Author: Jessica Phan | Posted On: 17 Jun 2025

Updates to New Vehicle Sales are published monthly. View previous wave

New Vehicle Sales May 2025 may be trailing behind last year, but the market is far from slow. May finished with 109,425 new vehicles sold, just 2,000 units shy of the same month in 2024. Year-to-date, total sales are down ~19,000 units, but while the gap may seem substantial, it is worth noting that 2024 set a new benchmark for the industry. In this context, 2025 remains strong, currently tracking as the second-highest YTD result on record.

Top 5 Takeaways

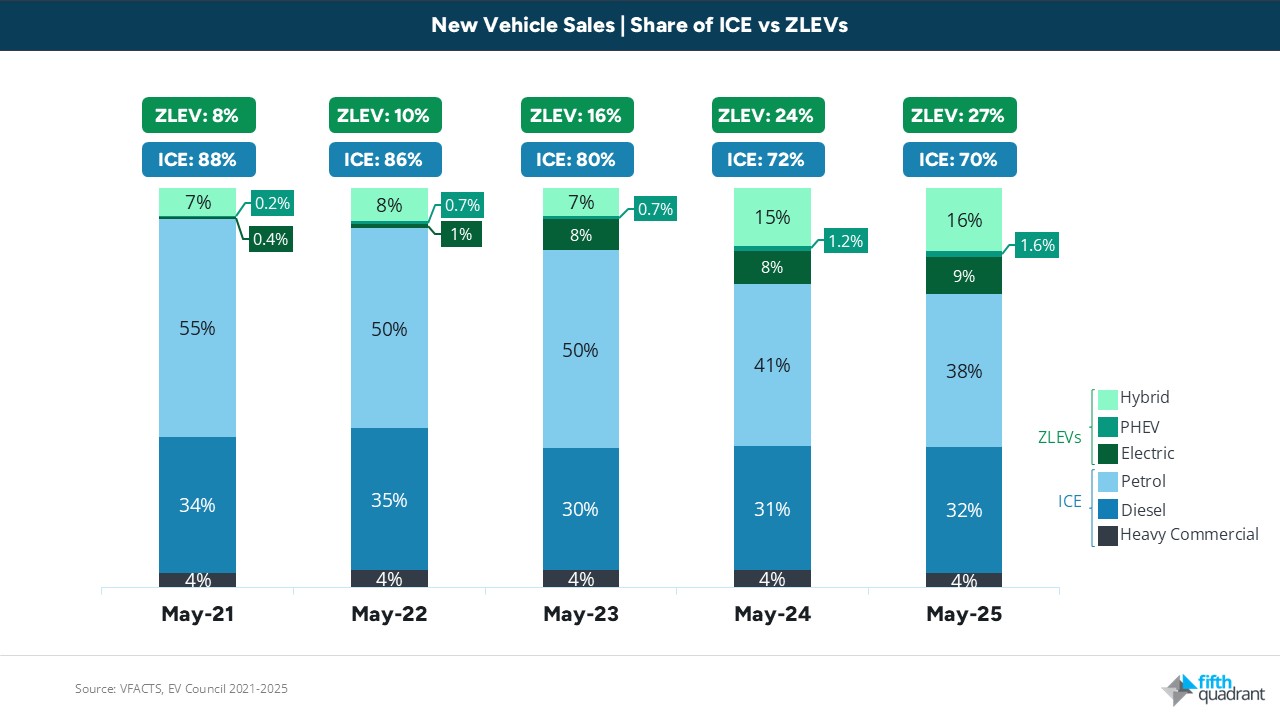

- Petrol Sales Share Drops Below 40%: Increase of Zero and Low Emission Vehicles (ZLEVs) sales post-COVID has triggered a gradual decline, pushing petrol sales share to a historic low point.

- EV Sales Rebound Past 10,000 Units: May marks the first month EVs have reached 10,000+ units sold since March 2024, helped by new models including the Kia EV5 (703 units, double last month), and the Geely EX-5 (511 units).

- Tesla Model Y Sparks a Comeback: Tesla returns to the Top 10 brands this month. This was driven by the revamped Model Y which sold 3,580 units, and ranked amongst the Top 5 best-selling vehicles.

