Author: James Organ | Posted On: 09 May 2025

Updates to this research are published monthly. View previous wave.

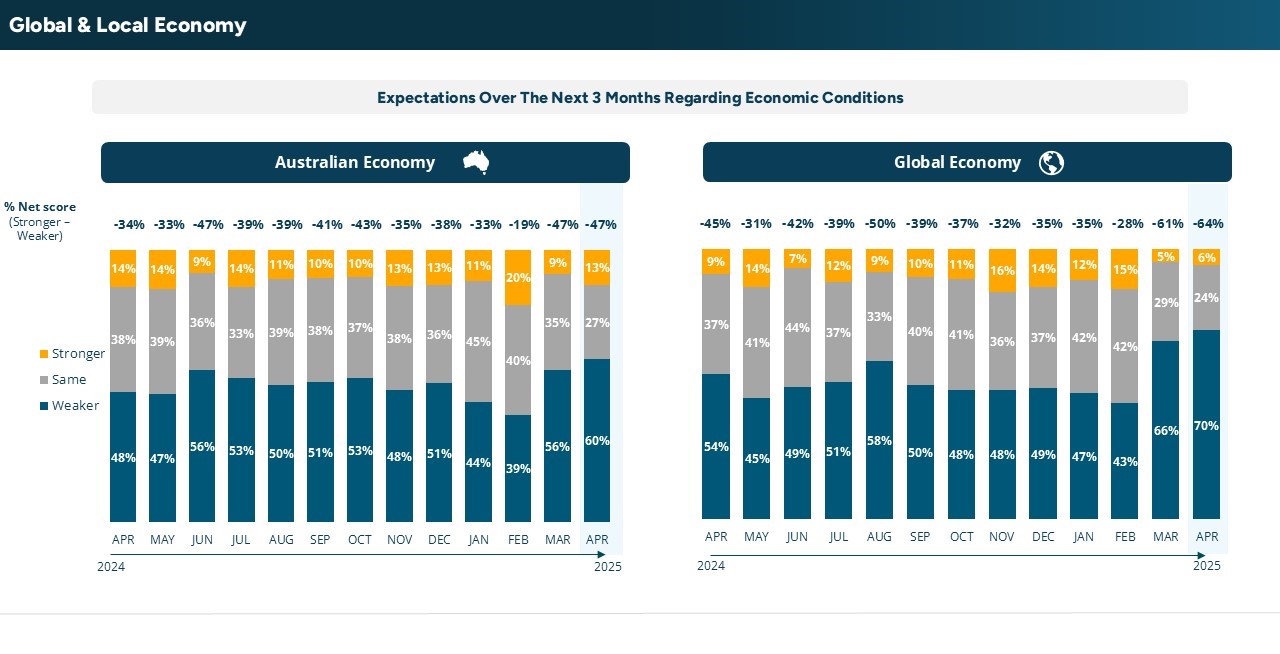

Ongoing geopolitical tensions continue to weigh on SME sentiment. Confidence in global economic conditions over the next three months has fallen to a 12-month low, with a net confidence rating of -64%.

