Author: Jessica Phan | Posted On: 16 May 2025

Updates to New Vehicle Sales are published monthly. View previous wave.

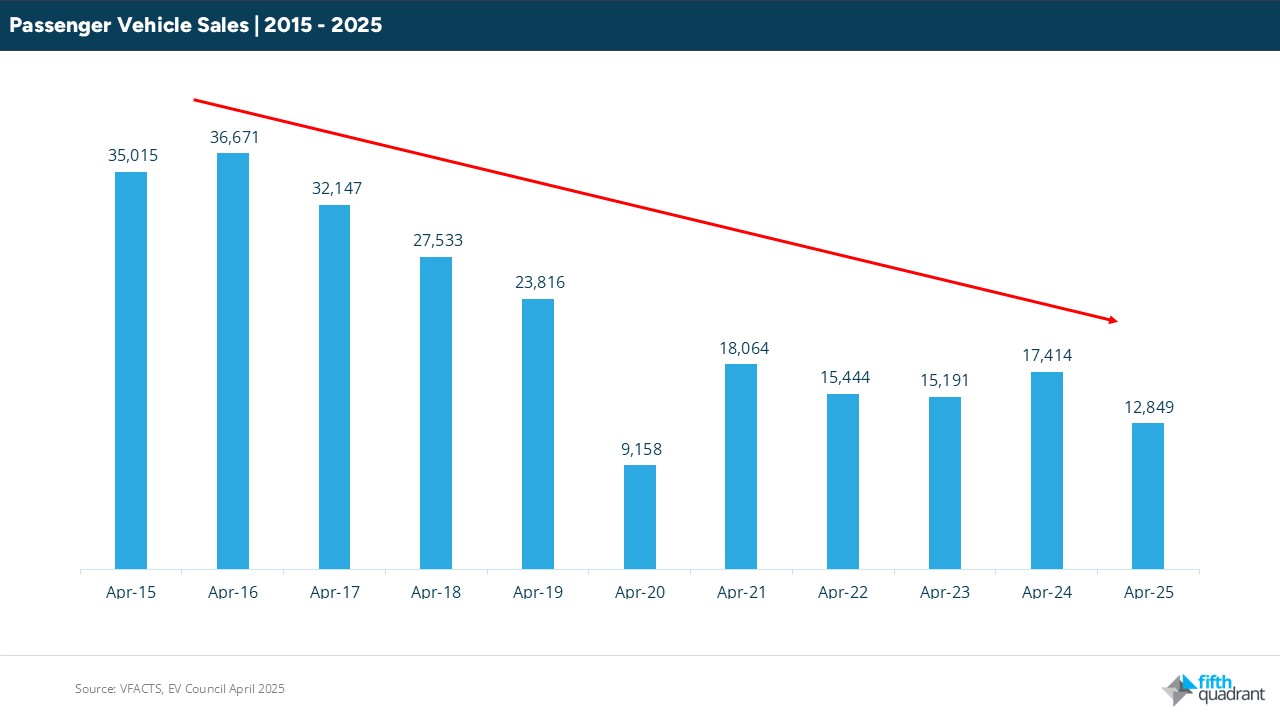

Australian new vehicle sales totaled 91,316 units in April 2025 (as captured in the FCAI’s VFACTS report and EVC’s Vehicle Sales Report), down 6% YoY and contributing to a YTD total of 387,286 units, down 4%. While this marks the third YoY decline of the year, the picture isn’t entirely bleak. April 2025’s new vehicle sales still ranked as the third-best April in the past decade, showing that despite softer conditions, Australians are still purchasing new cars at relatively strong levels by historical standards.

Top 4 Takeaways

- Toyota Hilux Sales Tops the Charts: The Toyota Hilux reclaims its title as Australia’s top-selling vehicle in April with 4,121 units sold, edging out its longtime rival, the Ford Ranger (4,031 units).

- PHEV Sales Plummet Post-FBT Incentives: Plug-in hybrid (PHEV) sales dropped sharply to 2,601 units, a 62% decline from March as the Fringe Benefits Tax (FBT) exemptions ended. However, the YoY picture remains more positive, with sales doubling compared to April 2024, largely thanks to newer entrants like the BYD Shark 6, and the enduring popularity of the Mitsubishi Outlander PHEV.

