Author: James Organ | Posted On: 08 Dec 2025

Updates to this research are published monthly.

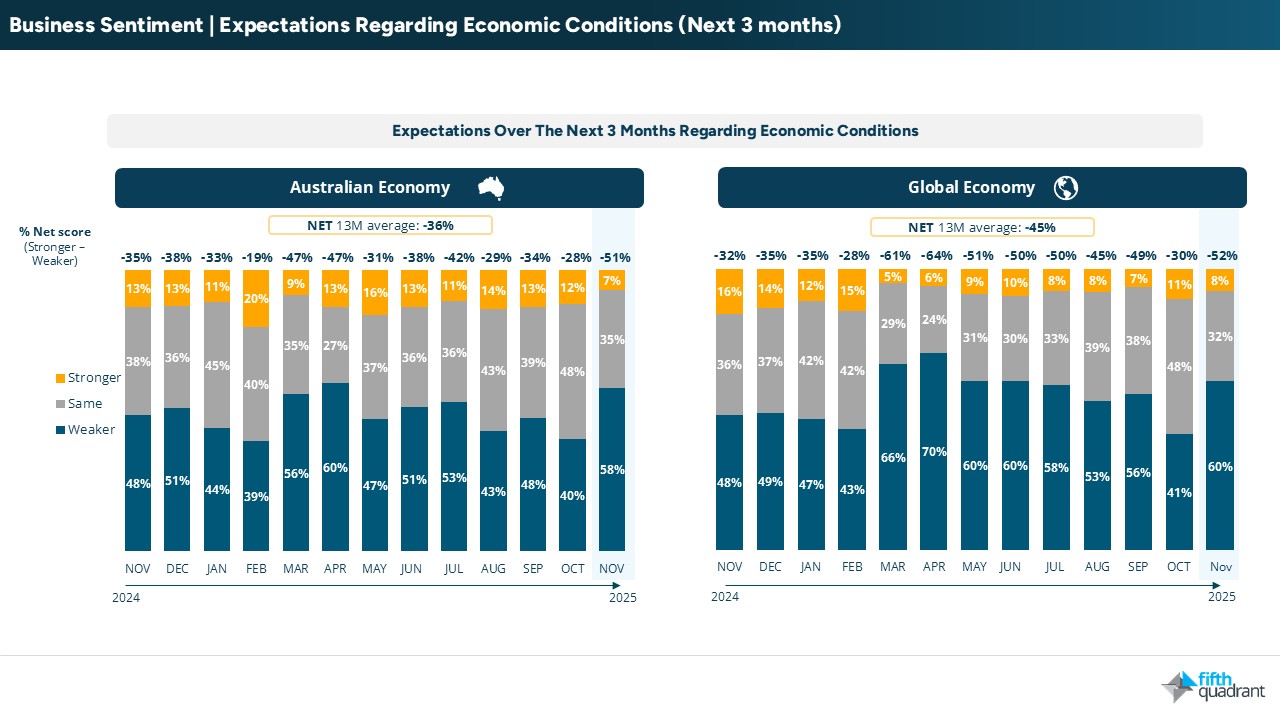

SME November 2025: SME sentiment weakened in November as rising inflation and softening global economic indicators contributed to a more cautious outlook.

Local inflation data suggests the interest-rate cycle may remain on hold for longer, heightening uncertainty for businesses already managing elevated input and wage costs. Globally, weaker growth signals across major economies added further weight to declining confidence.

