Author: James Organ | Posted On: 08 Sep 2025

Updates to this research are published monthly.

Stronger consumer spending and interest rate cuts drive SME sentiment

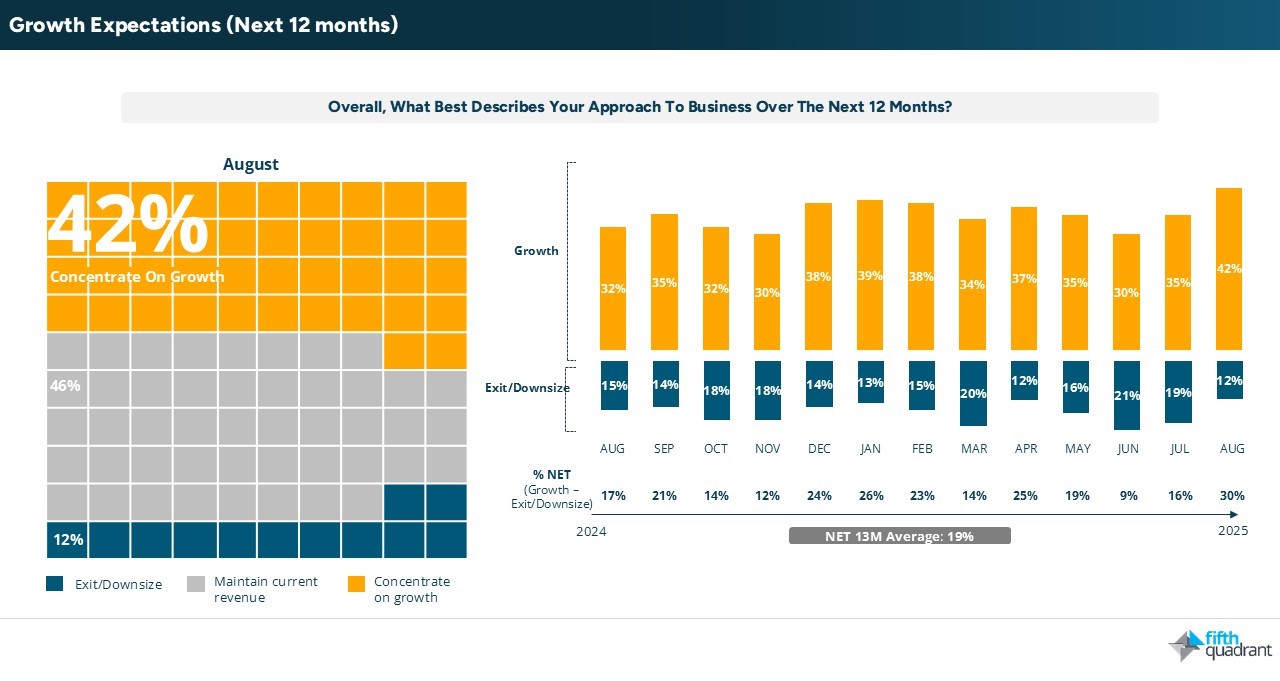

SME sentiment improved in August, supported by stronger consumer spending in July and further interest rate cuts in August. Revenue sentiment was the strongest since January, and growth expectations lifted sharply, with 42% of SMEs now focusing on expansion compared to 35% in July.

