Author: Ben Selwyn | Posted On: 28 Jan 2026

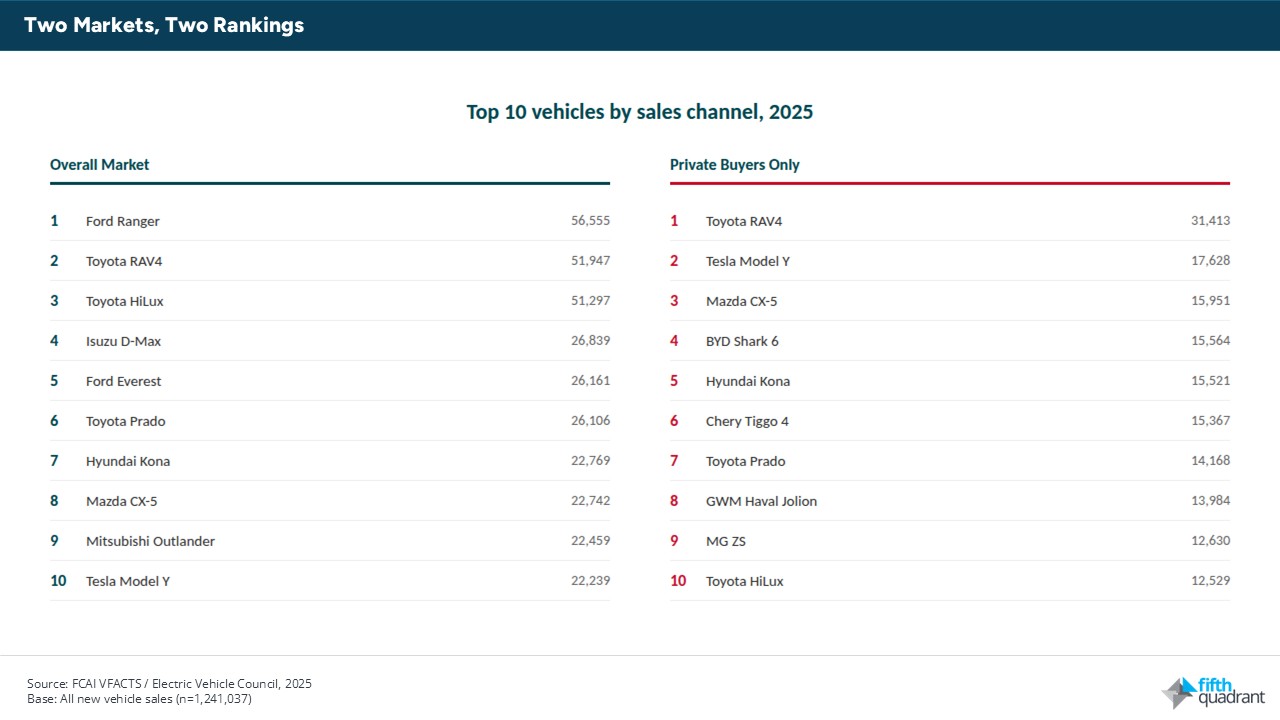

New Vehicle Sales 2025: The Ford Ranger was Australia’s best-selling vehicle in 2025. Among private buyers, it ranked 13th.

That gap tells you something important about where the Australian market is heading. Not that one ranking is right and the other wrong, but that we’re increasingly looking at two distinct markets operating under the same sales charts: the fleet market and the retail market. They want different vehicles, they’re moving at different speeds, and they require different strategies.

FCAI and Electric Vehicle Council data for 2025 shows the total market hit 1,241,037 vehicles, a record for the third consecutive year. But within that headline, the divergence between organisational and individual buyers has never been clearer.

Top takeaways

- Ford Ranger ranked first overall but thirteenth among private buyers; RAV4 led the private market

- The BYD Shark 6 outsold both Ranger and HiLux in the retail channel despite being less than two years old

- PHEVs grew 131% to become the fastest-expanding powertrain segment

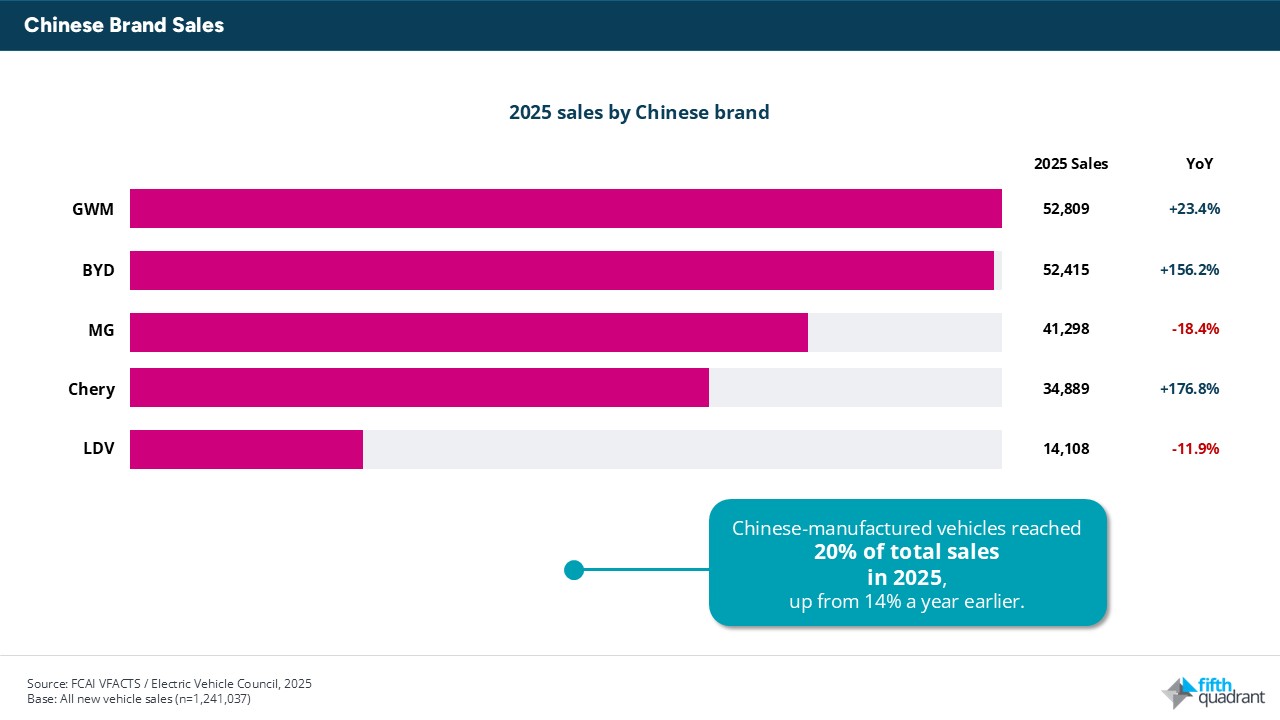

- Chinese-manufactured vehicles hit 20% of total sales, with three brands now in the top ten

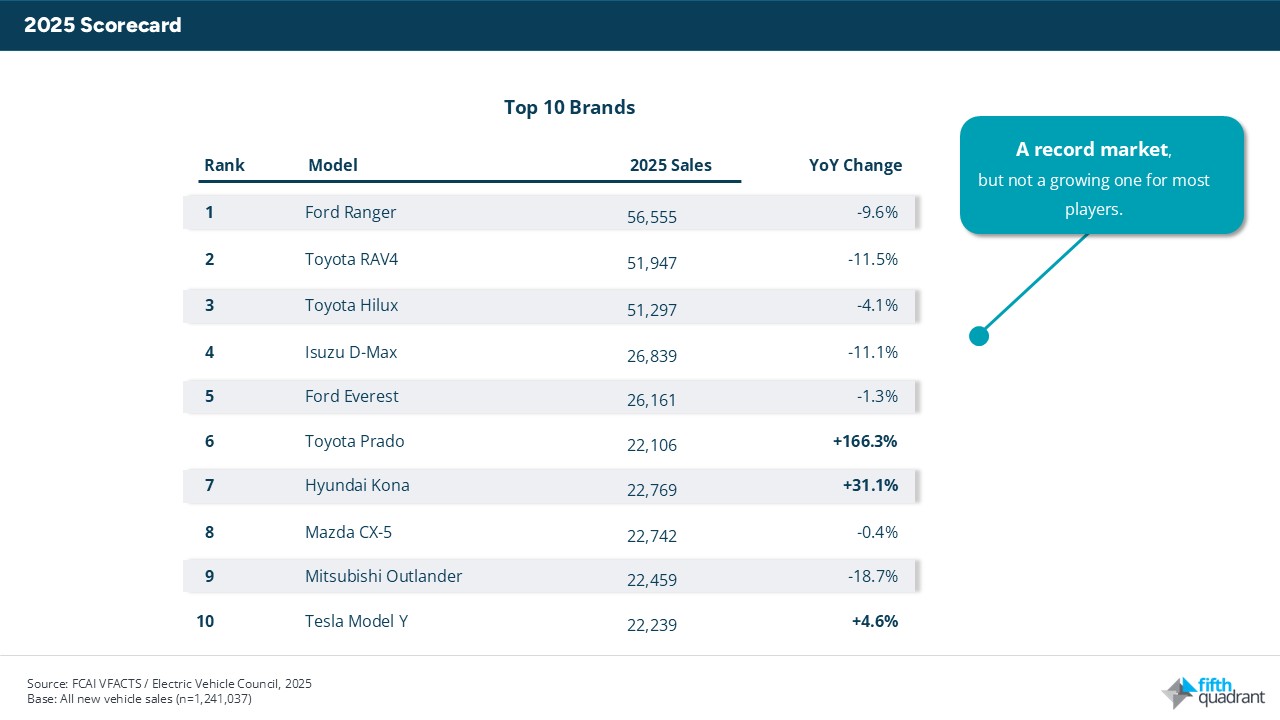

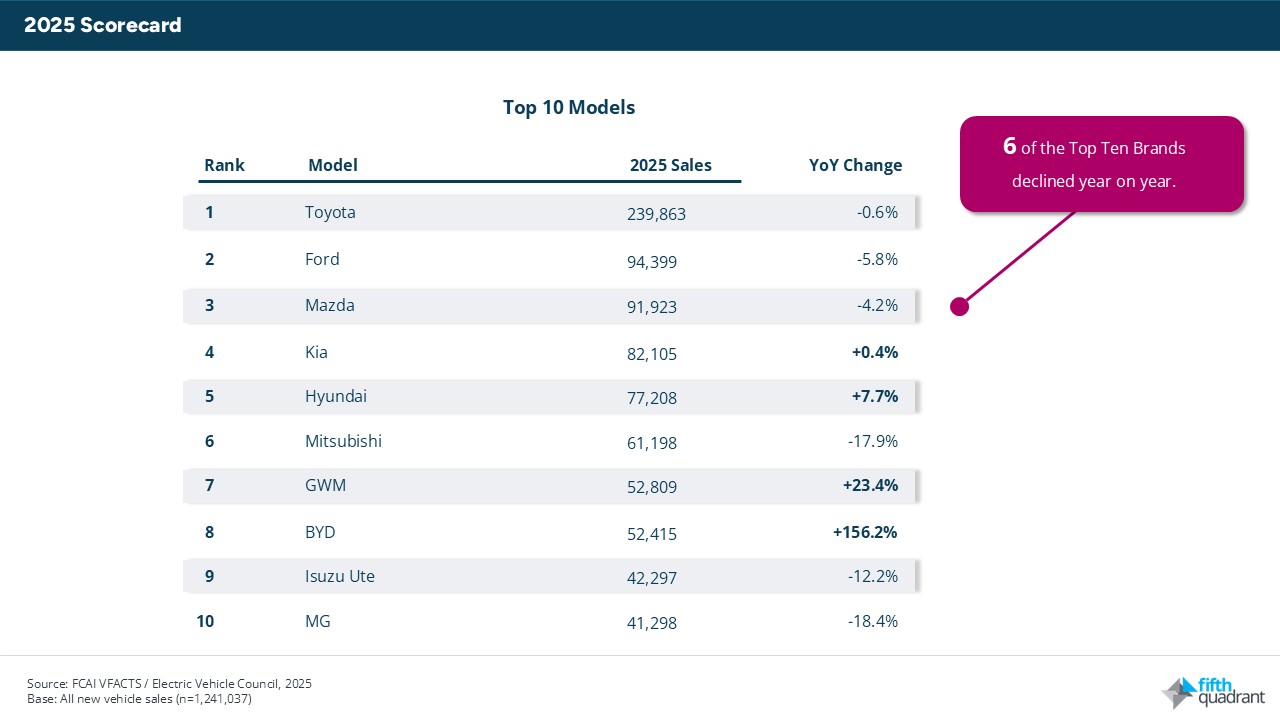

The 2025 scorecard

Here are the headline numbers.

