Author: James Organ | Posted On: 10 Oct 2025

Updates to this research are published monthly.

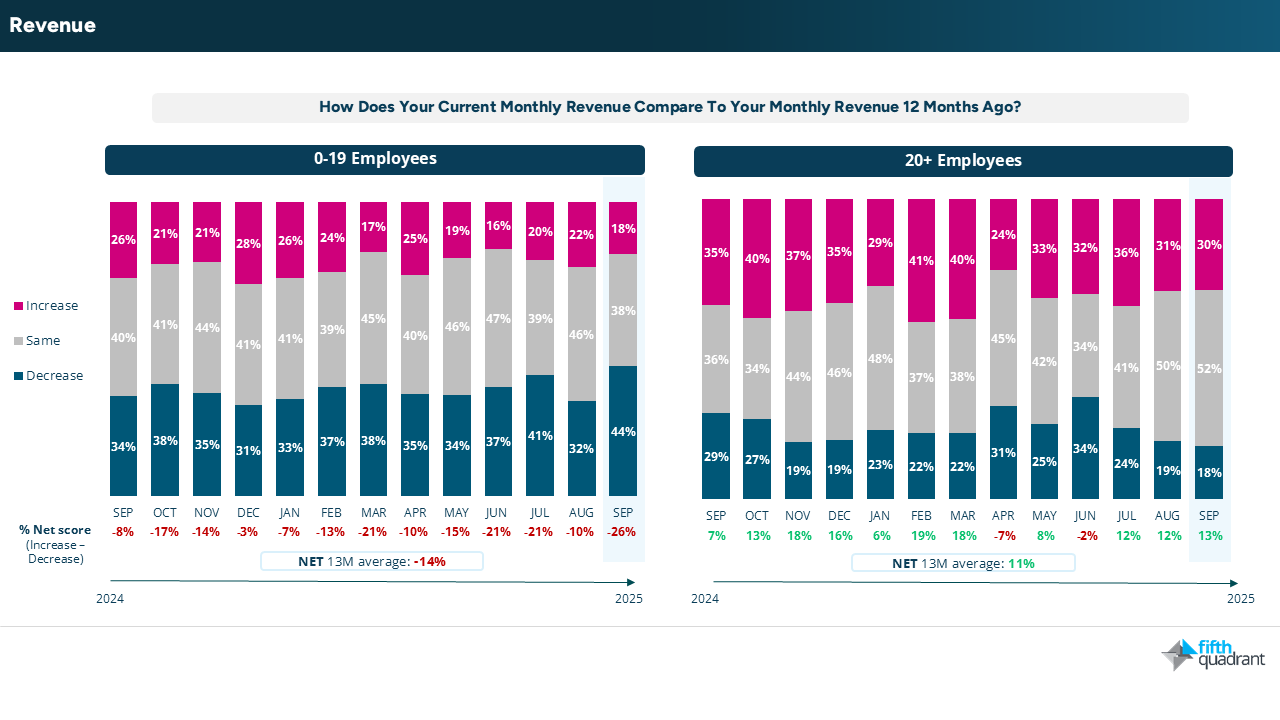

After showing signs of improvement in August, SME sentiment softened in September as economic caution returned. Falling consumer confidence following the RBA’s decision to hold rates steady at 3.6% appears to have weighed on both household spending and business optimism. As a result, revenue and profit sentiment weakened, particularly among smaller SMEs, many of whom reported softer turnover and tighter margins.