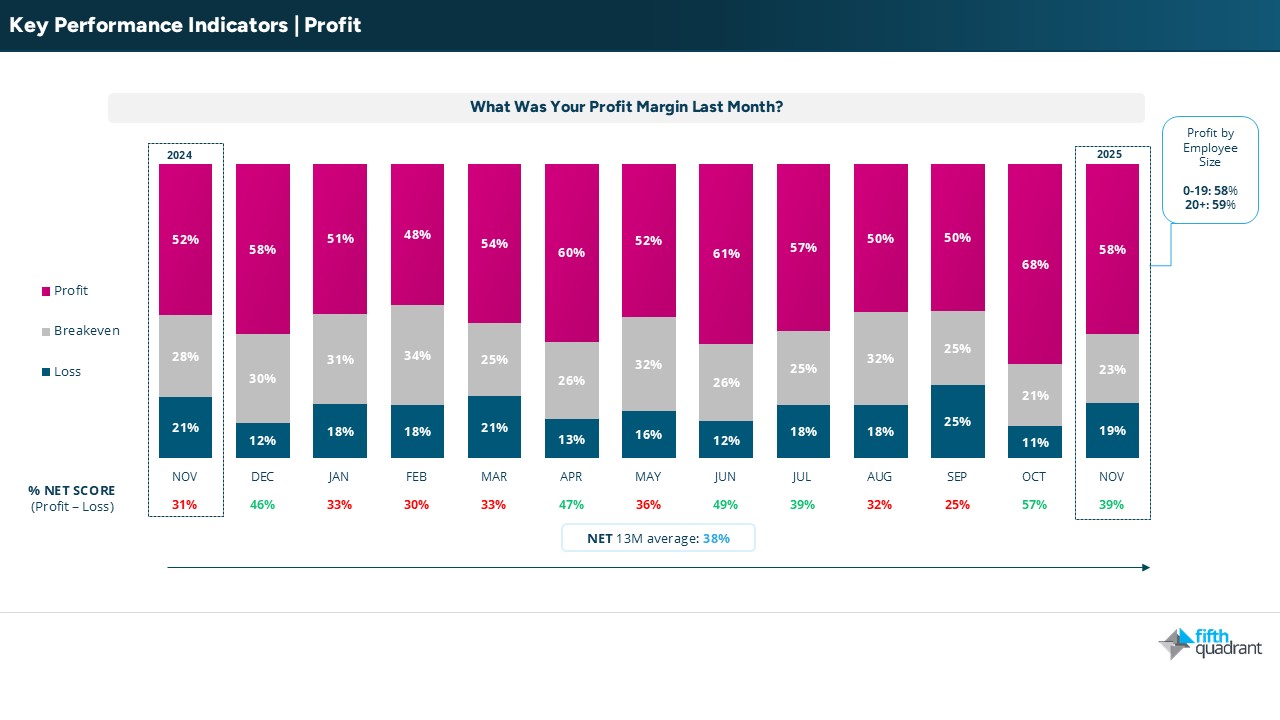

Profit and Revenue Expectations

Confidence among Australian SMEs once again fell below consumer sentiment. Short-term revenue expectations remain muted, with 19% of SMEs anticipating lower revenues over the next four weeks. Profit expectations also eased, though they remain marginally above the 12-month average.

SME sentiment

Growth aspirations declined after three strong months, with a notable increase in businesses indicating plans to downsize or exit. Sentiment among smaller SMEs is particularly weak, with 20% now negative about their outlook.