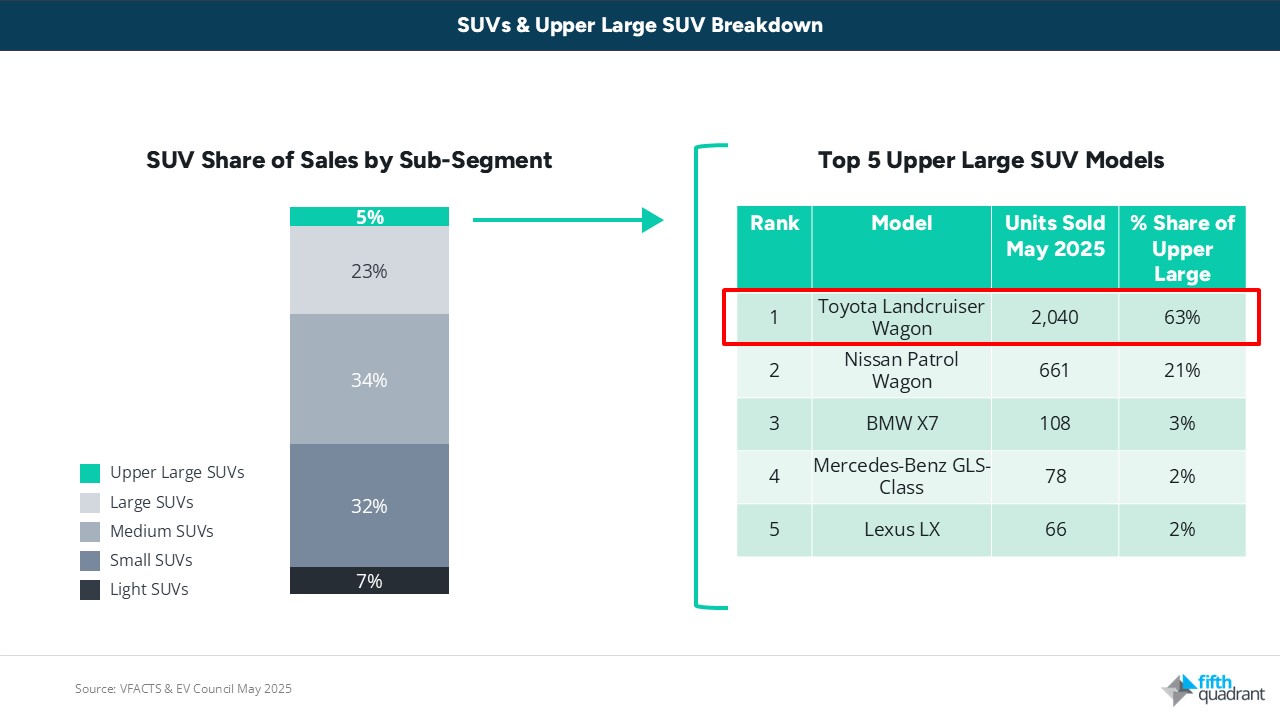

- The Toyota Landcruiser Wagon Reignites the Upper Large SUV segment: With 2,040 units sold, the Landcruiser Wagon re-enters the Top 10 for the first time since 2021, accounting for 63% of the Upper Large SUV segment.

- Passenger Vehicles Post Another Double-Digit Decline: Large drops are experienced by notable favorites such as the Kia Cerato (-96% YoY), Tesla Model 3 (-84% YTD) and the Toyota Camry (-63% YTD).

Upper large SUVs maintain relevance despite smaller share

It’s to no surprise SUVs continue to dominate the Australian vehicle market, with medium SUVs leading on 40% share, followed by large SUVs at 23%. Upper large SUVs account for just 5% of the segment; the smallest slice, but still an important one. This category serves large families, rural and regional drivers, and those requiring serious towing or off-road capabilities, all without sacrificing passenger space. The return of the Toyota LandCruiser Wagon to the Top 10 overall vehicle rankings shows that demand for capability-first vehicles remain strong. While the limited number of players in this segment suggests there could be room for more brands to challenge the status quo, it’s hard to tip against the entrenched audience for Toyota’s product.

ZLEV market expands as market forces drive change

Zero and Low Emission Vehicles (ZLEVs) accounted for 27% of all new vehicle sales this month, more than triple their share in 2021. This significant growth reflects growing model availability, evolving consumer preferences, and a broader industry pivot towards electrification.

At the same time, monthly sales remain sensitive to short-term drivers like model updates, discounts and government incentives. May’s EV surge, for example, was led by the refreshed Tesla Model Y, while PHEVs saw a boost earlier this year prior to the end of the federal government FBT exemptions.

However, even as incentives fade, market interest remains strong and ZLEV adoption trends upwards. Looking at PHEVs in particular, while overall share has now dropped below 2%, models like the BYD Shark have maintained robust sales, with over 1,300 units sold this month.

The introduction of the NVES offers a clearer framework for OEMs to work towards when it comes to emissions targets, giving them certainty around the future regulatory environment, and supporting a more stable and predictable transition towards low-emission transport nationwide.

looking ahead

June is typically the strongest month of new vehicle sales, with consumers and fleets taking advantage of excess stock and EOFY discounts. But EOFY isn’t the only force at play, as this is also the first June under the NVES scheme. The volume of offers in market suggest that a number of brands are working to offload higher-emitting stock before penalties start to bite.

The result? A busy month of discounting and volume pushing, even if it means thinner margins. Based on Fifth Quadrant’s forecasts for the year, we could see approximately 110,000-120,000 units for June, which will significantly close the mid-year gap.

Looking for more auto insights? Click here to view of our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility