Author: James Organ | Posted On: 10 Jun 2025

Updates to this research are published monthly. View previous wave.

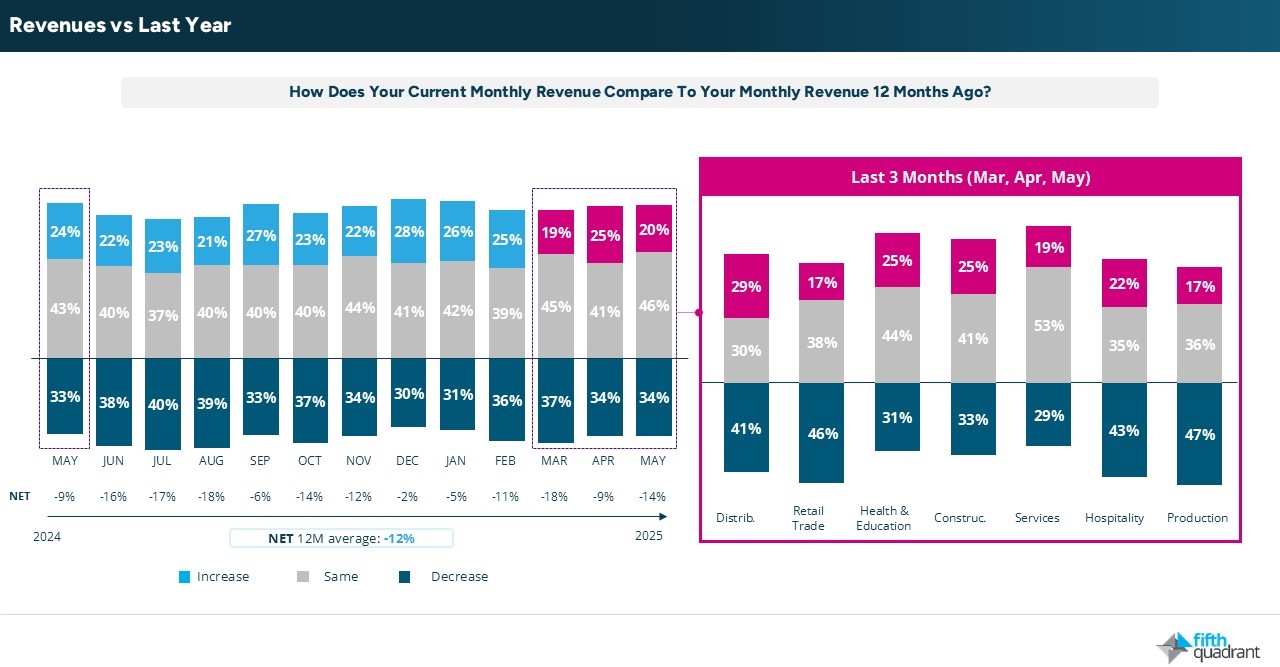

SME performance softened in May, with both revenue and profitability easing compared to April and the same period last year. Production and Retail sectors reported the weakest outcomes, reflecting the ongoing impact of cost-of-living pressures on consumer demand.

