Author: Melissa Borg | Posted On: 17 Feb 2026

Generation X is now Australia’s wealthiest generation, holding more wealth in property and shares than any other generation in Australia. According to the latest KPMG analysis, Gen X households have overtaken Baby Boomers in their ownership of dwellings and equities, benefiting from decades of asset price growth and peak earning years.

On the surface, this should be a story of financial confidence. Yet data from our November 2025 Fifth Quadrant Consumer Tracker suggests something very different. Despite their wealth on paper, Gen X does not feel particularly secure or optimistic about their financial situation. This disconnect between wealth and confidence is the pessimism paradox at the heart of Gen X’s financial experience.

What the wealth data tells us

KPMG’s findings confirm that Gen X has quietly become Australia’s dominant asset-owning generation. While Baby Boomers still retain the highest overall net worth, their wealth is increasingly shifting into cash and superannuation as they move through retirement. Gen X, by contrast, remains heavily invested in property and shares.

This reflects both timing and lifecycle. Gen X entered the housing market earlier than Millennials and benefited from sustained growth in property values over multiple decades. Many are now in peak earning years, often holding substantial housing equity alongside diversified investment portfolios.

By traditional measures, Gen X should be well positioned.

What Gen X says about their financial reality

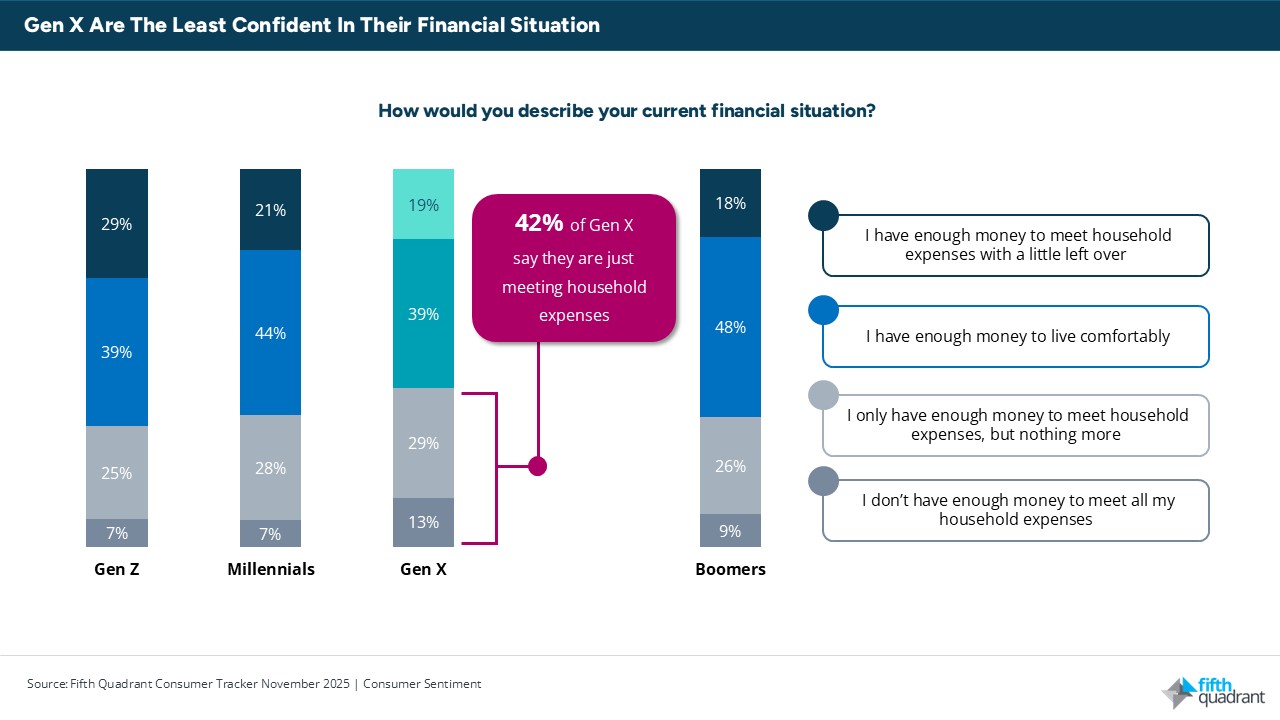

Our data paints a more cautious picture. When asked to describe their current financial situation, Gen X is less likely than Baby Boomers to say they have enough money to live comfortably. A sizeable share also report that they are only just meeting household expenses, placing them closer to Millennials than to older cohorts in terms of perceived financial ease.

Cost of living pressures beneath the surface

One reason for this pessimism lies in the pressures Gen X continues to face day-to-day. Cost of living concerns remain high among this cohort, and these are not discretionary expenses that can be easily scaled back. Only 17% of Gen X think cost of living will get better in the next 12 months, while their younger counterparts are much more optimistic with 31% of Millennials agreeing it will improve.