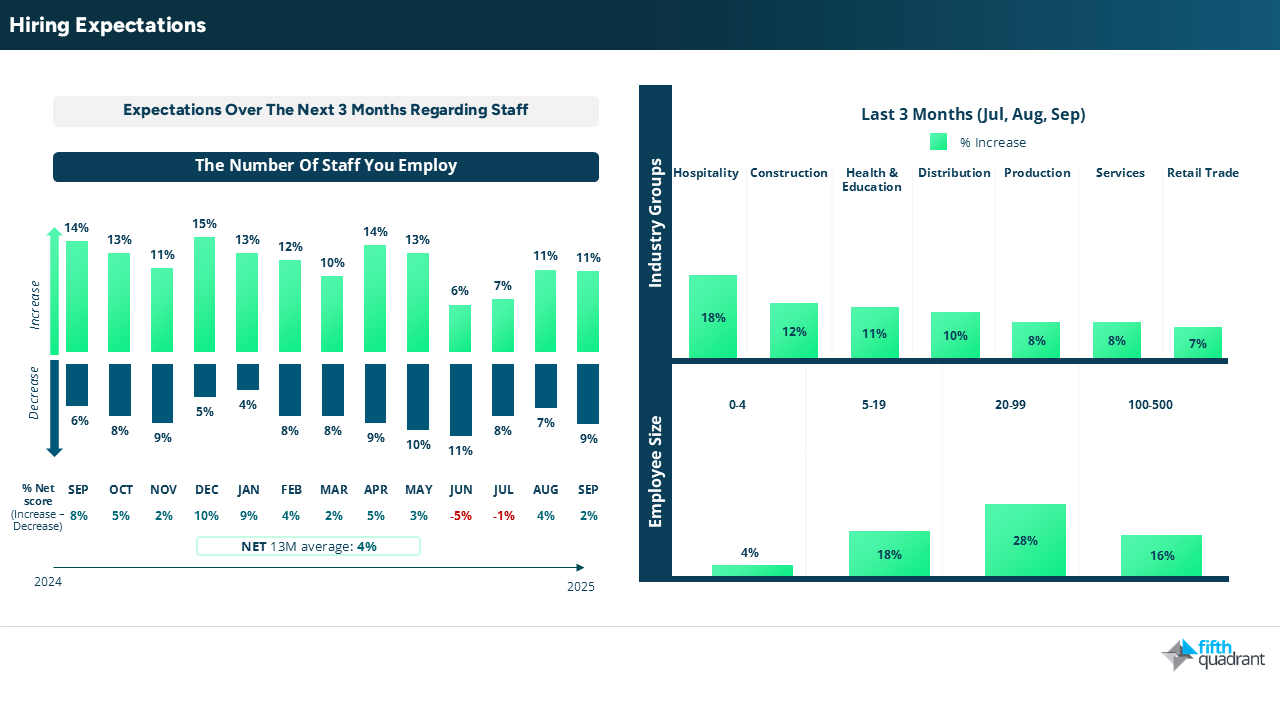

Job market cools as wages tick up

Labour market conditions continued to cool, with hiring expectations easing and job vacancies declining in line with national data showing fewer job advertisements. However, wage expectations lifted ahead of the pre-holiday period, as competition for staff is expected to intensify.

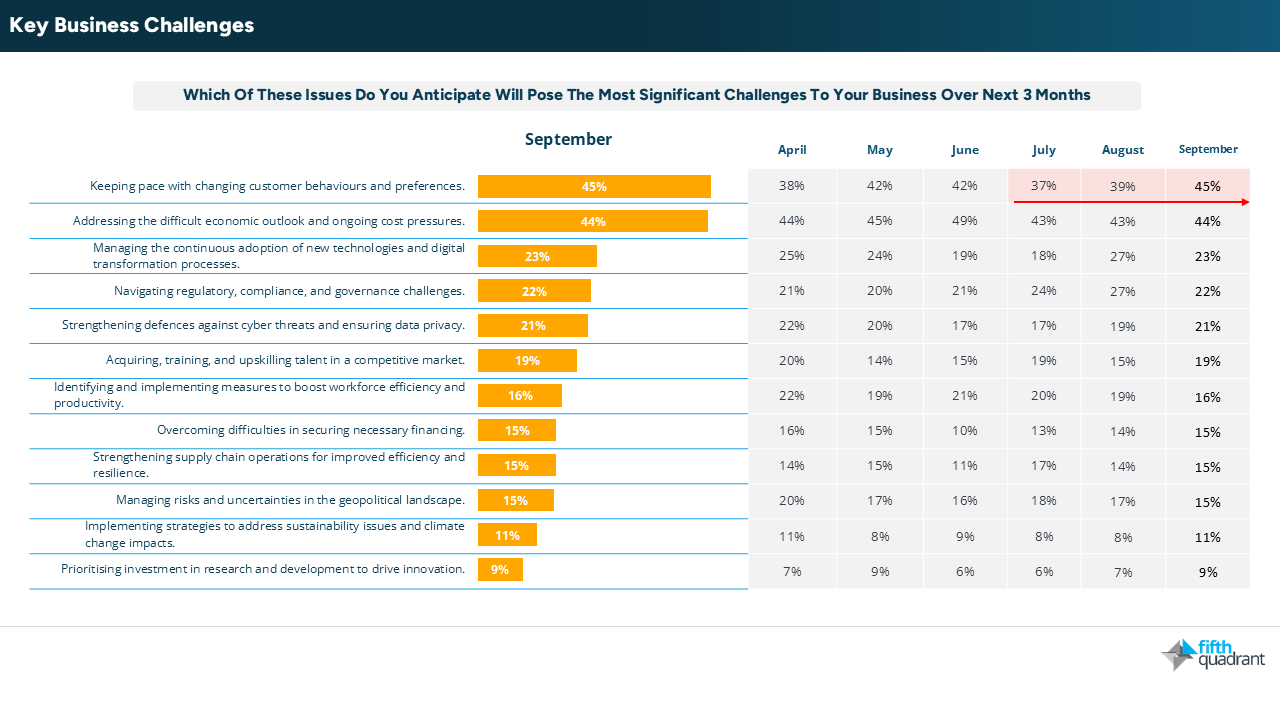

Customer behaviour becomes top SME challenge

Changing customer behaviour emerged as the leading challenge for SMEs in September, cited by 45%, a sharp rise from August and the first time this year it has overtaken cost pressures. The shift highlights growing uncertainty around evolving demand patterns as businesses head into the critical Christmas trading period.

