Author: Ben Selwyn | Posted On: 15 Jan 2026

According to the November 2025 Fifth Quadrant Consumer Tracker, 46% of drivers under 30 have fitted performance modifications to their vehicles. Brake upgrades, suspension or lift kits, and engine work. This surge in upgrades is reshaping the Australian aftermarket, with under-30s modifying at double the national average (23%) and six times more than drivers over 55 (8%).

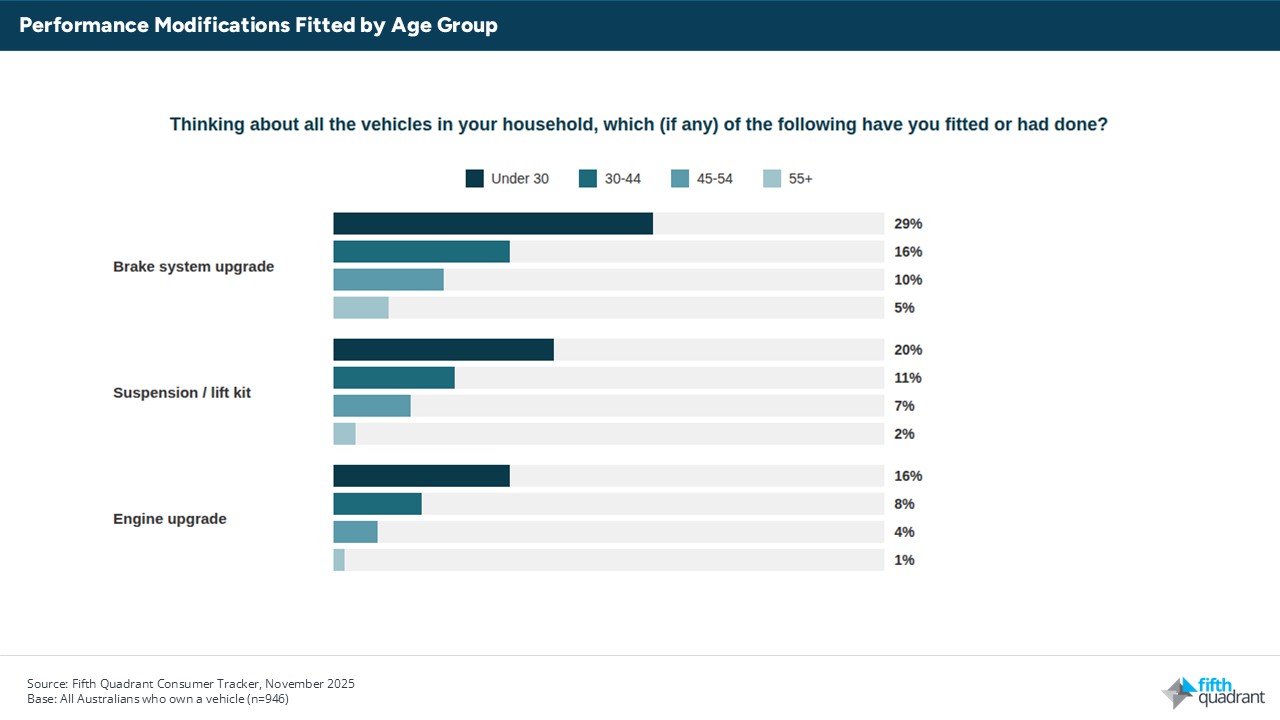

The pattern is consistent across performance categories. Almost three in ten under-30s (29%) have fitted brake system upgrades, compared to 5% of drivers aged 55 and over. One in five (20%) have fitted suspension upgrades or lift kits, versus 2% of the older cohort, while 16% have upgraded their engine (turbochargers, ECU tunes, performance intakes) compared to just 1% of over-55s.

The aftermarket industry holds two assumptions about these young drivers. First, that they modify vehicles for aesthetics: lowered stance, window tint, sound systems. Second, that when they do upgrade, it’s because they’re driving older cars that need the work.

Our automotive market research challenges both assumptions.

It’s not about driving older cars

The obvious argument is that young drivers modify more because they’re driving older, cheaper vehicles that need the work.

The data doesn’t support this.

Under-30s drive vehicles with a mean age of 9.4 years, while drivers over 30 average 8.7 years. The difference is small, and certainly not enough to double modification rates.

More telling is what happens when we control for vehicle age. Among drivers with newer cars (0-5 years old), 41% of under-30s have performance mods fitted, compared to 20% of those aged 45-54 and 8% of those 55+. The pattern holds across every vehicle age bracket: a 25-year-old driving a two-year-old Mazda is around three times more likely to have fitted performance modifications than a 45-year-old driving the same vehicle.

The gap actually widens for older vehicles. Among those driving cars 11 years or older, 50% of under-30s have modified versus 7% of over-55s. This points to deliberate choices rather than economic necessity.