Financial security without peace of mind

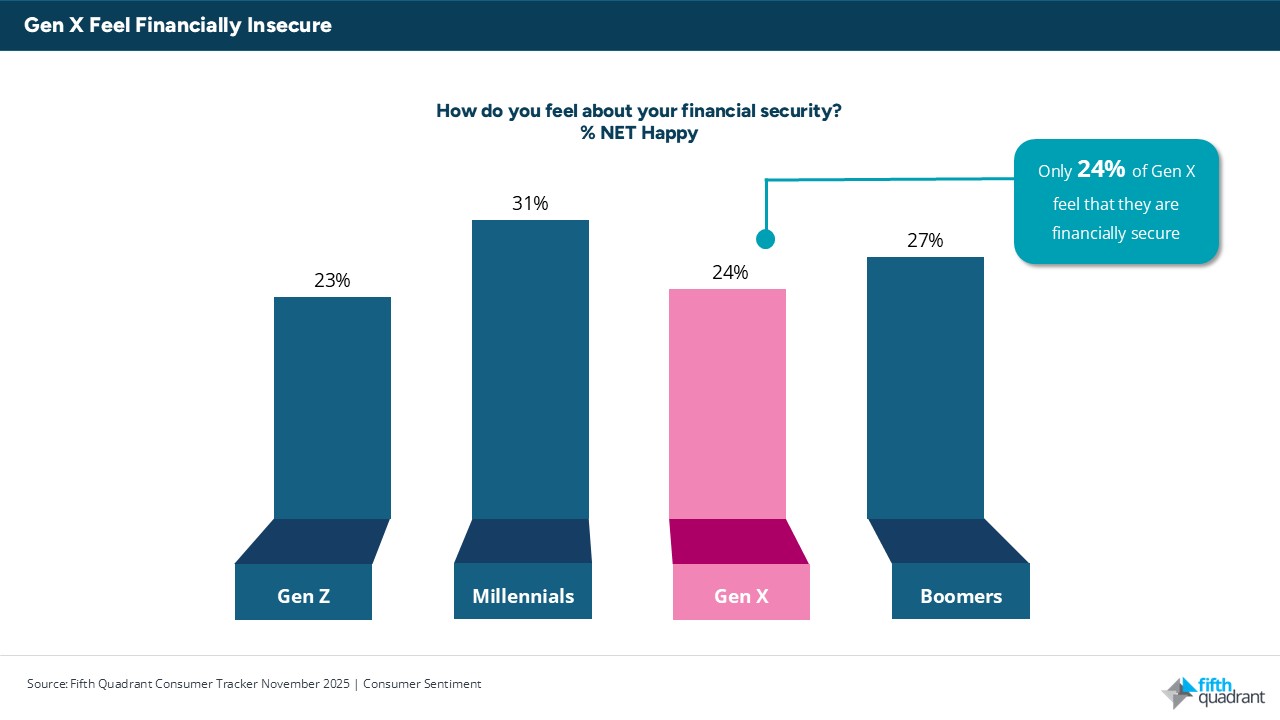

Our data also shows that Gen X does not emerge as the most financially secure generation. Only 24% state they feel financially secure, lower than average and their peers. Boomers tend to express stronger feelings of security, and while younger generations may feel constrained, they retain a sense of optimism.

Gen X sits between life stages, often carrying peak financial and caregiving responsibilities, supporting children (including education costs), ageing parents, and ongoing commitments such as mortgages and car payments. They are close enough to retirement for uncertainty to feel consequential, yet far enough away that outcomes remain uncertain.

This reality coupled with Gen X’s wealth being concentrated in assets, means that while their financial position is strong, it isn’t flexible. They are exposed to market volatility and interest rate movements, and there is limited margin for error as they age, as recovery time feels shorter. This creates a persistent sense of risk rather than peace of mind.

Rethinking generational wealth narratives

Much of the public conversation about wealth focuses on Baby Boomers and Millennials, often overlooking the cohort in between. Yet Gen X now plays a central role in Australia’s economic stability, housing market dynamics and intergenerational wealth transfer.

Their experience highlights an important lesson. Wealth alone does not equal confidence. Where wealth sits, how accessible it is, and what it must support all matter just as much.

For policymakers, financial services providers and brands alike, understanding generational attitudes to wealth requires looking beyond balance sheets. Gen X reminds us that financial wellbeing is as much about security and confidence as it is about assets. In that sense, Australia’s wealthiest generation may also be its most quietly insecure.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates.

For deeper insights into how Australians are really feeling about their finances? Our Fifth Quadrant Consumer Tracker runs monthly, capturing shifting attitudes toward wealth, security and cost of living across generations. Get in touch to learn how our latest data can help you stay ahead of changing consumer sentiment.

Australia’s Wealthiest Generation

Posted in Consumer & Retail, TL, Uncategorized