Author: Angus McLachlan | Posted On: 05 Mar 2024

Following three years of pandemic-induced disruptions and volatility, Australian businesses experienced improved stability in 2023. However, as decision-makers look ahead to the new year, they express genuine concerns about uncertainty and stagnation in 2024.

In January, the Fifth Quadrant SME Sentiment Tracker found the following to be the most anticipated business challenges in 2024:

- Tackling the challenging economic outlook and persistent cost pressures (40%)

- Adapting to evolving customer behaviours and preferences (31%)

- Reinforcing supply chain operations to enhance efficiency and resilience (18%)

In response to these challenges, business decision-makers are undertaking the following actions:

- Improving efficiency through the streamlining of business operations (25%)

- Phasing out unprofitable products/services (25%)

- Renegotiating supplier contracts or exploring alternative supply sources (21%)

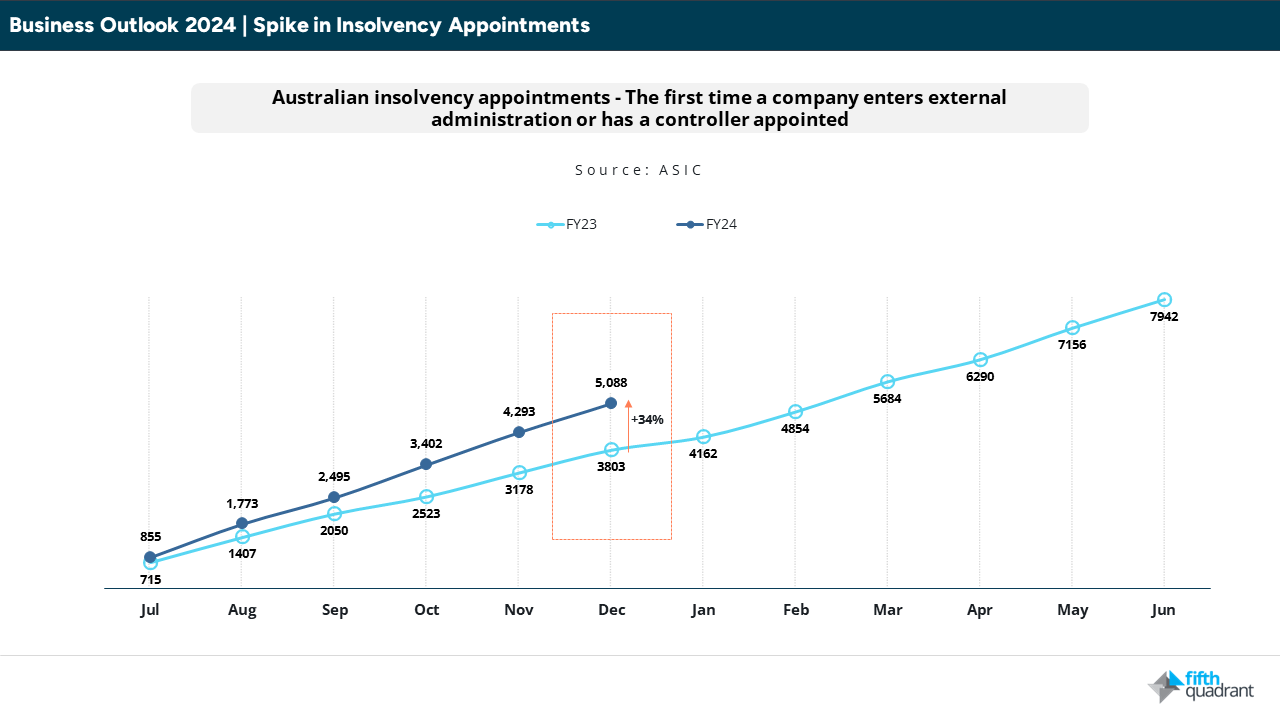

Spike in Insolvency Appointments

Elevated business concerns and hardened market sentiment have resulted in an increase in the number of insolvency appointments. January data from the Australian Securities & Investments Commission (ASIC) shows the number of small business failures has jumped by 34% this financial year. There have already been 5,088 insolvency appointments in FY24, compared to 3,803 during the same period last year. At an average of 848 per month, Australia is on track to pass last year’s high of 7,942.

the year ahead

In light of ongoing cost pressures, evolving customer behaviours, supply chain concerns, and an elevated number of small business failures, overall sentiment remains unwaveringly cautious. However, greater interest rate stability and falling inflation have provided some much-needed relief, and cause for optimism.

