Author: Ben Selwyn | Posted On: 22 Jan 2026

According to the November 2025 edition of the Fifth Quadrant Consumer Tracker, 72% of vehicle owners have cut corners on vehicle costs in the past 12 months. That’s nearly three in four drivers finding ways to reduce what they spend on vehicle maintenance and upkeep. With the rising cost of car servicing this isn’t surprising. Cost of living pressure is real, and vehicle running costs are one of the few household expenses with any flexibility. But not all cost-cutting is equal, and the data suggests some shortcuts are costing drivers more than they save.

The spectrum of cost-cutting

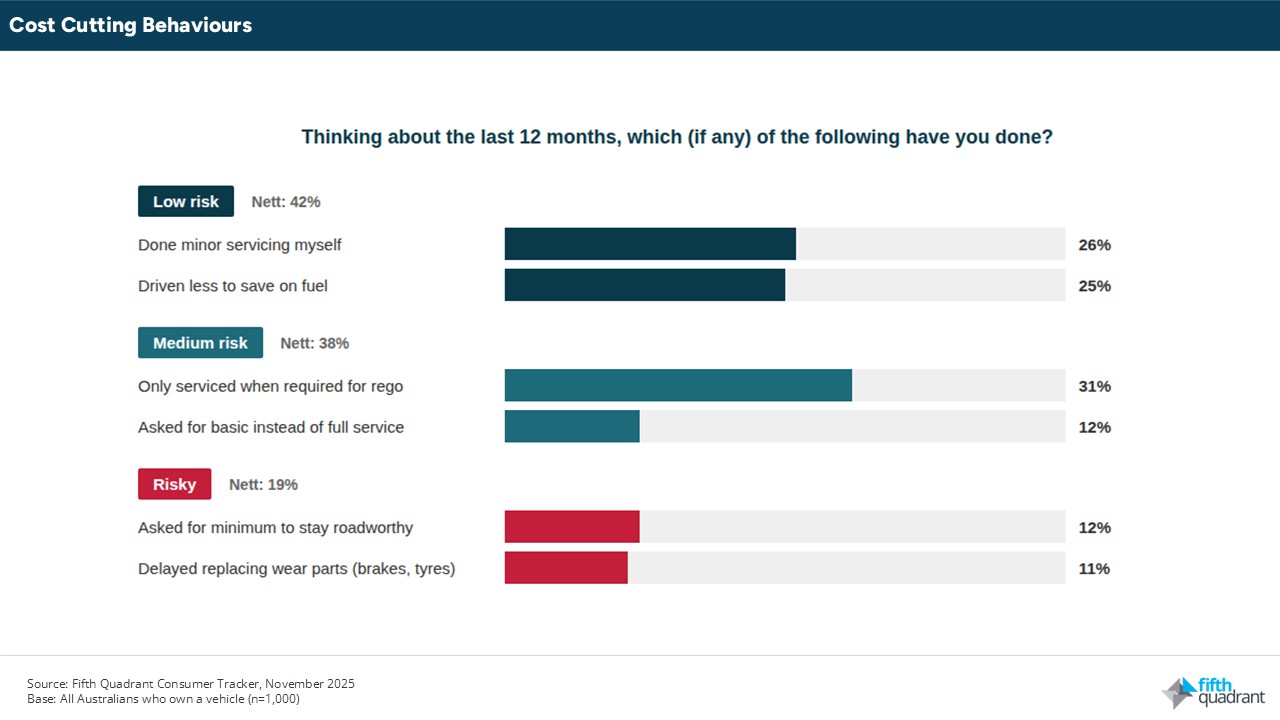

The behaviours range from sensible to risky. At the low-risk end, 26% have done minor servicing themselves and 25% have simply driven less. Sensible ways to save with little downside.

In the middle, 31% only service their vehicle when required for registration, while 12% have asked for a basic rather than full service. These defer costs rather than eliminate them, but they’re unlikely to cause problems.

At the risky end, 11% have delayed replacing wear parts like brake pads or tyres, and 12% have asked for the minimum needed to stay roadworthy. Combined, 19% of drivers have taken risky shortcuts in the past year. One in five.

Who’s taking the risks

The pattern varies by age. Under-30s are 2.5 times more likely to take risky shortcuts than drivers aged 55 and over (28% vs 11%). This matters because younger drivers often have older vehicles, tighter budgets, and less experience recognising the warning signs of wear. The cohort most likely to cut corners is also the cohort least equipped to assess what they’re risking.

It’s worth noting that this isn’t recklessness. For many younger drivers, it’s a calculated response to competing financial pressures. But the calculation may not be working out the way they expect.

