Author: Dr Steve Nuttall | Posted On: 14 Jan 2026

The Australian medtech sector faces a defining challenge: AI innovation moves in weeks while regulatory approval takes years. The TGA’s recent AI review confirms what industry has long suspected. Existing frameworks weren’t built for adaptive algorithms, and urgent reform is needed to prevent Australian innovators from falling behind.

TGA’s technology-agnostic approach creates both clarity and gaps

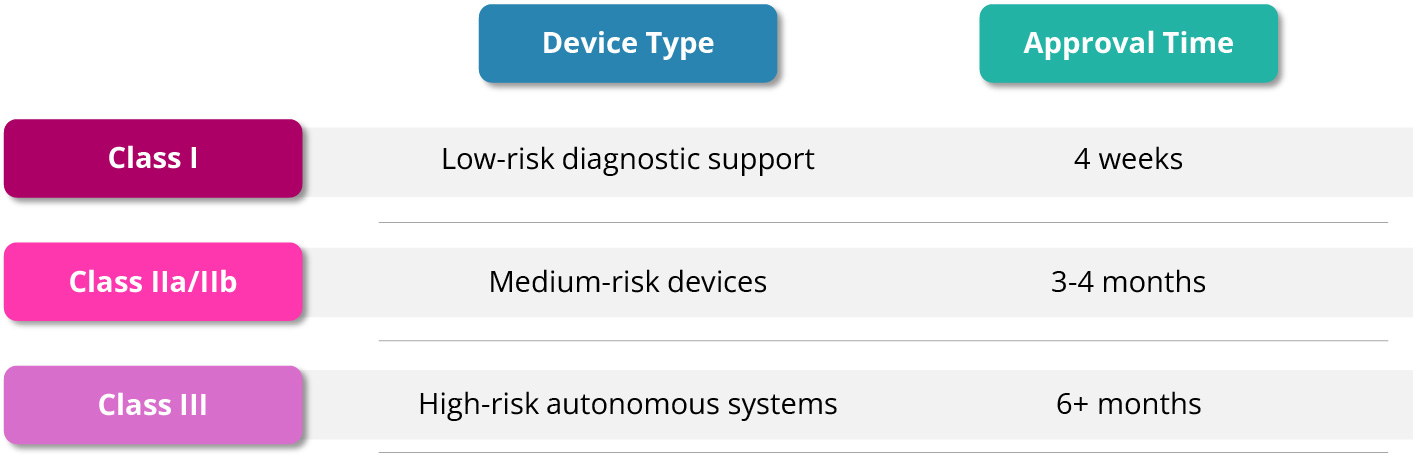

The Therapeutic Goods Administration regulates AI medical devices under its existing risk-based framework, applying the same rules regardless of underlying technology. A Class I diagnostic support tool faces four-week approval, while a Class III autonomous diagnostic system requires six months or more of conformity assessment. This technology-agnostic approach provides regulatory certainty, but creates friction when applied to software that learns and evolves.

The TGA’s landmark 2024 consultation, drawing 53 formal submissions and 600+ workshop participants, identified critical gaps. The July 2025 outcomes report flagged 14 key findings, with adaptive AI guidance marked as ‘urgent priority’. Currently, no adaptive AI has been approved to change functionality post-deployment without full re-assessment. The regulator explicitly acknowledged: ‘The traditional paradigm of medical device regulation was not designed for adaptive artificial intelligence and machine learning technologies.’

For medtech companies, this means algorithms locked at the point of approval. It’s a stark mismatch with technologies designed to improve continuously from real-world data.

The development-approval mismatch is measurable

Evidence from Australian companies quantifies the gap between innovation cycles and regulatory timelines. Artrya’s cardiac AI platform, Salix, demonstrates current pathway realities: development took years, whilst FDA 510(k) clearance required six months from September 2024 submission to March 2025 approval. The company conducted two pre-submission meetings with FDA and secured existing certification before approaching the US market.

