Author: James Organ | Posted On: 10 Nov 2025

Updates to this research are published monthly.

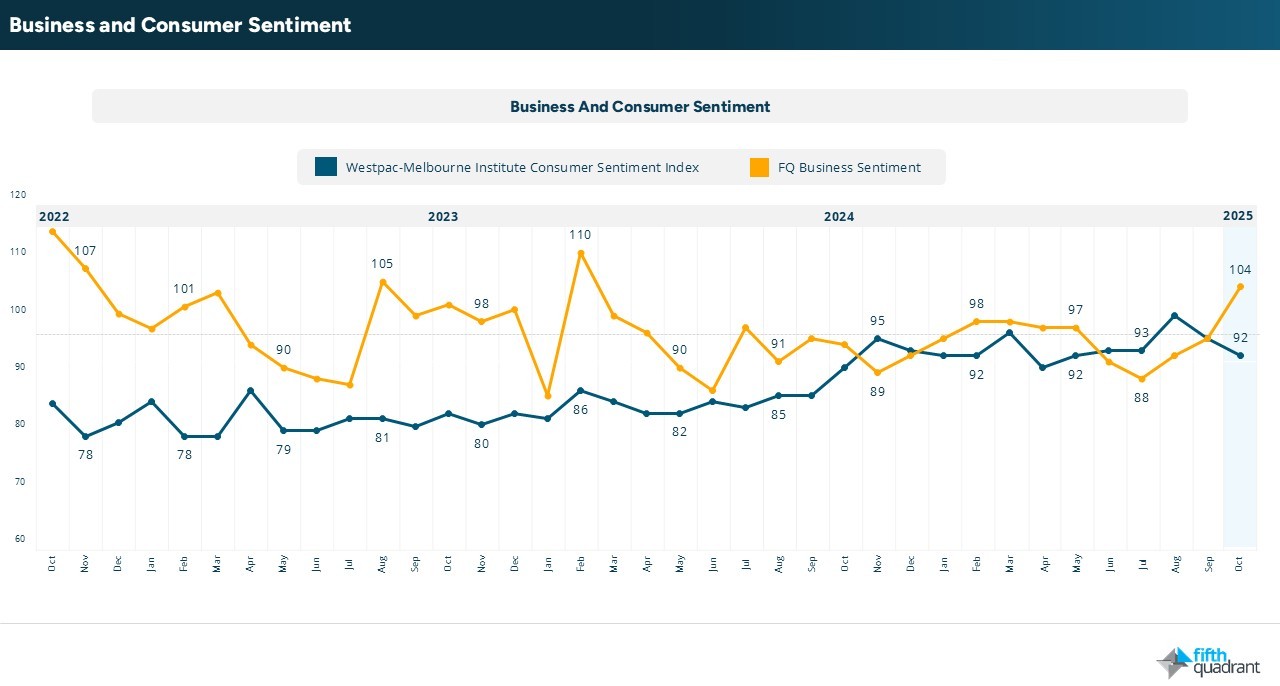

SME October 2025: SME confidence strengthened in October, rising above consumer confidence for the first time since May.