The consequences

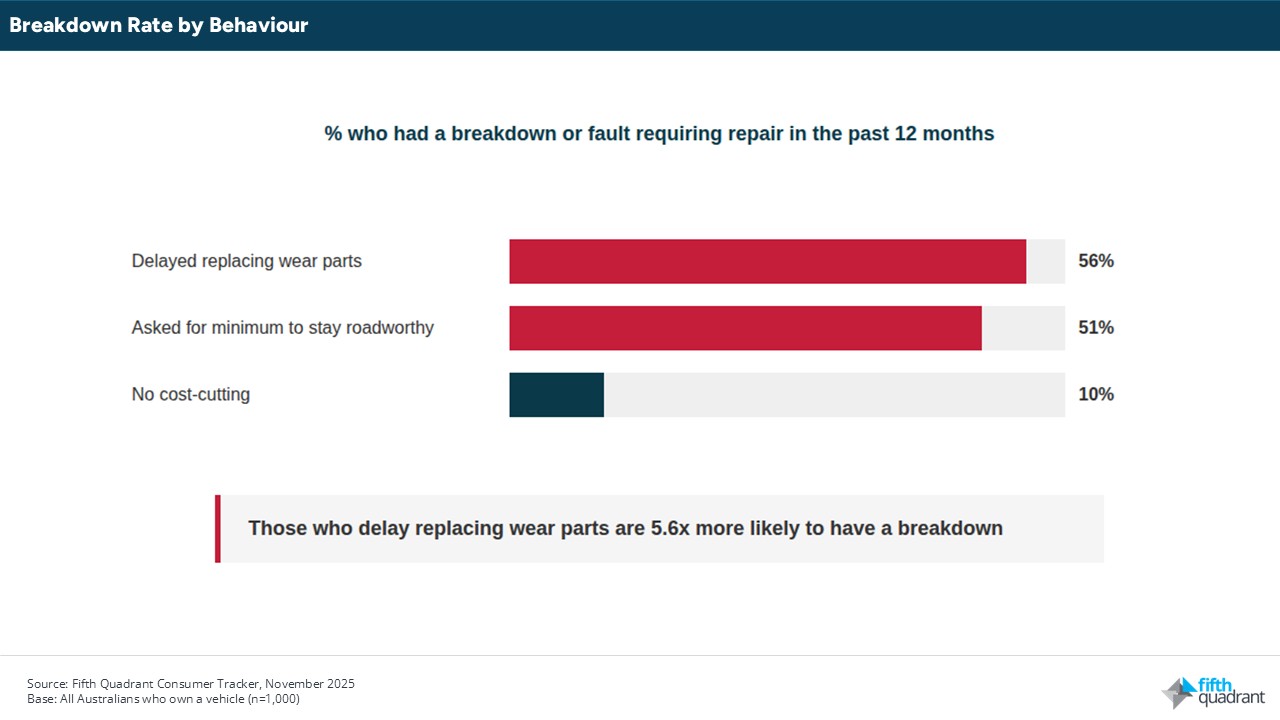

The data on what happens next is clear. Among those who delay replacing wear parts, 56% have had a breakdown or fault requiring repair in the past 12 months. Among those who ask for the minimum to stay roadworthy, 51% have had a breakdown. Among those who haven’t cut corners, the breakdown rate is 10%.

The repair bill

If the goal of cutting corners is to save money, the data suggests it’s not working. Among those taking risky shortcuts, 22% have faced an unexpected repair bill of $1,000 or more in the past year. That drops to 3% among those who haven’t cut corners. Risky cost-cutters are seven times more likely to face a major repair bill.

The short-term saving on brake pads or a full service is being wiped out by the roadside call-out, the tow truck, and the emergency repair. The false economy is measurable.

The pattern is self-reinforcing. Breakdown leads to repair bill, repair bill leads to tighter budget, tighter budget leads to more cost-cutting, more cost-cutting leads to the next breakdown.

What this means

The cost-of-living pressure driving these decisions is real, and this isn’t about judging drivers for making difficult choices. With that said, the data suggests that some of those choices aren’t saving money. For the 19% taking risky shortcuts, the question isn’t whether they’ll pay for maintenance. It’s whether they’ll pay now or pay more later.

This raises questions for the aftermarket. If one in five customers are skipping brake pads and asking for the bare minimum, is the value of preventative maintenance being communicated effectively? Or is the industry losing the argument to short-term budget pressure?

Workshops that can demonstrate the true cost of deferred maintenance, not through scare tactics but through clear numbers, may find a receptive audience among drivers who are already learning the hard way.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates or click here to view our automotive reports.

Also remember that our consumer tracker and b2b market research runs monthly. Click here if you have questions you’d like to ask.

Cost of Car Servicing

Posted in Auto & Mobility, B2B, QN