Author: James Organ | Posted On: 13 Jan 2026

Updates to this research are published monthly.

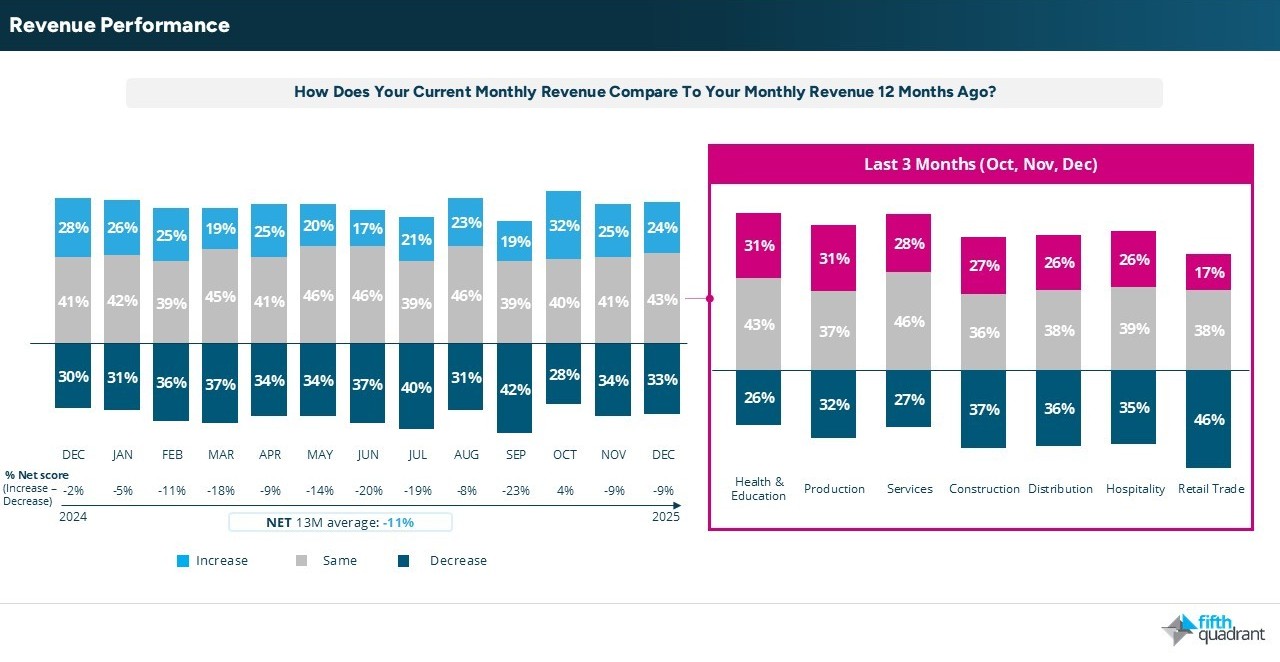

SME December 2025: SME confidence softened further in December as weaker trading conditions, ongoing cost pressures and heightened political and global uncertainty weighed on sentiment. While revenues were broadly in line with November, performance was weaker than December 2024.

Declining cost recovery continues to place pressure on margins, with fewer SMEs able to pass rising input costs through to customers, reflecting increasingly competitive conditions.