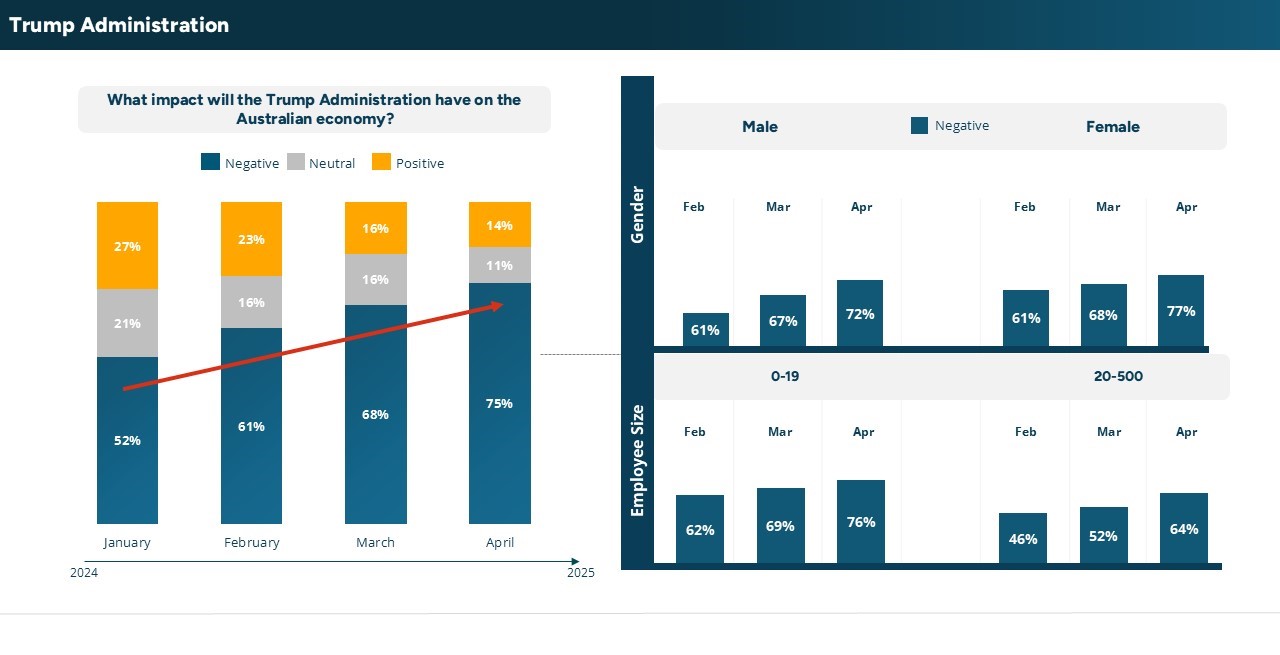

In April, 75% of SMEs expected the Trump Administration to negatively impact the Australian economy, marking the fourth consecutive month of rising concern, reflecting fears of trade disruption and global instability driven by unconventional foreign policy.

