Author: Madelyn Stafford | Posted On: 12 May 2025

Australia’s economy is underpinned by a few powerhouse industries, from iron ore and coal to refined metals, agriculture, and food processing. These sectors generate significant value, driven by strong demand from the Asia-Pacific region.

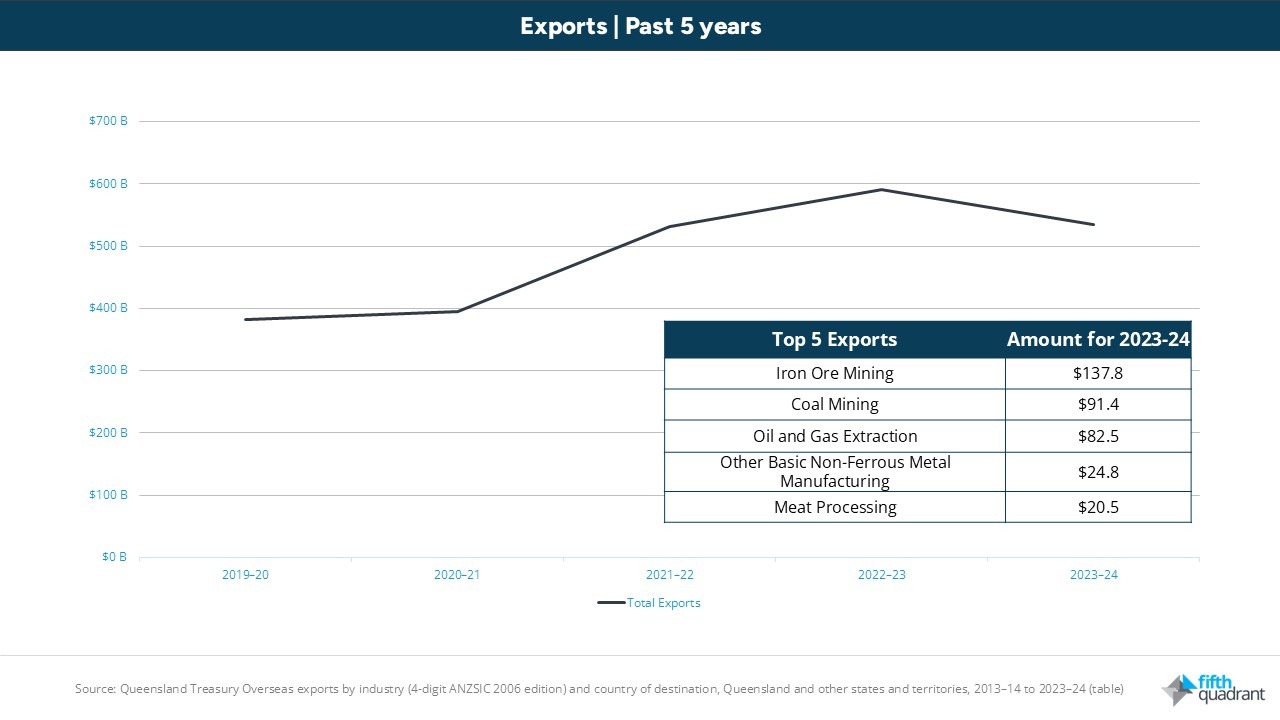

In 2023–24, exports contributed $534.8 billion. While this number was down from last year’s record, it was still well above pre-pandemic levels, reinforcing Australia’s position as a key global supplier of raw materials, energy, and food.

Australia’s export strength is anchored in five key sectors, which together make up around two-thirds of total export value. This is a reflection of the scale and global competitiveness of these industries. But when so much depends on a few products and a few buyers, it also brings exposure to global risks, from shifts in demand to policy changes and trade tensions, including the threat of tariffs that can disrupt supply chains and reshape market dynamics. For businesses and organisations looking to understand the country’s economic landscape, or target sectors with strong export demand, the latest export data provides a clear view of where Australia’s biggest opportunities and dependencies lie.

