Author: James Organ | Posted On: 12 Feb 2026

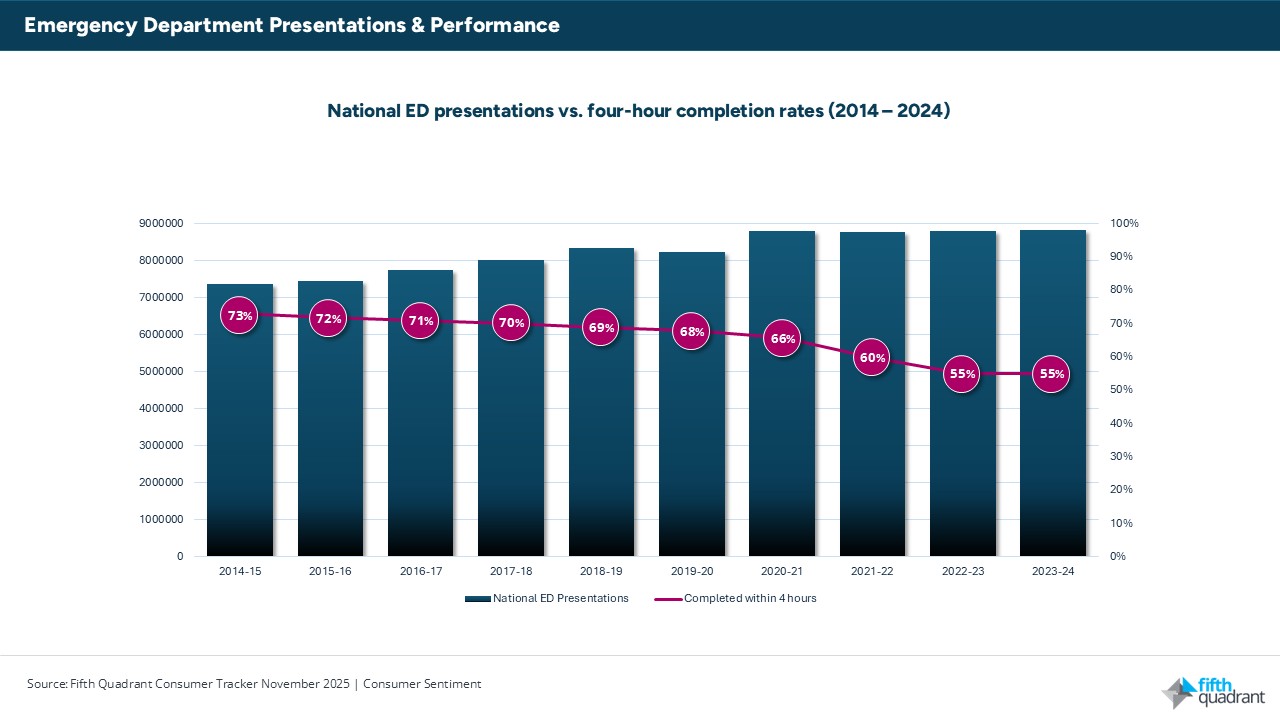

According to the Australian Medical Association’s 2025 Public Hospital Report Card, 55% of Australia’s emergency department (ED) visits in 2023–24 were completed within four hours.

The four-hour benchmark measures whether a patient is discharged, admitted or transferred within four hours of arrival. It is widely used as a system-flow indicator because it reflects more than waiting room times. Performance depends on inpatient bed availability, workforce capacity, discharge efficiency and coordination across the hospital.

A decade ago, 73% of ED visits were completed within four hours. The decline to 55% represents an 18-percentage-point reduction over ten years. In 2023–24, no state or territory recorded more than 60% compliance with the four-hour benchmark. This indicates that performance pressures are national rather than isolated to specific jurisdictions.

At the same time, ED presentations have increased materially over the past decade. Annual volumes are significantly higher than ten years ago, meaning emergency departments are managing substantially greater demand alongside lower throughput performance. Demand has remained elevated even after pandemic-related volatility, suggesting a structurally higher workload baseline.

Time to clinical assessment

The second key performance measure tracks whether patients are seen within clinically recommended timeframes under the Australian Triage Scale.

In 2023–24, 67% of patients were seen within the recommended timeframe, compared with 65% in 2022–23. This represents a modest year-on-year improvement and the first increase since COVID-19.

However, long-term performance remains below earlier levels.

Emergency (Category 2) and urgent (Category 3) cases account for the majority of clinically time-sensitive workload in EDs. These categories include patients requiring assessment within 10 minutes (Category 2) or 30 minutes (Category 3). The scale of presentations in these groups demonstrates that a significant proportion of ED activity involves time-critical care rather than low-acuity cases.

The modest improvement in time-to-assessment suggests front-end triage and initial clinical processes have stabilised to some extent. However, this improvement has not translated into better four-hour completion rates.

What the data shows

The 2023–24 results point to three structural patterns.

1. Demand has increased and remained elevated.

Emergency departments are consistently managing higher volumes than a decade ago. Increased population growth, ageing demographics and broader health system access issues contribute to sustained demand.

2. Throughput has declined relative to workload.

The fall in the four-hour completion rate indicates that system capacity has not kept pace with demand. When inpatient wards operate near full occupancy, admitted patients remain in emergency departments longer. This reduces available treatment space and contributes to access block.

3. Bottlenecks are occurring after triage.

The improvement in assessment timeliness alongside stagnant four-hour performance suggests delays are concentrated in admission, bed allocation and discharge stages. In other words, initial clinical review may occur, but patient movement through the hospital is constrained.

Operational implications

At a 55% completion rate, nearly half of all ED presentations exceed four hours. With national presentations at record levels, this translates into millions of extended stays annually.

Extended ED length of stay affects:

- Ambulance offload times

- Availability of treatment bays

- Staff workload and shift intensity

- Patient experience and crowding

The data reflects system-wide capacity constraints rather than short-term operational variability.

Conclusion

The 2023–24 national ED results show sustained demand growth, declining throughput performance and bottlenecks occurring beyond initial assessment.

Volumes are higher. Completion rates are lower. Assessment performance has stabilised but has not improved overall flow.

Taken together, the data indicates a structural mismatch between demand and hospital capacity rather than a temporary fluctuation in performance.

For policymakers, hospital executives and healthcare providers, the challenge is not only understanding what is happening, but why. At Fifth Quadrant, our healthcare market research helps organisations unpack the drivers behind demand, patient behaviour and system pressure. Through robust quantitative studies, stakeholder research and ongoing tracking, we support evidence-based decision-making across the health sector. If you would like to explore how independent research can inform service planning, resource allocation and patient experience strategy, get in touch with our healthcare research team.

Posted in Healthcare, Uncategorized