Author: James Organ | Posted On: 09 Feb 2026

Updates to this research are published monthly.

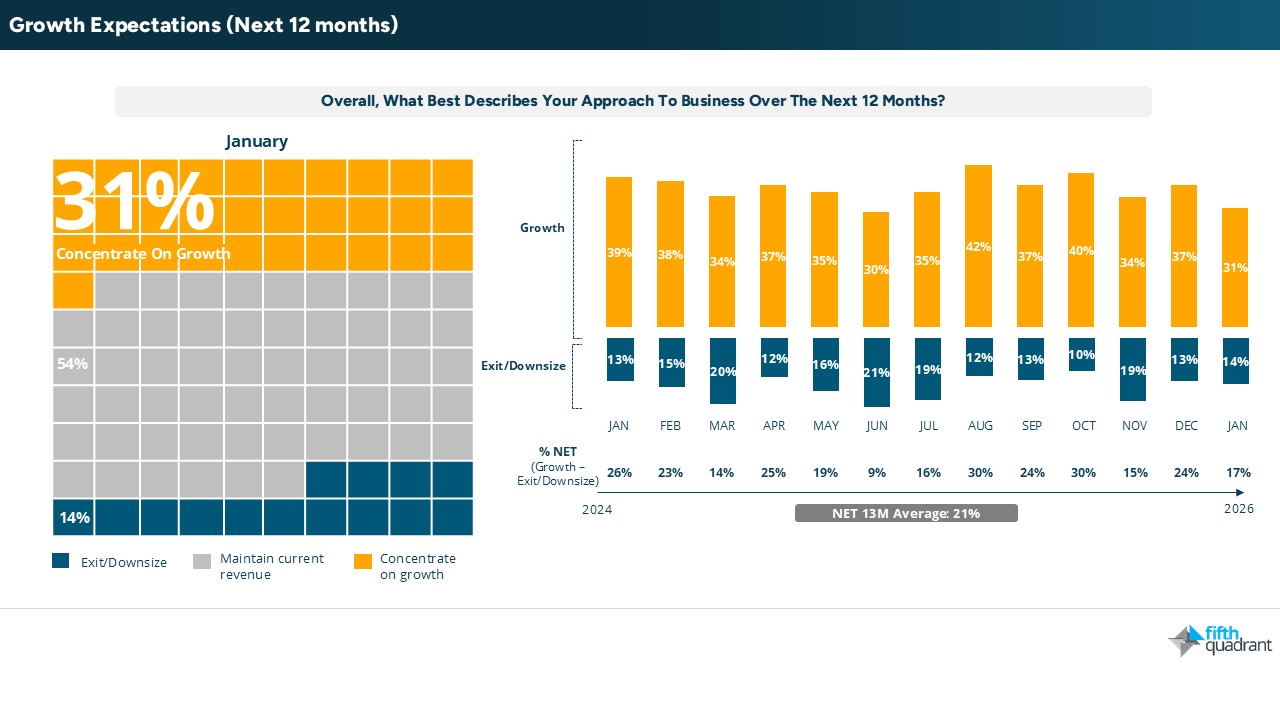

SME January 2026: Short-term business confidence weakened materially in January, slipping well below consumer confidence and reaching its lowest level in nearly two years. Near-term revenue expectations also turned negative for the first time since mid-2024, with more businesses now expecting revenues to be worse over the coming four weeks, as higher interest rates, heightened geopolitical uncertainty and volatile global markets weigh on sentiment.

Growth sentiment has followed the same trajectory. Just 31% of businesses are now focused on growth over the next 12 months, the lowest share since June, highlighting a broad reassessment of risk.

