Author: accounts fifthquadrant | Posted On: 03 Jul 2025

Australia’s second-hand EV market is on an upward trajectory, but uncertainty is emerging around how to properly value these vehicles. Unlike combustion vehicles, where odometers and service logs offer clear signals of value, EVs are harder to assess. Their resale value depends heavily on battery health, which is variable and often hidden from buyers. Additionally, while the right tools can track this from day one, that data is often not understood or captured.

This is becoming particularly relevant as more EVs hit the three-year mark (when fleet replacement cycles typically see vehicles transition to the second-hand market). Fleet managers preparing for disposal now find themselves facing new, previously unforeseen challenges: how do you prove the condition of a used EV, and ultimately maximise its value at resale?

The battery is the value, but can you prove it?

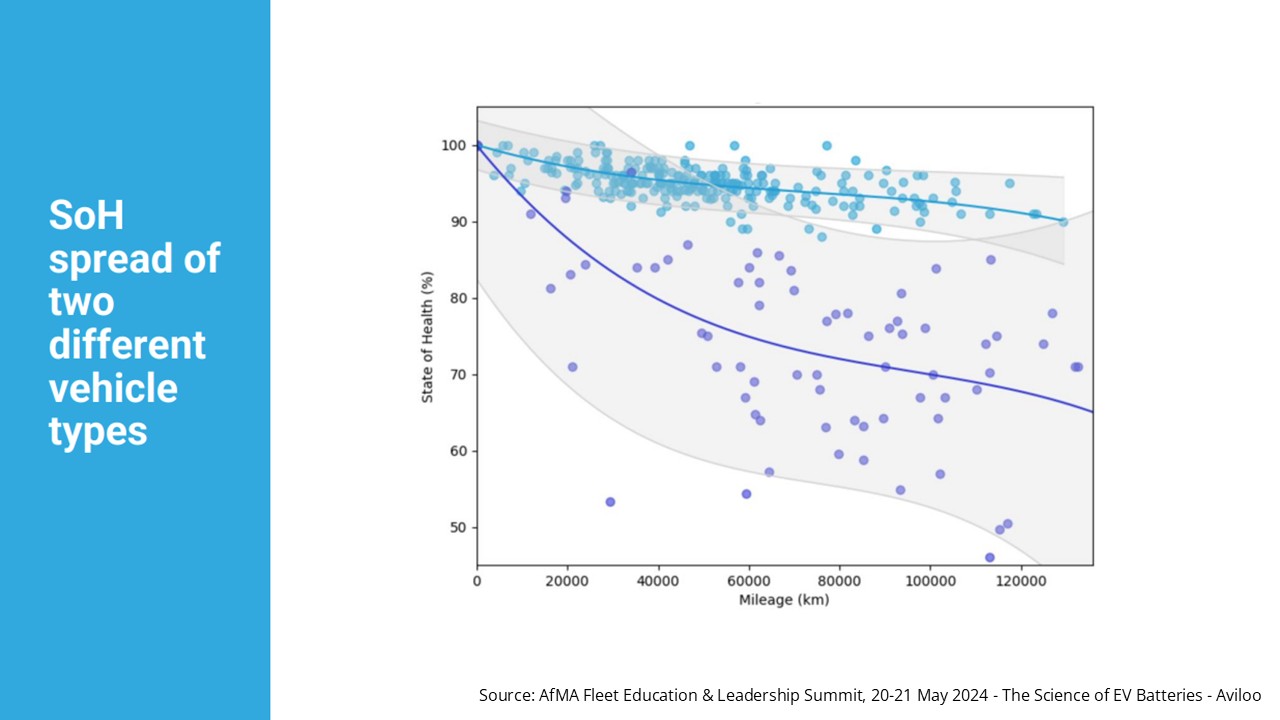

At the recent AfMA Fleet Education & Leadership Summit, speakers highlighted how battery State of Health (SoH) can be influenced by a range of variables, including temperature, charging behaviour, environmental exposure, and even the driving styles of individual users.

This complexity means that two vehicles from the same fleet, both showing similar mileage, may have very different battery health profiles. As shown in the chart below, while both vehicle types start at or near 100% SoH, one maintains strong performance even beyond 100,000 km, while the other declines much faster. In some cases, we can even see vehicles falling below 70% SoH before they have travelled 50,000 km.

For fleet sellers, this raises an obvious issue: mileage alone isn’t enough to gauge battery condition or justify pricing. However, given the resale market doesn’t yet fully understand this, that can mean underpricing strong vehicles, or creating a level of future risk in the case of weaker ones.

