Author: Amelia McVeigh | Posted On: 18 Jun 2025

Online shopping is the norm for Australians, but as digital spending grows, so too does the threat of ecommerce payment fraud, online scams, and broader cybercrime. According to PayPal’s eCommerce Index 2025, most Australians (91%) have experienced some level of fraud, and despite growing vigilance, 3 million Australians aged 15+ fell victim to fraud in FY24.

Cybercrime is undermining confidence in the digital economy meaning serious implications for both consumers and businesses. This raises critical questions: how are Australians responding to this growing threat? And what are businesses doing to keep customers secure and loyal?

The financial fallout is hitting hard

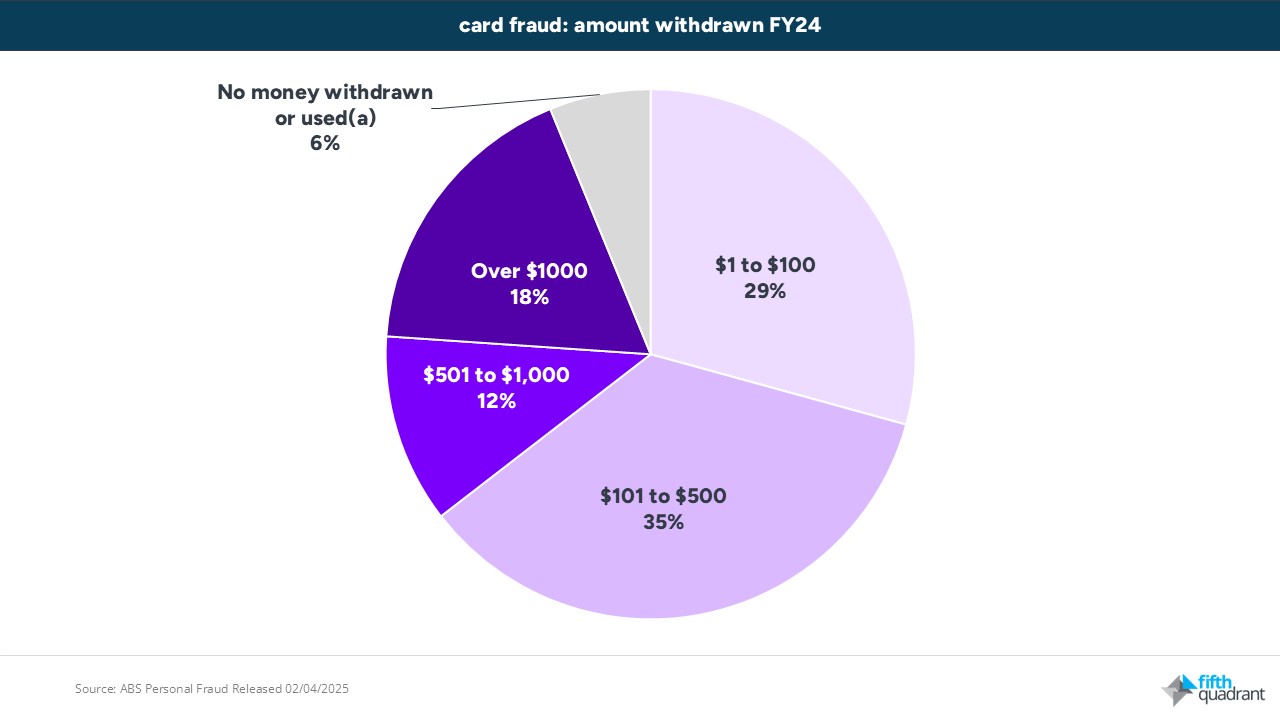

The financial toll on consumers is staggering. In FY24, the ABS tells us cybercriminals stole $2.1 billion through card fraud. While the median loss was $250, nearly one in five lost more than $1,000.

The good news? Three in four victims (75%) received some form of reimbursement, with card issuers absorbing much of the liability and shouldering the burden of maintaining customer trust. The bad news? Even after reimbursements, Australians were still out of pocket by $477 million.

