Author: Jessica Phan | Posted On: 02 Jul 2025

The New Vehicle Efficiency Standard (NVES) represents a major shift in transport policy. While government messaging focuses on cost savings and environmental benefits, the implications for fleets are more complicated. With diverse vehicle needs, slim margins, and limited infrastructure, the NVES will be a catalyst for significant operational and financial change.

For many fleet operators, it won’t just be about switching to cleaner vehicles; it means navigating a new automotive landscape, as OEMs adjust product line-ups and pricing strategies. Hence, fleet managers will face tough decisions around availability, suitability and total cost of ownership (TCO).

Fleets must adapt to OEM shifts

OEMs will play a central role in reshaping the vehicle market, making strategic adjustments to meet NVES emissions standards. While penalties for exceeding CO2 targets won’t commence until 2028, compliance obligations begin in July 2025 and are already changing the trajectory of the vehicle market. OEMs are expected to prioritise compliant stock, limit non-compliant supply, and accelerate hybrid and zero and low-emission vehicle (ZLEV) rollouts.

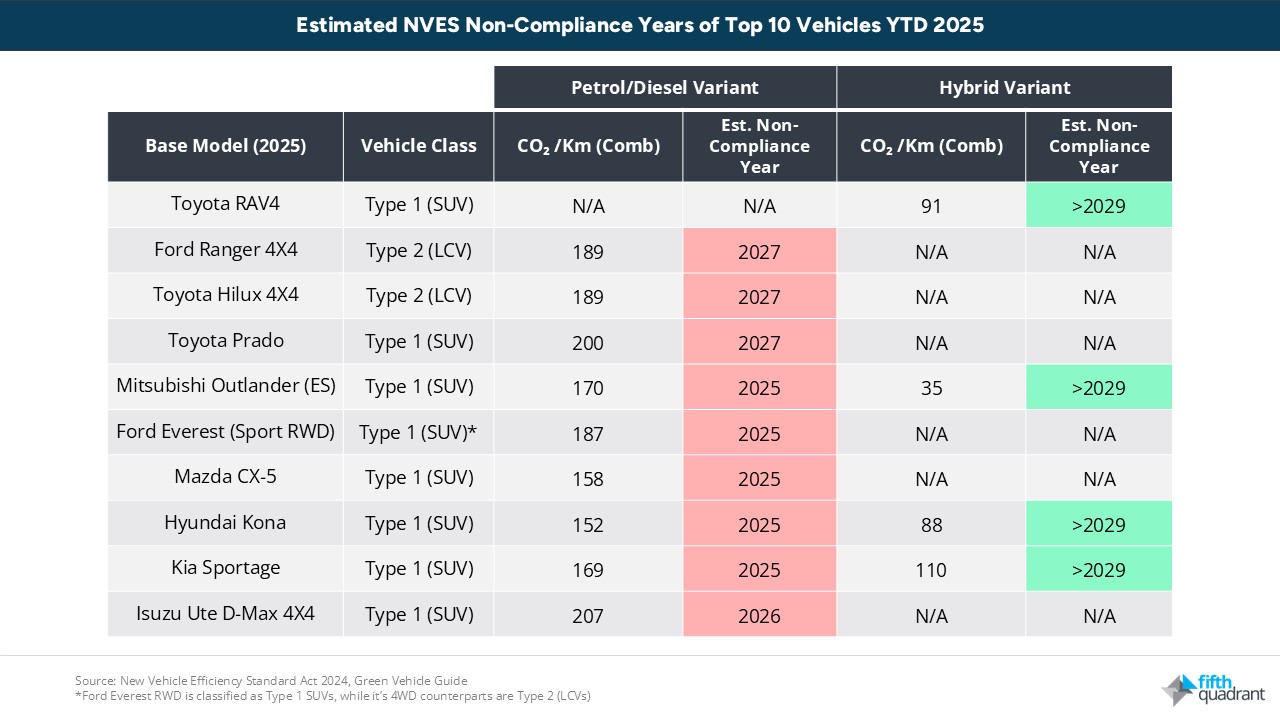

Based on their reported emission levels, many high-volume models (e.g. Ford Ranger, Toyota Hilux) are only marginally compliant with 2025 NVES thresholds, while several popular SUVs (e.g. Toyota Prado, Mazda CX-5, Hyundai Kona) already exceed current targets in their petrol or diesel configurations.

Additionally, 4×2 LCV variants are classified as passenger vehicles under the NVES scheme, meaning they must adhere to stricter standards compared to their 4×4 counterparts. This is already leading OEMs to phase-out ‘base’ models of some vehicles, such as the Ford Everest 4×2.

Procurement risk is growing

In this environment, fleet managers will need to rethink vehicle selection, diversify supplier relationships, and build more flexibility into vehicle sourcing and replacement plans. Fit-for-purpose options may narrow, especially for commercial and specialist segments, and some alternatives may not meet operational needs. Fleets will need to redefine “fit-for-purpose”, balancing NVES compliance and cost with requirements like payload, range, durability and maintenance needs.

At the same time, NVES is turning procurement into a risk management and TCO challenge. Vehicle availability constraints may increase lead times and reduce traditional benefits such as OEM volume discounts, procurement windows may shorten, and replacement planning will be more reactive. For fleets operating on thin margins and fixed service obligations, this unpredictability can impact business continuity and forward budget estimates.

ZLEVs are a key compliance tool, but adoption isn’t simple

As mentioned above, zero and low-emission vehicles (ZLEVs) offer OEMs a clear path to NVES compliance. Yet for fleet operators, the uptake of ZLEVs is complicated by structural, operational and financial uncertainty, making effective decision-making more difficult. In this new environment, fleet managers will be expected to plan multi-year investments without clear visibility on how ZLEVs will perform over time. Factors such as variable energy use by model and load, evolving servicing and maintenance requirements, and a lack of knowledge of battery degradation timelines make it difficult to assess ZLEV performance and operating costs. These unknowns are compounded by the current uncertainty around ZLEV resale values, especially battery-electric vehicles (BEVs), which are currently estimated to retain just 35-40% of their value after four years; significantly lower than their ICE equivalent of 60-70%. For organisations that rely on predictable turnover cycles, this combination of technical and financial risk complicates TCO modelling and adds uncertainty to large-scale adoption.

Looking ahead

Looking to the future, changing model availability, emissions thresholds, and supply dynamics will force fleets to reassess their procurement strategies. This includes building flexibility into vehicle selection and acquisition, and actively engaging with external suppliers and OEMs to gain insights into product roadmaps, stock availability, and potential resale support programs.

Governments also have a role to play. The market environment will continue to evolve, and the NVES rollout should be regularly reviewed to ensure it keeps pace with market realities and reflects the unique needs of the Australian vehicle landscape, including commercial use cases.

At Fifth Quadrant, we understand the complexity of this transition. As NVES reshapes the road ahead, we’re committed to providing clear, evidence-based guidance that fleet and policy leaders can use to support organisational decision making. For any questions or inquiries, feel free to contact us here.

Posted in Auto & Mobility, Energy Transition, Uncategorized