Author: James Organ | Posted On: 08 Jul 2025

Updates to this research are published monthly.

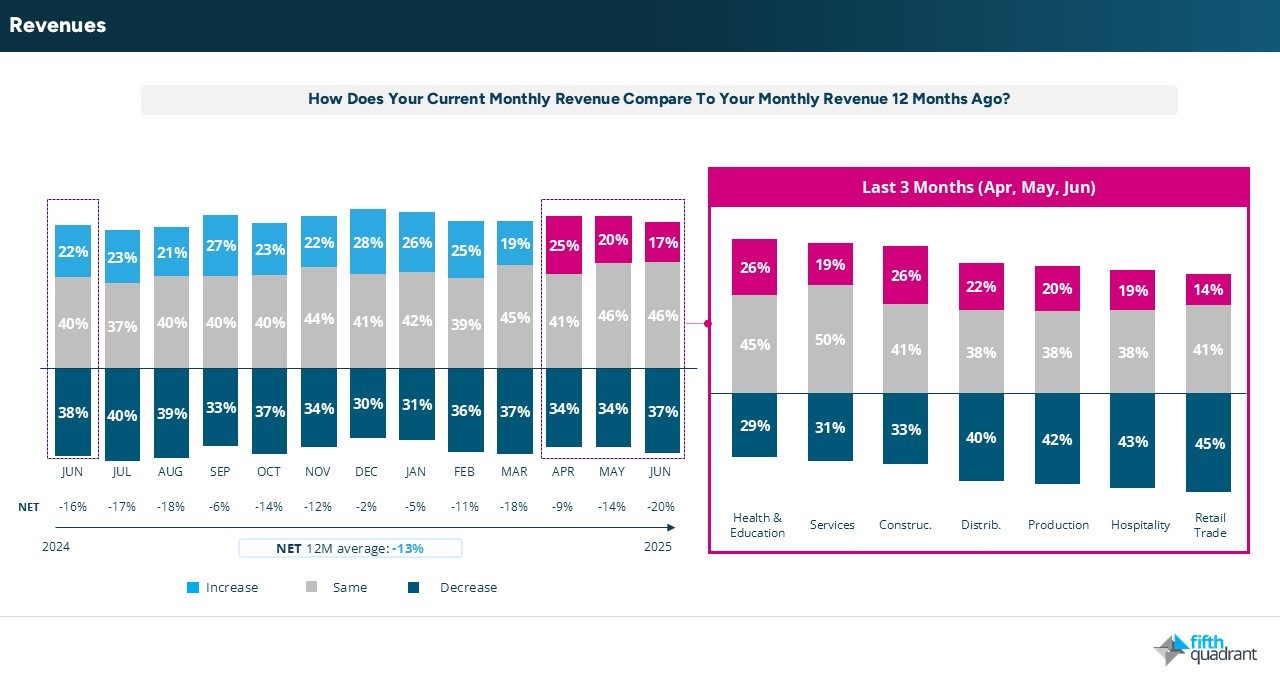

SME performance softened further in June as revenue pressures mounted, with revenue growth hitting its lowest point in the past 12 months as businesses closed FY25 on a cautious footing. Just 17% of SMEs reported higher revenue compared to a year ago, whilst 37% experienced a decline. The downturn was especially pronounced in Hospitality and Retail sectors, which continue grappling with reduced consumer demand despite recent interest rate cuts.

Regional disparities persisted, with WA remaining more resilient than eastern states like NSW/ACT and VIC/TAS.

Dwindling confidence

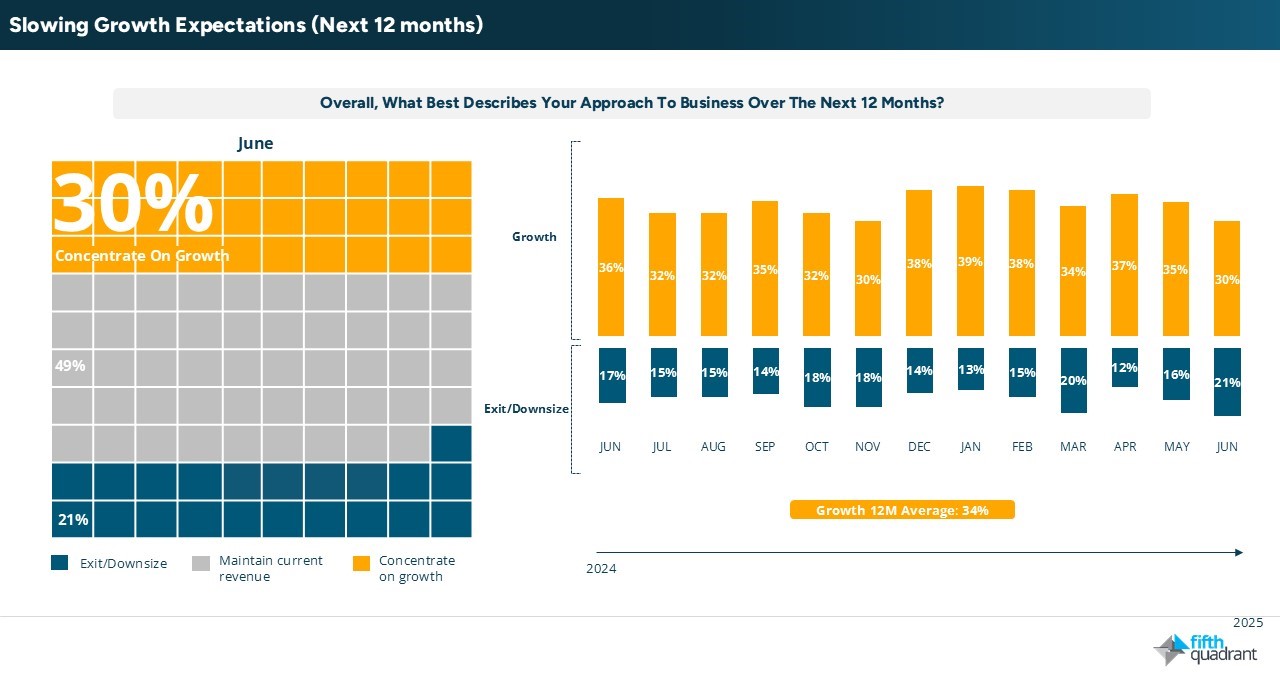

Confidence remained fragile in June, with nearly half of SMEs nominating the economic outlook and cost pressures as their top challenge. Growth intentions softened further to just 30% of SMEs focused on expansion, the lowest since November. For many SMEs, this now reflects active scaling back rather than simply pausing growth ambitions, as businesses prioritise cost control and short-term resilience whilst awaiting clearer signs of recovery.

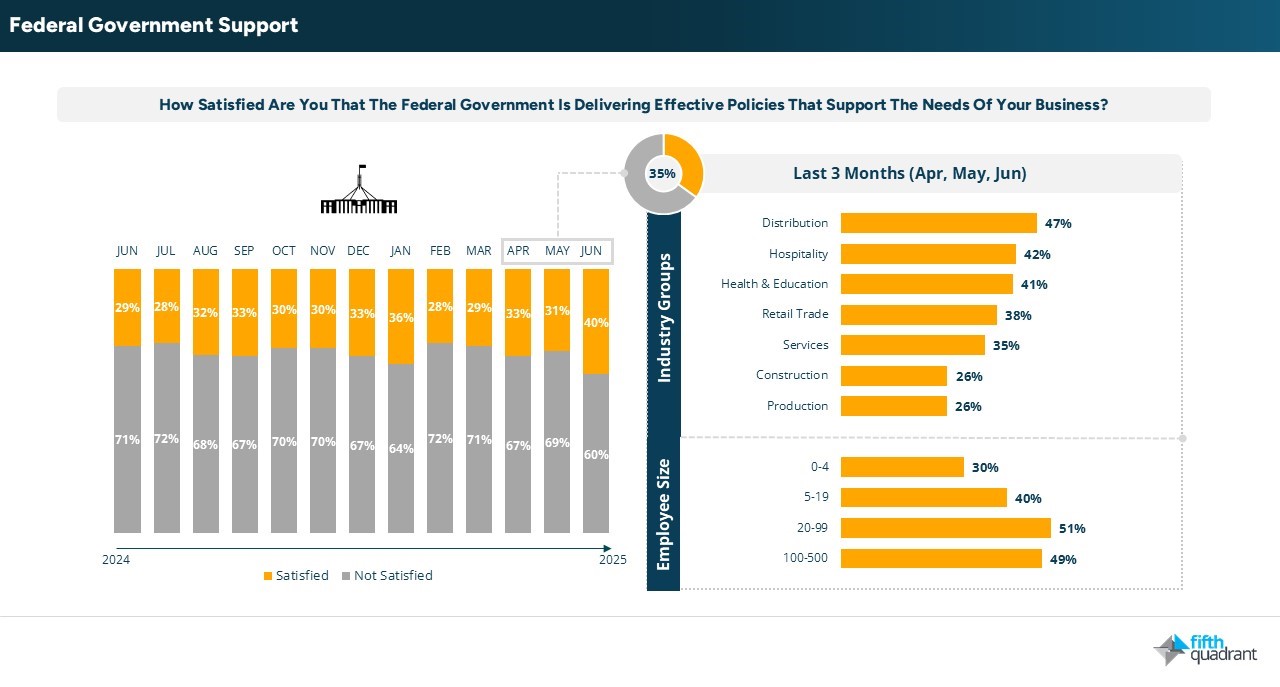

Government satisfaction rises

In a positive development, satisfaction with federal government support for SMEs lifted to 40% in June, the highest level recorded over the past year. The recent federal election result may have contributed to a short-term boost in confidence, though it remains too early to determine if this marks a sustained shift in sentiment.

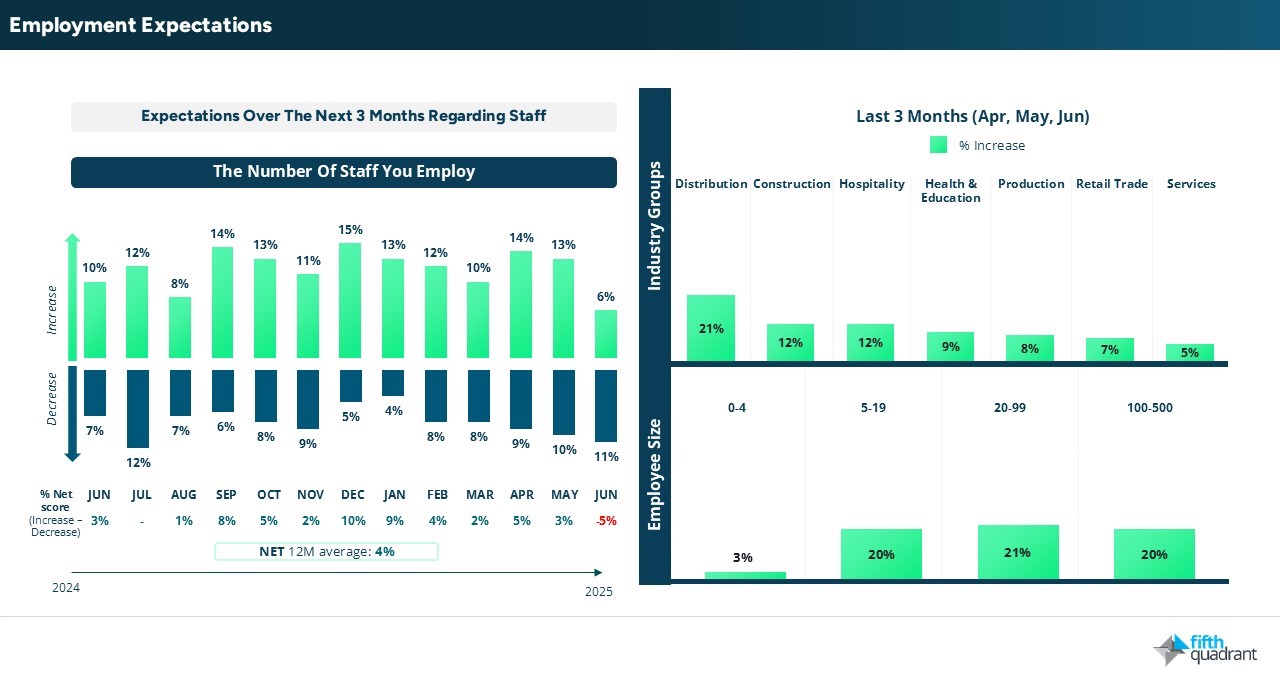

Slowing hiring intentions

Labour market indicators continued cooling, with hiring intentions dipping into negative territory (-5%) for the first time in over a year. Job vacancy rates remained flat, and wage expectations edged up slightly, likely in response to the upcoming award wage rise and end-of-financial-year reviews.

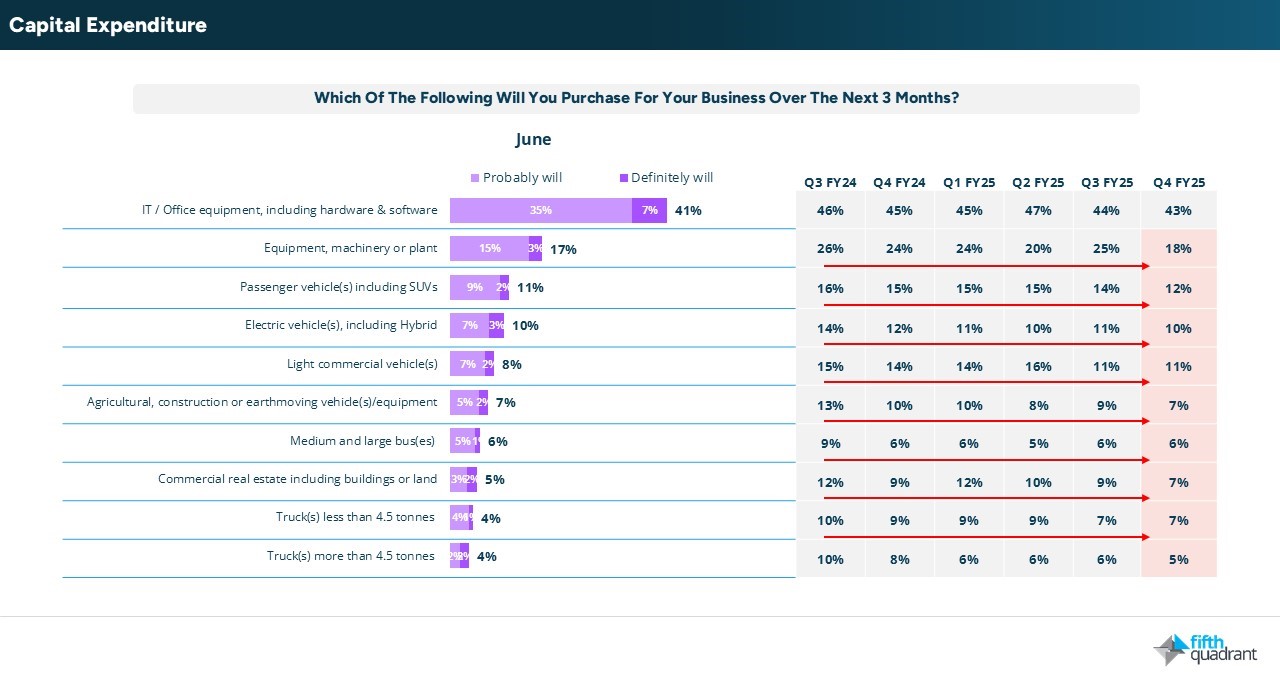

Capital expenditures

Investment activity showed mixed signals in June. Capital expenditure intentions lifted modestly to a net score of +12%, likely driven by end-of-financial-year activity rather than renewed confidence. However, interest in major asset categories like vehicles and machinery continued to soften, whilst finance demand remained subdued and focused on cashflow rather than growth initiatives.

Outstanding debts

Notably, the share of SMEs with outstanding loan repayments fell to 56%, down from 67% in May, pointing to deliberate deleveraging as businesses pull back from growth and manage financial risk more cautiously.

Conclusion

SMEs closed FY25 on a cautious footing, with revenue pressures persisting, growth sentiment softening, and investment activity remaining subdued. Amid rising concern over the economic outlook, many SMEs appear to be scaling back rather than simply standing still, prioritising cost control and short-term resilience whilst awaiting clearer signs of recovery.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

Upcoming SME webinar

To explore how AI is reshaping the SME landscape, don’t miss the upcoming NAIC webinar on 23 July 2023: How AI Solutions Can Drive Business Growth and Productivity. The session will feature a live demo of the AI Adoption Tracker, with Fifth Quadrant’s Research Director, Dr Steve Nuttall, sharing exclusive insights from our ongoing SME research. Hear from expert panellists, discover real-world use cases, and gain practical guidance to help your business harness the power of AI. Register now to secure your spot.

SMEs remain resilient

Posted in Uncategorized, B2B, Consumer & Retail, Financial Services