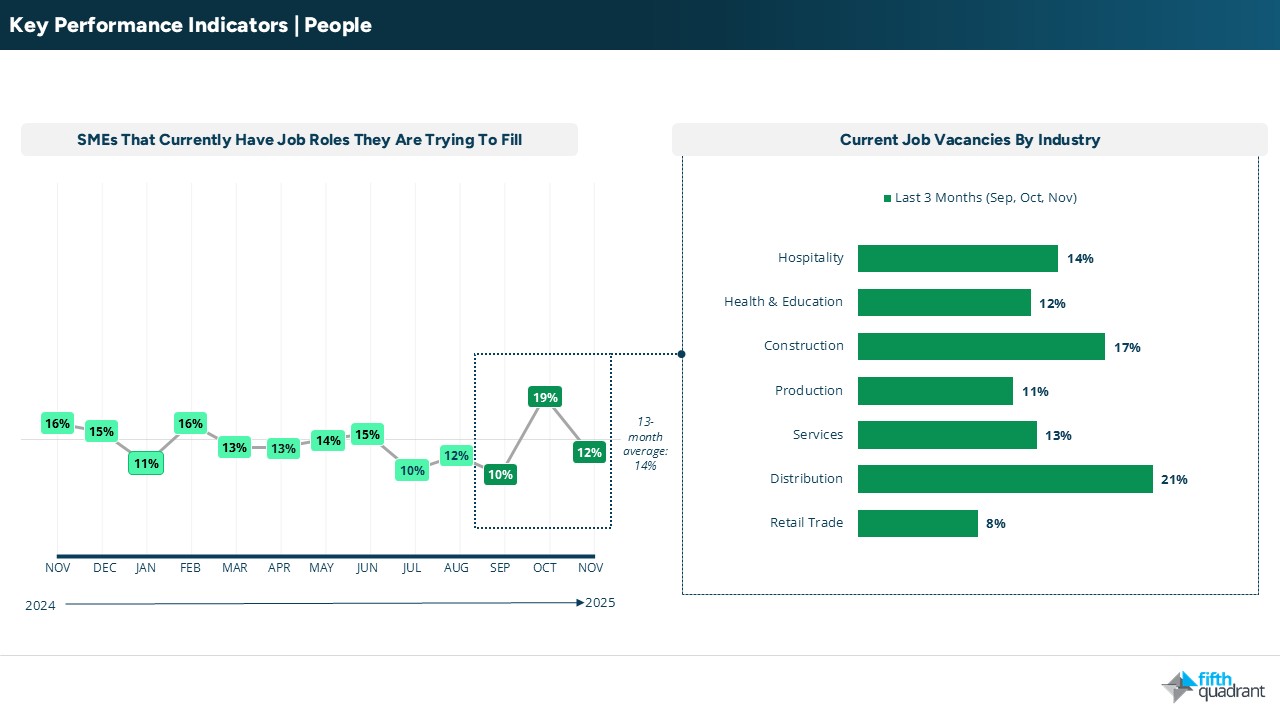

Hiring intentions

Hiring intentions have softened and job vacancies have declined across both employee cohorts. Despite lower recruitment activity, hiring challenges persist, with fewer candidates willing to move roles in a softer labour market.