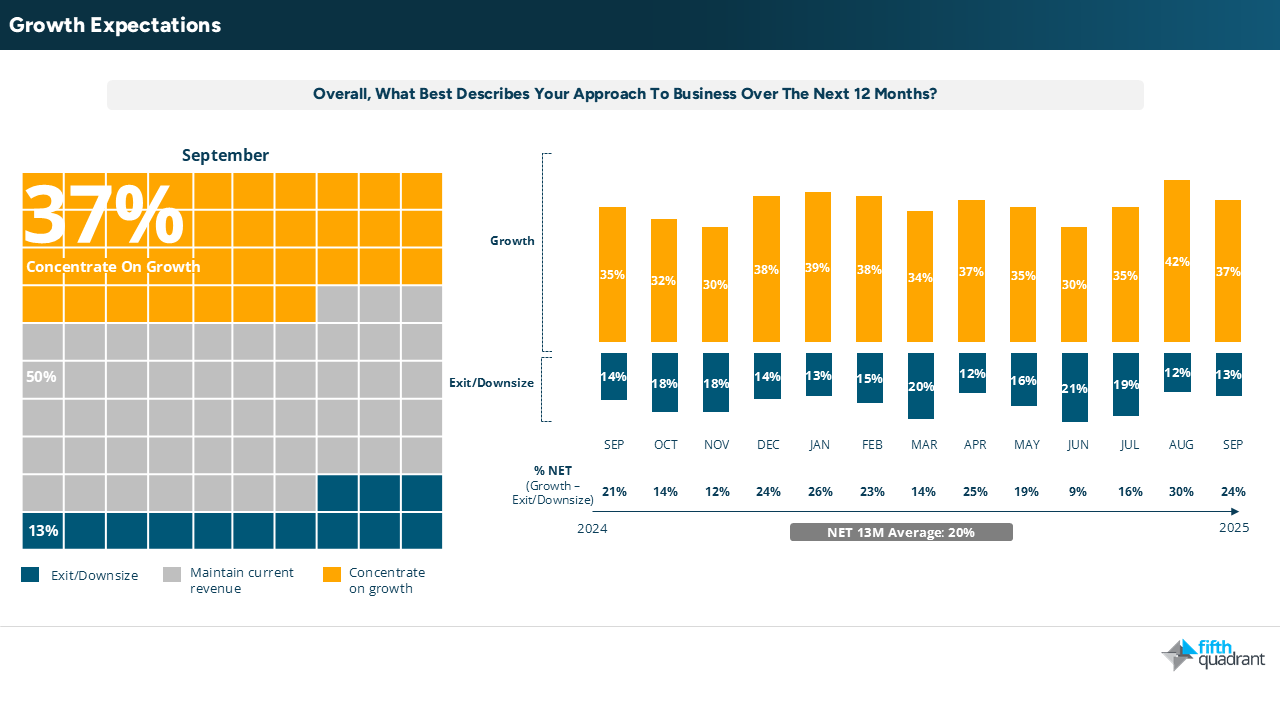

Over one third of SMEs are growth focused

While near-term trading sentiment has weakened, confidence in long-term growth remains relatively steady. Around one in three SMEs (37%) continue to focus on expansion over the year ahead, underscoring a degree of optimism amid tougher conditions. Investment intentions also remain stable, with most SMEs maintaining planned spending on capital and marketing activity.

Increasing loan stress

Loan stress increased to 11% in September after three steady months at 9%. The share of SMEs with debt remains consistent at around two-thirds, following a temporary dip during the EOFY period when some businesses cleared or restructured loans.

Final thoughts

Overall, September’s results signal a shift back toward caution among Australia’s SMEs. While demand volatility and cost pressures are weighing on short-term sentiment, many businesses continue to invest, plan for growth, and adapt to changing market dynamics. The balance between short-term caution and long-term confidence suggests that SMEs are bracing for a challenging finish to 2025 but are not losing sight of opportunities beyond the current headwinds.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in B2B, Consumer & Retail, Financial Services