Economic challenges

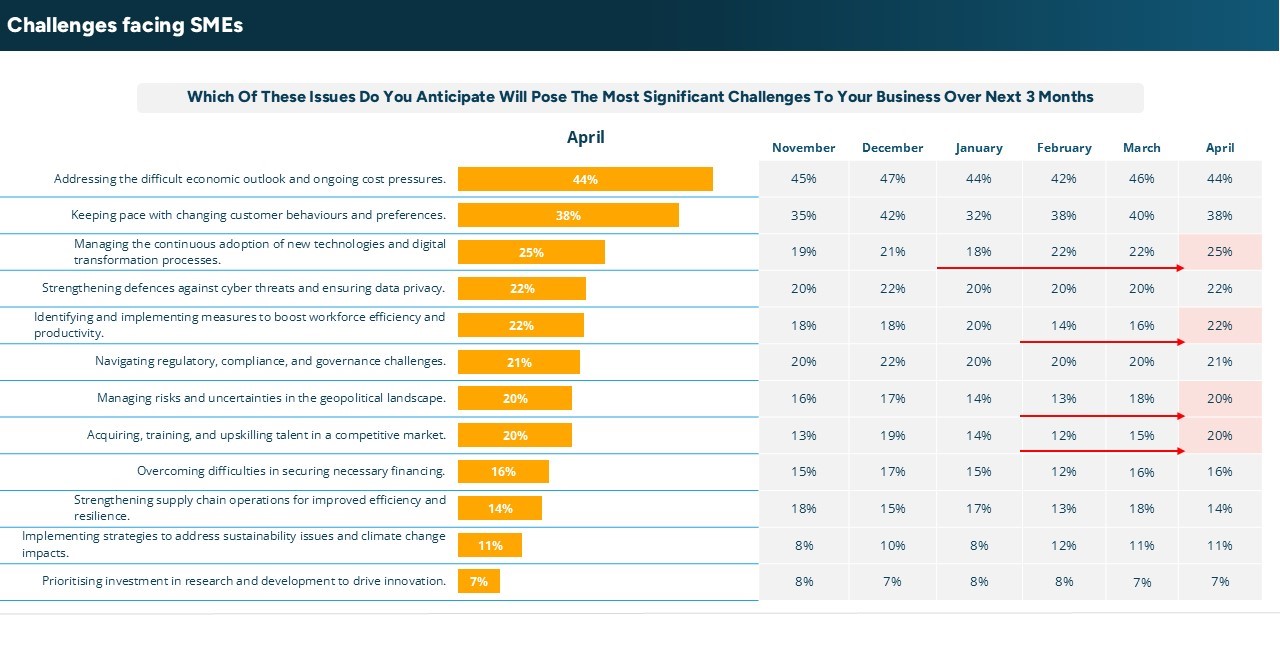

While economic pressures remain the leading concern, more SMEs cited new technology adoption (25%), workforce efficiency (22%), and talent upskilling (20%) as major challenges. Managing geopolitical risks also continues to rise in importance, cited by 20%.

Turnover, profit & hiring

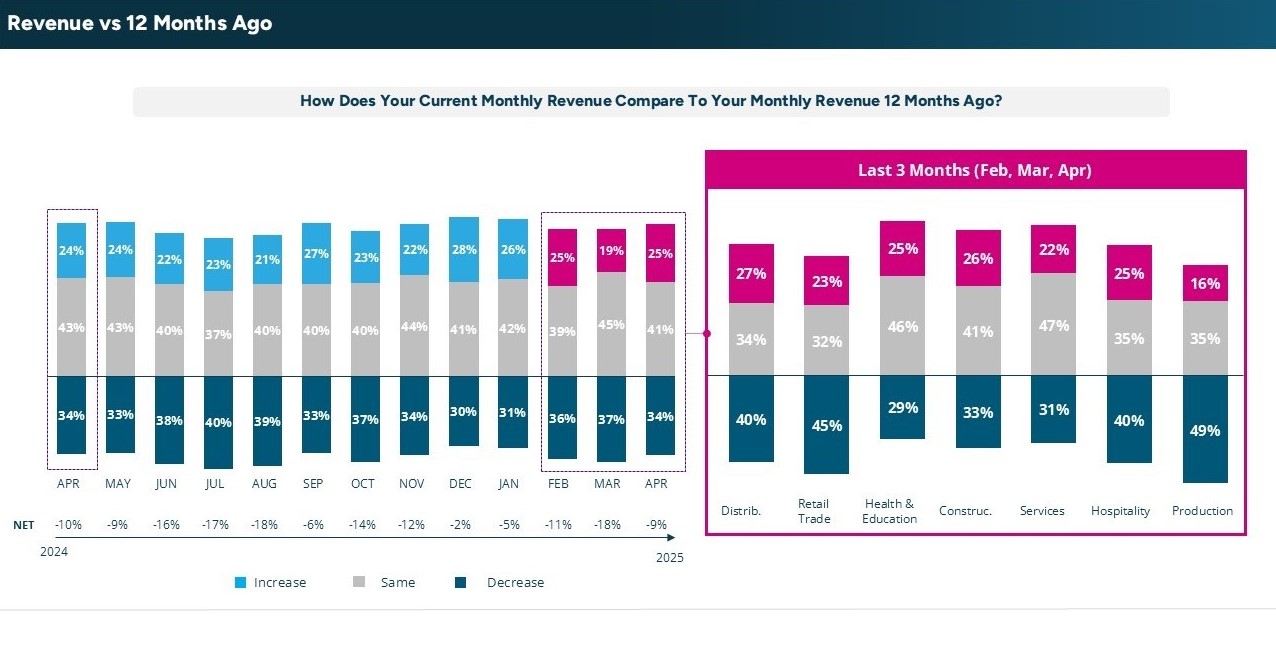

Despite these challenges, SME revenues rebounded in April, with 25% reporting higher turnover than a year ago, up from 19% in March.

Encouragingly, 60% reported a profit, continuing an upward trend since February. Hiring intentions also improved, with 14% expecting to increase staff, up from 10% last month.