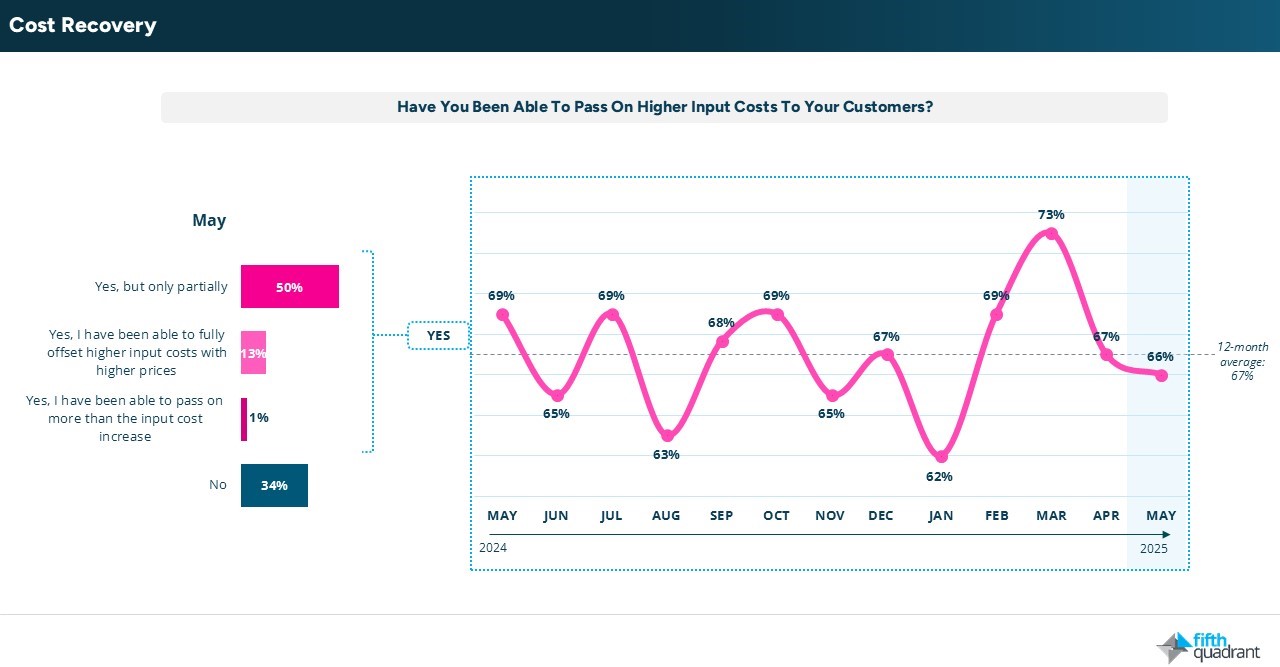

Those in NSW/ACT and VIC/TAS were more heavily affected, while WA continued to outperform. Profitability declined in line with revenue, and fewer businesses were able to pass on rising costs, suggesting stabilising inflation and increased price sensitivity among customers.

