Author: Colm Ryan | Posted On: 25 Nov 2025

New Vehicle Sales October 2025 reached 100,658 new vehicles, virtually unchanged from a year ago, but the underlying mix shifted dramatically.

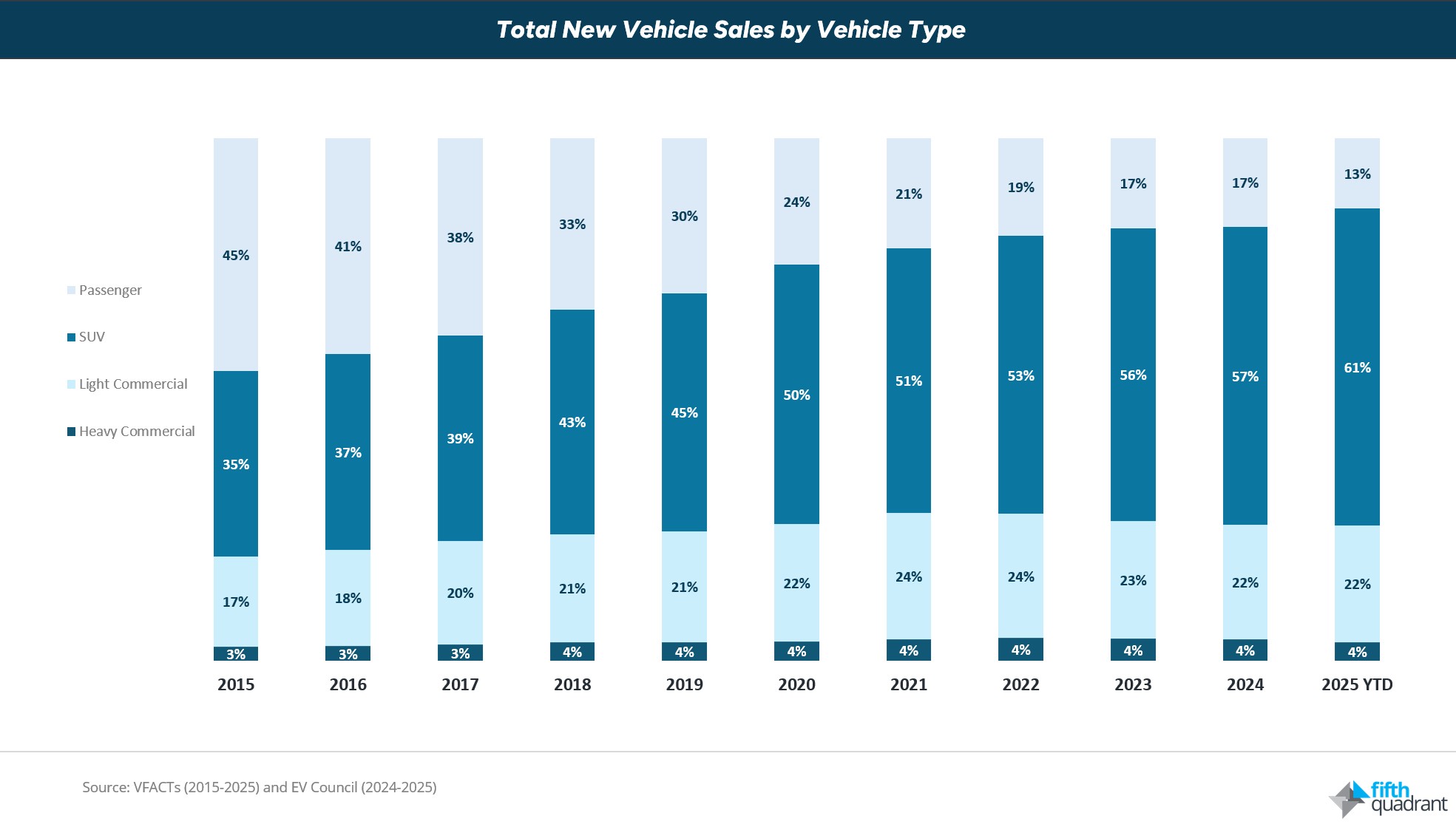

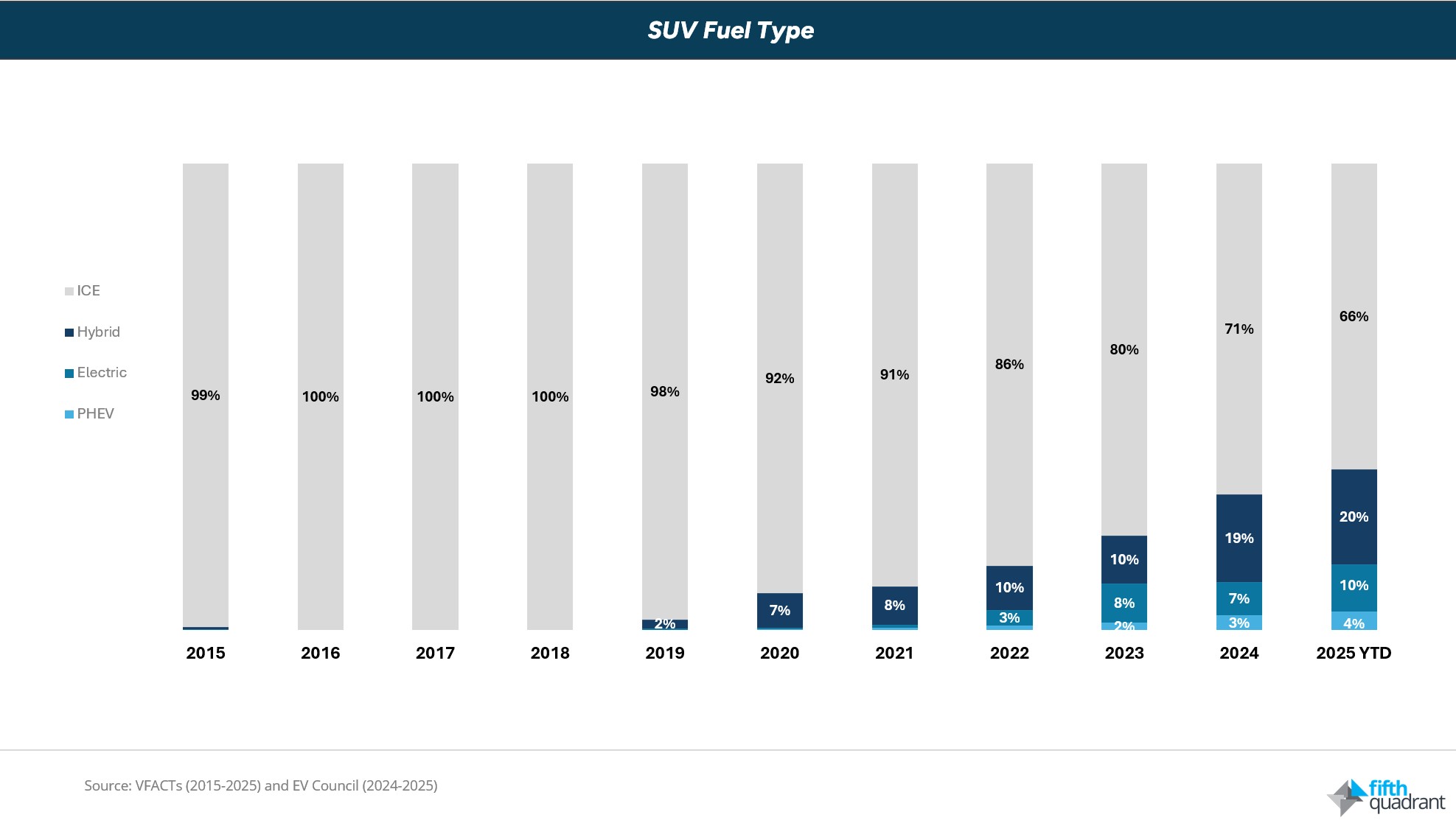

SUVs rose 9% to 62,292, while passenger cars fell from 16,040 to 12,371. Hybrids hit their second-best month ever at 17,692 sales. Passenger EVs jumped from 6,394 to 7,285, with SUV EVs reaching 5,933. Chinese-built vehicles passed 20% share for the first time, adding over 5,000 units. Meanwhile, petrol-only passenger cars and SUVs dropped from 41,369 to 35,305.

The pattern is clear: electrification is moving fastest in SUVs, and that’s where brands are now competing hardest. October shows which manufacturers have built the range to capture this shift, and which haven’t.

Key Shifts

- Total sales reached 100,658, flat year-on-year. This conceals shifts in body type, fuel type and manufacturing origin.

- SUVs rose 9% to 62,292 while passenger cars fell 23% to 12,371. SUVs now account for 62% of market volume, compared to 57% last October.

- Heavy Commercial Vehicles softened to 3,942, the first meaningful October decline since 2019. In contrast, Light Commercials remained stable at around 22,000 units.

- Hybrids reached 17,692, the second-strongest month on record. Sales continue tracking above last year as buyers shift toward electrification.

- Passenger EVs lifted from 6,394 to 7,285 while petrol dropped from 41,369 to 35,305. EV growth and petrol decline are now occurring simultaneously.

- Chinese-built vehicles rose from 15,401 to 20,405, passing 20% share. This represents the first time Chinese manufacturing has exceeded one-fifth of the market.

Why Are Some Brands Gaining While Others Lose Ground?

The brands outperforming in October are those with broad electrified SUV portfolios: hybrid foundations supported by expanding PHEV and EV options. Their gains reflect deliberate product development cycles aligned with a market that now rewards electrified breadth rather than isolated nameplates.

Chinese manufacturers are executing this formula consistently. BYD, GWM and MG have built hybrid and EV SUV ranges that appeal to buyers, with BYD’s Shark and Seal models, GWM’s Haval range, and MG’s ZS and HS variants all contributing to the 33% year-on-year growth in Chinese-built vehicles. This confirms that electrified completeness, not legacy brand strength, is becoming the key competitive lever. Meanwhile, brands like Ford and Nissan that continue leaning on slower electrification pipelines face structural pressure as buyers shift to manufacturers offering fuller electrified SUV choice.

For product teams, the message is clear: an electrified SUV range is no longer optional. Toyota and Kia have demonstrated how hybrid investment creates pathways to conversion, while Mitsubishi’s Outlander PHEV is appealing to households needing weekday efficiency and weekend capability. EV expansion from Tesla, BYD and Polestar sets these brands up to accumulate NVES credits, while capturing early adopters.

Are Consumers Ready For Chinese Brands?

Recent behavioural findings from our Consumer Omnibus survey reinforce the structural transition visible in October’s data. 39% of drivers say they would consider a Chinese brand, far above the 4% who currently own one. This gap signals that openness to Chinese manufacturers is no longer a fringe sentiment but a mainstream possibility.

A quarter of drivers also report using their vehicle less in the past year, creating downward pressure on service visit frequency. This ties in with the shift toward electrified powertrains, fundamentally changing service economics: hybrids and EVs require less frequent maintenance due to fewer fluids, extended brake life from regenerative systems, and simpler drivetrains. These two trends, reduced usage and reduced service intensity, compound the challenge for aftermarket businesses built around frequent service intervals.

The market structure, brand mix and consumer attitudes now point in the same direction. Electrified SUVs are becoming the centre of gravity for both new vehicle demand and service economics. Manufacturers and aftermarket players operating on pre-transition assumptions are increasingly misaligned with where buyers are heading.

What Should The Industry Do Now?

October’s flat headline concealed the structural change in the Australian new vehicle market. The shift to electrified SUVs is no longer emerging, it’s established. Chinese manufacturers have built the portfolios buyers want, legacy brands are scrambling to catch up, and aftermarket businesses face a fundamentally different service and parts landscape. The winners won’t be those who eventually respond to this transition. They’ll be those who recognised it was already underway.

Fifth Quadrant publish monthly new vehicle sales updates here. For more insights on automotive market trends and consumer behaviour, explore Fifth Quadrant’s automotive market research reports or contact our team.

Posted in Uncategorized, Auto & Mobility, QN