Hiring expectations

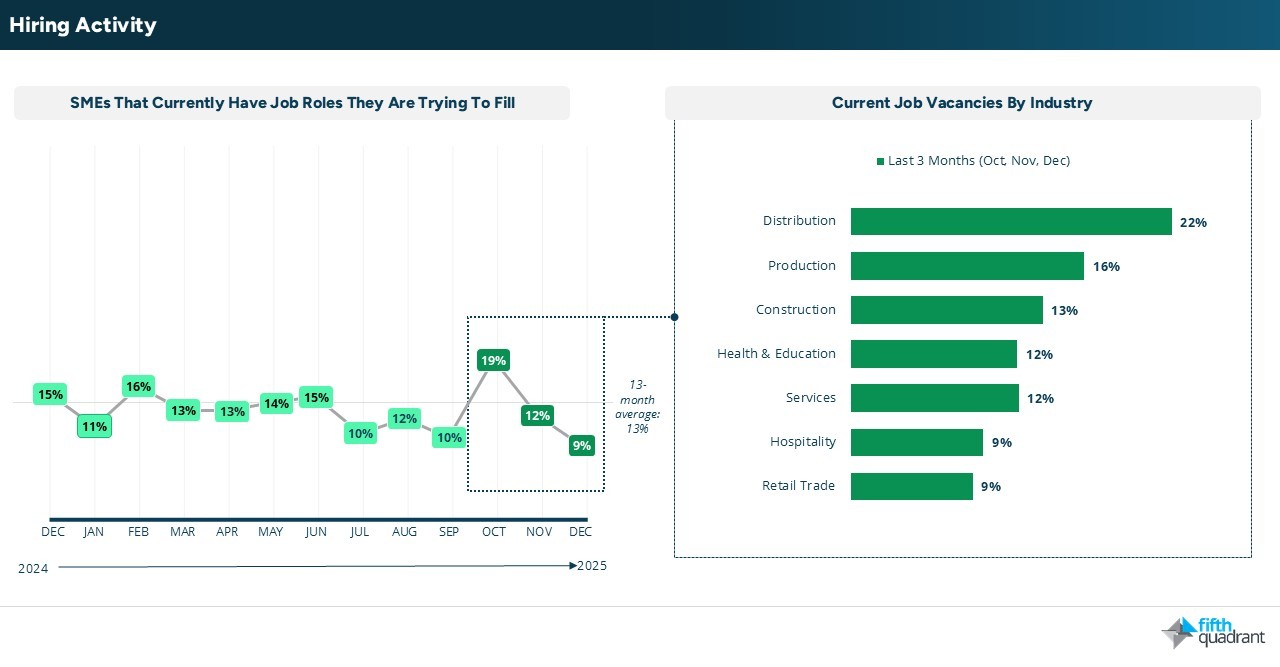

Profitability remains under pressure, and expectations for staff numbers have continued their negative trend since October, now sitting well below 2024 levels.

Hiring activity has fallen to a 12-month low, with fewer SMEs actively filling roles.

Despite this slowdown, recruitment challenges persist, driven by a lack of applications from suitably skilled candidates indicating a reluctance among candidates to change jobs in this environment.