Business sentiment

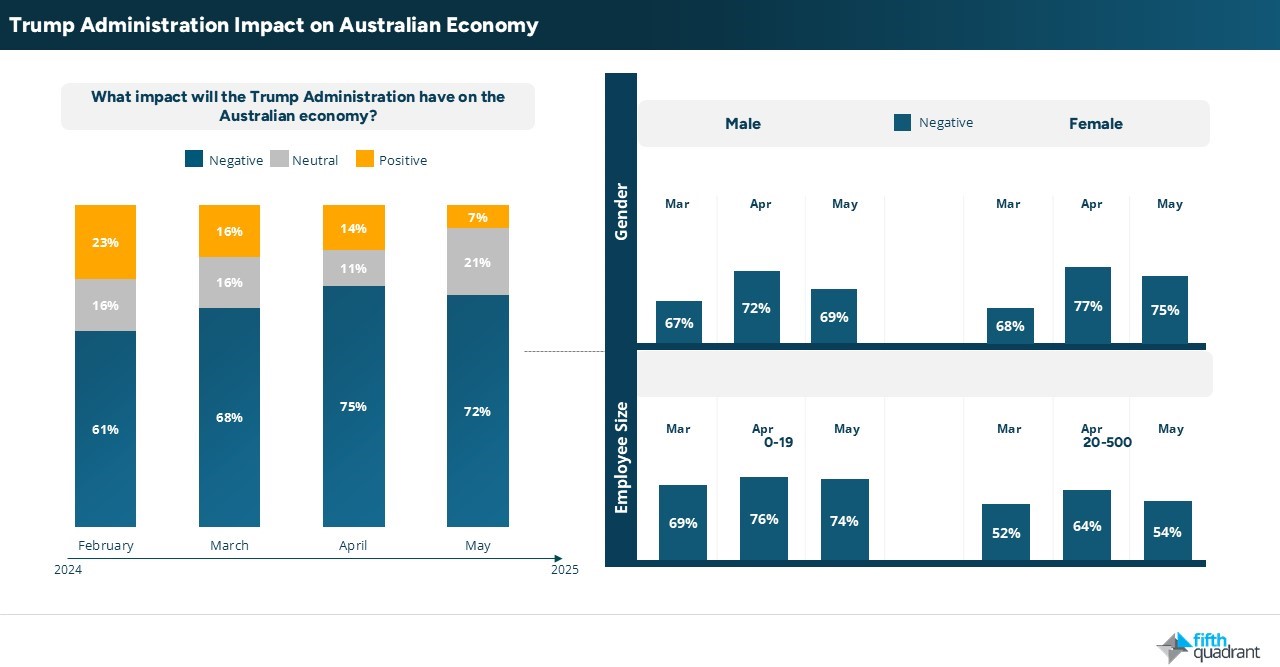

Sentiment remained cautious, with global economic confidence deeply negative and only a modest improvement in views of the Australian economy. While financial sentiment softened, short-term revenue expectations held firm, and business sentiment continued to outpace that of consumers. Support for the Trump administration’s impact on Australia’s economy continued to decline, with only 7% of SMEs viewing it positively, down from 23% in February.

Employment expectations

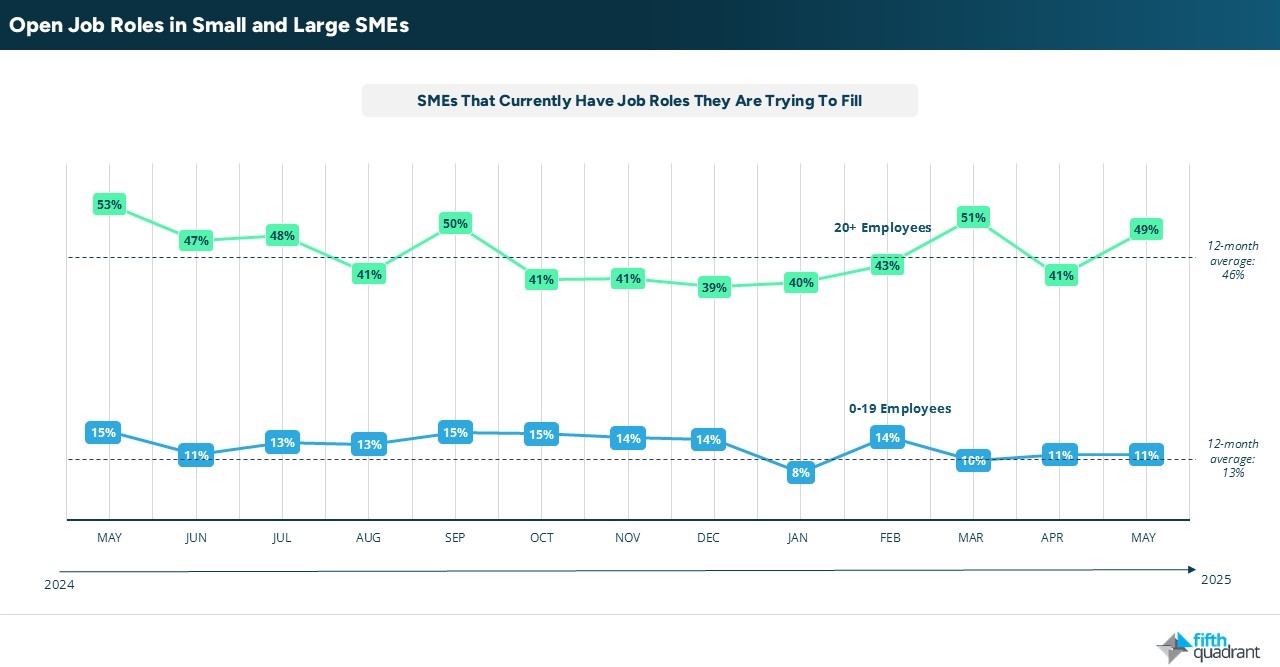

Employment expectations eased slightly in May, aligning with softer trends across other key performance indicators. Job vacancies remained steady but below the 12-month average, indicating low job growth and potentially low staff turnover. FY25 continues to reflect a broader downward trajectory in hiring demand, particularly among smaller SMEs. However, larger businesses reported more open roles, which may point to higher staff turnover driven by pressure on revenues and profit margins.

