Author: Angus McLachlan | Posted On: 12 Feb 2024

Cost-of-living pressures impacted Australian households dramatically throughout 2023. The effects of a rising cost-of-living are well-documented and far-reaching, extending from economic hardship and loan stress, to declining social cohesion and weakened consumer demand.

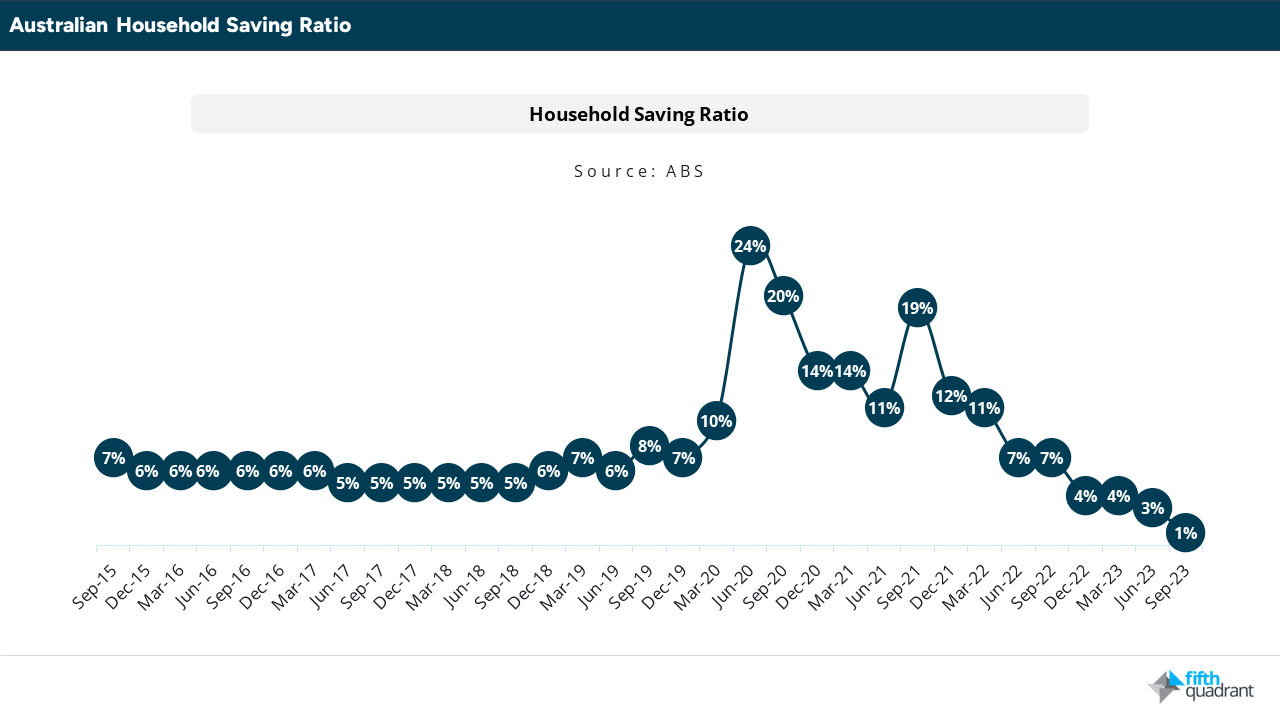

Household essentials such as fuel and electricity saw significant price rises in 2023, as the Consumer Price Index (CPI) increased by 5.4% in the 12 months preceding Q3 2023. As a result, many are now saving less, with the household saving ratio falling to 1.10 percent in Q3 2023, the lowest level since December 2007.

As we found in the 2023 edition of Commbank Consumer Insights, one in four (27%) Australians are doing it tough, including 22% who can only cover household expenses, and 5% experiencing a shortfall. Furthermore, we found the average consumer is redirecting an extra $448.40 per month to cover the elevated cost-of-living.

With households forced to spend more and save less, it is no surprise many have sought alternate methods to counteract the heightened cost-of-living.

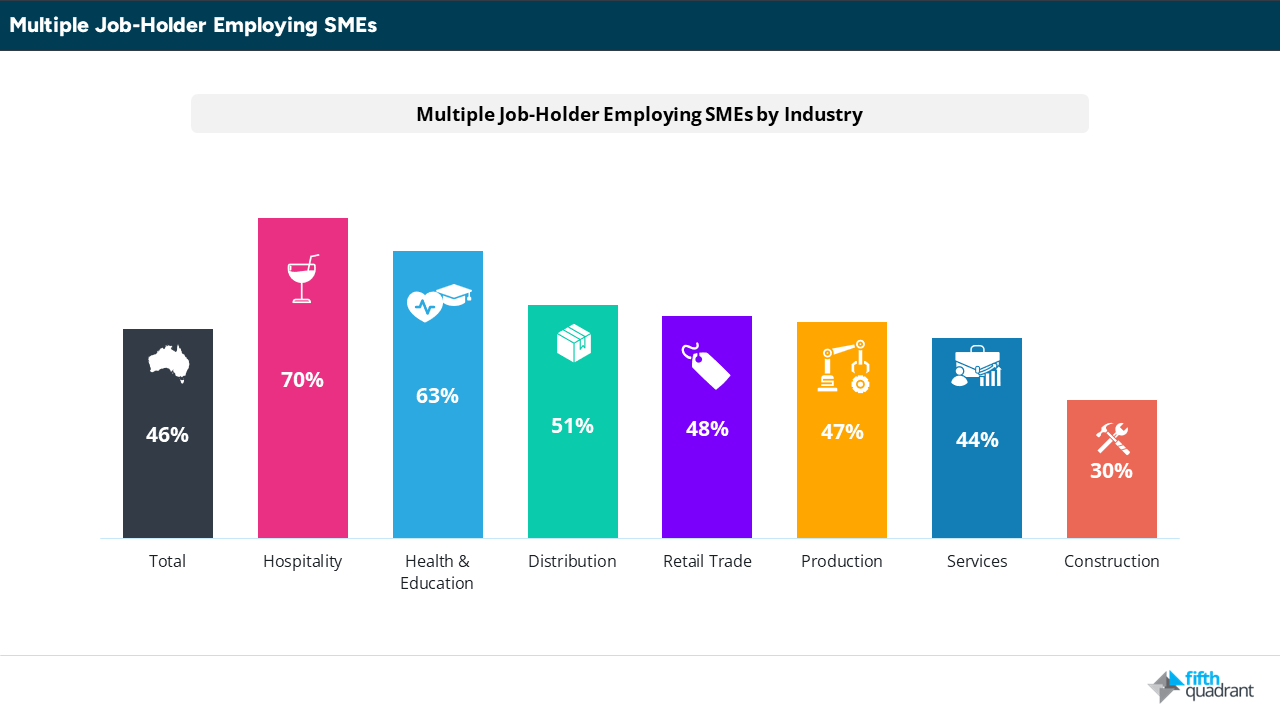

46% of SMEs employ multiple job-holders

The January edition of Fifth Quadrant’s SME Sentiment Tracker has found 1 in 2 (46%) SMEs employ staff who work multiple jobs. Seasonally impacted industries such as Hospitality (70%), and Health and Education (63%) are more likely to employ multiple job-holders.

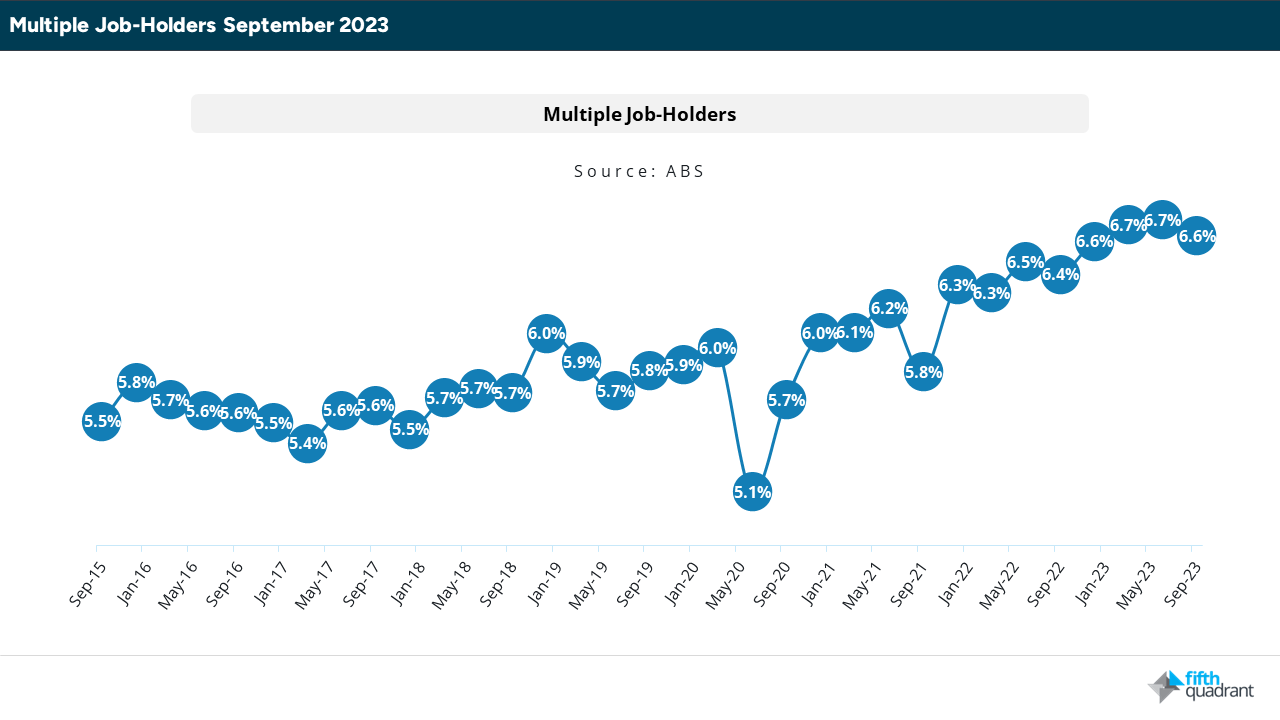

The number of multiple job-holders hit a record high of 962,900 (6.7% of all employed people) in June 2023, up from 5.7% in June 2019. Evidently, the rate of multiple job-holders maintains an inverse relationship with the household saving ratio.

potential risks

A higher rate of multiple job-holders presents a unique set of challenges, with the demands of multiple employment rendering many employees more susceptible to a decline in overall well-being and diminished work-life balance. This can lead to fatigue and burnout, poorer health, decreased productivity, social isolation, as well as limited job satisfaction and career growth. When coupled with the existing financial stress of a rising cost-of-living, these effects are especially burdensome for employees, and have substantial flow-on effects for workplace dynamics and employee happiness.

As we found in CommBank GP Insights 2023, the proportion of Australians that rated their health as very good or excellent declined from 45% in 2020 to 36% in 2022. While nation-wide lockdowns provided us with an opportunity to recalibrate our approach to health and well-being, for many, a rising cost-of-living has had the opposite effect.

summary

The current cost-of-living situation, combined with a record low household saving ratio, has led to an increase in the number of multiple job-holders. As inflationary pressures begin to subside, so too should the number of those juggling multiple employment. This will ultimately result in improved levels of productivity and overall employee well-being.

Updates to the SME Sentiment Tracker and other research are posted regularly here. For any questions or inquiries, feel free to contact us here.

Posted in TL, Consumer & Retail, Financial Services, QN, Social & Government