Author: Madelyn Stafford | Posted On: 30 Jun 2025

Australia moves on wheels, and no wheels are more important to our economy than trucks. From delivery vans weaving through city streets to prime movers pulling freight across state lines, commercial vehicles are the enablers of national growth.

But they are more than just a presence on our roads. Changes in our truck fleet can give us insights into how goods flow, how cities grow, and where infrastructure and investment are heading next.

Recent vehicle registration data and projections from the Bureau of Infrastructure and Transport Research Economics (BITRE) reveal how the commercial vehicle landscape is evolving. These shifts point to important trends in freight, logistics, and mobility.

Freight on the rise: What the road ahead looks like

Commercial vehicle demand is closely tied to freight activity, and the trajectory is clear. According to BITRE’s freight forecasts, Australia’s total freight task is projected to reach 865 billion tonne kilometres by 2035, up 13% from 768 billion in 2020. Road freight is expected to grow significantly faster though, increasing by 38% from 223 billion to over 308 billion tonne kilometres over the same period.

This reflects broader changes in the supply chain, such as the rise of decentralised warehousing, demand for faster (often same-day) delivery, and the growing importance of regional logistics hubs.

Metro movers: The rise of the urban workhorse

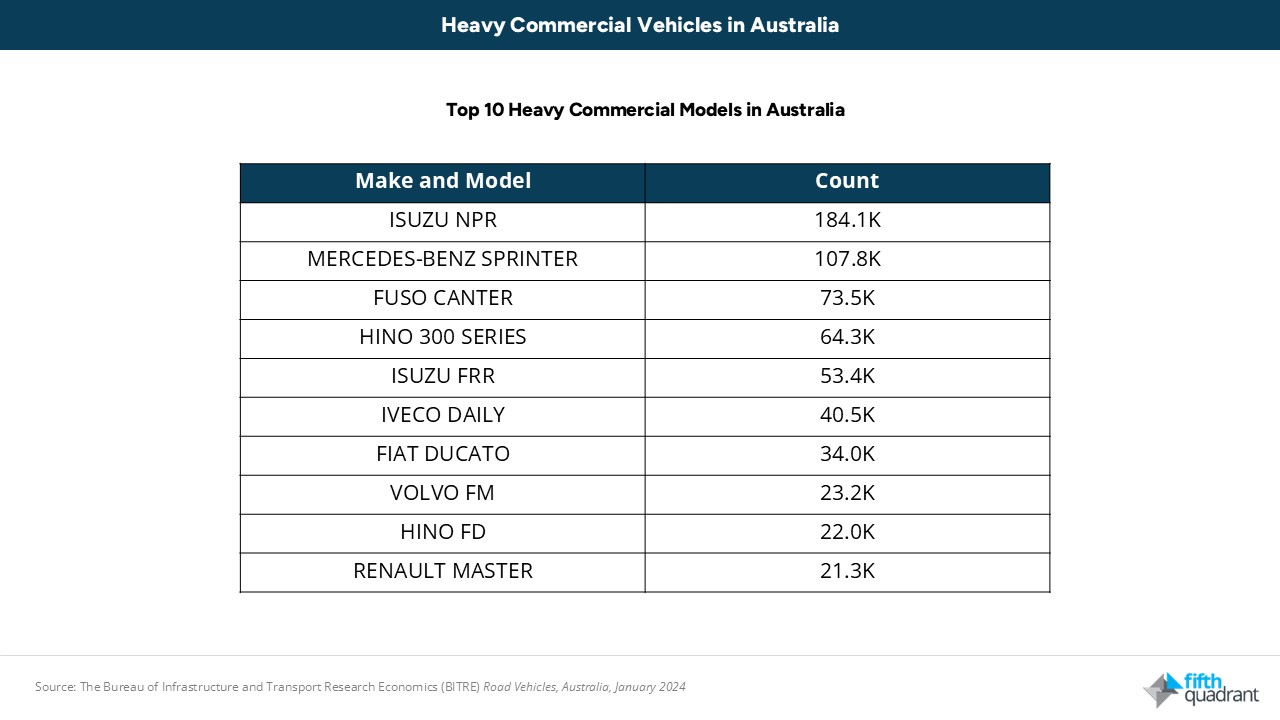

One particularly noticeable change in recent years is the surge in heavy vans, particularly in metropolitan areas. Models such as the Mercedes-Benz Sprinter, Fiat Ducato, Iveco Daily, and Renault Master are now core components of last-mile delivery fleets. These vehicles are agile enough for city driving, large enough to handle volume, and are increasingly built to support electric drivetrains.