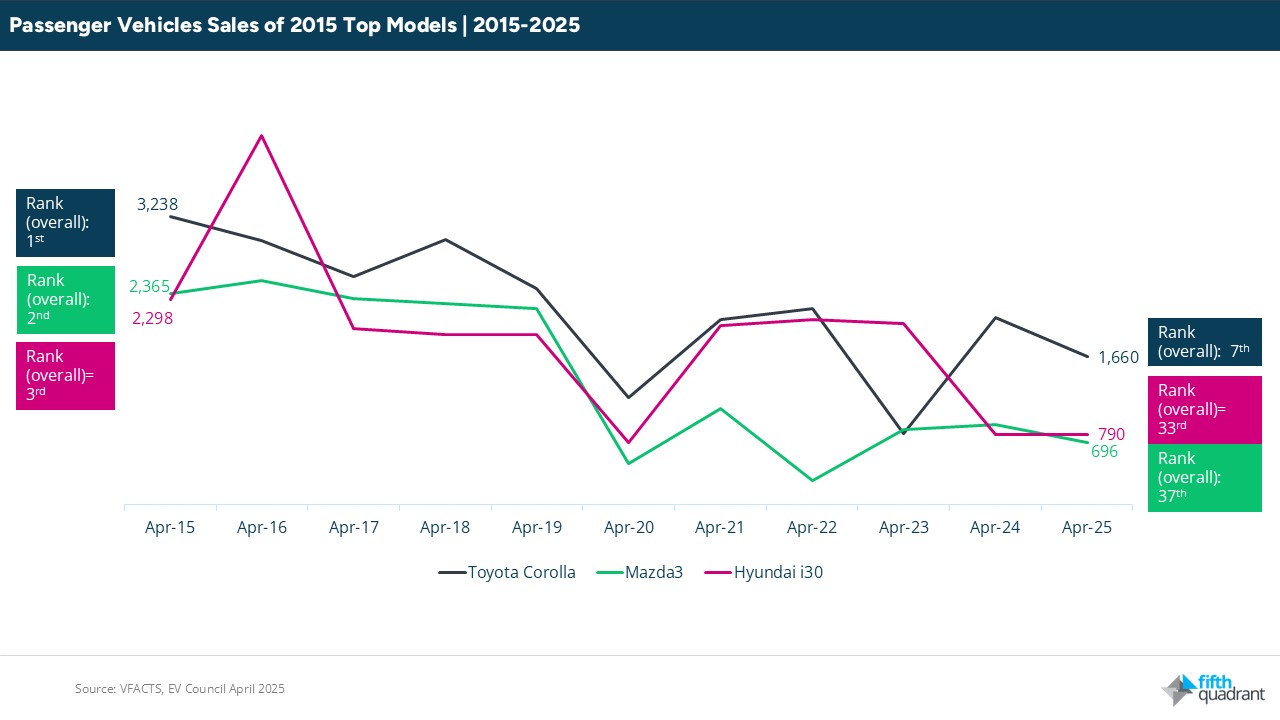

- Toyota Corolla Climbs Back into the Top 10: In a rare bright spot for passenger cars, the Toyota Corolla climbed to the Top 10 with 1,660 units sold, outpacing several SUV mainstays such as the Mazda CX-5 (1,607 units) and Hyundai Kona (1,605 units).

- Hybrid Sales Slip After a Sustained Period of Growth: Hybrid sales declined 13% YoY, breaking the sector’s upward trend. Momentum in this segment will be closely monitored in the months ahead.

Deep dive: Is this the end of passenger vehicles in Australia?

Passenger vehicles, once a staple in the Australian market, have fallen away drastically in popularity, with just 12,849 sold in April, down 26% from the 17,414 units in April 2024. In 2015, half of the Top 10 cars sold were passenger vehicles, with the Toyota Corolla, Mazda3 and Hyundai i30 vying for top position. In 2025, reaching 1,000 units a month can be challenging for many of these past favourites.

While the Corolla’s reappearance in the Top 10 this month does offer a minor victory, it’s largely a reflection of softer SUV performance than a passenger car resurgence. In fact, Corolla sales were approximately 400 units lower than the same month last year.

A market dominated by few

Australia’s automotive market is crowded with more than 70 brands currently selling at least one model. But beneath this diversity lies a stark imbalance in market share. In 2024, 31 of these brands sold fewer than 5,000 units. This group includes not only niche marques, but also familiar names such as Renault and Skoda which maintain visible advertising but clearly struggle to convert brand recognition into meaningful sales.

Meanwhile, the market remains highly concentrated at the top. Just 13 brands accounted for nearly 80% of total new vehicle sales in April 2025, with one-in-five sales being from Toyota. For those operating on the margins, low sales volumes threaten dealer viability, aftersales support, and consumer confidence, creating a cycle that can be difficult to break. With many existing leaders holding strong new product pipelines, and a range of new entrants actively targeting the Australian market, they risk joining the growing list of brands such as Opel, Infiniti, and Proton that have exited the Australian market altogether in recent years.

looking ahead

As the Australian automotive market heads deeper into 2025, current new vehicle sales figures suggest that the industry may fall short of the record 1.2 million new vehicles sold in 2024. With year-to-date sales down 4% compared to the same time last year, the momentum needed to match or exceed last year’s milestone is noticeably absent. April’s decline marks the third consecutive month of YoY contraction, pointing to a softer demand environment as buyers navigate economic pressures and OEMs increasingly look to incentives to push sales volumes. Looking for more auto insights?

Looking for more auto insights? Click here to view of our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility