Author: Amelia McVeigh | Posted On: 09 Jul 2025

Updates to New Vehicle Sales are published monthly. View previous wave.

New Vehicle Sales June 2025 delivered a strong close to the first half of the year, with 127,437 new vehicles sold, offsetting earlier softness and narrowing the year-to-date (YTD) deficit to just 8,968 vehicles. The result shows a market potentially settling back into a more normal cadence, with June driven by end-of-financial-year sales activity and efforts by OEMs to shift stock ahead of incoming models and NVES penalties.

Top 5 Takeaways

- June closes the gap: 127,437 new vehicle sales in June, a 6.2% uplift YoY, cutting the year-to-date shortfall from 16,390 vehicles at the end of May to 8,968 by the end of June. Based on historical trends, this suggests a full year total of 1.19m-1.25m (our forecasts predict 1.217m for anyone keeping track)

- SUVs maintain market dominance: The segment continued to lead growth, with sales up 25,059 units year-on-year. Growth came mostly from small and large SUV categories, although medium SUVs remained the largest single contributor within the segment

- EV sales hit new highs: Electric vehicle sales rebounded strongly over the past two months, reaching 13,169 units in June, the highest monthly EV result on record (and second month in a row of 10k+ in EV sales). Year-to-date, EV sales stand at 47,145 for H1 2025, marking the strongest first half for EVs in Australia.

- Light Commercials rebound: After a subdued start to 2025, June saw a noticeable lift in light commercial sales, reaching 24,646 units, now slightly ahead of 2024 on a year-to-date basis.

- Chinese brands gain momentum: BYD, Chery, and GWM saw the strongest year-on-year volume growth in June, all finishing in the top 20, and increasing by 9,828, 7,678, and 3,665 units respectively. They join MG and LDV in the top 20, as Chinese brands continue to build their presence in the Australian market.

Winners and losers

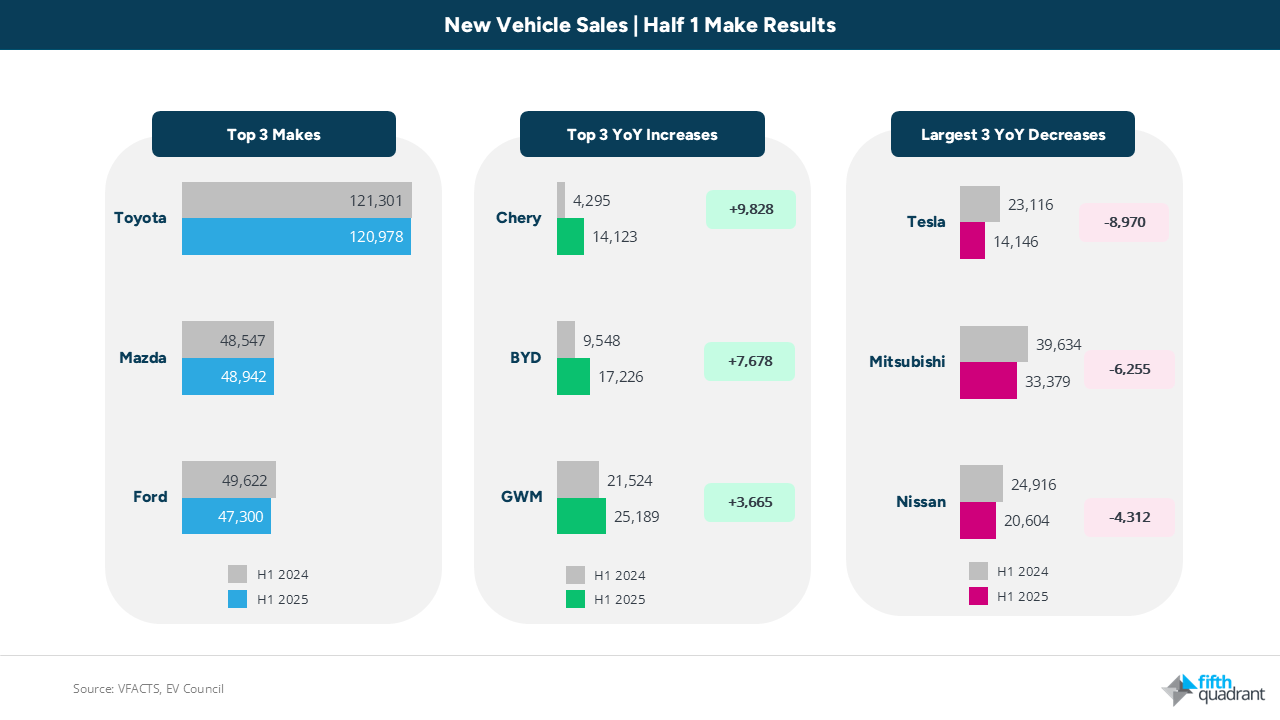

Toyota retained its top position with 121,301 sales for H1 2025, despite sitting behind its 2024 performance. Mazda has then edged ahead of Ford for second place with a modest year-on-year increase.

Among the fastest-growing brands, Chery surged by 9,828 units year-on-year, followed by BYD (+7,678) and GWM (+3,665). Tesla recorded the steepest decline, down 8,970 units year-on-year, despite improving performance in recent months. Mitsubishi and Nissan also posted sizable declines over the first half of the year.

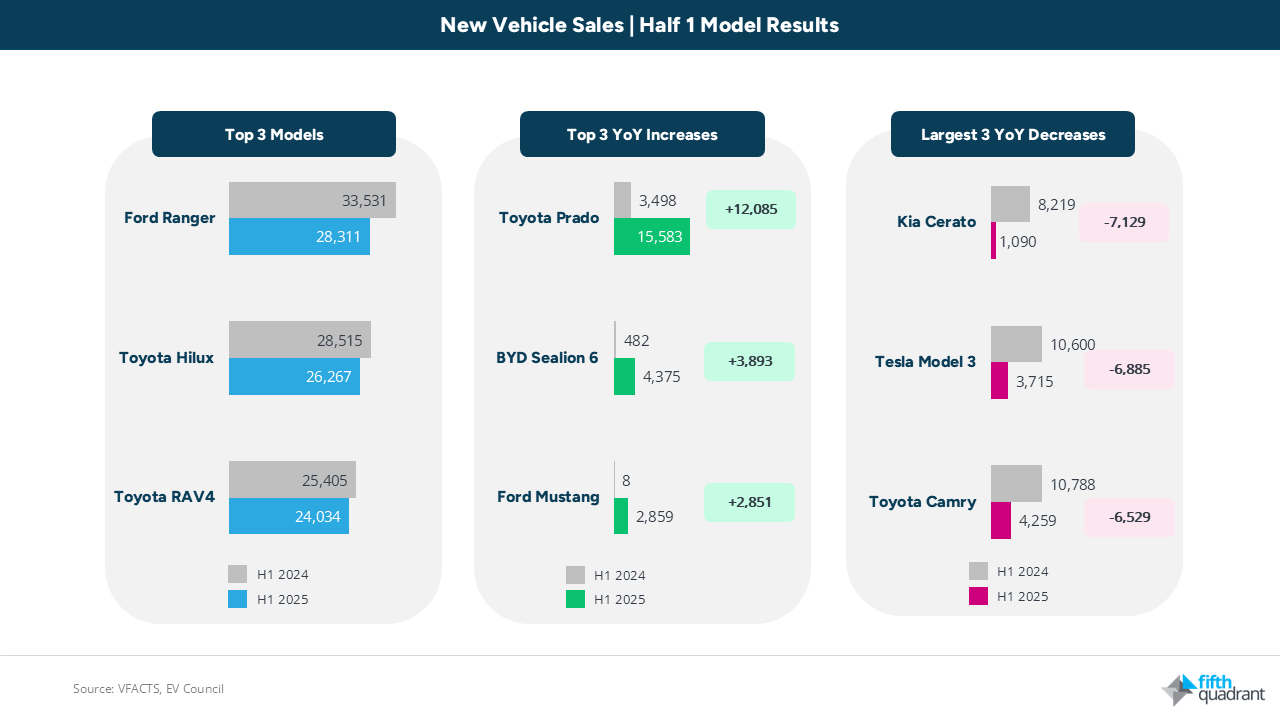

At a model level, the Ford Ranger (33,531 YTD), Toyota’s Hilux (28,515) and RAV4 (25,405) led overall sales. The Toyota Prado recorded the strongest YoY uplift (+12,085), followed by the BYD Sealion 6 (+3,893) and Ford Mustang (+2,851). Conversely, the Kia Cerato, Tesla Model 3, and Toyota Camry saw the most significant declines, losing a combined 20,543 sales YoY.

New entrants making their mark

Beyond the headline performers, a number of newer brands are beginning to gain traction. Geely leads the cohort with 1,845 YTD sales, followed by JAC (907), and Omoda Jaecoo (690). Other notable newcomers include Zeekr (450) and Leapmotor (309), signalling the continuing influx of Chinese OEMs.

The Chery Tiggo 4 Pro was the most successful new model with 7,996 sales, followed by the BYD Shark 6 (4,295) and BYD Sealion 7 (3,756). Other strong debuts included the Kia K4 (2,664), and Mazda CX-80 (2,065).

What’s next

As we enter the second half of the year, all eyes will be on how the New Vehicle Efficiency Standard (NVES) begins to shape product pipelines and sales strategies. With emissions penalties in play from July 1, the Australian market is likely to see an influx of new or updated low-emissions vehicles as OEMs seek to balance their fleet mix.

We can also expect growing competition among newer entrants, especially in the hybrid and EV space, as brands race to align with regulatory pressures and shifting consumer preferences. How these dynamics unfold will be critical in determining whether the market can keep up with the pace set in 2024.

Looking for more auto insights? View our automotive market research reports. Fifth Quadrant publish monthly new vehicle sales updates here. For any questions or inquiries, feel free to contact us.

Posted in Auto & Mobility, QN