Growth & investment

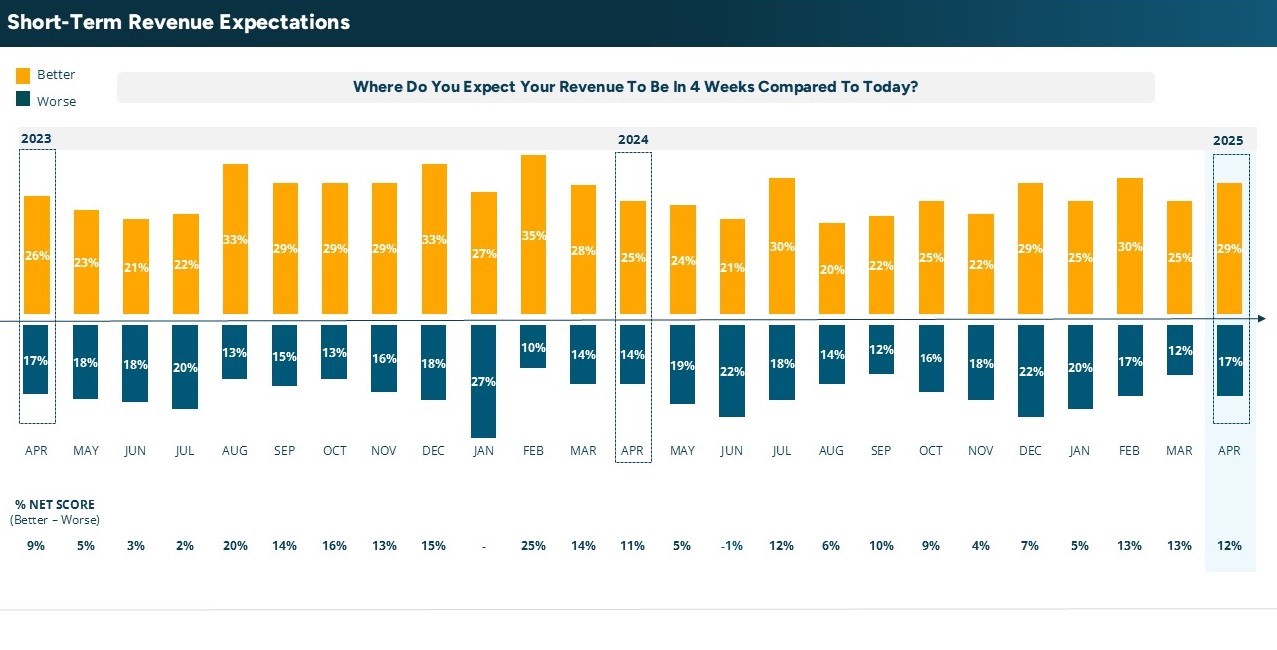

Marketing sentiment also strengthened, with 18% projecting increased spend over the next three months. Accordingly, 37% of SMEs are targeting growth, up from 34% in March, while 29% expect revenue growth over the next four weeks.

However, capital investment remains flat, and longer-term trends across equipment and vehicle categories continue to decline, suggesting SMEs are extending asset lifecycles. After a sharp dip in March, demand for additional finance rebounded to the 12-month average in April. Notably, demand for funds to support new market expansion spiked, as businesses seek alternatives to the US in response to shifting trade conditions.

Government satisfaction

April also saw a modest uptick in approval for the Federal Government ahead of the May election. With the incumbent Government winning in a landslide, it is clear many previously dissatisfied voters ultimately supported the government, reflecting a perceived lack of viable alternatives among SME decision makers.

Conclusion

Overall, while geopolitical tensions and economic uncertainty continue to challenge SMEs, April delivered signs of cautious optimism, with improving revenue, profit, hiring, and marketing intentions. Despite weak investment and ongoing concerns about global conditions, more SMEs are targeting growth, signaling a willingness to adapt in an increasingly complex environment.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized, B2B, Consumer & Retail, Financial Services