Heavy-duty haulage: Still the backbone of the economy

Despite growth in urban delivery, heavy-duty trucks remain essential for Australia’s long-haul and bulk freight tasks. Vehicles like the Kenworth T610, Volvo FM, and Hino FD play a central role in moving goods between ports, cities, and regional centres. The industry is however being constrained by the capacity of current models, so discussions are continuing around increasing freight mass limits and improving access to key routes in order to raise transport efficiency.

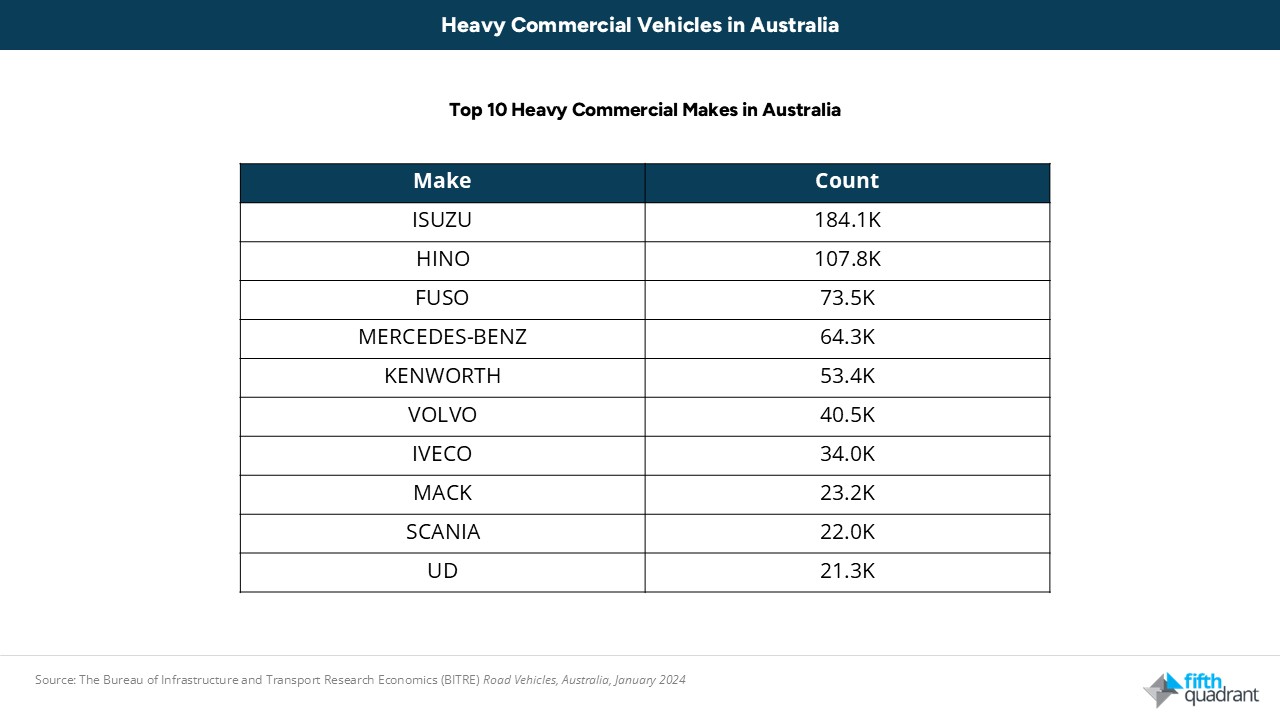

Brand stories: Isuzu’s quiet dominance and Volvo’s innovation

Isuzu accounts for more than 184,000 commercial vehicles on Australian roads, dominating the light and medium-duty segments. Isuzu is now also expanding its presence in the heavy-duty category, putting pressure on long-established leader Kenworth.

At the same time, Volvo is positioning itself at the forefront of freight innovation. It hopes that investing in electric truck production can give it an edge in a market where delivering sustainable outcomes is becoming a more significant consideration for many fleet operators.

What comes next: Three forces to watch

- Sustainability and electrification

The adoption of low-emissions commercial vehicles is gaining momentum, particularly in urban settings. Emissions regulations and fleet renewal strategies will accelerate this shift. - Digital transformation of fleet operations

The use of telematics, real-time routing, and predictive maintenance continues to increase, helping operators manage costs and improve service reliability. - Freight infrastructure development

Projects such as the Western Sydney Airport, and the roll-out of new logistics centres are changing freight corridors and influencing vehicle needs.

Australia’s commercial vehicle fleet is more than a collection of trucks. It is a real-time indicator of economic direction, urban transformation, and freight system resilience. Understanding how and why it is changing is essential for manufacturers, logistics providers, infrastructure planners, and policymakers.

Fifth Quadrant delivers custom research into Australia’s automotive market, infrastructure trends, and freight futures. Contact our team to explore how data-driven insight can shape your transport strategy.

Posted in Auto & Mobility, Transport & Industrial