Australians are more worried and expect businesses to step up

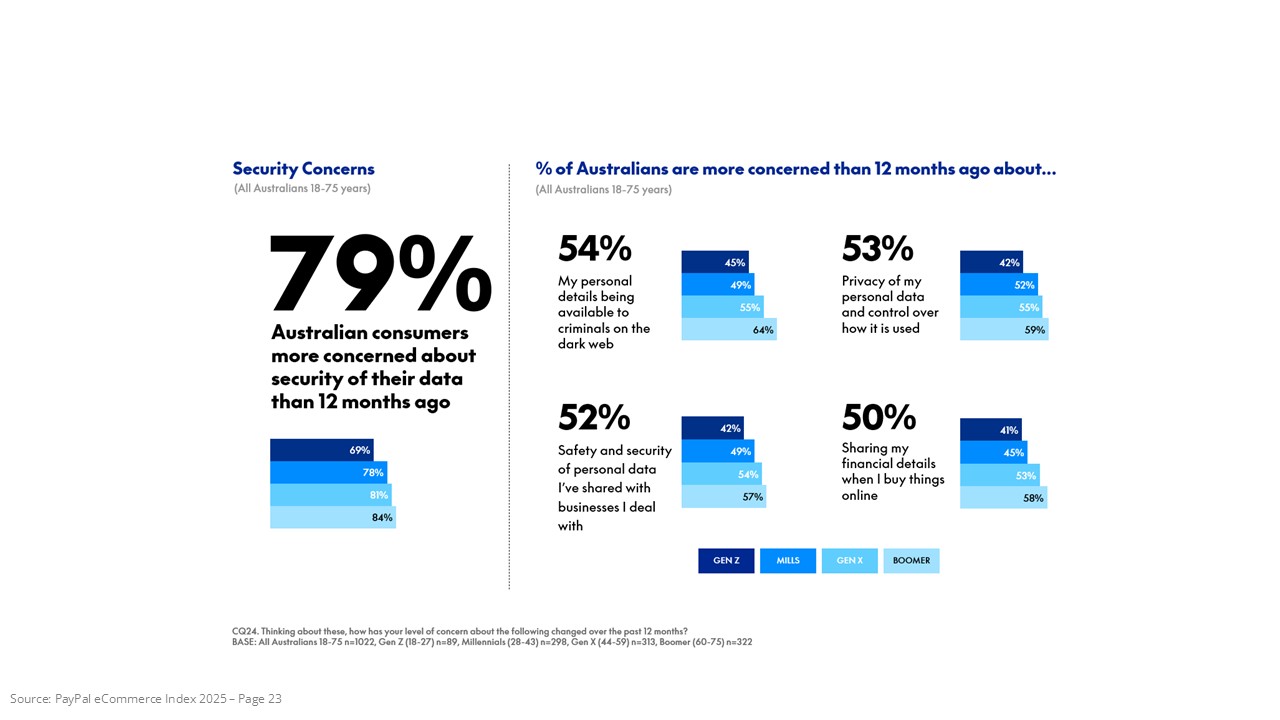

Given this trend, it’s no surprise that Australians are becoming increasingly concerned about digital security. Eight in ten (79%) are more worried about the safety of their personal data than they were a year ago (PayPal eCommerce Index). They’re worried about businesses vulnerability to breaches, where their data might end up, and how it could then be used. And this fear is reshaping how freely they share personal information online.

