Author: James Organ | Posted On: 07 Dec 2023

Updates to this research are published monthly. View previous wave.

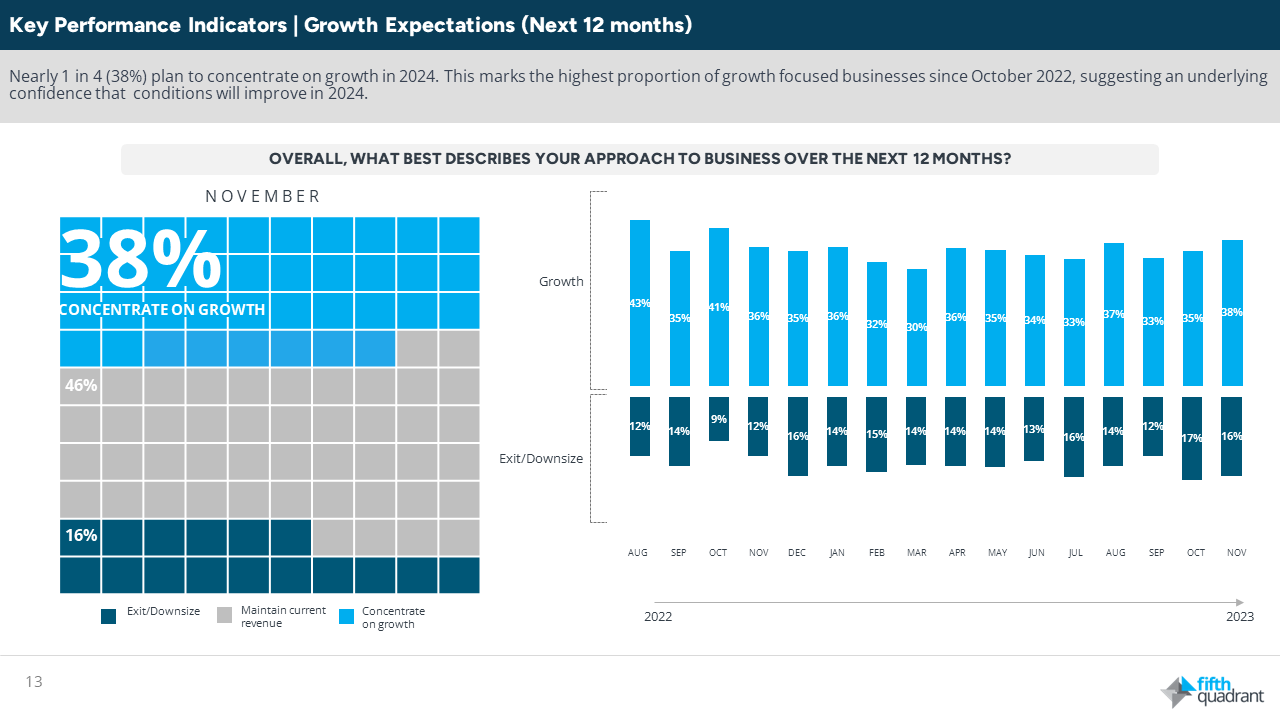

The latest wave of the Fifth Quadrant SME Sentiment Tracker indicates that in the face of escalating business challenges, a significant number of small and medium-sized enterprises (SMEs) are shifting their focus towards growth. A record 38% of SMEs have plans to prioritise growth in the coming 12 months, the highest percentage observed this year.