Two markets, two rankings

The overall 2025 sales chart is dominated by utes and large SUVs. Ranger first, RAV4 second, HiLux third, D-Max fourth, Everest fifth. These are vehicles that move in volume through fleet channels, novated leases and government contracts.

Among private buyers paying with their own money, the picture shifts.

The Toyota RAV4 led this cohort. The Tesla Model Y placed second. The Mazda CX-5, a mid-sized SUV climbed to third. The BYD Shark 6, a plug-in hybrid ute that launched in late 2024, finished fourth.

The Ranger dropped to thirteenth. The HiLux fell to tenth. The D-Max sat at fifteenth.

This isn’t about which ranking is more “real.” Both represent genuine purchasing decisions. But they reveal different priorities. Fleet buyers optimise for total cost of ownership, residual value certainty and operational requirements. Private buyers respond to technology, brand perception, lifestyle fit and monthly payment.

The PHEV exception

Plug-in hybrids were 2025’s standout segment, with sales more than doubling to 53,484 units. Growth of 131% outpaced every other powertrain category.

This is one area where fleet and private buyers are converging rather than diverging. PHEVs appeal to fleet managers seeking emissions reductions without charging infrastructure complexity. They appeal to private buyers wanting electric capability without range anxiety.

BYD’s Shark 6 is the clearest example. A dual-cab ute with plug-in hybrid power, it sold strongly to private buyers while also gaining traction with businesses. The Sealion 6 and Sealion 7 SUVs followed similar patterns.

Battery electric vehicles grew 13% to 103,269 units, but the pace has slowed despite a vastly increased range of models on offer. Market share reached 8.3%, up just 0.9 percentage points from 2024. Hybrids remained the most popular electrified option at 199,133 vehicles, up 15%. For now, PHEVs appear to be the powertrain where both markets agree.

The China factor

Chinese-manufactured vehicles reached 20% of total sales in 2025, up from 14% a year earlier. China overtook Thailand to become Australia’s second-largest source country behind Japan.

Three Chinese brands finished in the top ten: GWM at seventh (+23%), BYD at eighth (+156%), and MG at tenth. Chery grew 177% but narrowly missed the top ten.

The growth isn’t uniform though. MG fell 18% despite launching new models. LDV dropped 12%. Chinese brands are now competing with each other as intensely as they compete with legacy manufacturers, and not all are winning.

Legacy brands did however also feel the pressure. Mitsubishi declined 18%. Nissan fell 22% and dropped out of the top ten. Volkswagen was down 21%. Jeep recorded its lowest annual sales since 1997.

What this means

The divergence between fleet and private markets has practical implications across the entire automotive ecosystem.

For dealers, the question is portfolio balance. A business built around fleet sales will see different brand momentum, different service requirements and different trade-in profiles than one focused on retail. The Ranger remains a volume anchor for fleet-oriented dealers. For retail-focused operations, RAV4, Kona and the emerging PHEV segment may be better bets.

For manufacturers, the challenge is product strategy. Vehicles that succeed in fleet don’t automatically translate to retail, and vice versa. BYD’s rapid growth came largely from retail appeal; converting that into fleet penetration is the next test. Conversely, brands with strong fleet relationships face the question of whether their products resonate with private buyers making discretionary choices.

For the aftermarket, the powertrain mix is the story to watch. PHEVs and EVs are entering workshops at accelerating rates, and the brands driving that shift (BYD, GWM, Tesla, etc), aren’t the ones most workshops have historically serviced.

The 2025 record was real. But treating it as a single story with a single set of winners misses the point. Australia’s vehicle market is splitting into two lanes, and success increasingly depends on knowing which one you’re in.

Fifth Quadrant publish monthly new vehicle sales updates here. For more insights on automotive market trends and consumer behaviour, explore Fifth Quadrant’s automotive market research reports or contact our team.

Posted in Auto & Mobility, B2B, Uncategorized