SMEs prioritise control

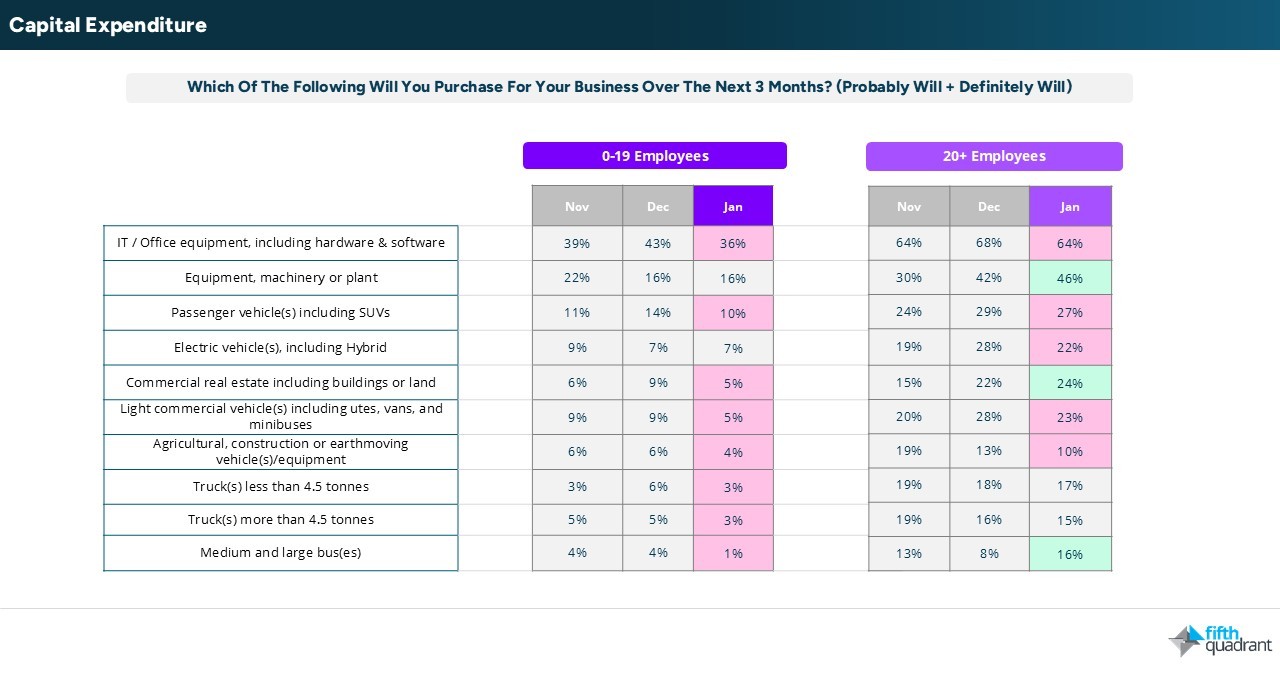

As confidence weakens, SMEs are clearly pulling back from expansion. Hiring intentions remain subdued, marketing spend expectations have softened, and capital investment plans have eased relative to December.

Rather than pursuing growth, businesses are prioritising cost control, cashflow management and operational efficiency. This shift is evident across firm sizes but is particularly pronounced among smaller businesses, which tend to be more exposed to changes in financing costs and demand conditions. The focus is on protecting the core business rather than pushing for expansion in an uncertain environment.

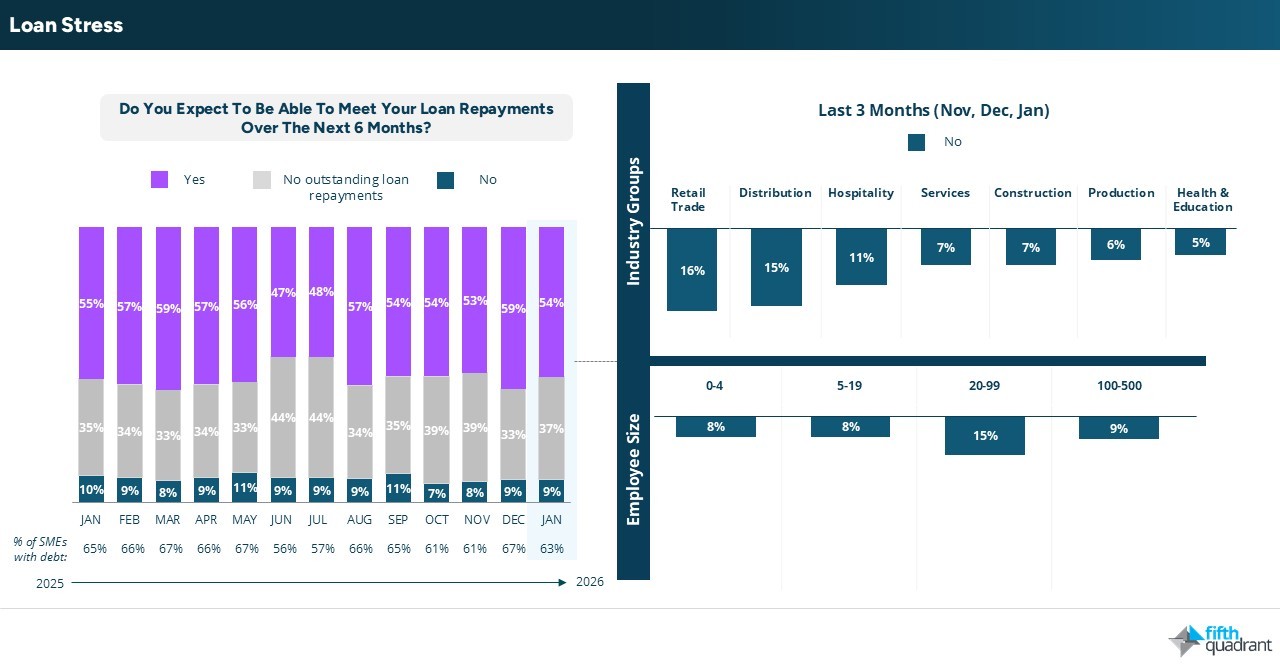

Loan stress remains low

Despite weaker sentiment, loan stress remains relatively low. Fewer than one in ten SMEs with debt expect to miss repayments over the next six months, indicating that balance sheets remain broadly resilient. That said, loan stress is more pronounced among businesses in retail and distribution, as well as mid-sized firms with 20 to 99 employees who tend to be more exposed to both cost pressures and demand volatility.

Conclusion

In summary, SMEs are responding to heightened uncertainty by deferring decisions, preserving liquidity and tightening operating conditions. This shift toward defensive behaviour is likely to dampen near-term growth and investment activity, while increasing preparedness to further interest rate increases or external shocks should economic conditions deteriorate further.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SME December 2025

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services