Investment and finance

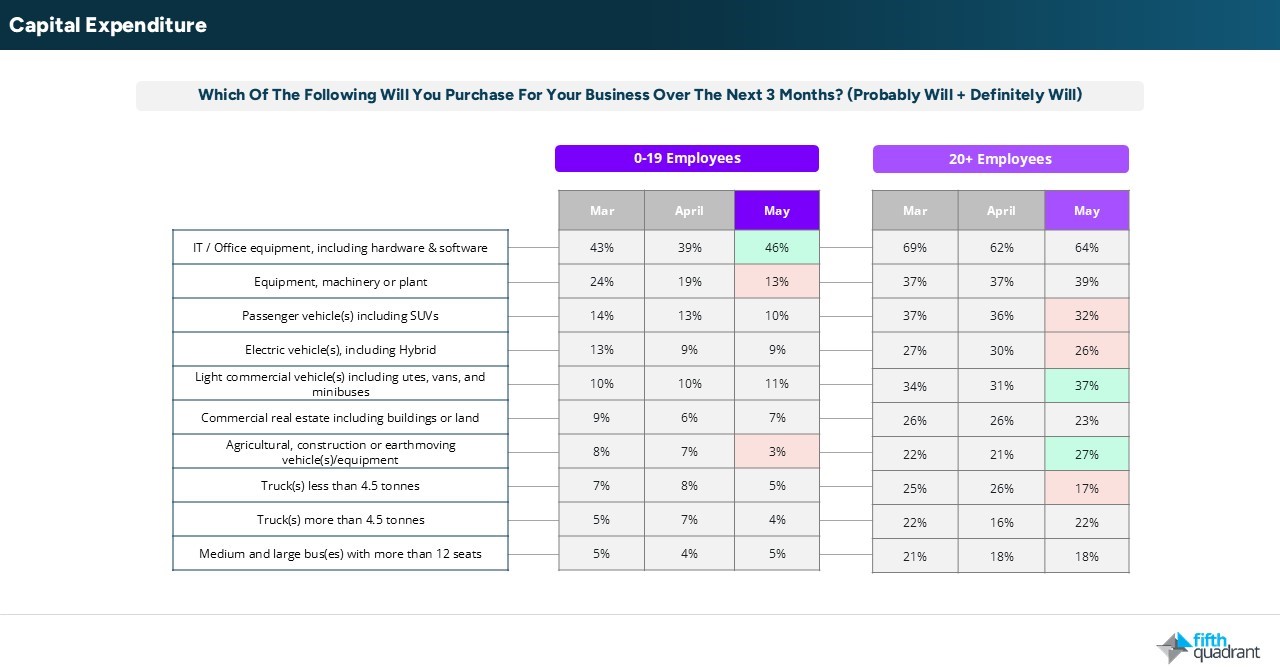

Investment and finance indicators also showed subdued activity. The usual end-of-financial-year increase in capital expenditure has so far failed to materialise, with marketing taking priority as businesses focused on short-term revenue. Smaller SMEs showed stronger interest in IT investment, while intentions to invest in equipment, machinery, and plant declined.

In May, SME demand for additional finance declined, with weakening interest across the Construction, Hospitality, and Services sectors. The proportion of SMEs with debt rose from 62% in February to 67% in May, while loan stress also increased, with 11% of businesses, particularly in the Retail, Health, and Education sectors, concerned about meeting repayments in the next six months.

Conclusion

SMEs faced a challenging May, with softer revenues, easing profitability, and cautious sentiment reflecting ongoing economic uncertainty. Despite increasing financial pressures and increasing loan stress, most SMEs appear to be in a holding pattern, focused on short-term stability while awaiting clearer economic signals both locally and globally.

Please click the link below to access the full report including subgroup analysis by industry sector, size of business and state. Fifth Quadrant and Ovation Research publish monthly updates of this SME market research here. For any questions or inquiries, feel free to contact us here.

SMEs remain resilient

Posted in Uncategorized, B2B, Consumer & Retail, Financial Services