Growth ambitions

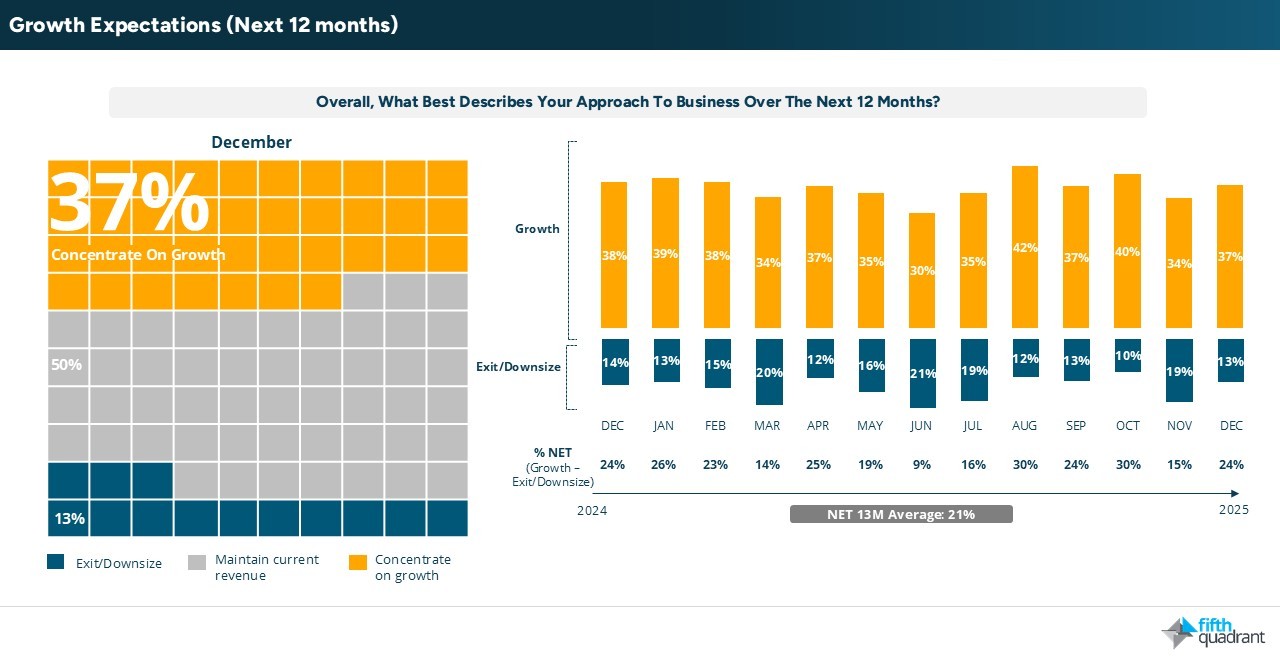

Growth aspirations, however, remain relatively resilient. More than a third of SMEs are still looking to expand over the next 12 months, in line with December 2024 and an improvement on November.

Growth sentiment has rebounded across both employee size cohorts, with larger SMEs recording their strongest growth outlook since February 2025, highlighting a growing divergence by business size.

Demand for finance

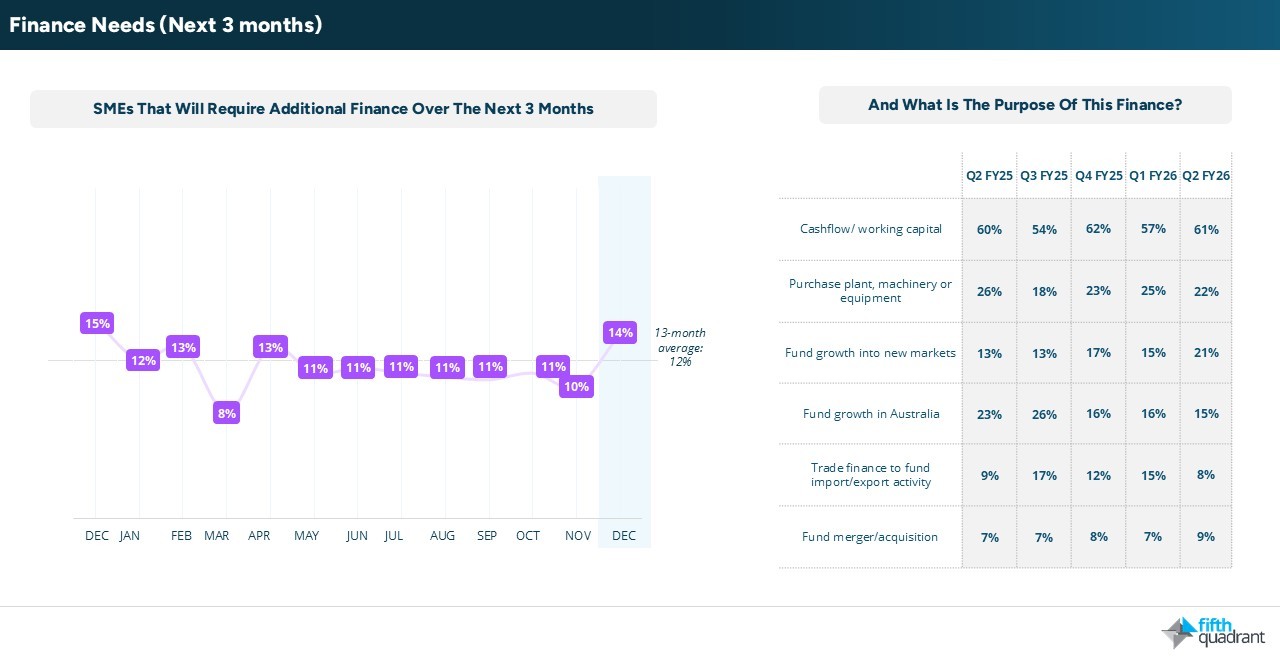

Demand for finance increased through December as SMEs navigate the quieter period, particularly among Hospitality, Construction and Distribution businesses. Encouragingly, loan stress remains low and stable, sitting below 10% for the third consecutive month and well below 2024 levels.

Conclusion

SMEs finish 2025 facing a challenging operating environment characterised by margin pressure, softer hiring conditions and elevated uncertainty. However, contained financial stress and steady growth ambitions, particularly among larger businesses, suggest many SMEs are entering 2026 in a position of cautious optimism.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SME December 2025

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services