Author: James Organ | Posted On: 08 May 2024

Updates to this research are published monthly. View previous wave

The latest findings from the Fifth Quadrant SME Sentiment Tracker reveal a slight weakening in year-on-year revenue, with 34% of SMEs reporting a decline compared to 29% in February. Despite this decline, 59% of SMEs reported a profit which is notably higher than reported last month, but in line with the data reported in April 2023. This stronger profitability data has been achieved by 74% of SMEs successfully passing on higher input costs to customers in April.

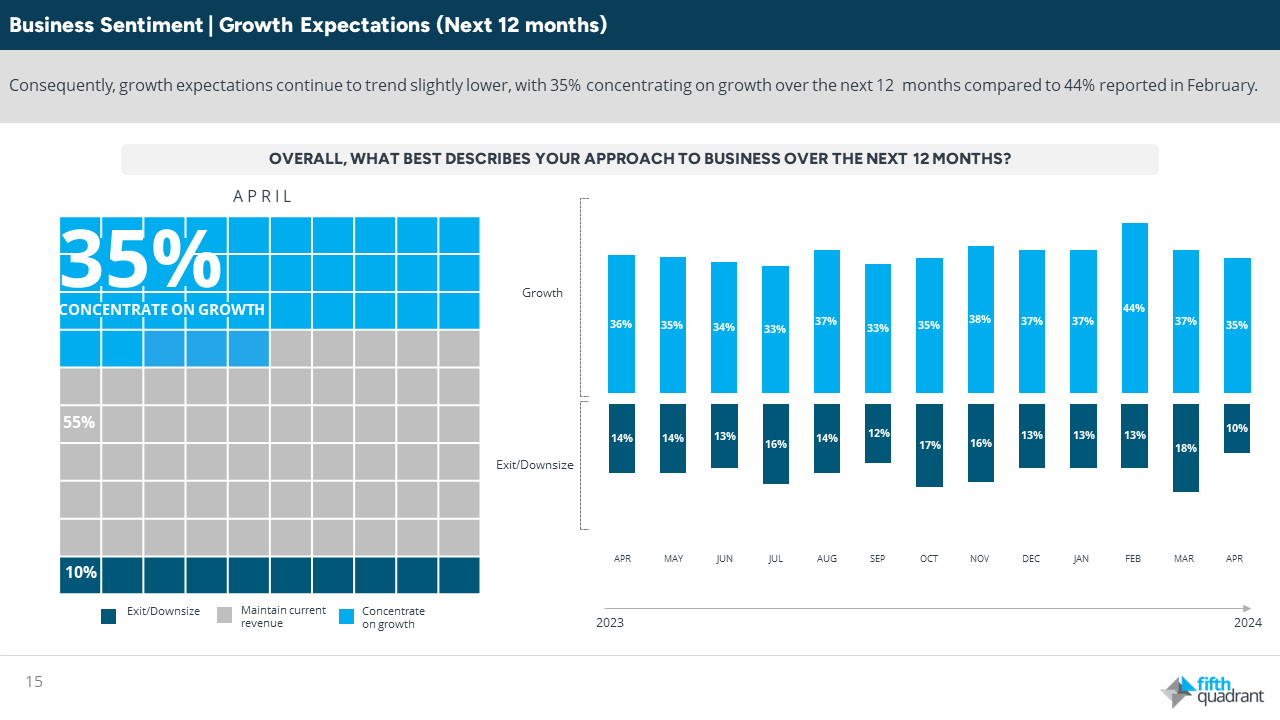

growth expectations

After a strong start to 2024, expectations concerning economic conditions, both domestically and internationally, are continuing to weaken, with persistent inflationary pressures delaying any immediate relief in interest rates. Consequently, growth expectations continue to trend slightly lower, with 35% concentrating on growth over the next 12 months compared to 44% reported in February.