Small business momentum and reduced loan stress

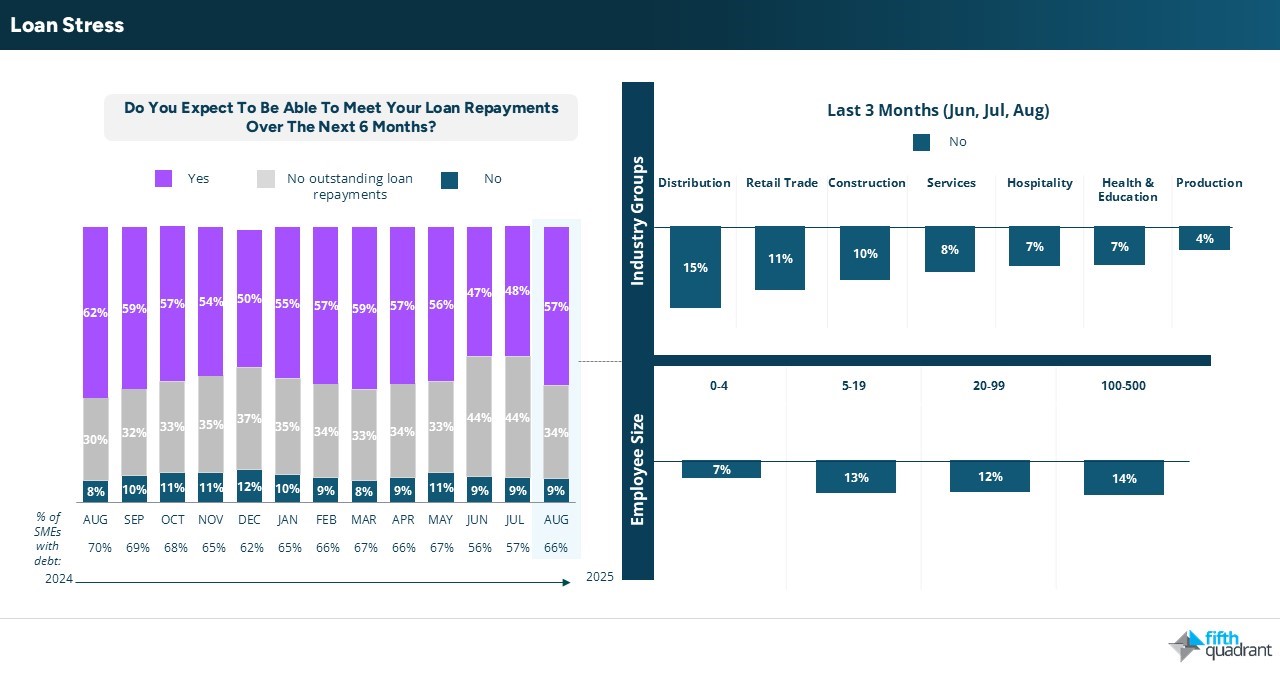

Smaller businesses in particular showed stronger momentum, while larger firms held steady. Loan stress also eased, with more SMEs confident they can meet repayment obligations, reflecting the combined impact of easing rates and firmer revenues.