Australia’s 5 top exports

- Iron Ore: The $138 Billion Cornerstone

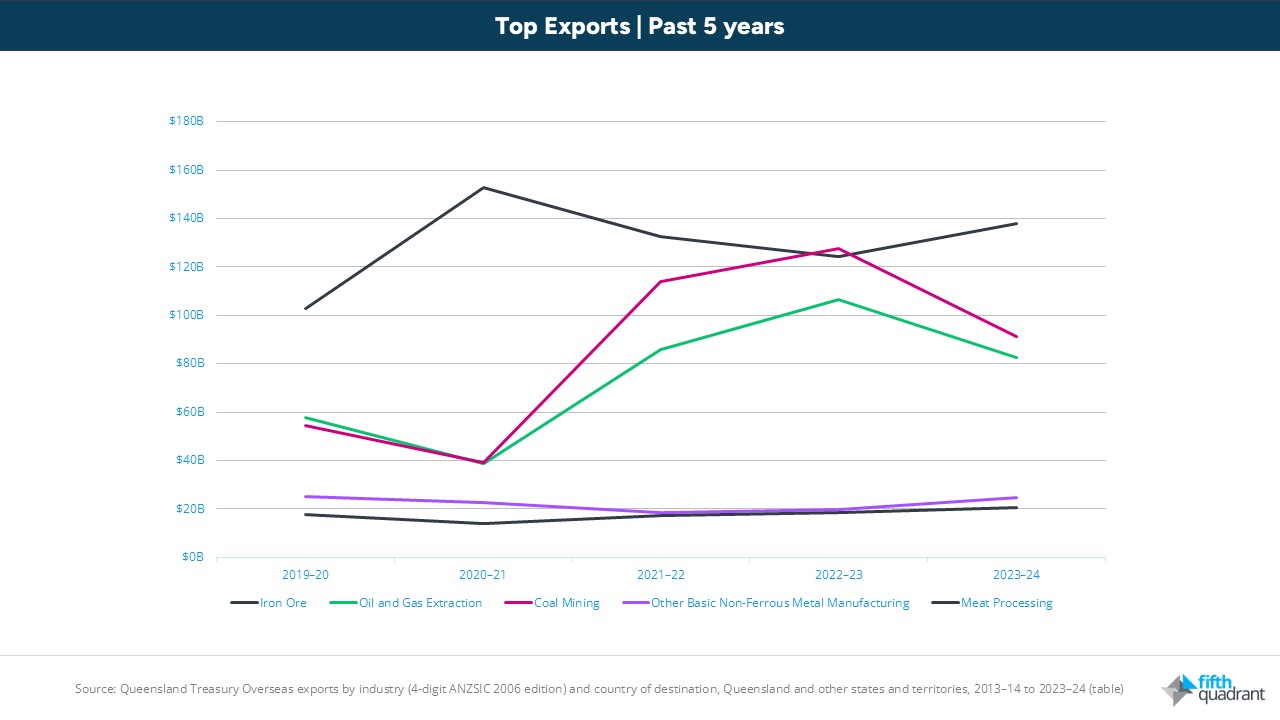

Iron ore remains Australia’s largest export, contributing nearly $138 billion last year. Over the past five years, export values have fluctuated with iron ore prices and Chinese steel demand, peaking at $153 billion in 2020–21 before softening and partially rebounding.