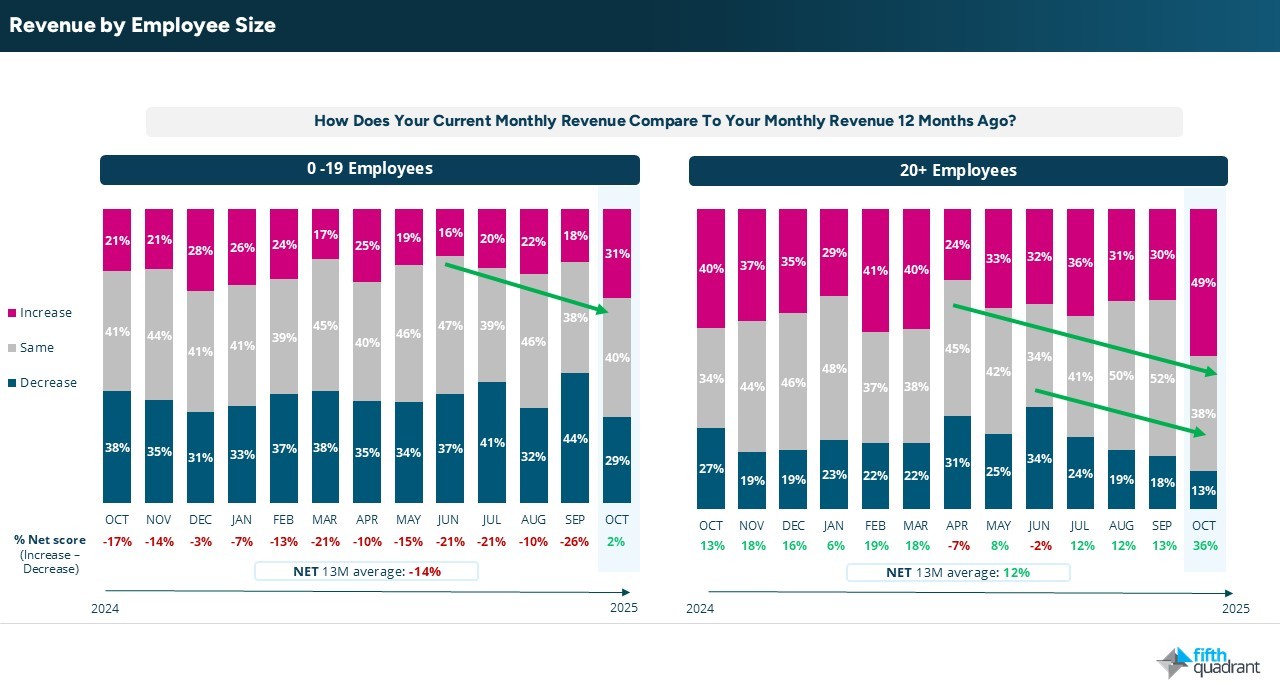

Revenue and profits

Revenue and profit results were very positive, supported by seasonal demand. Larger SMEs continue to lead the improvement, contributing to a positive trend that has been building since the start of the financial year.