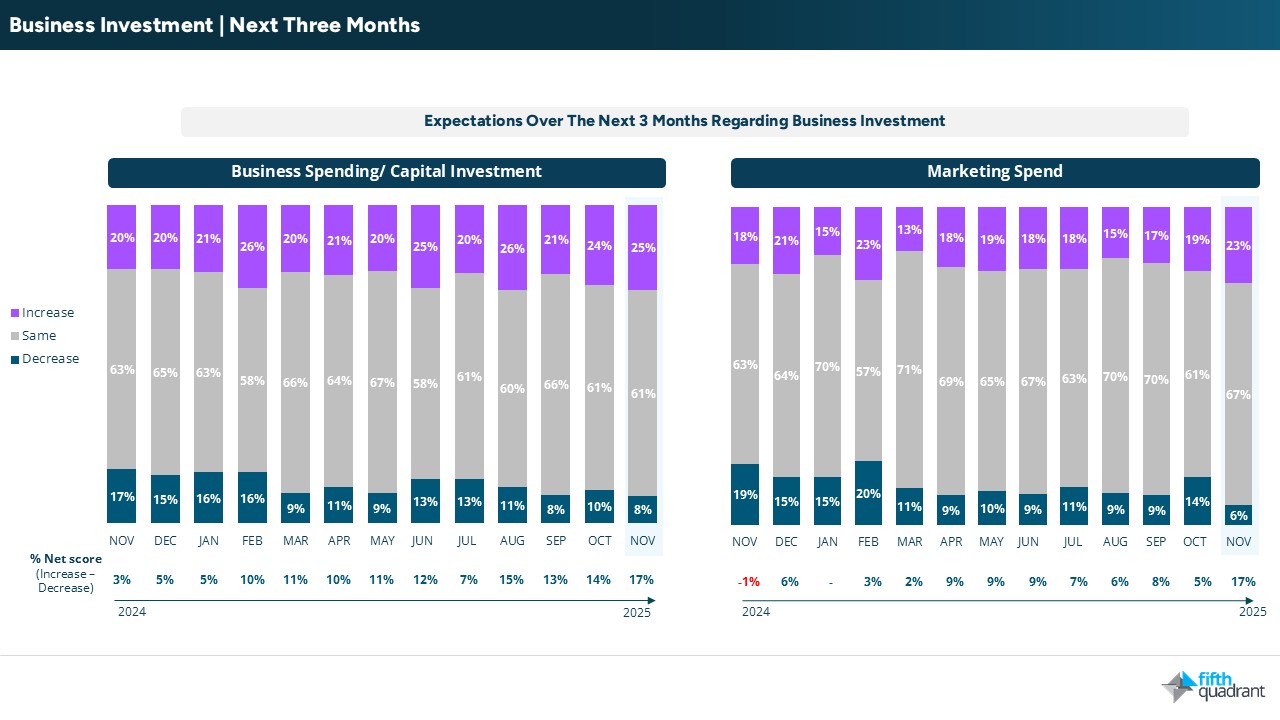

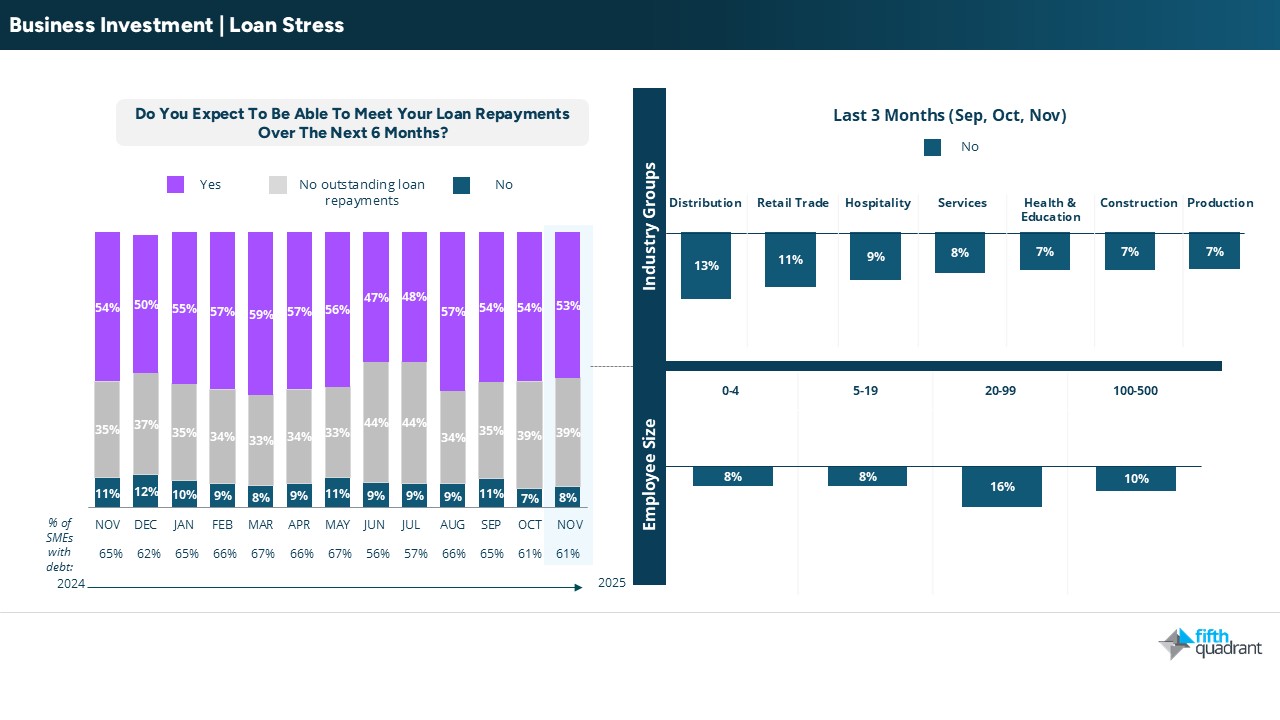

Business investment

Investment intentions present a mixed picture. While sentiment has softened, SMEs are signalling plans to increase capital investment and marketing spend as they move into 2026, with both measures stronger than last month and the same period last year. In contrast, technology investment intentions have fallen across both employee cohorts, and larger SMEs are also less inclined to invest in EVs, real estate and small trucks.

Demand for additional finance also dipped slightly and remains below average levels, though loan stress is stable at relatively low levels. Only 8% of SMEs express concern about meeting loan repayments, significantly lower than the levels recorded last November.

Conclusion

SMEs close out 2025 with softer confidence as inflation and global uncertainty weigh on the outlook. Growth and hiring intentions have eased, though financial stress remains low, and many businesses have strengthened their efficiency and cost controls over the year. While pressures remain, SMEs feel better positioned than they did last November and are looking to 2026 with cautious confidence, supported by planned increases in capital and marketing spend.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services