Author: Jessica McMahon | Posted On: 10 Feb 2026

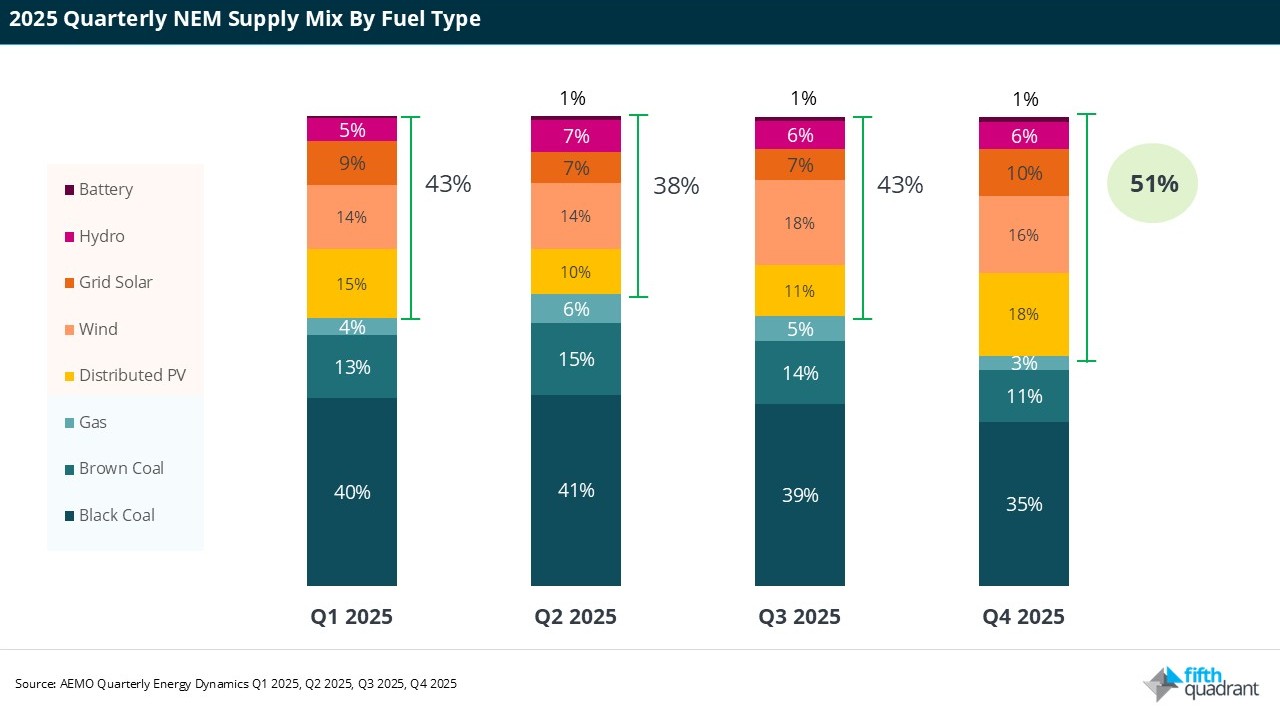

Australia’s electricity system crossed a critical threshold in the final quarter of 2025. For the first time, renewable energy sources supplied more than 50% of total electricity demand across the National Electricity Market (NEM), even as underlying demand reached a new record. This outcome, highlighted in recent ABC News reporting, is more than a symbolic milestone, it marks the system passing the halfway point toward the national target of 82% renewable electricity by 2030, and signals a fundamental shift in how energy is produced, consumed and managed across the economy.

At its core, this shift reflects accelerating electrification, as gas, petrol and diesel technologies are replaced by electric alternatives.

What electrification means in practice

Electrification refers to the substitution of fossil-fuel-based end uses with electric alternatives. In Australia, this is occurring across multiple sectors simultaneously.

In homes and commercial buildings, gas-based heating, hot water and cooking appliances are increasingly being replaced with electric alternatives. This shift is being reinforced by state-level restrictions on new gas connections in Victoria and the ACT, alongside local government planning controls, including a City of Sydney decision to ban indoor gas appliances in new buildings from 2026.

In transport, electric vehicles are now beginning to displace internal combustion engine cars rather than simply adding to the fleet.

Each individual switch may appear modest, but collectively these changes are reshaping the electricity demand profile. Australian Energy Market Operator (AEMO) has consistently highlighted electrification as one of the primary drivers of long-term demand growth in its Electricity Statement of Opportunities.