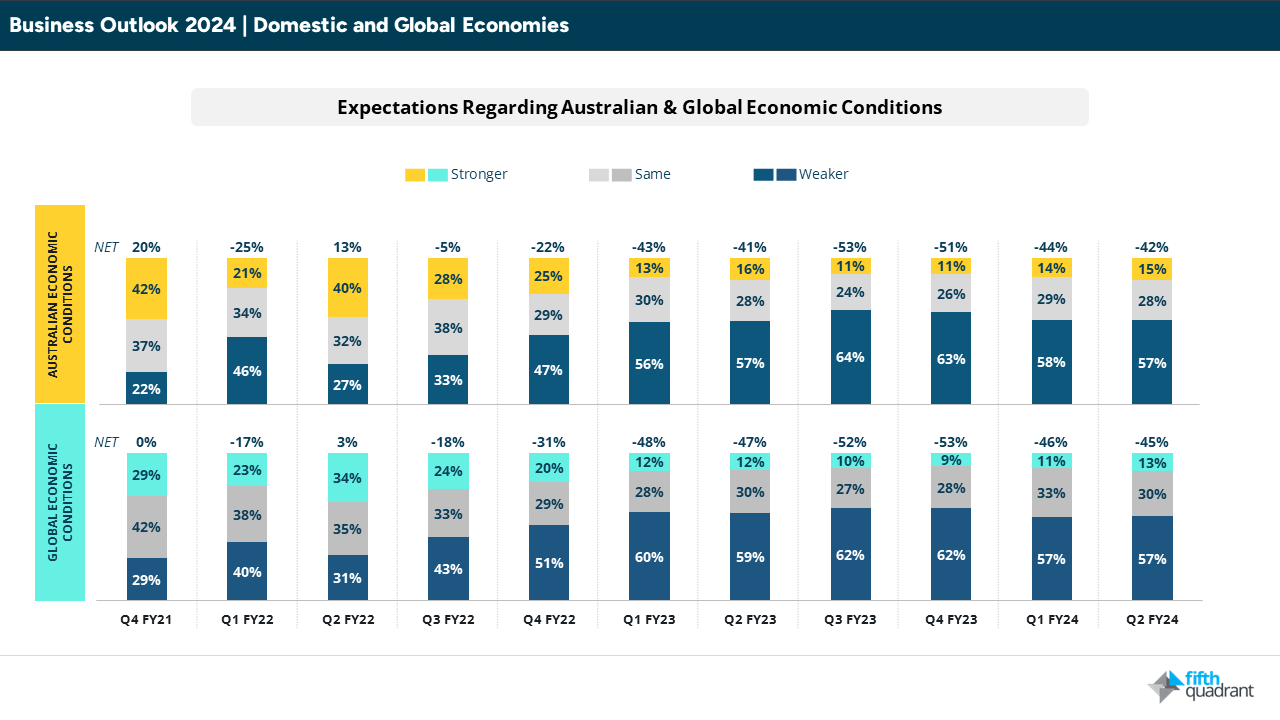

australian & global economic conditions

Positive sentiment towards domestic and international economic conditions spiked in Q4 FY21 and Q2 FY22. The strong optimism that characterised these post-lockdown quarters has gradually declined from early 2022. The RBA expects inflation will decrease slightly faster than initially anticipated, driven by a larger-than-expected decline in goods price inflation and slightly softer domestic demand compared to previous forecasts. However, services inflation remains high, and thus sentiment towards domestic and international conditions remains modest entering 2024.

