Author: Amelia McVeigh | Posted On: 11 Jul 2025

In an age of economic uncertainty, it would be reasonable to expect consumers to cut spending. Ongoing financial pressure has seen household savings plummet, from 13.3% in 2021 to just 3.8% by the end of 2024, and cost-of-living concerns dominated the last federal election. Yet many Australians are still splashing out on upgraded products and experiences, proof that a strong premium brand strategy can thrive even when wallets are under pressure.

Since 2019, the luxury sector has grown strongly, with many brands reaching record profitability. We’ve also seen many clothing brands that began as accessible or value-focused partnering with luxury fashion houses (e.g. Crocs x Balenciaga, IKEA x Virgil Abloh, and Dior by Birkenstock).

So, what’s driving this willingness to spend more, even when wallets are under pressure?

Premiumisation: A shift in value

Premiumisation isn’t just about paying more – it’s about how people define value. Today’s consumers want more than function; they seek meaning. A premium product signals status, trust, and emotional connection. Price becomes less a barrier and more a cue: Is this worth it?

Think $6 single-origin coffee or sneakers made from ocean plastic. These purchases go beyond utility – they express identity.

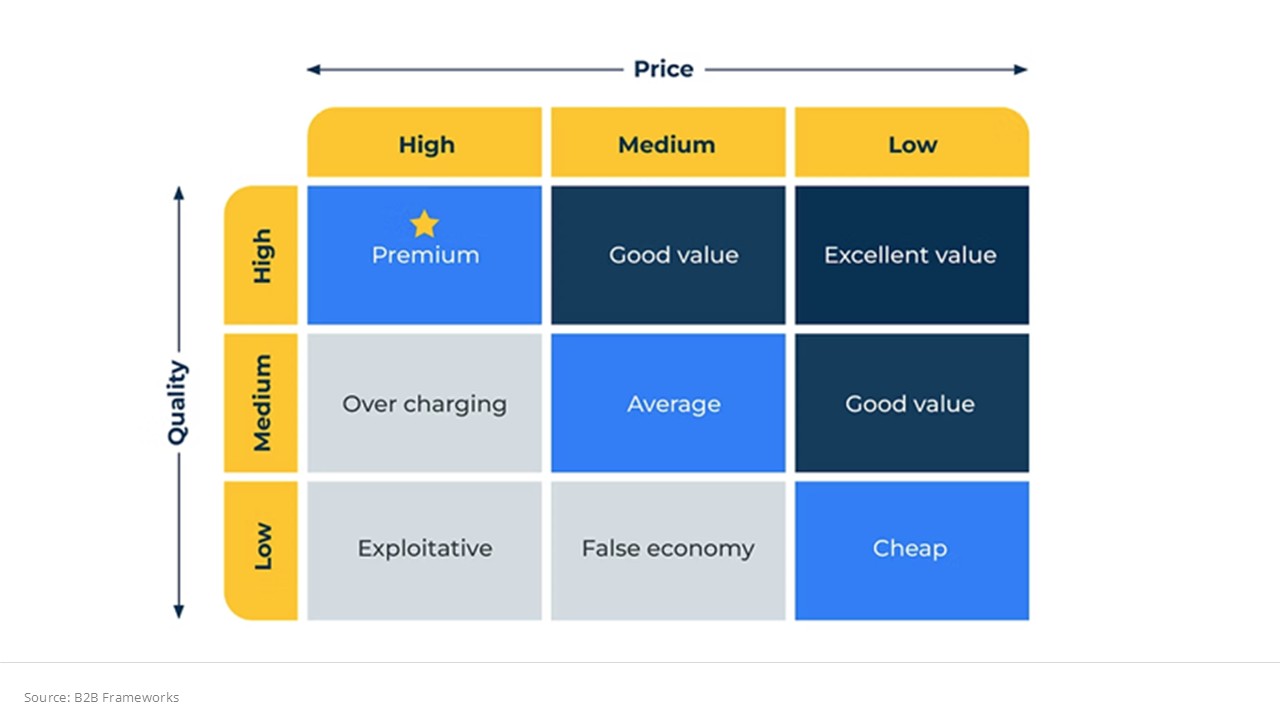

The price–quality strategy shows how pricing influences perceptions of quality and prestige. But price alone doesn’t make a product premium. The experience must deliver.

The premium branding playbook

Premium brands shape perception. Common strategies include:

- Storytelling: Authentic brand narratives about craft, values, or purpose build emotional connection.

- Scarcity: Limited releases and exclusivity boost perceived value.

- Packaging: Premium is sensory. Elegant, tactile design elevates experience.

- Price Anchoring: Pricing next to cheaper alternatives reinforces perceived quality.

In beauty, brands like Aesop and La Mer combine design, storytelling, and elevated pricing to create indulgence. In food and drink, craft beer and artisanal chocolate sell provenance and craft. Tech players like Apple blend sleek design and ecosystem exclusivity.

But cues alone aren’t enough. Brands must deliver consistently. When consumers part with more money, they expect a clear return in quality, service, or emotional satisfaction.

The risk of trading up

- Price Fatigue: Even loyal customers reconsider spending. Streaming platforms like Netflix and Spotify have faced cancellations after repeated price hikes. Some fashion brands have seen backlash for raising prices without adding value.

- Category Misfit: Not all products can go premium. Think luxury toilet paper or wine-priced water – efforts that often confuse more than convert.

- Inauthenticity: Buyers are quick to reject fake premium. Pepsi’s Kendall Jenner ad is a classic case – packaging purpose without credibility backfired.

Premiumisation only works when positioning, product, and expectation align.

When premium makes sense

Many consumers are more selective, not just frugal. They’ll pay more – but only for what feels worth it. That might mean fewer purchases, but better ones.

For brands, this means shifting from transactional to meaningful. Premium brands succeed when they reflect who their customers want to be – and deliver consistently.

It also means understanding how those perceptions change. Premium isn’t fixed; what feels valuable today may not feel valuable tomorrow. Brands that monitor sentiment closely are better equipped to maintain relevance.

More than a price tag

Premium isn’t a pricing strategy, it’s a perception strategy. Price is a signal. The challenge is crafting a brand that justifies it.

That requires investing in experience, design, and ethics, not just product. It’s about building a brand ecosystem that earns trust and desire.

And that’s where research matters. Understanding how your brand is perceived, and how that shifts with pricing or repositioning is vital. Whether you’re rebranding or refining a premium offer, research reveals how consumers interpret value.

Understanding your brand’s place in the premium equation starts with listening. Fifth Quadrant’s research programs help track brand perception as markets shift. When you know what consumers value, you can price and position with confidence. Speak to one of our experts today about how Fifth Quadrant can help you uncover what premium really means to your customers, refine your positioning, and build a brand that commands true value.

Posted in Consumer & Retail, CJM