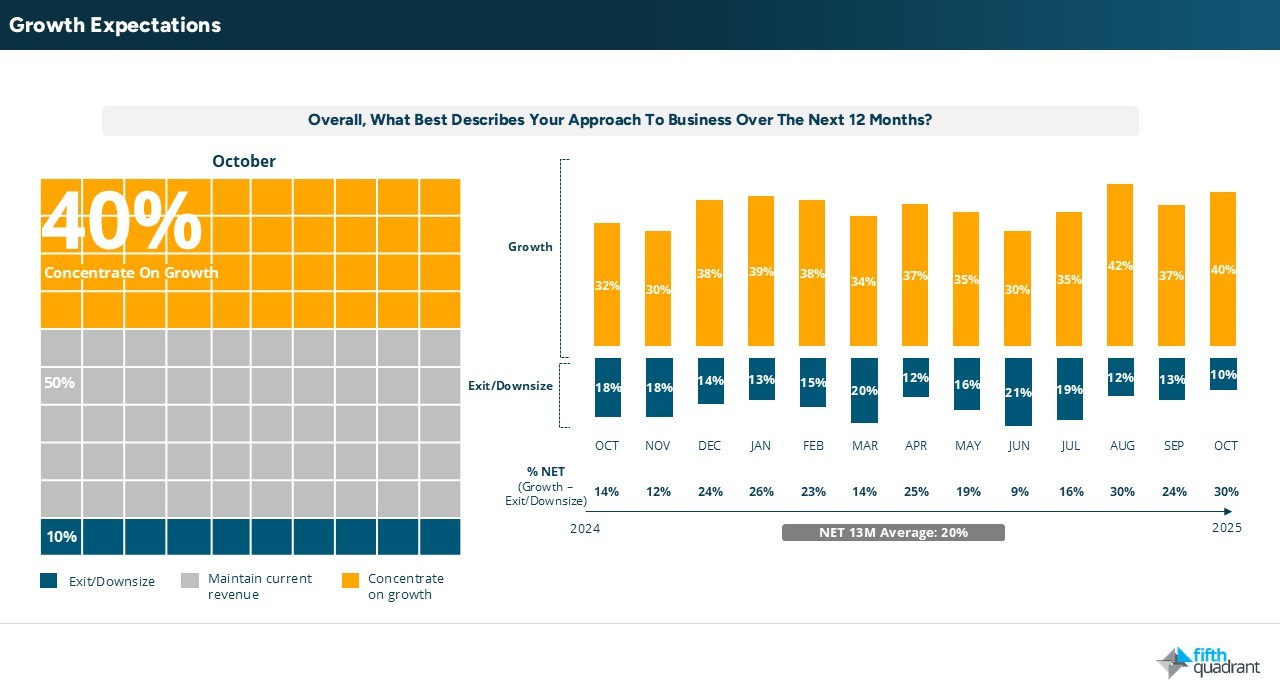

Growth expectations

Growth aspirations remain elevated, with 40% of SMEs focused on expansion over the next 12 months, well above the long-term average. Encouragingly, this marks the third consecutive month where growth intentions have remained strong, signalling consistent optimism despite broader economic uncertainty.

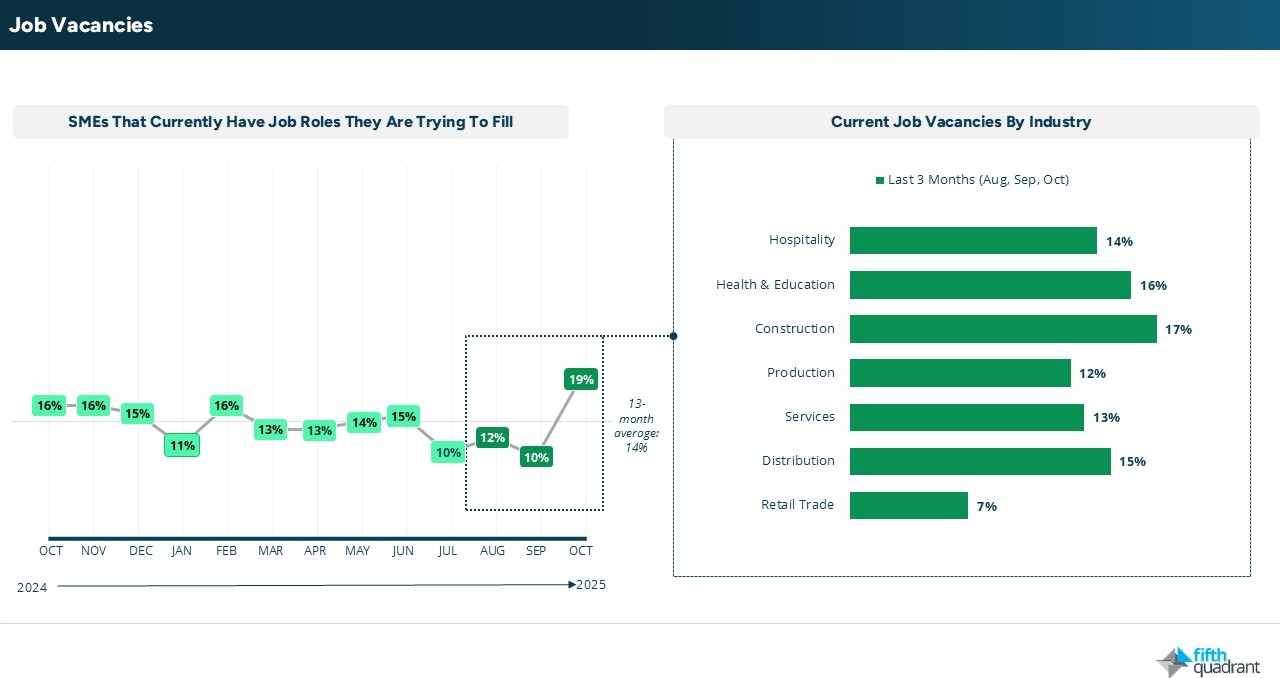

Job vacancies

SME job vacancies increased significantly in October, with 19% of businesses currently trying to fill roles, up from 10% in September and above the 13-month average of 14%. This is led by demand in Hospitality and Construction.

