Author: Ben Selwyn | Posted On: 22 Oct 2025

New Vehicle Sales September 2025 reached 938,960 YTD, up 9% on 2015 and 45% on the 2020 result. Behind that growth is a wholesale transformation: Chinese entrants rewriting the brand order, SUVs eclipsing cars, and old leaders fighting to hold ground.

With that said, the 2020 comparison requires context. That year’s 644,891 total reflected COVID-driven supply chain issues and consumer uncertainty rather than underlying demand preferences. The main strength of the 2020 result is to reveal the general trends in the market. The 2025 numbers then confirm a permanent realignment toward SUVs and utes as default vehicle choices, with traditional passenger cars occupying niche, price-driven positions.

Top takeaways

- Market reinvention: The Australian market has grown 9% against 2015 and 45% against COVID-affected 2020, but this volume growth masks a complete structural transformation.

- China rises: Chinese brands GWM, BYD and MG now command 12% market share vs near-zero a decade ago, collectively outselling many established players.

- SUV supremacy: SUV and pick-up dominance is complete, with Medium SUVs (231,303 units) and Small SUVs (153,520) combining with pick-ups to represent 80% of total sales, while passenger cars have collapsed to just 12% of the market.

- Korean divergence: Kia up 148% while Hyundai declines, illustrating how brand-level volatility persists even within overall market growth.

YTD performance

2015 was orderly; 2020 distorted; 2025 diversified. While total sales rose 76,000 units vs 2015, the composition of those sales is completely different.

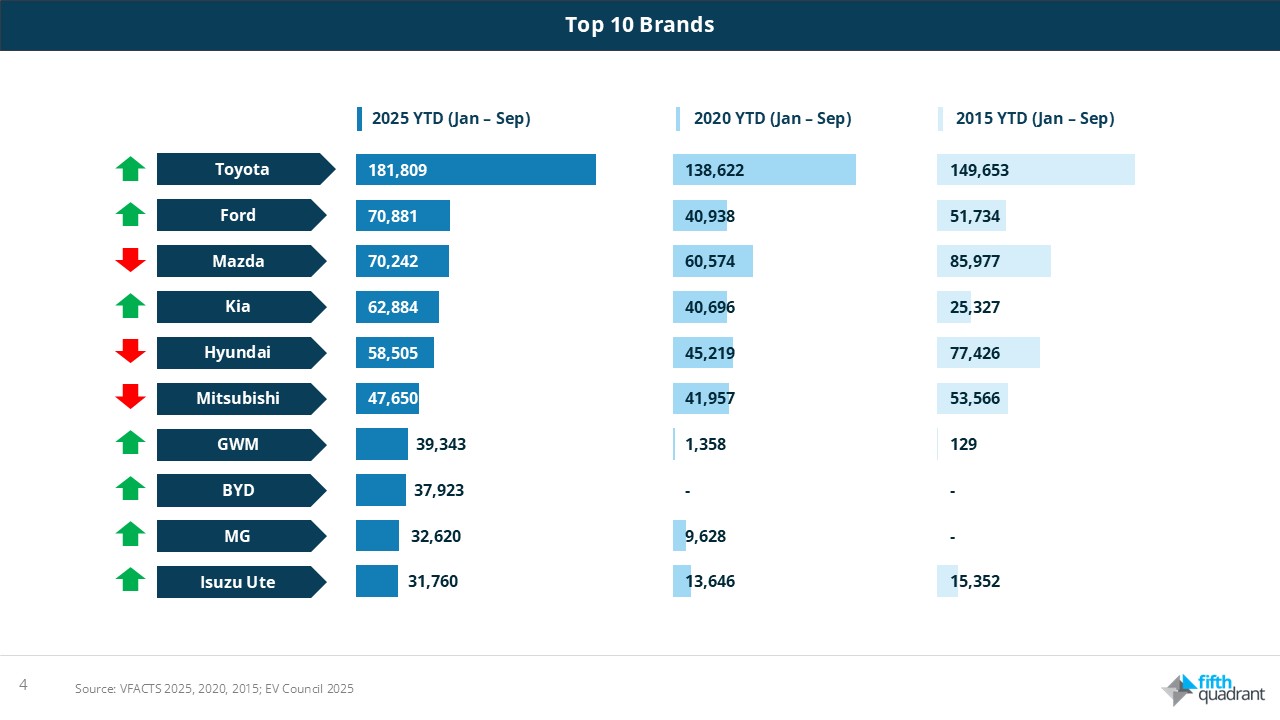

With that said, Toyota (181,809) maintains its dominance, gaining ground from 149,653 in 2015 even as the market fragments. Ford (70,881 vs 51,734) is well up on the back of Ranger’s dual-cab popularity, while Mazda (70,242 vs 85,977) has declined despite overall market expansion. The Korean brands tell contrasting stories: Kia’s progress to 62,884 units represents 148% growth, driven by competitive SUV pricing and improved brand perception. In stark contrast, Hyundai (58,505 vs 77,426 in 2015) has lost significant ground, potentially reflecting pricing and product positioning challenges.