Employment expectations rise amid recruitment challenges

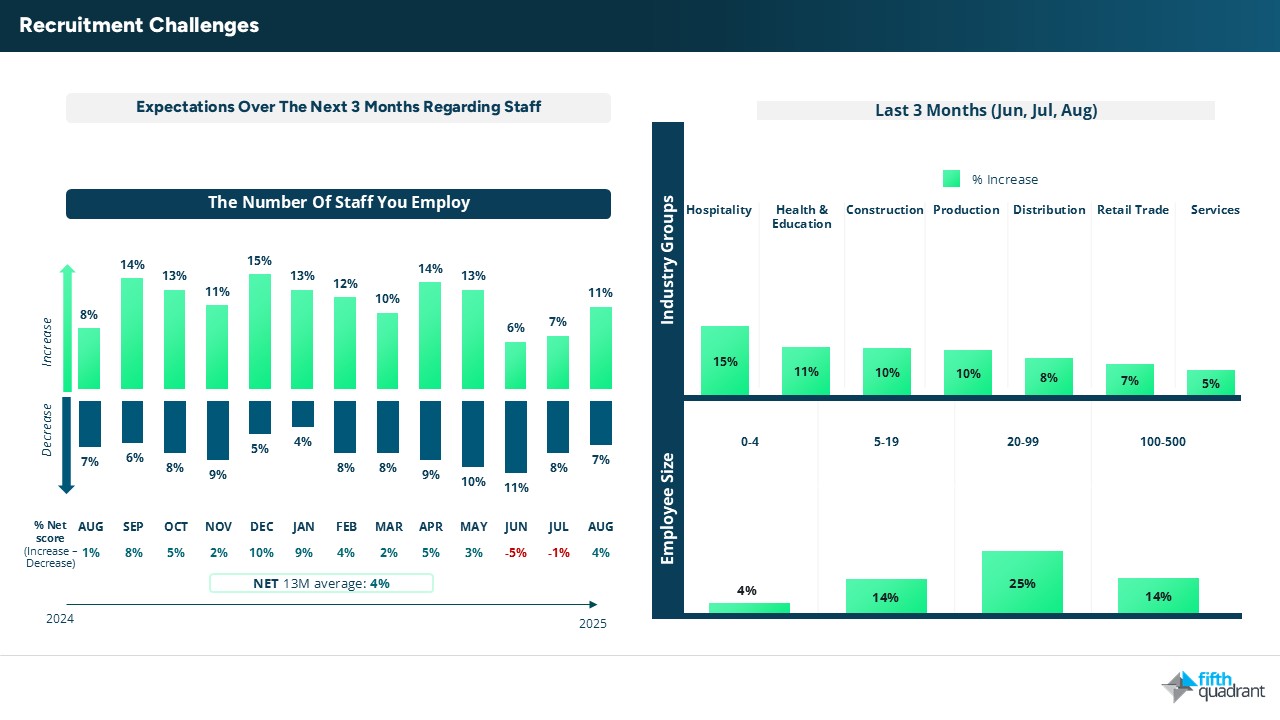

Employment expectations also ticked higher, with more SMEs planning to increase headcount after two weaker months. Recruitment difficulties continue to be increasingly shaped by wage demands and flexibility expectations, highlighting the ongoing tightness of the labour market.

Australian and global economic outlook strengthens

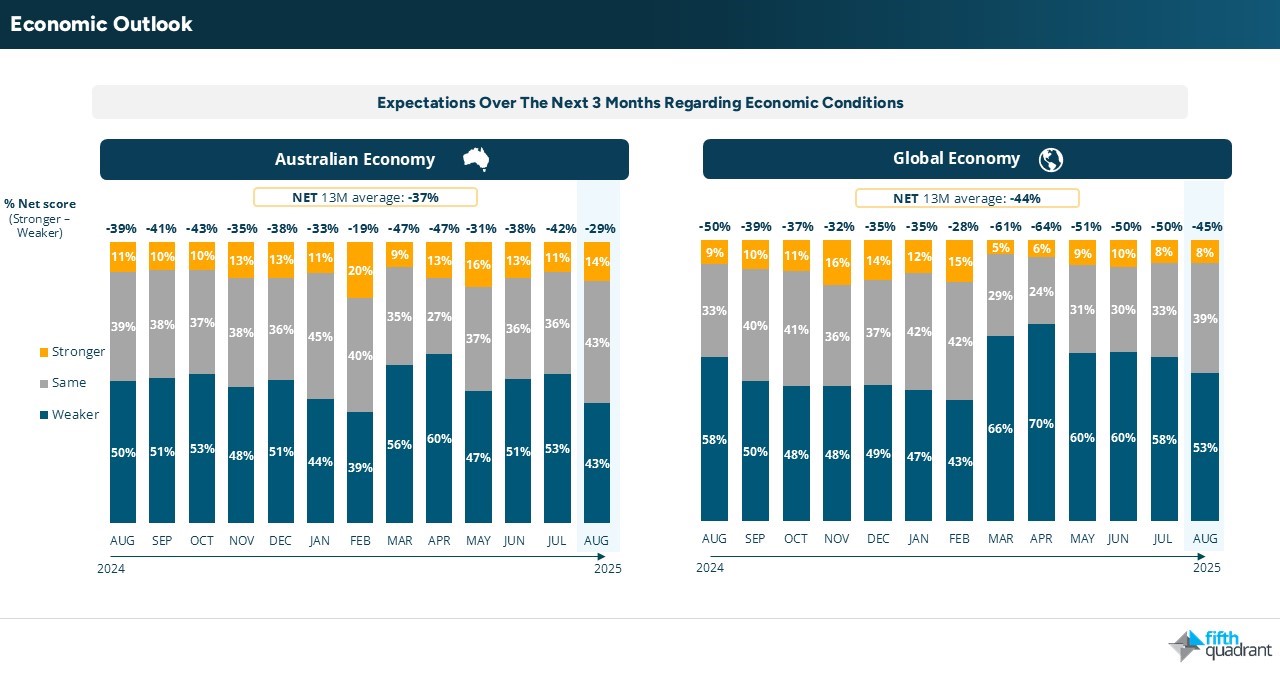

Expectations for the Australian economy strengthened to their most positive level since February, while global sentiment also continued to trend upward from the low point in March.

Technology and AI adoption shape future growth

Technology is becoming a defining theme, with IT and software investment trending upward and more businesses adopting digital tools to drive efficiency and innovation. This may include the early integration of AI and automation, which offer opportunities for productivity gains but also bring new compliance, governance, and data security challenges.

Conclusion

Growth is the standout theme in August, with SMEs showing a clear lift in confidence and intent to expand despite ongoing cost and compliance pressures. Rising revenue sentiment, stronger growth expectations, and renewed capital investment highlight a shift toward cautious optimism. With interest rates easing and business confidence holding firm, SMEs appear better positioned to pursue growth in the months ahead.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services