Author: Angus McLachlan | Posted On: 15 Apr 2024

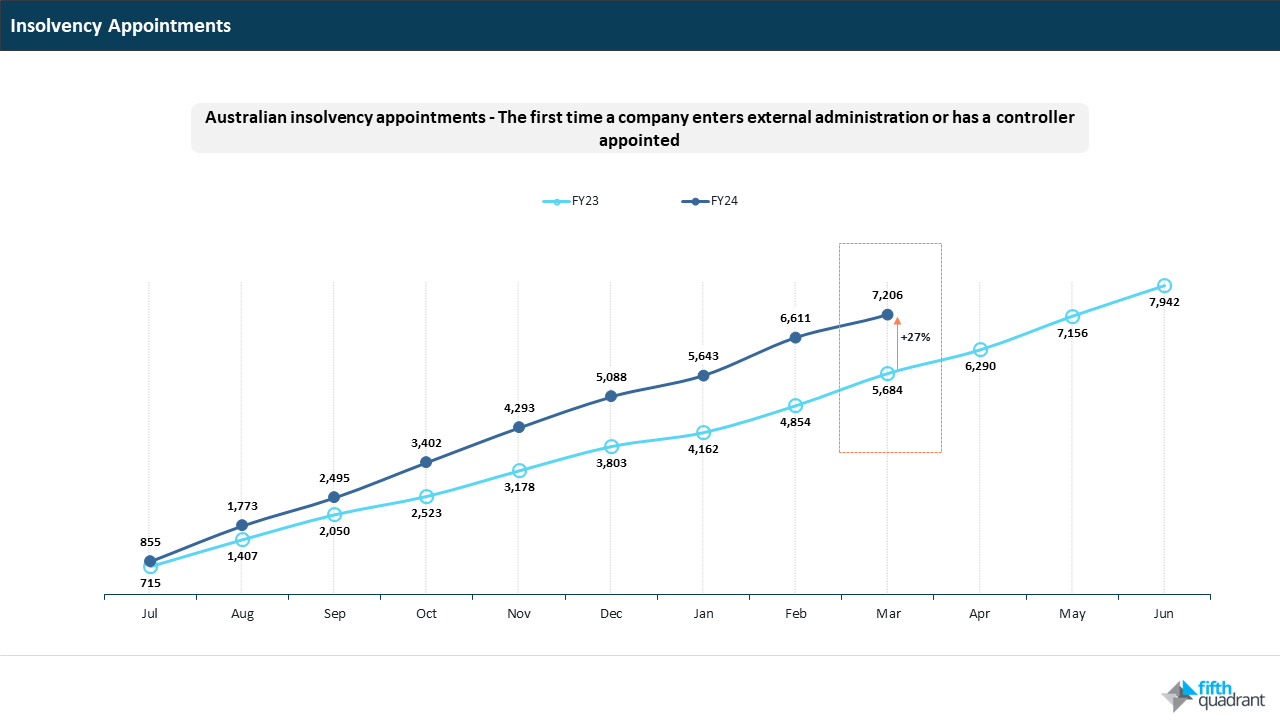

Difficult economic conditions in FY24 have triggered a record increase in the number business failures. In February, the number of monthly insolvencies reached its highest level in almost a decade. Heightened borrowing costs, weakened demand, and a more aggressive stance from the ATO have each taken a considerable toll on the Australian business landscape. Accordingly, the first three quarters of FY24 saw over 7,000 insolvencies, a 27% increase from the same period last year.

Construction, hospitality, and retail have been most affected

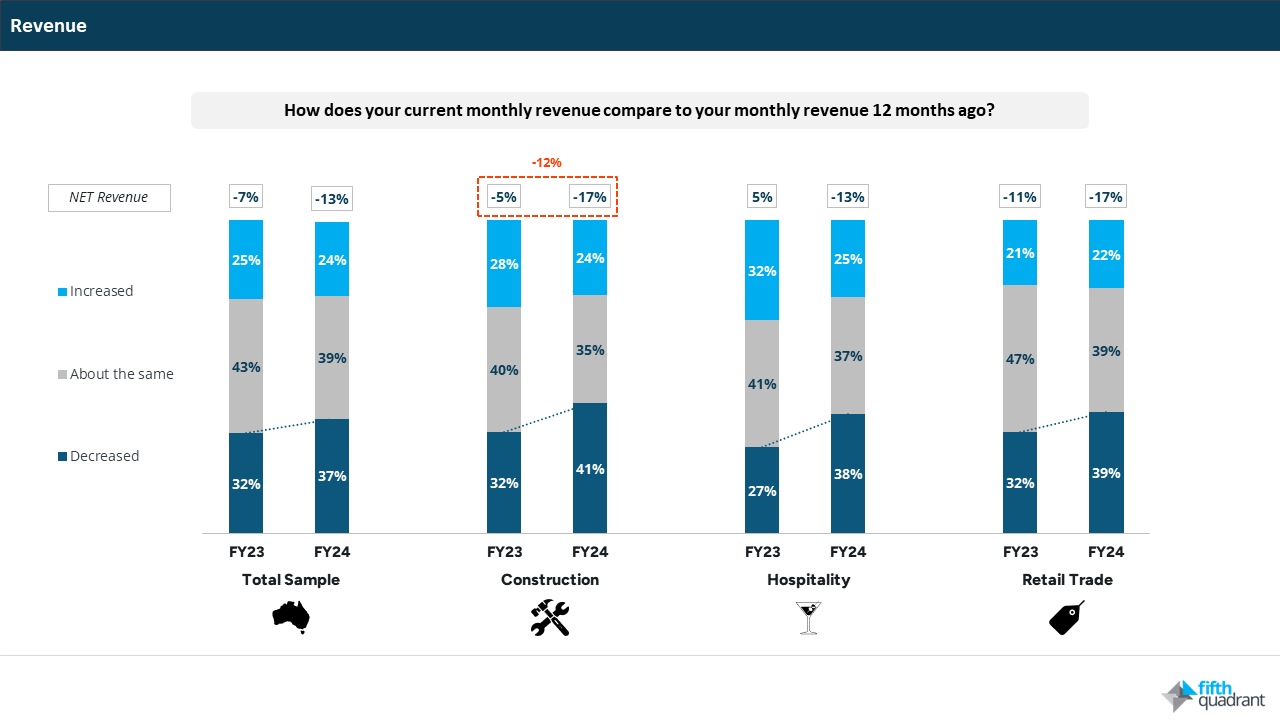

Current insolvencies are heavily concentrated in industries grappling with the effects of a slowing economy, such as construction, hospitality, and retail. In particular, the construction industry has seen the steepest rise in insolvencies.

In October 2023, the RBA announced profitability in the construction sector had taken a severe hit due to a steep increase in the costs of essential inputs like materials and labor. As a result, the construction industry has seen 1,987 insolvencies in FY24 to date, up from 1,495 in March FY23, and 782 in March FY22.

Fifth Quadrant’s SME Sentiment Tracker found so far in FY24, 41% of those in construction are generating less revenue than 12 months ago. This is a 9% jump from FY23. Concerningly, net YoY revenue in the construction sector has fallen by 12%, with many residential builders continuing to struggle with cashflow and low profit margins on existing fixed-price contracts.

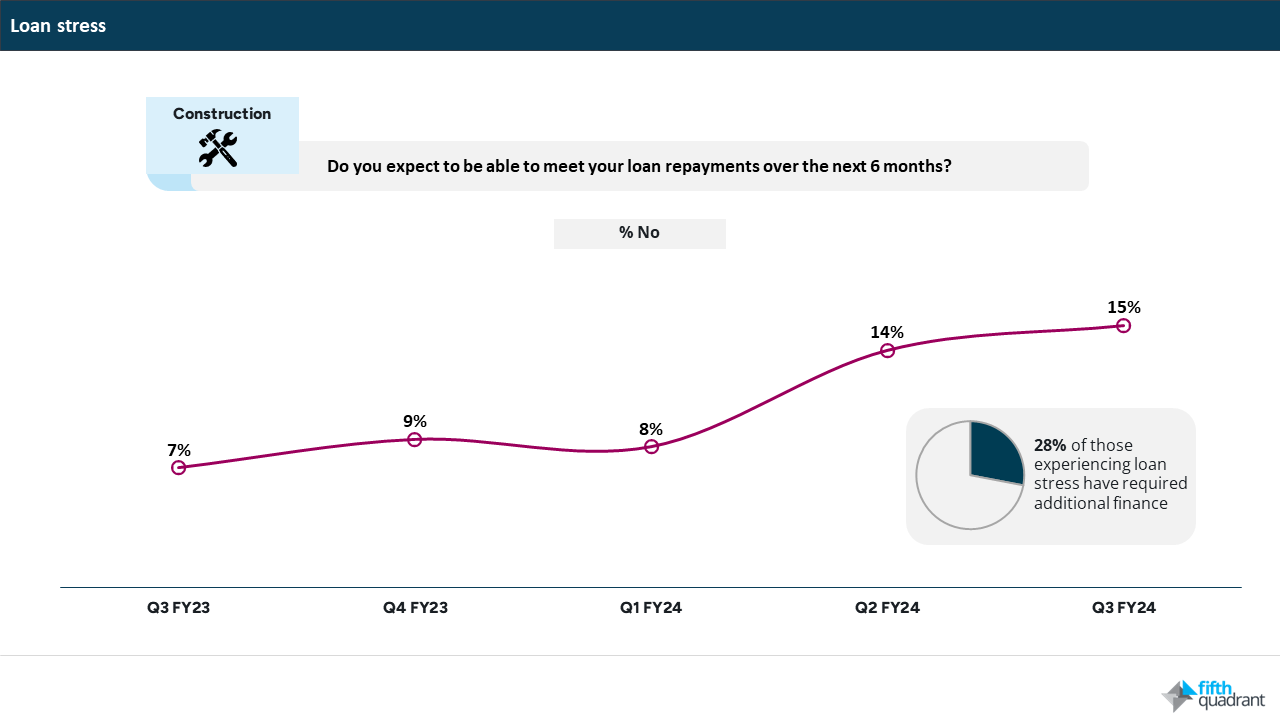

Increasing loan stress in the construction industry

Amidst ongoing headwinds, we have seen an 8% jump over the last 12 months in the number of construction SMEs unable to meet their loan repayments. Worryingly, 28% of those experiencing loan stress have required additional finance on top of their existing loans. This mounting loan stress continues to place the construction sector in a precarious position.

In summary

FY24 has seen a surge in business failures, underscoring the impact of adverse conditions on the Australian business landscape. With heightened borrowing costs, weakened demand, and intensified debt recovery from the ATO, the number of insolvency appointments has increased to levels not seen in almost a decade. The construction industry has been particularly affected, while many hospitality and retail SMEs have borne the brunt of decreasing household consumption. This heightened number of insolvencies underlines the persistent level of difficulty SMEs face in FY24.

If you’ve enjoyed this piece, keep an eye out for our regular updates on SME trends. Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Want to stay up to date with our latest content? Sign up to our newsletter below.

Posted in B2B, Financial Services, QN, TL