4DMedical achieved TGA approval for its lung imaging AI six months ahead of schedule, still representing months of regulatory process for software that could iterate far more rapidly. Harrison.ai, now valued above $1 billion following a US$112 million Series C in February 2025, has deployed its Annalise radiology AI across 1,000+ healthcare facilities globally. However, it registered initially as a Class I device, the lowest-risk classification.

The pattern is clear: successful Australian AI medtech companies are either targeting lower-risk classifications where approval is faster, or building extensive pre-submission engagement into their timelines. Higher-risk adaptive systems face regulatory frameworks that one academic alliance characterised bluntly: ‘The sector is hot, technology is moving fast, but we are moving slow.’

Market implications differ sharply by company stage

For Australian startups, the regulatory burden creates significant barriers to entry. The IMARC Group noted that ‘high regulatory compliance costs with strict guidelines requiring significant investment in technical documentation, clinical trials, and compliance fulfilment creating financial and administrative burdens particularly for smaller companies.’ With biotech and medtech raising $347 million in Australian VC funding during 2024, capital is available, but investors increasingly scrutinise regulatory pathway feasibility before committing.

ASX small caps face a strategic choice. Pro Medicus has achieved a $30 billion market capitalisation by building deep US relationships and FDA expertise. Smaller players like CurveBeam AI pursue modular FDA approvals, breaking complex systems into separately certifiable components. The 2024 acquisition of Volpara by South Korea’s Lunit for $292 million demonstrated that regulatory portfolios (the company held 100+ patents and registrations) constitute significant exit value.

Global players benefit from TGA’s acceptance of overseas certifications. Approximately 85% of medical devices reach Australia via the abridged pathway using existing FDA clearances, CE marks, or MDSAP certificates. This reliance on foreign certification accelerates market access but also means TGA rarely leads on AI-specific requirements. It follows.

International comparison reveals Australian positioning

The FDA has authorised over 950 AI/ML medical devices, with 99.7% via the 510(k) pathway. Crucially, FDA’s Predetermined Change Control Plans now allow pre-approved algorithm updates without new submissions. This is a regulatory mechanism TGA has not yet implemented.

The EU’s approach layers the AI Act (Regulation 2024/1689) atop existing MDR requirements, classifying many AI medical devices as ‘high-risk’ with additional conformity requirements. Both FDA and EU are further ahead than TGA in codifying AI-specific pathways.

TGA participates actively in IMDRF’s international harmonisation efforts and has adopted the Good Machine Learning Practice principles developed jointly by FDA, Health Canada, and UK MHRA. But participation in international frameworks is not the same as leadership. For Australian companies, following rather than leading means competitive disadvantage in global markets.

The path forward requires regulatory evolution

The TGA’s 2025 review commits to further consultation through 2025-2026 on adaptive AI guidance, open dataset requirements, and legislative definition updates. Industry bodies MTPConnect and AusBiotech have both called for risk-proportionate regulation that doesn’t stifle innovation. MTPConnect CEO Stuart Dignam stated in June 2024: ‘There is no time to wait to start building AI capabilities for our medical science SMEs.’

The evidence points to clear conclusions. Australia’s $8.48 billion medtech market will grow to nearly $14 billion by 2033, with digital health expanding at 15.7% annually. The opportunity is substantial. But regulatory frameworks designed for static devices applied to adaptive AI create a fundamental mismatch that current TGA reforms have identified but not yet resolved.

For medtech executives, the strategic imperative is clear: engage early with regulators, consider FDA-first pathways for AI products, design for lower-risk classifications where possible, and build regulatory expertise as a core capability rather than an afterthought. The companies succeeding in Australian AI medtech (Artrya, 4DMedical, Harrison.ai) share a common characteristic: they treat regulatory strategy as central to product development, not sequential to it.

At Fifth Quadrant, we bring deep expertise in healthcare and medtech market research. Explore our latest healthcare insights or get in touch to discuss how regulatory dynamics are shaping your market.

Posted in Healthcare, B2B, TL, Uncategorized