Author: Pajman Johnstone | Posted On: 06 Jun 2025

Overview of the BNPL landscape in Australia

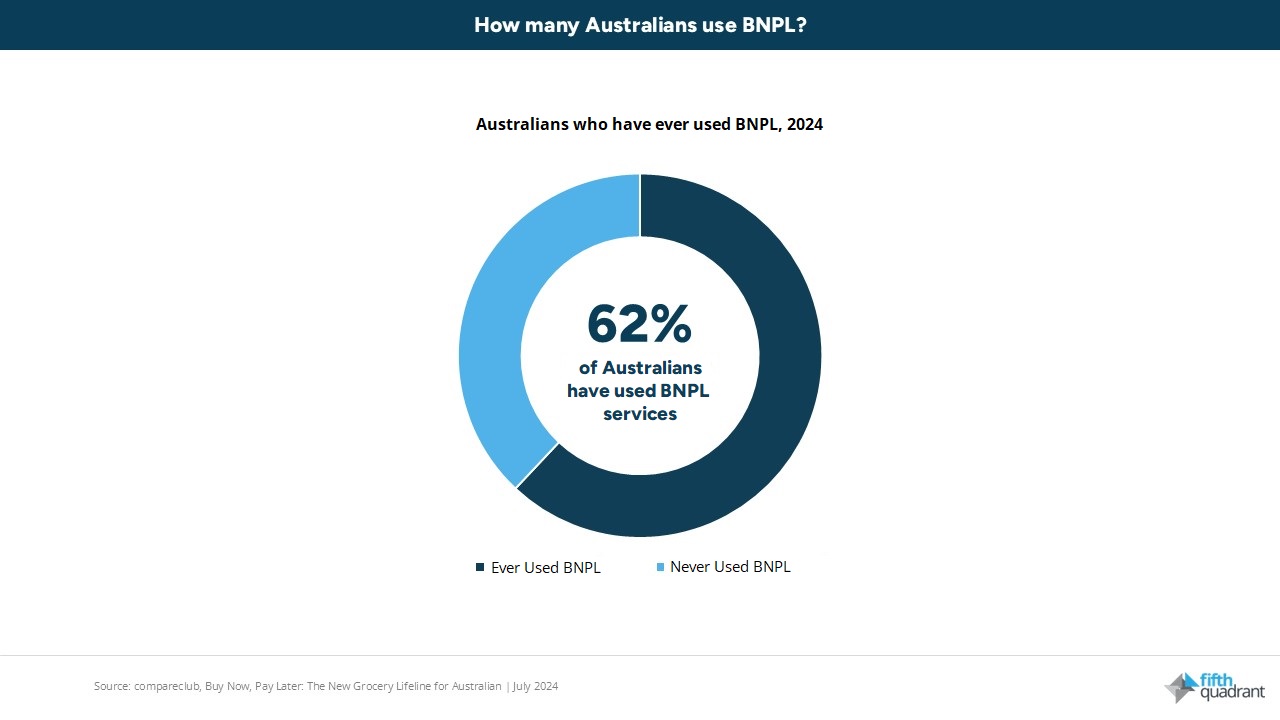

Since the pandemic, Buy Now Pay Later (BNPL) has quickly risen to a mainstream payment method in Australia, with 62% of consumers having used BNPL at least once. This surge in popularity has made BNPL the country’s third most-used credit product, behind only credit cards and home loans—prompting growing attention on BNPL regulations to ensure responsible use and consumer protection.

BNPL platforms account for an estimated 37% of online purchase volume in Australia, underscoring how embedded they have become in the retail landscape. This significant share of purchase volume is dominated by a few key players including Afterpay, PayPal Pay-in-4 and Zip.

As with many innovations in the finance sector, widespread adoption tends to precede regulation. As these services mature and become embedded in everyday spending behaviours, the need for consistent oversight inevitably follows to protect consumers, preserve market integrity and manage systemic risk.

As former Financial Services Minister Stephen Jones warned, “BNPL looks like credit, it acts like credit, it carries the risks of credit,” a comparison Treasury used to liken BNPL to high-cost, short-term loans such as payday loans, which have previously trapped vulnerable consumers in cycles of debt.

New BNPL regulations

Accordingly, Australia has implemented significant regulatory reforms for Buy Now, Pay Later (BNPL) services, aligning them more closely with traditional credit products such as credit cards. These regulations came into effect on June 10, 2025.

BNPL providers will now be treated as a new credit category called “low cost credit contracts.

All BNPL providers are now required to hold an Australian Credit Licence (ACL) and must meet ongoing obligations of licensees, providing clear pre-contract disclosures and importantly confirmation of customer income, expenses & debts. Those that are deemed higher risk or fail income assessments may be declined credit moving forward.

The percentage of BNPL users that will be affected by this can only be estimated at this time, however research from the University of Sydney in late 2022 found that approximately 10% of BNPL users could be considered ‘high risk.’

Business implications and strategic adaptation

The new BNPL regulations carry wide-ranging implications for retailers, consumers, and BNPL companies. All players in the ecosystem will need to adapt their strategies in response to a more controlled credit environment:

BNPL companies themselves face the most direct impact. They must invest in compliance overheads, from obtaining licenses to upgrading systems for credit checks and reporting. This will increase operational costs and may slow the frictionless onboarding that fuelled BNPL’s growth.

Analysts predict consolidation in the BNPL sector is likely, as weaker players either exit or get acquired by bigger rivals better equipped to handle a regulated lending environment. However, some in the industry maintain that the BNPL model remains a growth opportunity in consumer finance, since demand for convenient instalment payments is now engrained into spending habits. Australian retailers have embraced BNPL as a sales-boosting tool, often noting higher conversion rates and bigger basket sizes when customers use BNPL. With stricter rules, retailers might see a drop in BNPL purchase volume at checkout, particularly if impulsive buyers can no longer get instant approval or are declined due to affordability checks.

Summary

With new regulations bringing BNPL in line with traditional credit, providers now face tighter compliance, rising operational costs, and likely sector consolidation. While demand for flexible payments remains strong, success will depend on how well platforms and retailers adapt to a more mature, regulated BNPL environment.

At Fifth Quadrant, we help organisations implement strategies that can navigate evolving consumer and financial landscapes. Contact us to discuss how our research can future proof your financial planning and enhance customer engagement.

Posted in Consumer & Retail, B2B, Financial Services