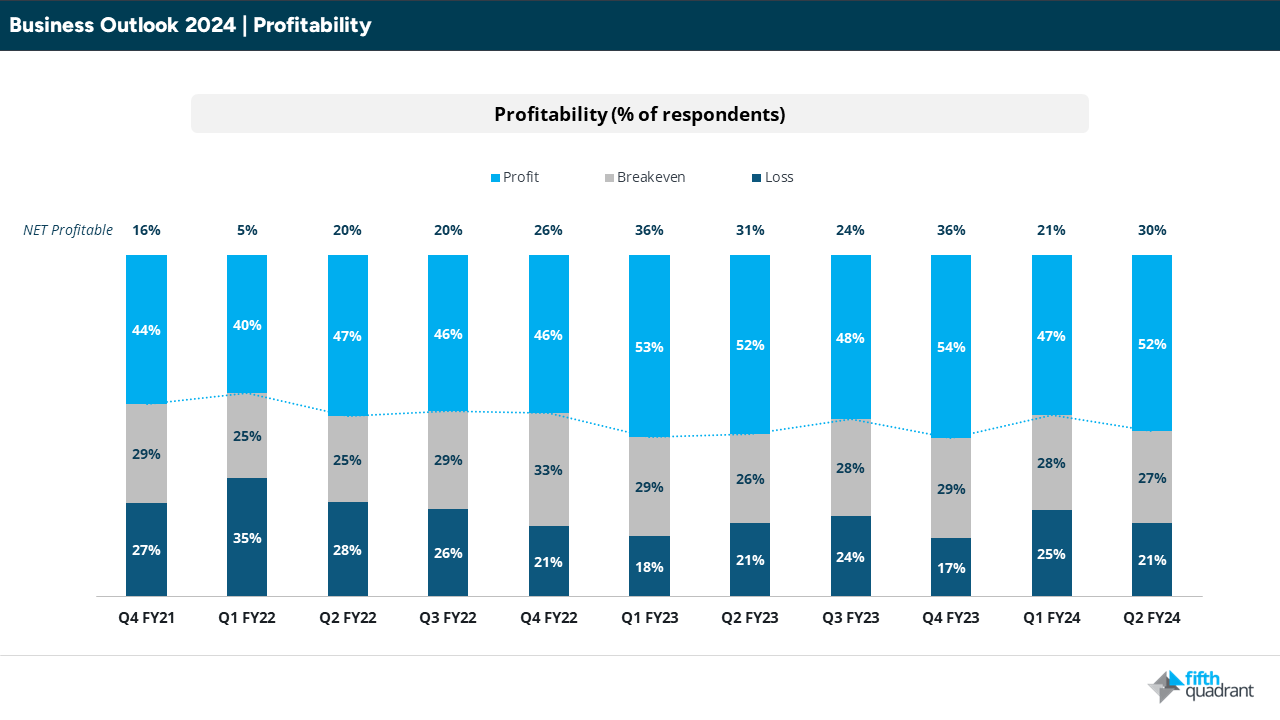

profitability

Despite ongoing inflationary pressures, profitability remains high at an aggregate level. Two-thirds (64%) were able to pass on higher input costs over the last 12 months, resulting in greater stability in the number reporting a profit. However, persistent challenges have resulted in one in four (23%) recording a loss in the first half of FY24.