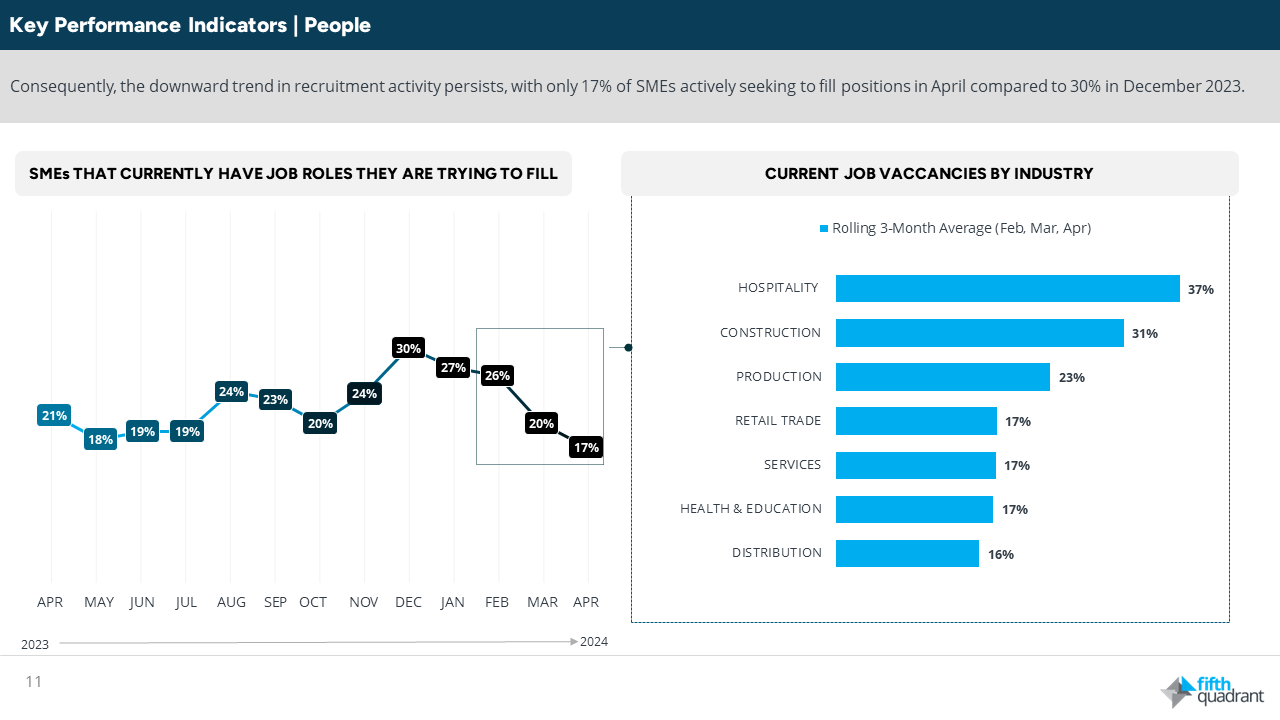

people

Expectations regarding employee growth are also diminishing, with only 10% anticipating an increase in staff over the next three months. Consequently, the downward trend in recruitment activity persists, with only 17% of SMEs actively seeking to fill positions in April compared to 30% in December 2023.

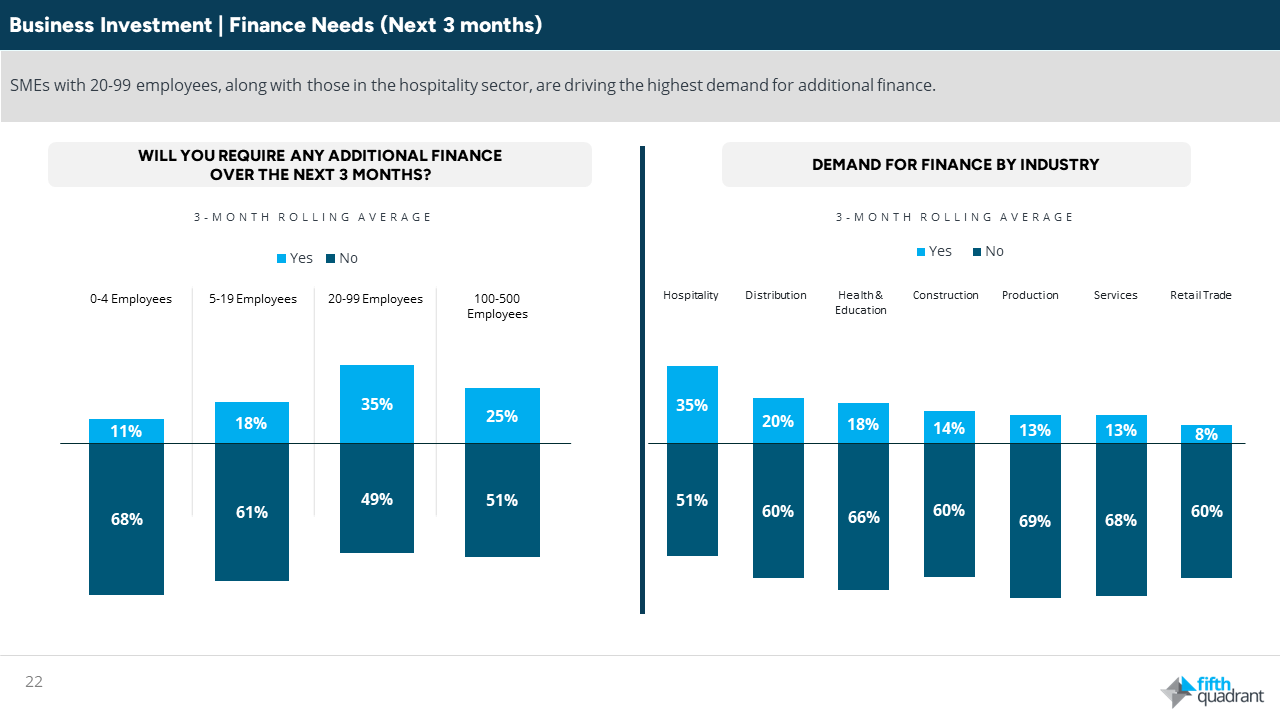

financial needs

With mounting concerns about interest rates, expectations regarding capital investment and marketing spend have once again retreated slightly. However, as we near the end of the financial year, purchasing intentions for passenger, light and heavy vehicles remain buoyant and therefore demand for additional finance has rebounded, with 18% of SMEs requiring additional funds over the next 3 months. SMEs with 20-99 employees are driving the highest demand for additional finance.

The SME Sentiment Tracker is conducted by leading business market research firm Fifth Quadrant in partnership with Ovation and tracks business sentiment across more than 400 small and medium enterprises each month.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research here. For any questions or inquiries, feel free to contact us here.

Posted in TL, Consumer & Retail, Financial Services, QN, Social & Government