table 1: sme growth expectations

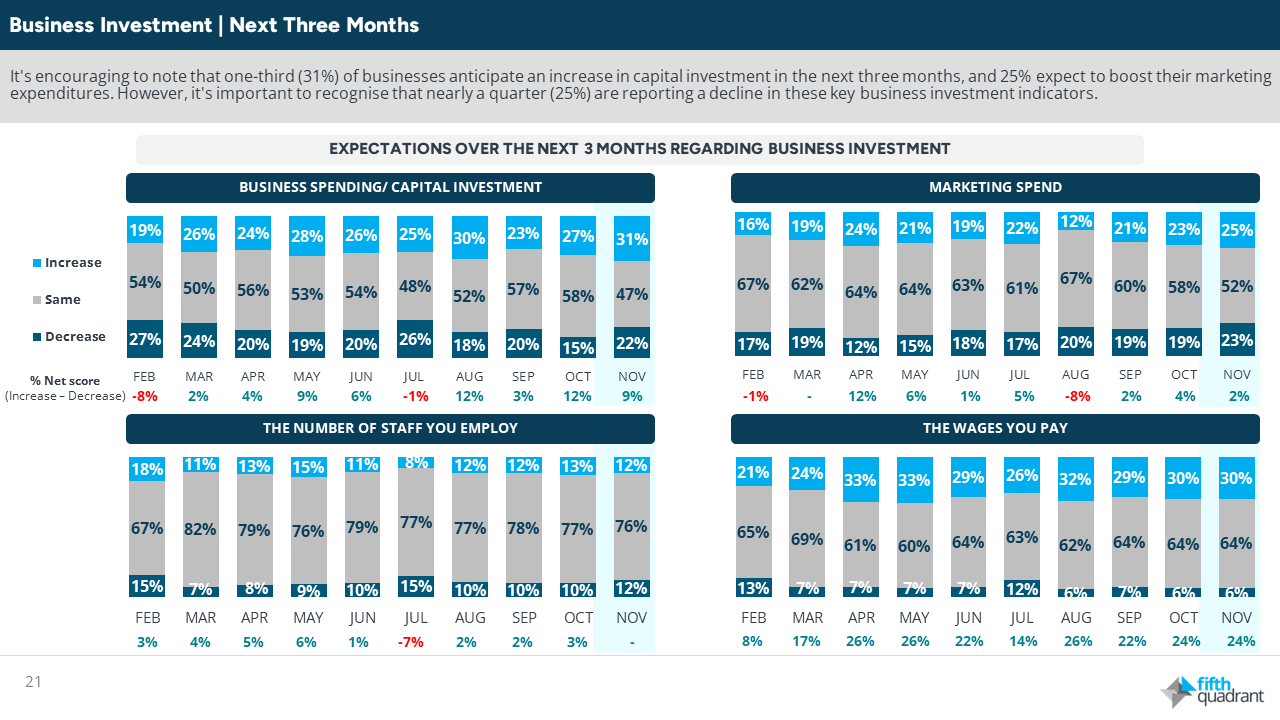

Concurrently, the proportion of SMEs anticipating a rise in capital expenditure has also reached a peak, with one-third (31%) expecting to increase their investments, marking a notable high point in investment intentions.