Renewables at scale, and what the 50% quarter proves

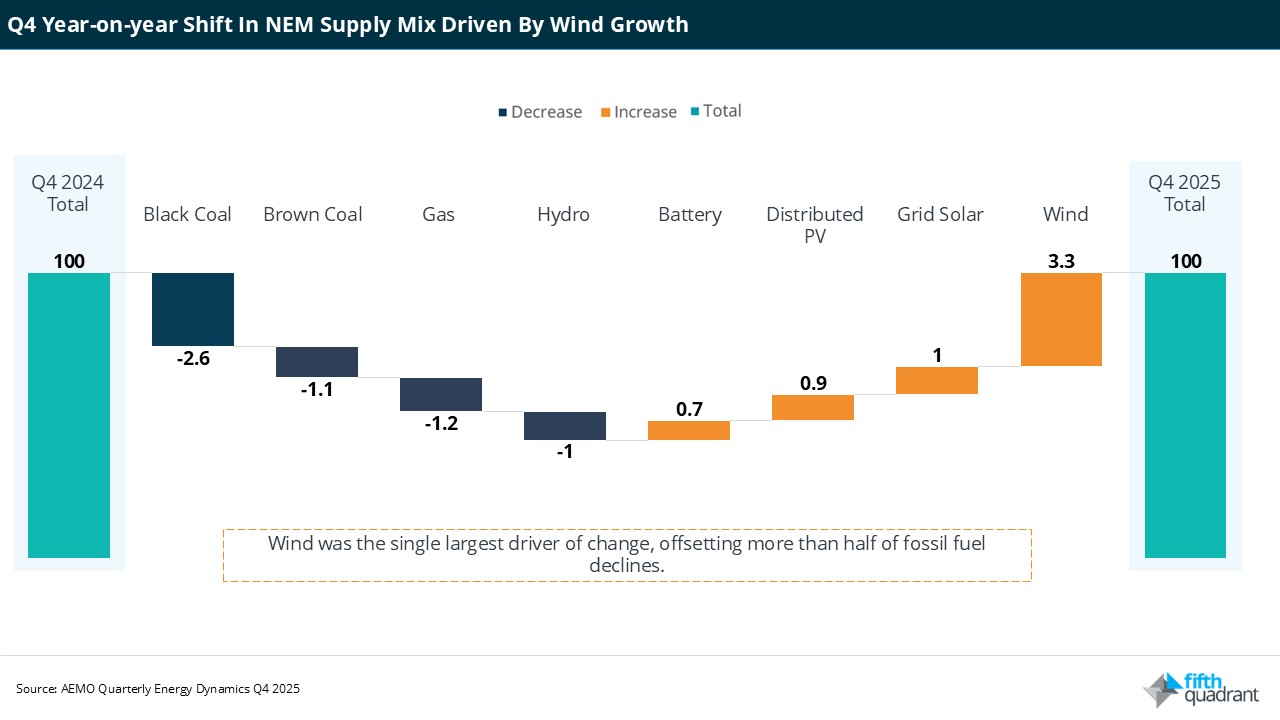

The December 2025 quarter shows that renewables are no longer a side contribution to Australia’s electricity system. For the first time, they supplied majority of power over an extended period, shaping how the grid operates day to day rather than only during favourable conditions.

This shift brings new challenges. The main issue is no longer having enough electricity, but keeping the system stable as traditional coal and gas power stations run less often. In the past, these plants helped steady the grid simply by being online. As they operate less, that role has to be filled in other ways, such as through batteries or changes in how the system is managed.

AEMO has already noted that it is stepping in more often to keep the system operating securely during periods of very high renewable output. This suggests that reliability is becoming more about how different parts of the system work together, rather than whether there is enough fuel available.

At the same time, wholesale electricity prices are falling even as overall electricity use increases. While this reflects the low cost of renewable energy, it also means prices are becoming a less reliable signal for future investment, particularly as negative prices and renewable curtailment become more common.

The real question: What gets built next and when?

At 50% renewables, the transition challenge is now about sequencing investment correctly, as well as building more generation.

As renewables supply a larger share of electricity, reliability and cost are increasingly shaped by what supports the system, not just how much energy is generated. Storage, flexible demand, transmission and system services now matter more to day-to-day operation than adding more energy-only generation.

Transmission is a clear example. In some Renewable Energy Zones, congestion and delays to new interconnectors mean renewable generators are being forced to switch off even when demand is high. This leaves low-cost energy unused and increases reliance on more expensive local supply.

Together, this points to a shift in risk. The main challenge is no longer running short of electricity in the long term, but keeping different parts of the system (generation, networks, storage and market settings) moving in step as the system changes.

Key learnings from the 50% renewables milestone

- The shift to 50% renewables represents a change in how the system operates, not just how it is supplied.

Renewables are no longer supplementing the electricity system, they are increasingly setting conditions for pricing, reliability and dispatch. - Electricity demand growth is being driven by electrification rather than short-term weather effects.

Rising electricity use reflects longer-term changes across buildings, transport, and industry, even where grid demand appears flat because more power is being generated through rooftop solar. - Maintaining system stability is becoming a central challenge as renewable energy increases.

As coal and gas power stations run less often, the stabilising role they once provided cannot be taken for granted and must be delivered through other means, such as batteries and updated system operations. - Lower average electricity prices are occurring alongside greater operational risk.

Wholesale prices are falling overall but are also becoming more volatile, with more frequent price swings, negative prices, and wasted generation, weakening traditional signals for new investment. - The transition challenge is shifting from scale to coordination.

The key issue is no longer simply how much capacity is built, but whether generation, storage, transmission, and market arrangements are delivered in the right sequence and at the right pace. - Transmission and flexibility will be decisive this decade.

If grid upgrades and flexible resources do not keep up with renewable development, congestion and delays risk wasting low-cost energy and increasing costs across the system.

At Fifth Quadrant, we support companies navigating energy transition through data-driven analysis, market insight and practical system understanding. As Australia’s electricity system becomes more complex, success increasingly depends on understanding how generation, storage, transmission and market settings interact in practice, not just in theory. Our work supports better investment decisions, clearer risk management and more effective policy and strategy outcomes across the transition. Explore our energy transition market research to see how we support clients operating at the leading edge of change.

If you’d like to discuss how these changes affect your organisation, contact us to start the conversation.

Posted in Energy Transition, Uncategorized