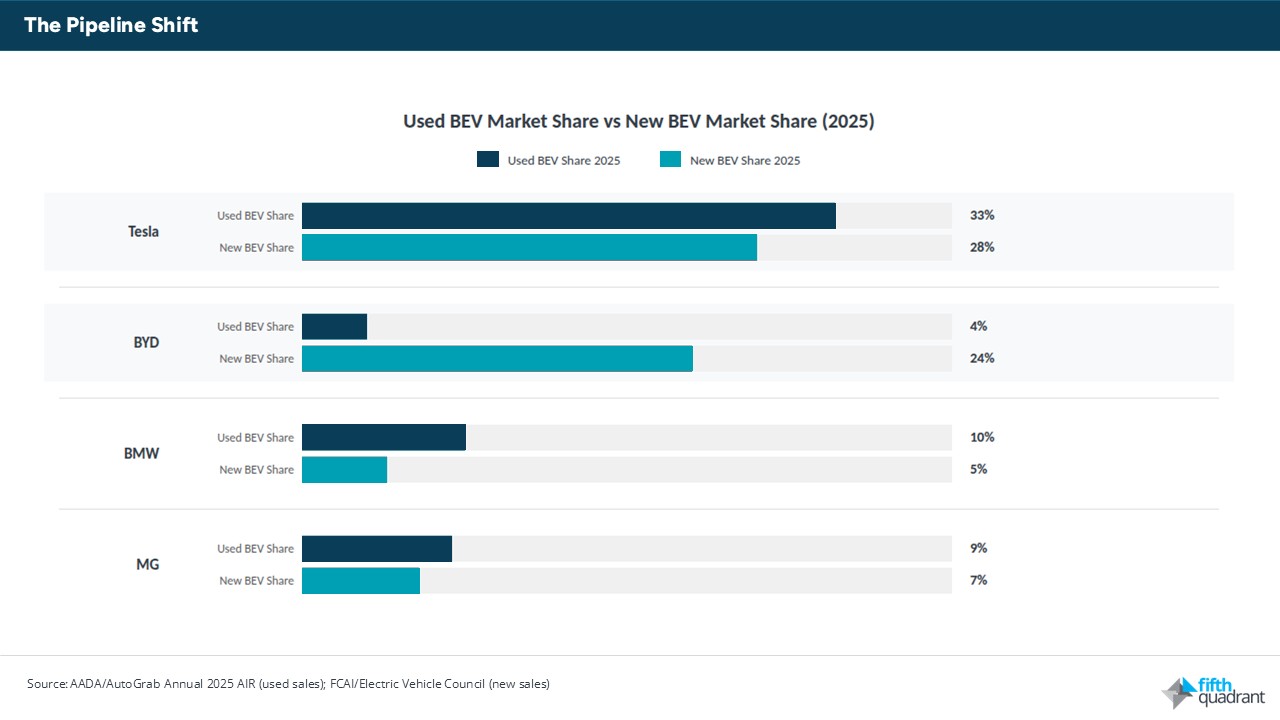

Tesla’s dominance of Australia’s used EV market in 2025 looks, at first glance, like a success story. Data from the AADA/AutoGrab Annual Automotive Insights Report shows used Tesla sales surged 123% year-on-year, with the brand commanding 33% of all used BEV transactions. The Model 3 alone accounted for 19% of used BEV sales, with Model Y adding another 12%.

But look closer at the data, and a different picture emerges. Tesla’s used market strength isn’t a sign of current momentum. It’s an echo of past dominance, and the same forces reshaping the new vehicle market are about to arrive at the used car lot.

Top takeaways

- Tesla holds 33% of used BEV sales, but this reflects historical new vehicle dominance rather than current market strength

- New Tesla sales fell 25% in 2025 while BYD surged 156%, fundamentally changing the future used vehicle pipeline

- Used BEV retained values dropped from 95% to 75% for one-year-old vehicles over 18 months

- Chinese brands are barely visible in used data today, but will represent a significant share of used stock within 2-3 years

The inheritance problem

Tesla’s used market position is inherited, not earned. The brand sold more new EVs than anyone else in 2021, 2022, and 2023. Those vehicles are now cycling through to second and third owners, creating the surge we see in 2025 used data.

This is how car markets work. Today’s new sales become tomorrow’s used stock. The question isn’t where used sales are now. It’s where they’re heading.

And the answer is clear: away from Tesla.

FCAI and Electric Vehicle Council data for full-year 2025 shows new Tesla sales fell 25% to 28,856 units. Meanwhile, BYD’s new sales surged 156% with a portfolio spanning the Sealion 7, Shark 6, Atto 3, Seal, and Dolphin, with Chinese-manufactured vehicles now representing roughly 20% of all new cars sold in Australia. That’s the pipeline feeding the used market in 2027 and 2028.

What the new market tells us

Structural shifts in new vehicle sales don’t take long to flow through. Fleet turnover cycles are shortening. Novated lease terms typically run three years. Private buyers are trading more frequently as technology evolves. The AADA/AutoGrab data shows market liquidity improving through 2025, with dealer days-to-sell trending downward. Faster turnover accelerates how quickly the new vehicle mix flows into used stock.

This means the 2025 new vehicle mix, where data showed Tesla’s monthly EV market share falling as low as 8% and Chinese manufacturers claiming 20% of total new vehicle sales, will quickly reshape used stock.

Tesla built Australia’s used EV market. They educated buyers, established residual value benchmarks, and created the infrastructure, both physical and psychological, that made second-hand EV ownership mainstream.

But building a market and owning it permanently are different things. The data suggests Tesla is about to learn that lesson in used just as they learned it in new.

Where to from here

For dealers, the implication is straightforward: used EV sourcing strategies need to reflect where the market is heading, not where it’s been. Tesla will remain significant, but betting exclusively on the brand means betting against the pipeline.

For consumers, the message is arguably positive. More competition means more choice, better pricing, and faster value normalisation. The days of paying near-new prices for a two-year-old EV are ending.

For the market as a whole, Tesla’s trajectory in used will be the clearest signal yet of how quickly Australian buyers are recalibrating their EV preferences. The brand didn’t just dominate the used EV market in 2025. They were the market.

That’s exactly why 2026 will look different.

For more insights on automotive market trends and consumer behaviour, explore Fifth Quadrant’s automotive market research reports or contact our team.

Posted in Uncategorized