Table 2: next three months

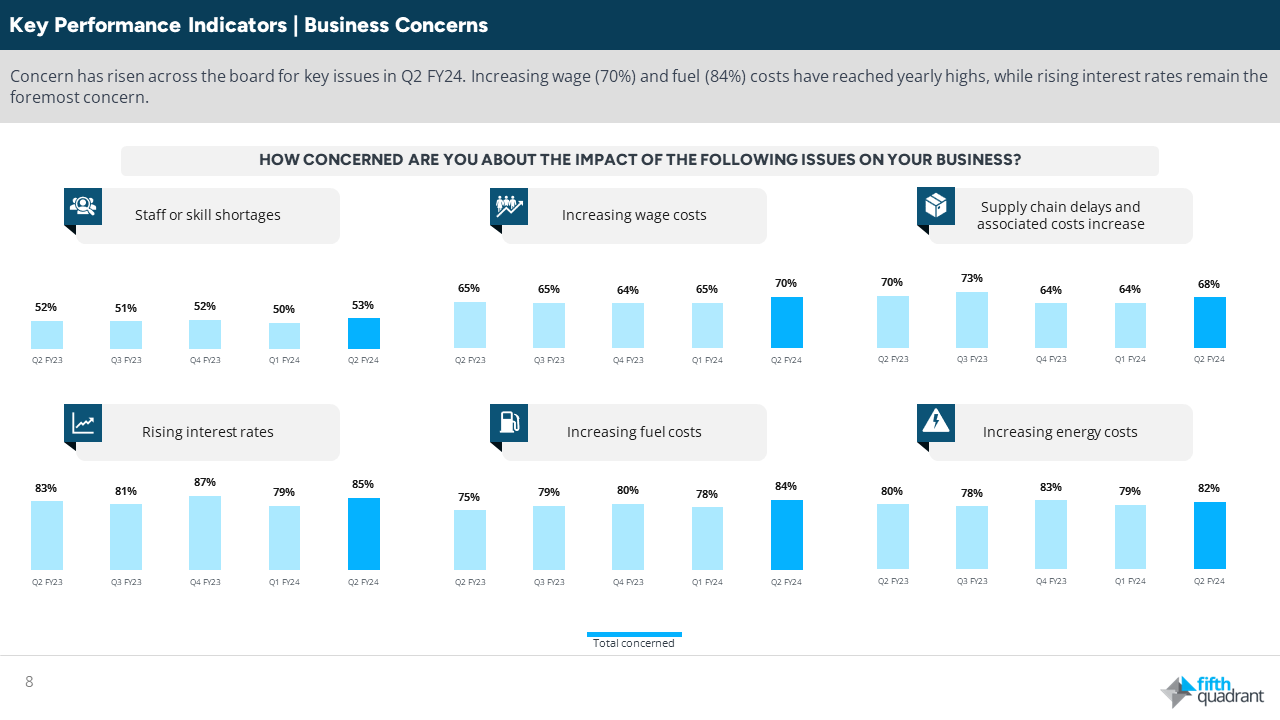

This increased appetite for growth comes amidst the ongoing concerns regarding wage (70%), fuel (84%) and energy (82%) costs, as well as the possibility of future interest rate rises (85%).

Table 3: sme business concerns

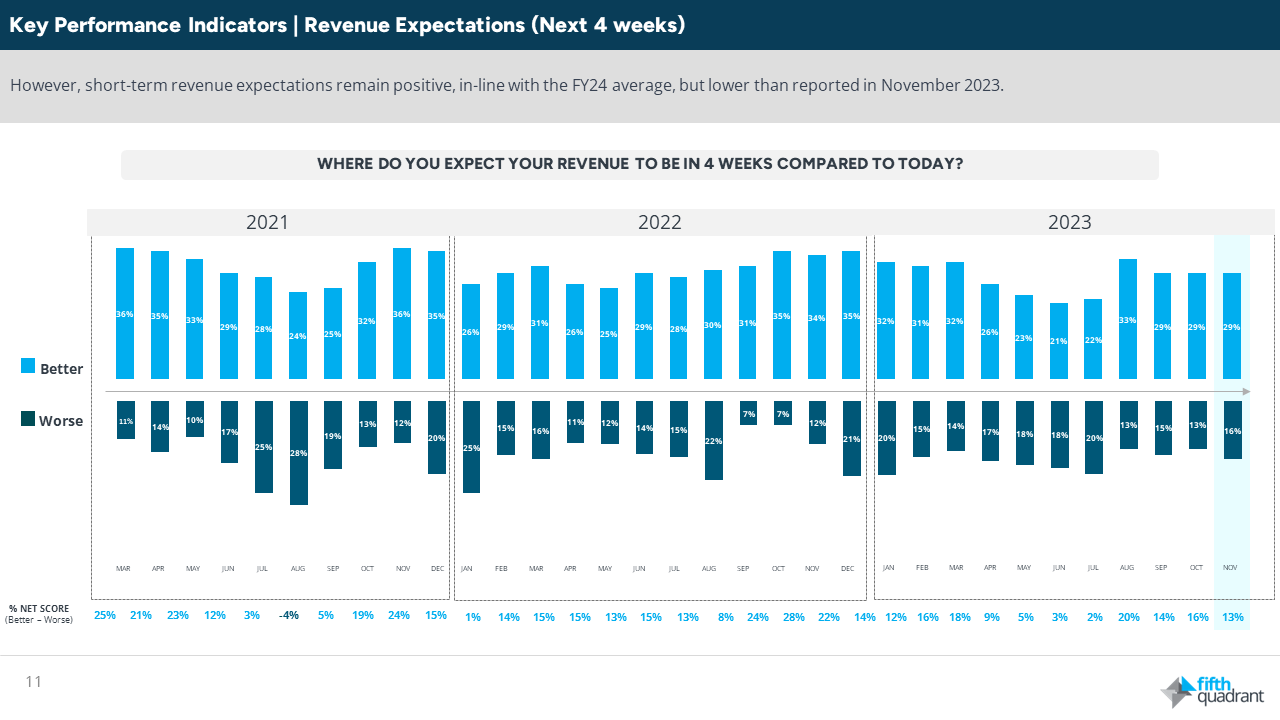

Even with escalating worries about rising costs and a cautious stance regarding both global and local economic conditions, short-term revenue forecasts among businesses have remained consistent. For the third month in a row, 29% of businesses anticipate a revenue increase in the upcoming four weeks.