Battery certification builds confidence and value

What the market needs is third-party battery certification to bridge the gap between technical battery data and real-world buyer understanding. These independent assessments provide a standardised view of battery condition, reporting on usable capacity, energy throughput and potential anomalies. In practice, certification supports accurate pricing, improves buyer confidence, and helps with warranty or residual value discussions.

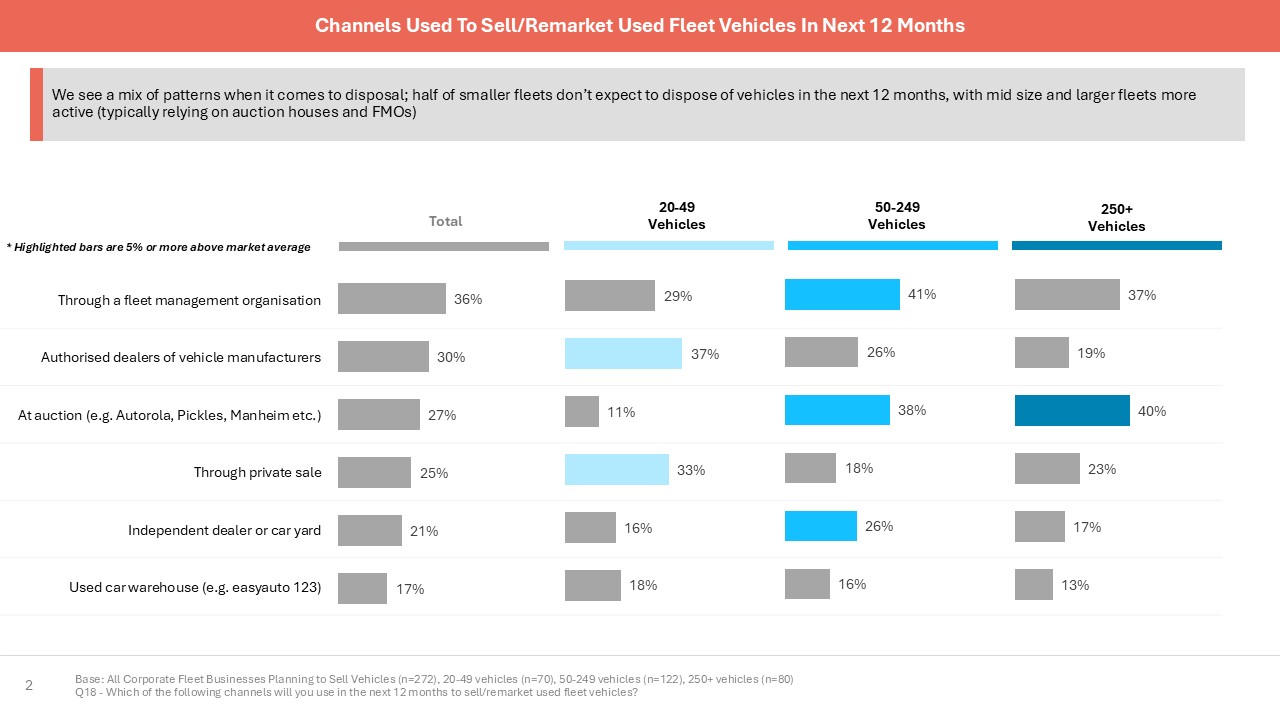

The challenge is that this is likely to become more easily available to larger fleets first. As shown in the Fifth Quadrant 2024 Corporate Fleet Insights report (produced in partnership with AfMA), resale channels vary significantly by fleet size, with larger fleets more likely to use auction houses and fleet management organisations (FMO), while smaller fleets opt for dealer or private sales.

Building on this, as of right now, certification depends more on who you sell through than what you’re selling. While some fleet management organisations and auction houses are integrating diagnostic testing of batteries, others lack the tools or protocols to assess and present EV battery health transparently.

What’s next: turning transparency into trust

Australia’s EV transition is accelerating, and fleet managers have an opportunity to lead on transparency while protecting their resale values. Two approaches are worth considering: implementing regular battery monitoring from the outset, and building relationships with resale channels that can properly assess and certify battery health.

Fleets that explore these options early may find they not only protect their own assets, but also help establish the transparency standards that will benefit the entire second-hand EV market. In a developing sector like this, early movers often help shape the practices that others follow.

Want to hear more about our fleet insights?

At Fifth Quadrant, we help businesses navigate change with data-driven insight and strategic foresight. View our automotive insights here. Get in touch to see how we can support your next move.

Posted in Uncategorized