Author: Sam Antrobus | Posted On: 19 Aug 2025

Updates to New Vehicle Sales are published monthly. View previous wave.

Despite the natural slowdown following the end-of-financial-year surge, New Vehicle Sales July 2025 set a new July record with 104,244 units sold. The introduction of NVES penalties on July 1st is beginning to influence market dynamics in the first full month since implementation.

Top 5 Takeaways

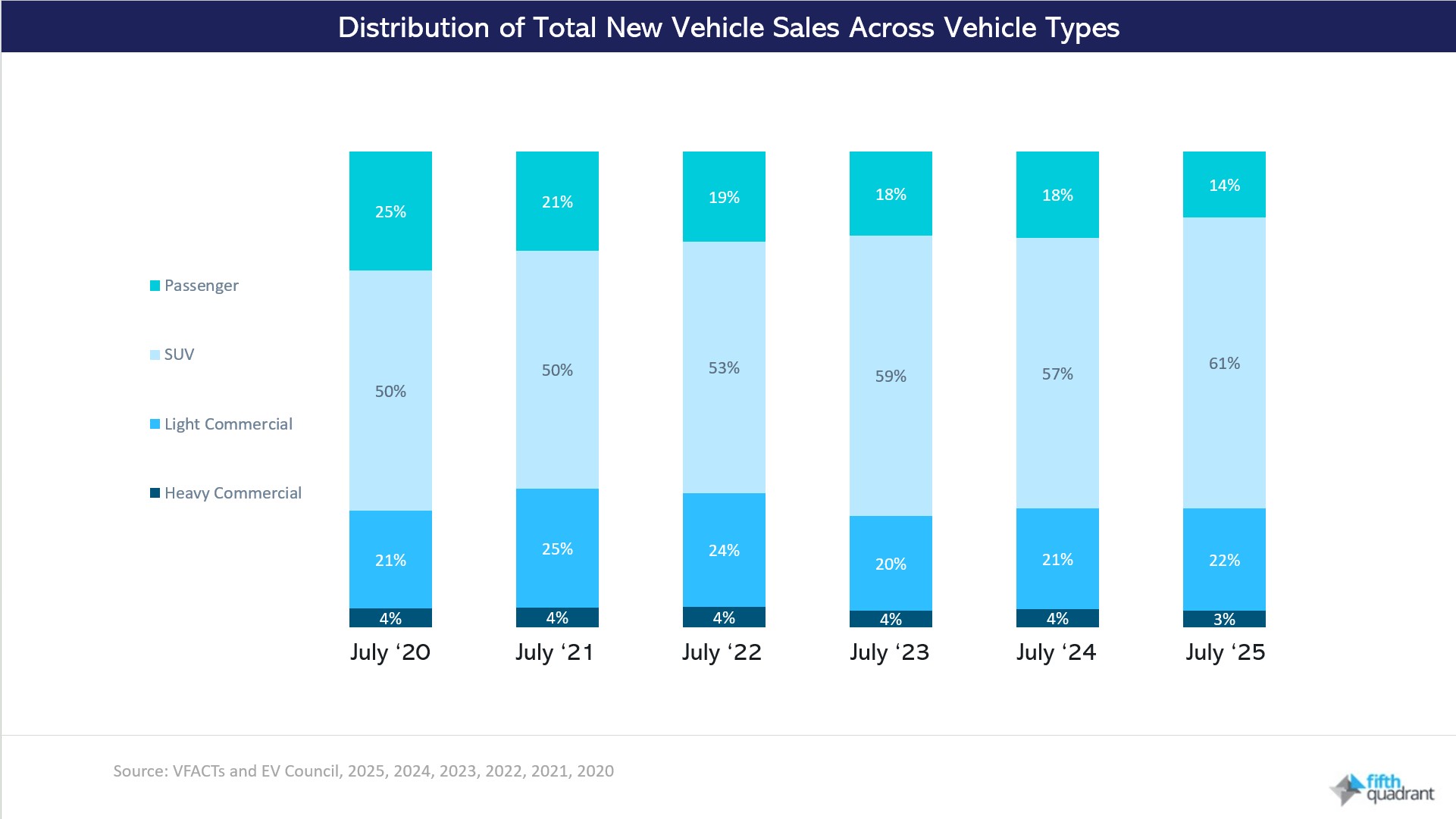

- Record breaking July to start the financial year: Sales in July 2025 are the highest yet, up 2% from July 2024. The high numbers are driven by rapid growth in SUV and LCV sales, both recording a significant boost and comprising 83% of the total market.

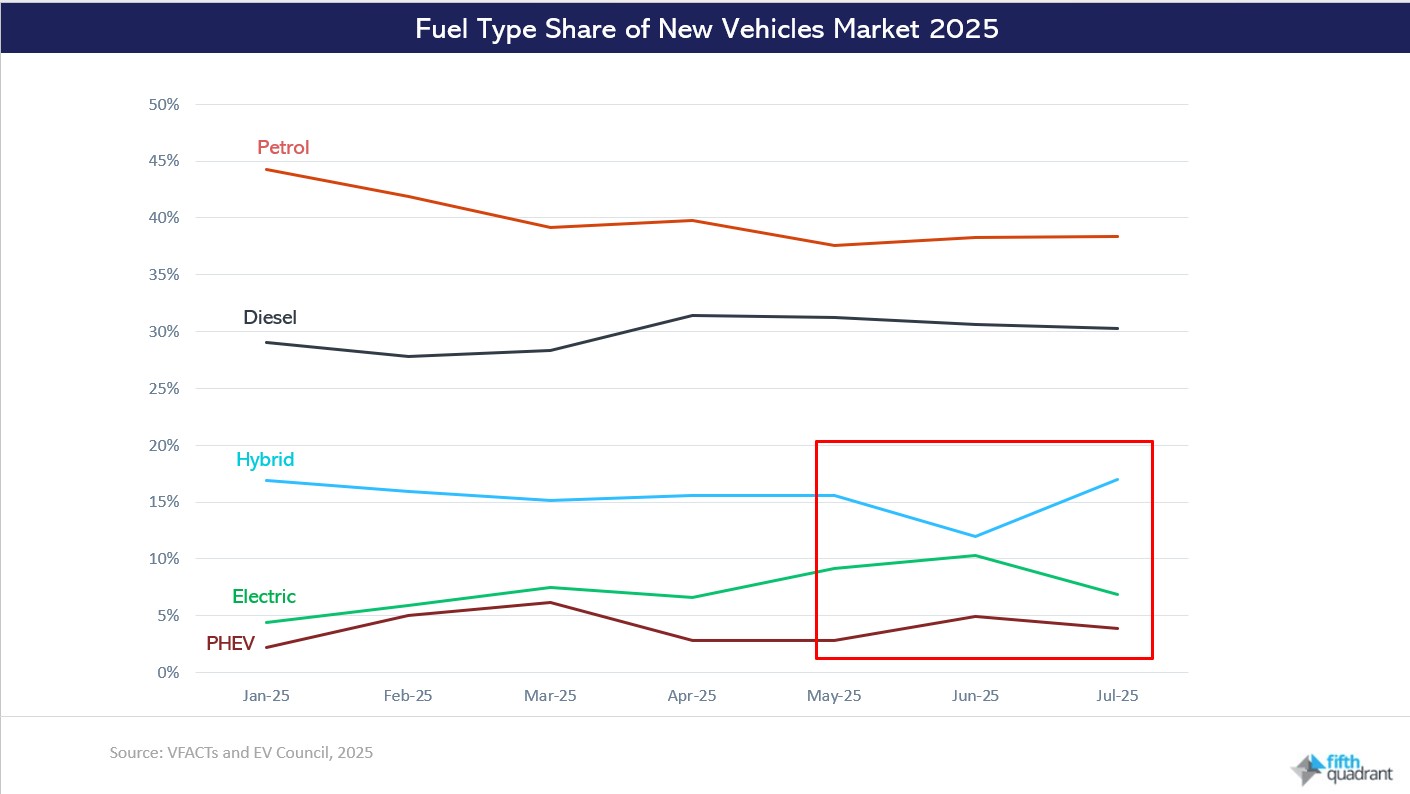

- Hybrid sales surge in July: Hybrid vehicle sales reached their highest point of 2025 so far, with a notable increase of 16% from June to a total of 17,757 units, despite a general drop in new vehicles sales at the start of the financial year. This rise in hybrid sales, combined with a dip in the number of EVs sold, has resulted in a 5% boost in total market share for hybrid vehicles.

- LCV market adapts quickly to changing pressures: In 2025, the light commercial vehicle (LCV) market has undergone a rapid shift, with zero and low emission vehicles (ZLEV) gaining ground fast. July marked the weakest month for petrol LCV sales since the pandemic, with internal combustion engine (ICE) LCV sales falling 916 units compared to July last year. In contrast, sales of new ZLEV LCVs have surged, increasing sixteen fold in the past 12 months.

- SUVs remain market leaders: SUVs continue to dominate the market, comprising 61% of total new vehicle sales at 63,723 vehicles. Sales increased by 5,768 units compared to July 2024, putting 2025 on track to surpass last year’s numbers.

- Toyota bounces back hard: Toyota has seen a strong recovery following a dip in sales of the RAV4, Corolla and Landcruiser, achieving the best month of 2025 for sales of both the Corolla and Camry.

Shifting priorities among ZLEV

In July 2025, the Australian new vehicle market shifted noticeably, with manufacturers and buyers moving from pure EVs and PHEVs toward conventional hybrids. The change reflects a practical response to updated policy settings under the NVES and recognition that hybrids offer a more accessible entry point into the zero and low emission vehicle (ZLEV) market.

2025 has emerged as a definitive year for the hybrid in Australia, with manufacturers launching 12 new hybrid vehicles since January. Among the standout performers, the BYD Shark 6 has redefined the light commercial vehicle landscape, delivering 11,657 sales since its February launch, propelling it to fourth position among Australia’s best-selling LCVs in 2025 so far.

The July 2025 hybrid pivot carries significant implications across the automotive ecosystem. For manufacturers, it validates hybrid technology as a sustainable medium-term strategy while full EV infrastructure develops. The success of hybrid models provides breathing room for EV product development and charging network expansion without sacrificing NVES compliance.

Is the expansion of SUV dominance sustainable?

SUVs continue to dominate, with sedan sales plunging by a quarter year-to-date. For every two passenger vehicles sold so far in 2025, Australians bought nine SUVs. In July, the Toyota Corolla was the only sedan to break into the top 20 model list, competing in a lineup otherwise dominated by SUVs. In the last five years, SUV sales have risen from 50% of total vehicle sales to almost two-thirds, whilst passenger vehicles hit a record low.

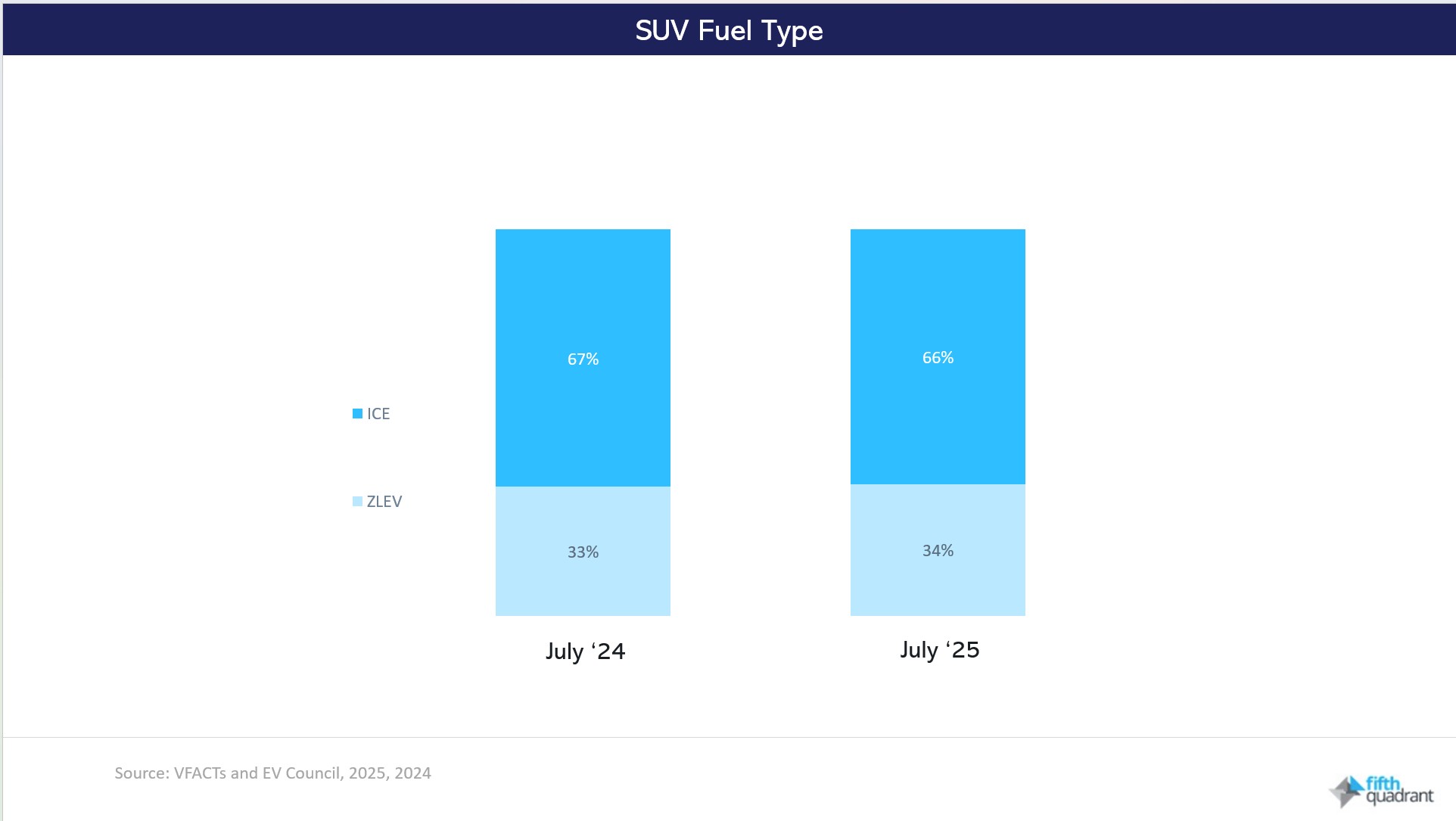

However, SUV manufacturers will need to adapt to the changing environment, with 66% of new SUVs sold in July being ICE, a figure that hasn’t changed over the last 12 months.

The NVES is the most significant regulatory change in Australian automotive history, reshaping both manufacturer strategies and consumer choices. With two thirds of SUV sales in July still internal combustion engine (ICE) models, the scale of the challenge is clear as NVES penalties take effect. As ICE production costs rise, manufacturers will need to shift more of their range toward zero and low emission vehicles (ZLEV) to protect sales.

Looking ahead

Chinese brands with established hybrid and electric line-ups are well placed to benefit from traditional manufacturers’ challenges, while the surge in hybrid sales suggests consumers will shift toward electrified options as ICE prices climb under penalty costs. Many vehicles sold in July avoided NVES penalties by being imported before the June 30 cut-off, so the full impact is likely to be clearer in August sales figures.

Looking for more auto insights? View our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us.

Posted in Auto & Mobility, QN