Table 4: sme revenue expectations

This stability in revenue expectations is likely influenced by heightened marketing efforts, particularly in preparation for the Christmas season, as evidenced by 25% of businesses increasing their marketing investments during this period.

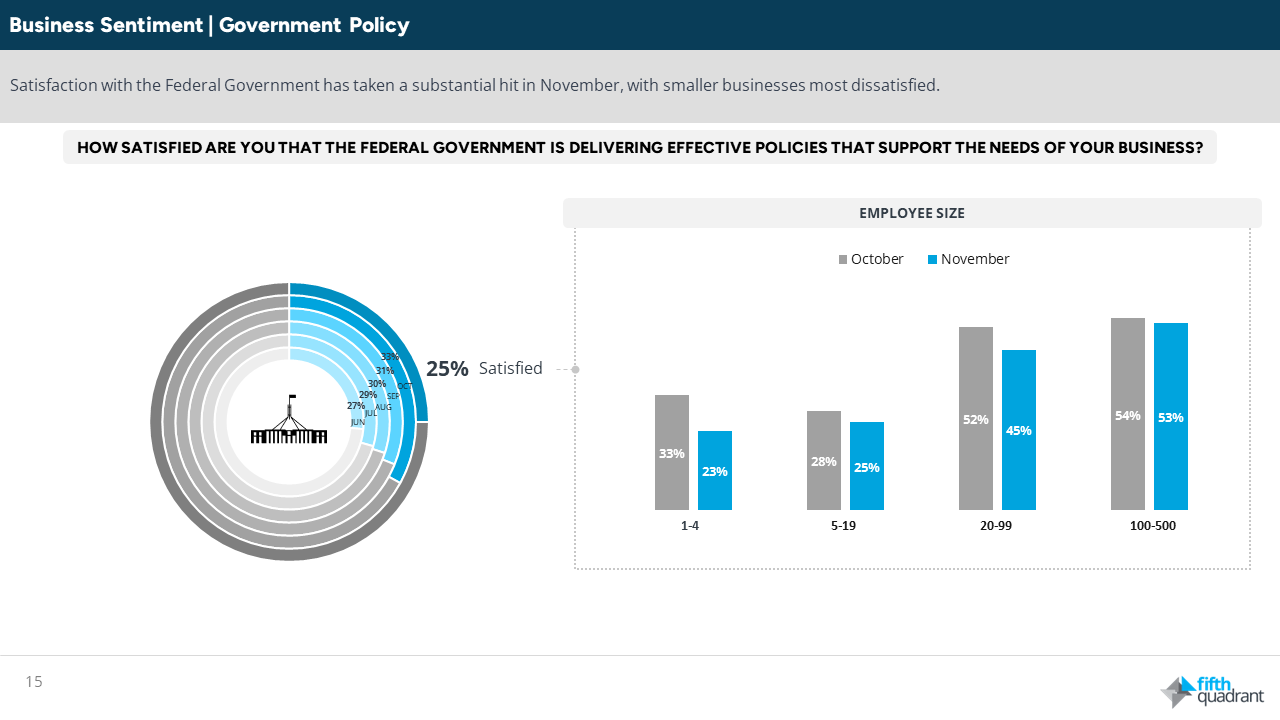

Satisfaction with the federal Labor government has seen a notable decline, dropping from 33% in October to 25% in November. This significant decrease in approval is likely a reaction to the latest interest rate hike and ongoing increases in operating costs.

Table 5: government policy

In summary, higher growth intentions and steady short-term revenue expectations provide cause for positivity heading into the Christmas period. While the potential for further rate rises in 2024, coupled with higher input costs, are causing much anxiety for SMEs, recession readiness and the ability to pass on higher input costs remain steady. Thus, many SMEs will enter the Christmas period optimistic, and hopeful of easing inflationary and cost pressures in the new year.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research.

Posted in Financial Services, B2B, QN, TL