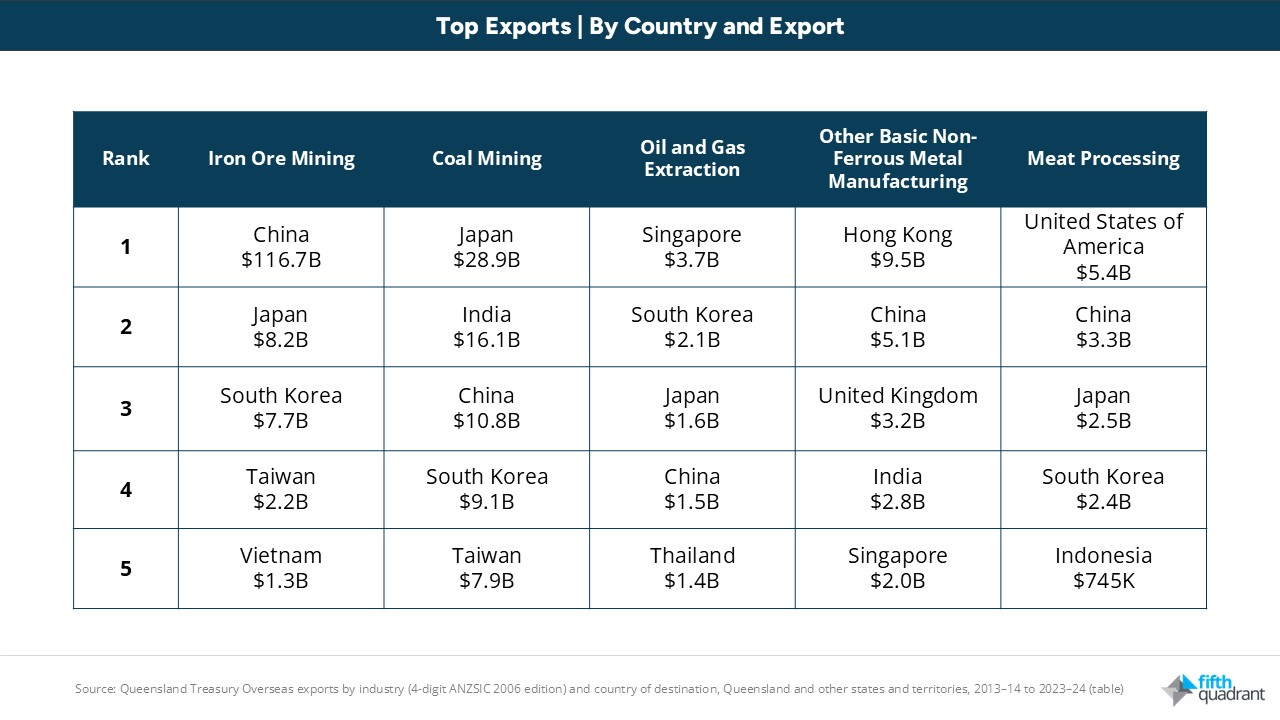

China alone accounts for almost 85% of Australia’s iron ore exports, underscoring both the sector’s profitability and its exposure to geopolitical risk. Changes in China’s steel production, construction sector, or foreign policy can ripple directly through Australia’s economy.

- Coal: Holding Steady Amid Energy Transition

Coal exports, worth $91.4 billion last year, remaining Australia’s second-largest contributor. Japan leads demand, with India, China, and South Korea also major buyers.

The sector saw sharp gains during the global energy crisis of 2021–23 but faces an uncertain future as many key markets prioritise net-zero targets in the coming years. The key question for coal is not whether demand will decline, but the pace at which that will happen.

- Oil and Gas Extraction: Supplying Asia’s Energy Needs

The oil and gas sector in Australia brought in $82.5 billion in 2023–24, largely from exports to Asia. Singapore acts as a major destination, serving as both an energy trading hub and the storage site for some of Australia’s strategic petroleum reserves.

Oil and gas extraction continues to play an important role in regional energy security, but like coal, it faces increasing pressure from the global push to decarbonise.

- Non-Ferrous Metals: Supplying Global Industry and Manufacturing

Exports of Non-Ferrous Metals contributed $24.8 billion. This category includes processed non-ferrous metals like nickel and tin, with nickel playing a key role in battery technologies for electric vehicles. This is supported by steady demand from Hong Kong, China, and the UK. As global investment in electric vehicles, batteries, and renewable infrastructure accelerates, this sector may become even more central to Australia’s export profile.

- Agriculture: Meat Processing Hits a Five-Year High

Australia’s meat processing exports (excluding poultry), reached a five-year high of $20.5 billion. The United States remains the top buyer, followed by China, Japan, South Korea, and Indonesia. Australia’s reputation for high-quality, biosecure food production continues to underpin this success.

Looking forward

Australia’s export economy remains strong but highly concentrated within the Asia Pacific region, with 58 percent of exports going to just three markets: China, Japan and South Korea. This reliance leaves key sectors exposed when global conditions change. Slower growth in China, diplomatic tensions or renewed US tariffs on Chinese goods under a Trump administration could quickly flow through to Australian exporters.

For businesses and organisations operating in this landscape, understanding the potential risks are how market demand may shift is not optional but essential when it comes to making informed decisions.

At Fifth Quadrant, we help our clients stay close to these dynamics and turn uncertainty into insight. Contact us to learn more about our market research services.

Posted in Consumer & Retail, Transport & Industrial