Recruitment challenges

However, recruitment challenges persist, particularly for smaller SMEs, with rising wage demands and a shortage of transient and migrant workers continuing to apply pressure.

Demand for additional finance

Demand for additional finance remains stable, though funding for mergers and acquisitions has increased, indicating targeted, strategic investment activity.

Encouragingly, only 7% of SMEs expect difficulty meeting loan repayments over the next six months, down from 11% a month earlier.

Government Policy

Satisfaction with federal government policies continued to improve for the third consecutive month, now at 34%.

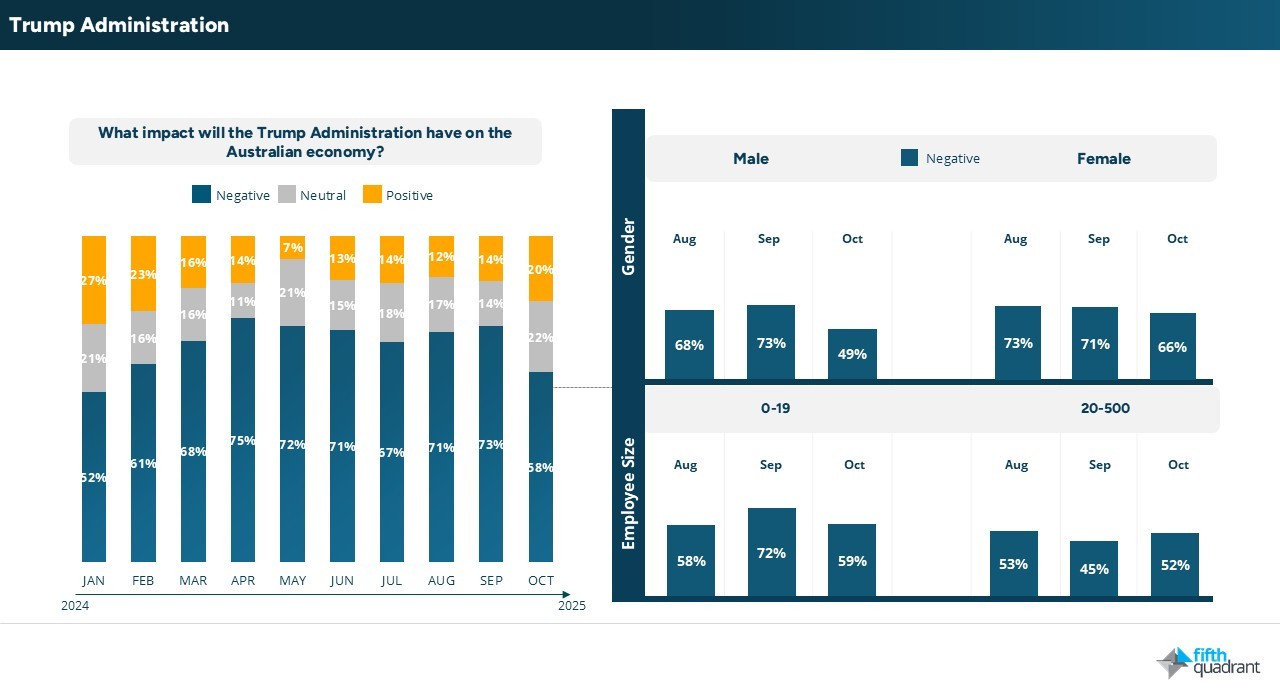

At the same time, negative sentiment toward the Trump administration eased, again reflecting reduced geopolitical risk and tariff concerns.

Conclusion

In summary, October was a very positive month for SMEs, with seasonal demand lifting revenue, profit, and hiring intentions. While this strong outlook sets a solid platform for the rest of the year, stubborn inflation and the pause on interest rate cuts could stall momentum and temper confidence in the months ahead.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services