Author: Ben Selwyn | Posted On: 19 Sep 2025

Australia’s automotive market is experiencing its most dramatic shift since local manufacturing ended in 2017, but August 2025 still delivered 103,695 new vehicle sales, up 2.9% on August 2024, and the second-strongest August on record. Over the past 12 months, total sales reached 1.23 million vehicles, down 2.4% year on year, a resilient result in the face of significant economic headwinds.

Key Shifts

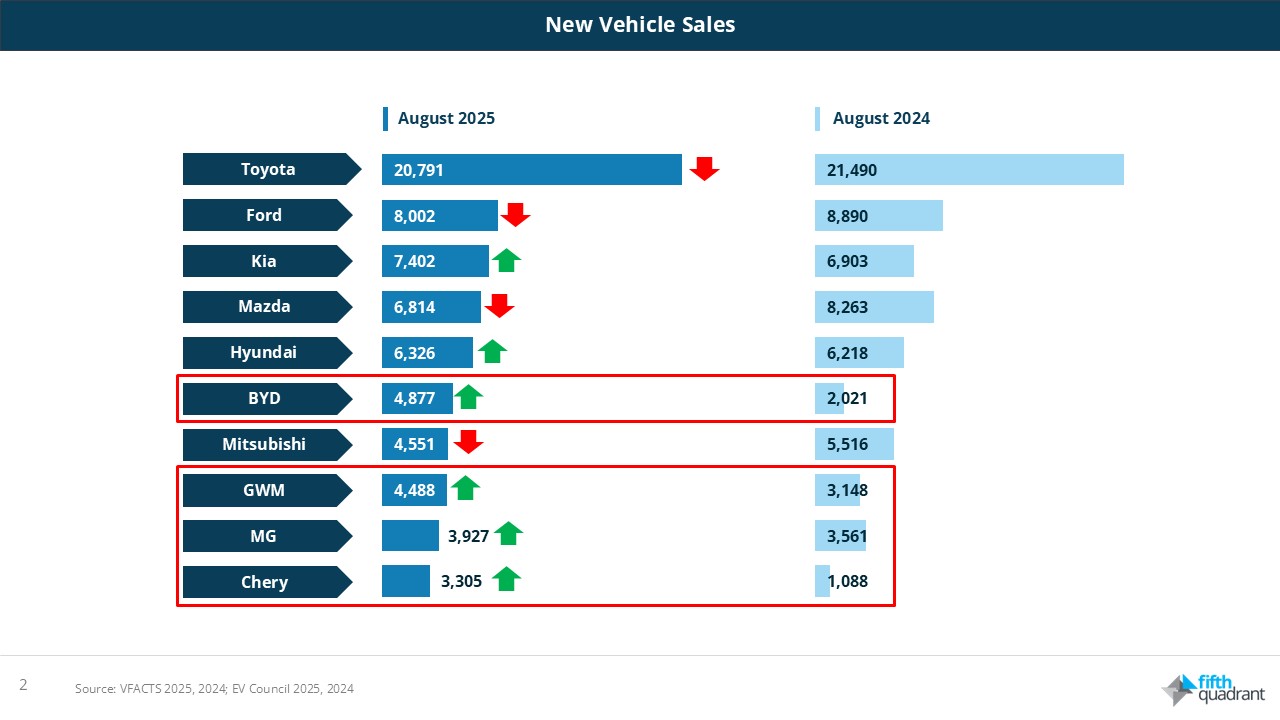

- Chinese brands break through: Four Chinese brands (BYD, GWM, MG, Chery) ranked in the national top 10 for the first time in August. Chinese sales hit 19,016 in August, up 72% year on year. YTD, their share climbed to 16% (132,808 vehicles), up from 10.9% the year before.

- Hybrids drive growth: Hybrids made up 15% of total sales in H1 2025, with plug-in hybrids (PHEVs) up 218% year on year. Hybrids are now the main bridge to electrification, as EV adoption slows due to price and charging barriers.

- Traditional brands under pressure: Toyota sales in August were down 3.3% year on year, but it wasn’t alone as a top 10 brand recording a decline; Ford dropped 10% against August 2024, while Mazda and Mitsubishi were both down 17.5%.

- SUVs and utes dominate: SUVs held 60% of total sales in August (60,495 units). In July, SUVs grew 11.5% while passenger cars fell 19.3%.

Chinese brands reshape the market

August 2025 marked a turning point as four Chinese brands entered the national top 10. GWM sold 49,189 vehicles over 12 months (+18.8%), while BYD more than doubled to 39,942 (from 17,800 a year earlier).

Their success isn’t limited to EVs. BYD leads plug-in hybrid sales, with the Shark 6 ute, launched in May 2025, targeting Australia’s most popular vehicle segment. Chinese brands are now competing directly in mainstream categories, not just niches.

Impact: Chinese brands outsold European marques by around 15:1 over the past year, compared with 8:1 the year before. This rapid shift is forcing dealers to consider Chinese partnerships and pushing traditional manufacturers to rethink product strategy.

Hybrids become the main transition

EV uptake remains limited by cost and charging gaps, but hybrids are surging. Kia grew 4.3% over the past 12 months and 7.2% in August alone, while Hyundai rose 3.5% and 1.8% respectively.

The New Vehicle Efficiency Standard (NVES) is accelerating this shift as manufacturers expand hybrid line-ups to meet compliance targets. Toyota still leads, but competition is heating up quickly.

Implications: Fleets can cut emissions today with hybrids and PHEVs (without infrastructure challenges), while OEMs need to balance EV investment with hybrid development to match consumer demand.

SUVs and Utes stay on top

Australian preference for larger vehicles is holding firm. SUVs made up 60% of sales in August, with medium SUVs leading electrified uptake: 59% of new BEV sales and 39.5% of hybrid sales in Q2 2025.

Light commercials are shifting faster. Sales of low- and zero-emission LCVs grew sixteen-fold in the 12 months to July 2025 compared to the same period the previous year (albeit off a very low base), while petrol LCVs had their weakest July since the pandemic.

Challenge: Most SUVs remain petrol or diesel, creating compliance risks under NVES. Manufacturers must electrify these platforms without losing towing and load capacity, key buyer requirements.

What This Means

- Manufacturers: Speed up hybrid launches, refine EV strategy, and prepare for stronger Chinese competition.

- Dealers: Stock hybrids, evaluate Chinese partnerships, and keep SUVs/utes at the centre of inventory strategy.

- Fleets: Adopt hybrids now, test plug-in utes for future commercial use.

- Policymakers: Track NVES effects on pricing and ensure charging infrastructure keeps up with adoption.

Looking ahead

The market is shifting along two key lines: the rise of Chinese (largely value-driven) brands and the rapid adoption of hybrids. Traditional brands that aren’t prepared face some pretty significant challenges in adapting to this new market landscape.

Key questions for the next 12 months:

- How will NVES penalties affect petrol and diesel vehicle prices?

- Will plug-in hybrid utes gain lasting traction in fleet and private markets?

- How quickly will hybrid uptake spread across different buyer groups?

- How far will Chinese brands expand into new segments and networks?

The winners will be those who adapt fastest, reshaping line-ups, partnerships and strategies to meet consumer demand for value and practical electrification.

Looking for more auto insights? View our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us.

Posted in Uncategorized