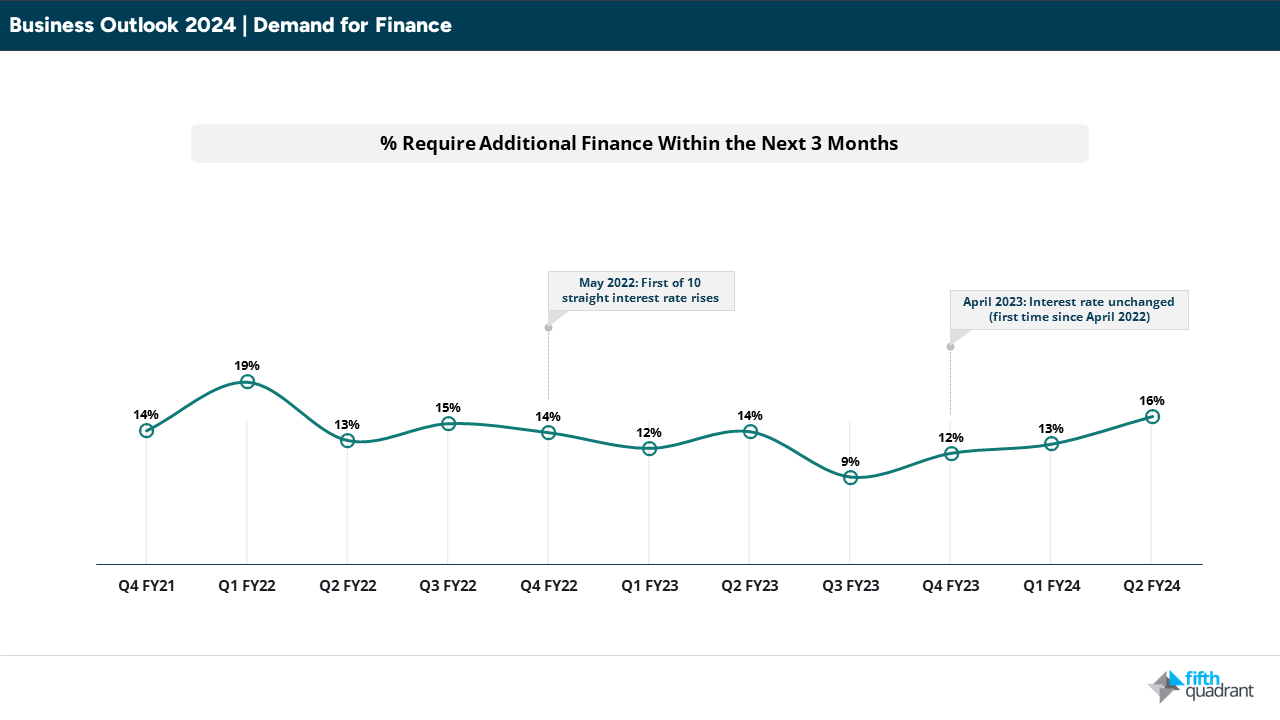

demand for finance

The demand for additional finance fell to 9% in Q3 FY23 following 10 straight RBA interest rate rises. The demand for additional finance has since returned to levels seen prior to these recent rate rises, with growth strategies on the agenda for 37% of SMEs in Q2 FY24.

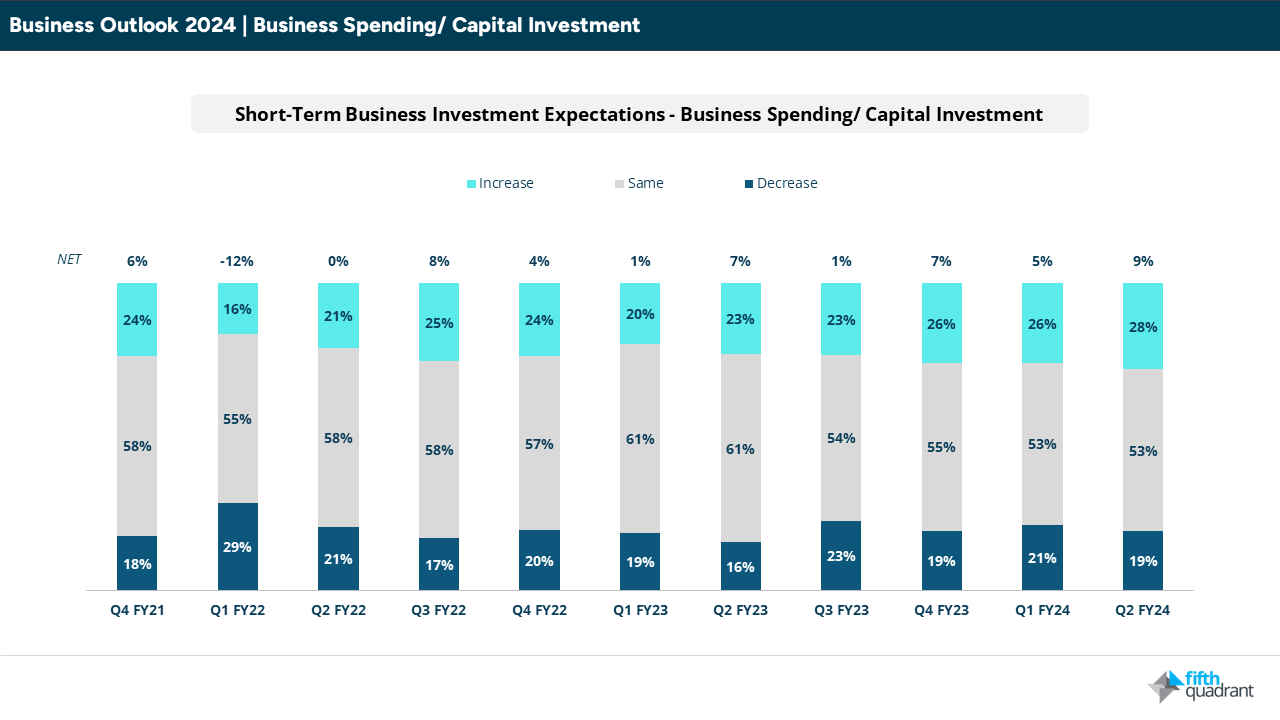

Short-Term Business Investment Expectations

Accordingly, capital investment intentions have steadily rebounded over the last 12 months, following a level of volatility between Q1 FY22 and Q1 FY23. This recent stability should continue into 2024, as many SMEs seek to tackle the challenging economic outlook and persistent cost pressures through the improved efficiency provided by technology and innovation.