Safety, not stance

If it’s not about driving old cars, perhaps it’s about aesthetics? The “stance culture” narrative suggests young drivers modify for social media: slammed suspension, aggressive wheel fitment, visual presence. But again, the data tells a different story.

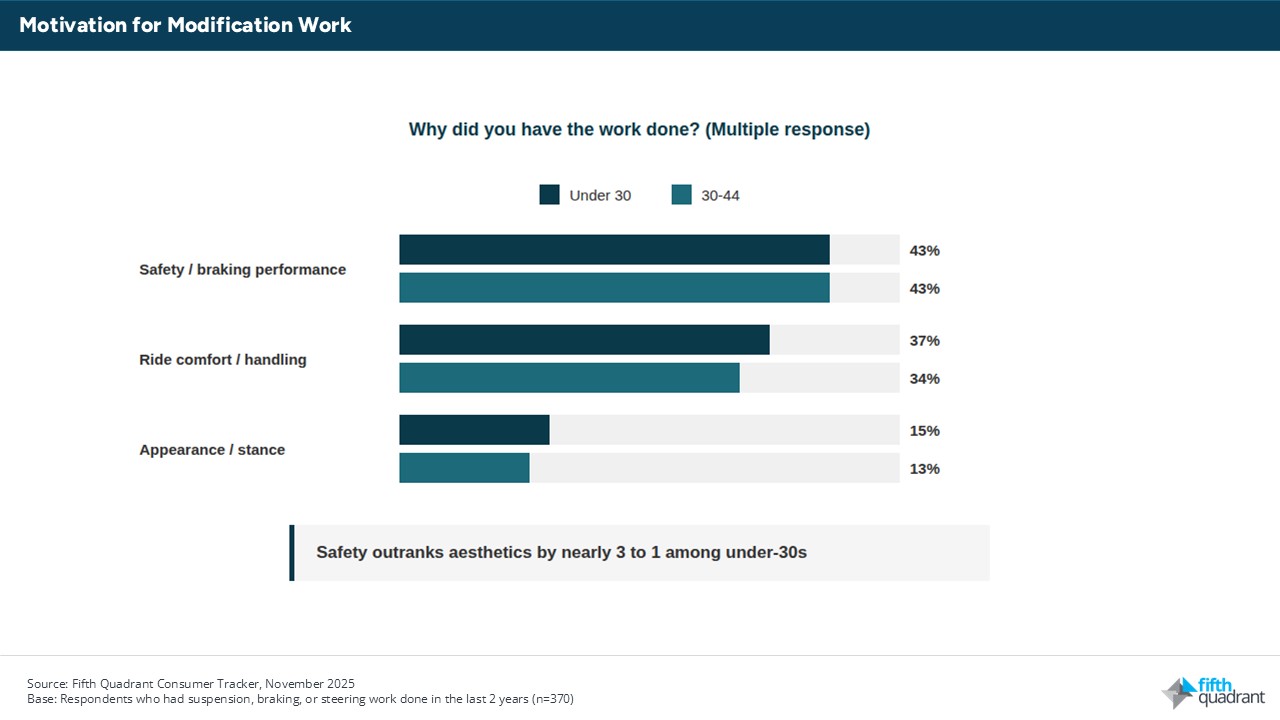

Among under-30s who have had modification work done, 43% cite safety and braking performance as a motivation, with ride comfort and handling following at 37%. Appearance and stance sits at just 15%, meaning safety outranks aesthetics by around three to one.

This holds when compared to older drivers too. Among the 30-44 cohort, 43% cite safety and 13% cite appearance. Young drivers aren’t more focused on looks; if anything, they’re slightly less so. The picture that emerges here is one of functional motivation. Under-30s are fitting upgraded brakes because they want better stopping power, and suspension upgrades because they want better handling.

What this means for the Australian aftermarket

The industry has long treated vehicle modification as a lifestyle niche: a segment of enthusiasts chasing horsepower and visual impact. The marketing often follows suit, with performance imagery, motorsport associations, and aggressive aesthetics.

The under-30 data suggests a different positioning opportunity. For this generation, modification appears to be standard ownership behaviour rather than enthusiast territory. Nearly half have fitted performance upgrades, their motivation is safety and handling, and they’re modifying new cars, not just old ones.

This raises questions about how performance upgrades are positioned. If safety is the primary driver for this segment, why does the visual language remain grounded in horsepower claims, racing heritage, and aggressive styling?

At Fifth Quadrant, our automotive market research identifies exactly these positioning gaps, and the behavioural insights needed to close them.

Want more of this content? Sign up for our newsletter here to ensure you stay up to date with our monthly updates or click here to view our automotive reports.

Also remember that our b2b and consumer tracking research runs monthly. Click here if you have questions you’d like to ask.

Posted in Uncategorized, Auto & Mobility, B2B, QN