Chinese brands have gone from obscurity to a mainstream force. GWM (39,343 vs just 129 in 2015), BYD (37,923), and MG (32,620) collectively command approximately 12% market share. The speed of this disruption is unprecedented in Australian automotive history. While other markets took decades to diversify their brand mix, Australia has compressed this into five frantic years.

Segment evolution

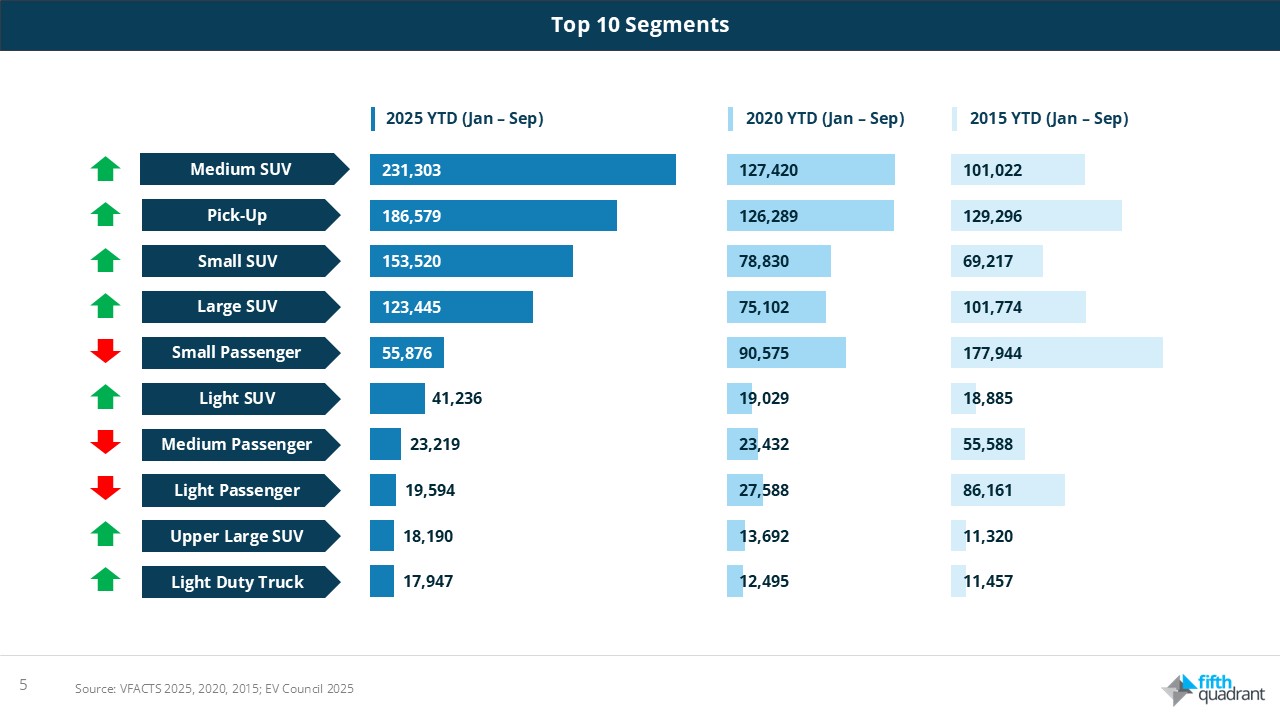

SUV and pick-up sales now account for approximately 80% of the market vs around 50% in 2015. Medium SUVs lead at 231,303 units, more than doubled from 101,022 a decade ago and up 81% even on 2020 (127,420). Small SUVs (153,520) are similarly up from 69,217, while Large SUVs (123,445) have grown 64% from 2015’s 75,102 despite already being an established segment. Pick-ups (186,579) have also maintained steady volume growth, increasingly serving both fleet and lifestyle buyers as the quintessential Australian workhorse.

This SUV concentration reflects multiple drivers: family buyers seeking perceived safety and versatility, fleet operators embracing functional utility, and lifestyle purchasers valuing capability over efficiency. The breadth of SUV segments now available, from sub-$30,000 Chinese entries to six-figure European premium models ensures there’s a suitable product available at every price point.

Passenger cars, meanwhile, have experienced a significant decline. Small Passenger (55,876 vs 177,944) has fallen 69%, Medium Passenger (23,219 vs 55,588) down 58%, and Light Passenger (19,594 vs 86,161) has virtually disappeared as a volume segment. Combined, all passenger car categories represent just 12% of market volume, less than Chinese brands alone and a fraction of the approximately 45% share they commanded in 2015.

What does this mean?

Make no mistake: these shifts create both opportunity and strategic risk for industry stakeholders. OEMs face the most competitive brand landscape in decades, where Chinese entrants prove agility and value proposition can overcome heritage advantages. Dealers must adapt inventory and expertise to reflect Chinese brand permanence. Aftermarket suppliers need parts coverage for brands that barely registered five years ago. Fleet managers now evaluate purchase options unthinkable in 2015, while residual value uncertainty for newer brands complicates total cost calculations.

Fifth Quadrant publish monthly new vehicle sales updates here. For more insights on automotive market trends and consumer behaviour, explore Fifth Quadrant’s automotive research or contact our team.

Have you seen our automotive reports?

Click here to view our extensive range of automotive reports.

Posted in Uncategorized