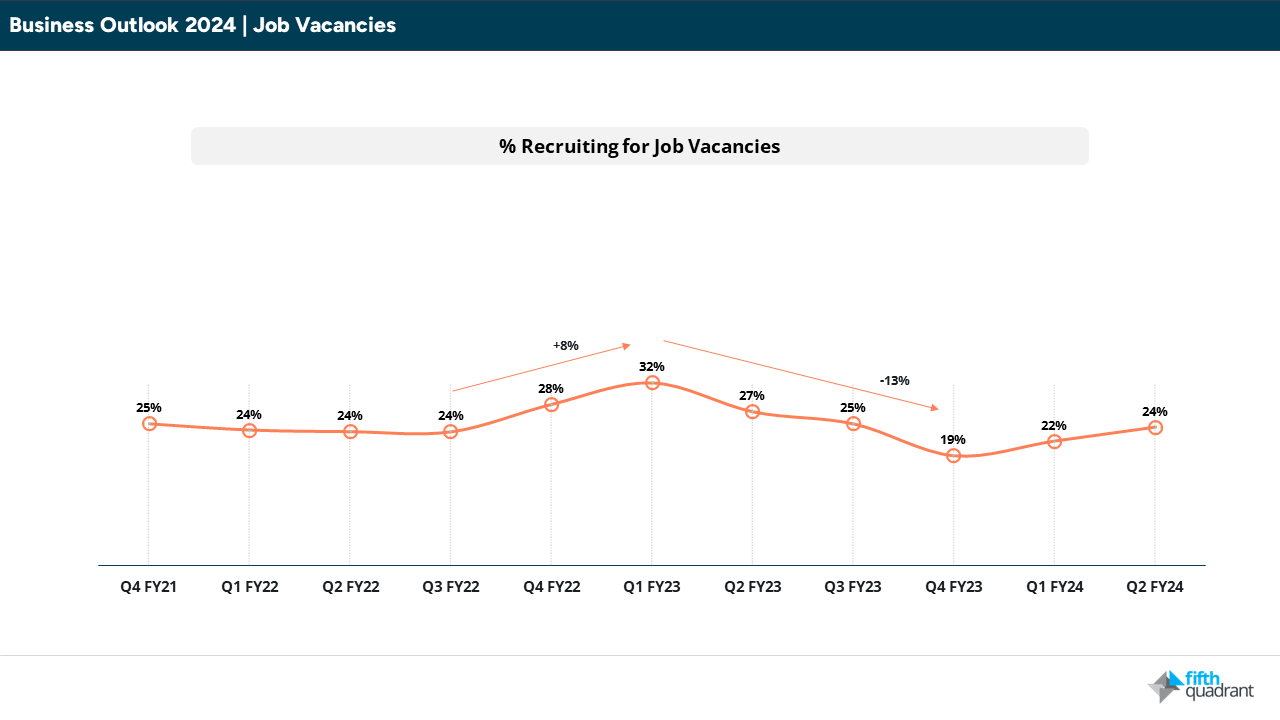

Job Vacancies

While 2022 was characterised by a tight labour market, conditions in 2023 were slightly softer. However, despite the economy slowing, many SMEs are still experiencing recruiting challenges. 87% report a level of difficulty in recruiting so far in FY24, with 57% attributing this difficulty to a lack of skilled/qualified candidates.

summary

SMEs are approaching 2024 with a sense of prudent optimism. While inflationary pressures continue to ease, Australian business conditions remain uncertain in a slowing, supply-constrained economy. Key challenges include persistent cost pressures, meeting demand amidst evolving customer behaviours, and the need for supply chain resilience. Encouragingly, profitability remains stable, with many able to recover higher input costs. Despite a slight softening in labour market conditions, recruiting challenges persist. Overall, SMEs enter 2024 focused on improving efficiency and innovation to navigate the challenging economic conditions ahead.

Updates to the SME Sentiment Tracker and other research are posted regularly here. For any questions or inquiries, feel free to contact us here.

Posted in TL, Consumer & Retail, Financial Services, QN, Social & Government