Author: Pajman Johnstone | Posted On: 27 May 2025

Home ownership amongst young Australians

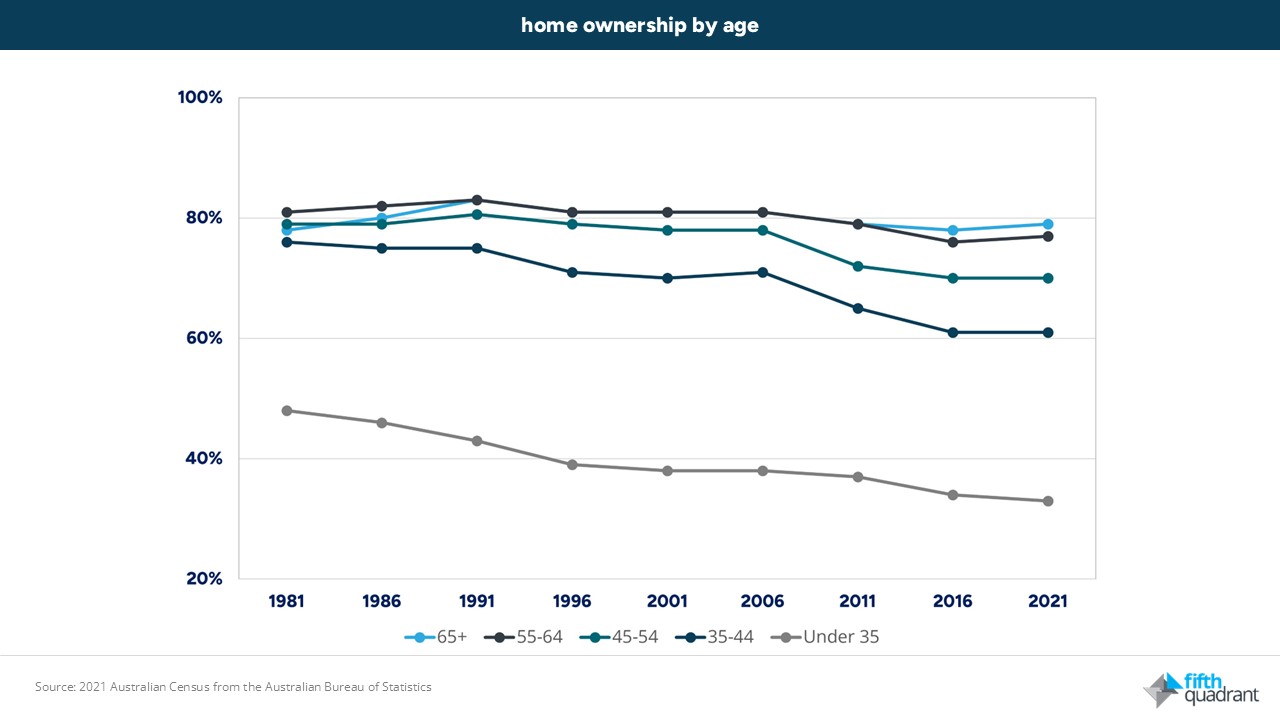

For many young Australians, the path to financial security can feel out of reach, with home ownership plummeting among today’s youth – just 36% of late Millennials (born 1992–1996) owned a home by the 2021 Census.

Stagnant wage growth through the 2010s and soaring living costs have made it harder to build wealth early in life. Yet amid these challenges, new research is shining a light on what young people can do to improve their long-term financial outcomes.

Key habits that build wealth

Australia’s authoritative Household, Income and Labour Dynamics in Australia (HILDA) Survey – a long-running study following the economic lives of thousands of Australians – has identified three personal finance habits closely linked to greater wealth accumulation. As the latest HILDA report puts it, “three factors were found to be associated with greater wealth accumulation – regular savings habits, a longer savings horizon, and greater preparedness to take financial risks.”

In other words, Australians who consistently put money away, who plan and invest for the long haul, and who are willing to accept some risk in pursuit of higher returns, tend to build more wealth. HILDA’s lead author notes that this data shows that these habits stand out across two decades of research.

Breaking it down, HILDA found that people who save a set amount each month or pay themselves first are more successful at growing their net worth over time. Those with longer investment horizons, typically younger savers – allow compounding to work its magic, riding out short-term market fluctuations for future gains. And importantly, participants who reported being prepared to take on “substantial or above average” financial risks in expectation of higher returns ended up the richest in the long run. By contrast, playing it too safe can mean missing out on the superior growth that assets like shares or property can deliver over decades.

The long-term advantage of sensible risk

Financial experts echo HILDA’s findings that a little more risk can reap rewards for young investors. Superannuation is a prime example. One analysis, by Innova Asset Management, found that by upping the risk level slightly, the returns beat the average default “balanced” fund by 13.6% over the past decade. That difference represents the power of higher growth assets over time. With Australians under 40 typically having 25 to 40 years before they can access their super, even a modest tilt toward growth assets can significantly boost retirement balances. The logic is straightforward: younger people have ample time to recover from the occasional market downturn, so they can more comfortably ride out volatility in exchange for higher long-term returns.

US tariffs

Recent events in international trade have added new complexities for young Australians planning their financial futures. The United States recently introduced unexpected sweeping tariffs on all imports, quickly frozen shortly after and significant tariffs on Chinese goods, which remain active. These moves triggered sharp swings in the stock market, with one of the worst trading days followed swiftly by one of the strongest recoveries within the same week, leaving investors feeling as though markets are balancing precariously on a knife’s edge.

Implications for young Australians

This turbulence underscores the importance of resilience and discipline in investment strategies. While market fluctuations can be unsettling, especially for those new to investing, it’s crucial to maintain a long-term perspective. History has shown that markets tend to recover over time, rewarding those who stay the course. As the HILDA Survey and other studies have shown, those who dare to invest in their future tend to reap the rewards in years to come. It’s an encouraging message: even in a tough economic landscape, strategy and patience can stack the financial odds in young people’s favour

For young Australians facing unprecedented housing costs and uncertain wage growth, adopting steady saving habits and growth-oriented investments early provides a proactive path to financial security. The key is striking a balance – embracing sensible risk aligned with personal comfort levels. History shows markets recover over time, rewarding patience and strategic thinking. Even in tumultuous economic conditions, disciplined investing positions young Australians to significantly enhance their financial futures.

Fifth Quadrant runs a regular Consumer Sentiment Tracker, offering organisations access to fast and cost-effective insights that can help them understand the changing needs of consumers in this environment. Join our omnibus and explore sentiment, brand health, preferences or experiences, uncovering insights that can inform your brand, marketing and customer engagement strategies.

For any questions or inquiries, feel free to contact us here.

Posted in Financial Services, Consumer & Retail