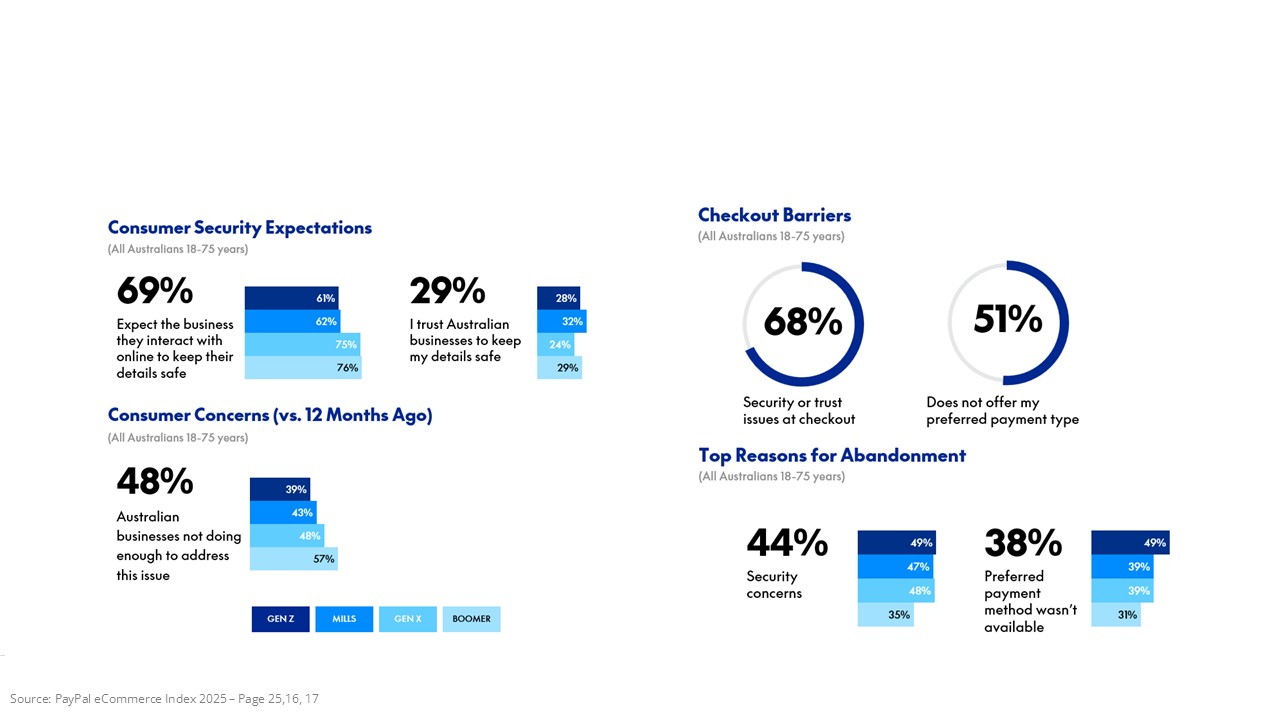

Many people are also taking action into their own hands, more closely scrutinising emails and messages, enabling two-factor authentication, and regularly updating passwords. They see these actions as important to their security as despite most consumers (69%) believing the businesses they deal with have a responsibility of to keep them safe online, just 29% feel confident that they are doing enough.

This disconnect has real commercial implications, with almost seven in ten (68%) Australians less likely to complete a purchase if they have security concerns at checkout, while more than two in five (44%) will abandon a transaction altogether.

Businesses are worried too, but taking steps to stay ahead

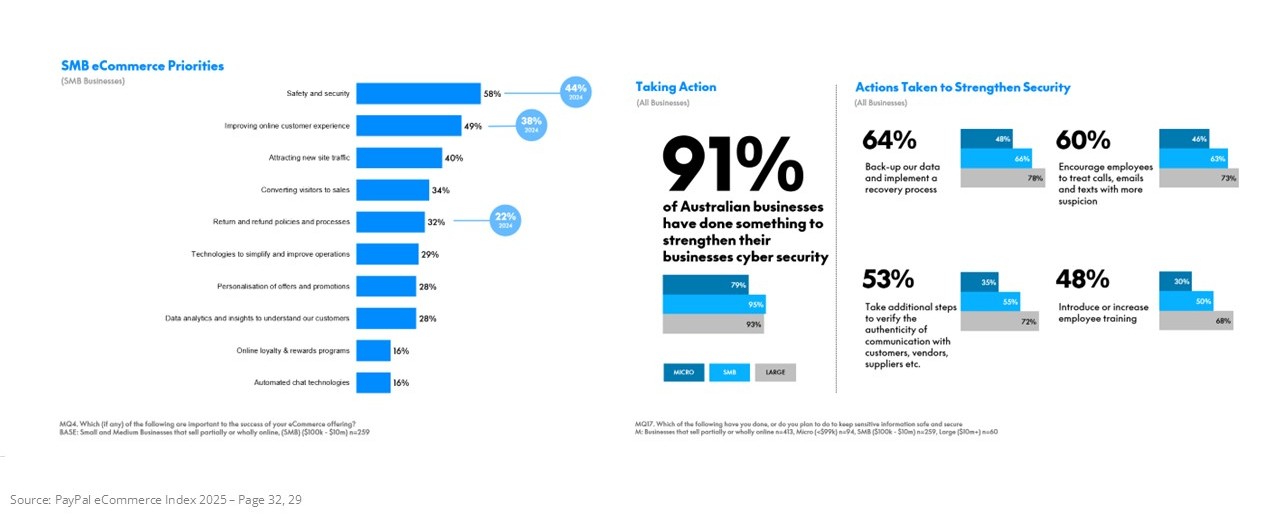

This is not to suggest that businesses are standing still. In fact, security & safety is the top eCommerce priority for small and medium businesses. Almost all of them (91%) are actively investing in measures to strengthen their cyber security, from backing up data, additional authenticity steps and training staff. They are aware that fraud tactics are constantly evolving and express a level of concern over the complexity and cost of staying ahead of cyber criminals.

Adding to this challenge is the fact that they can’t just focus on delivering a safe online environment, but must also preserve a seamless shopping experience to ensure that customers don’t get put off by overly onerous or time-consuming security checks.

What comes next

Cybercrime is a significant, ongoing issue. And the businesses that treat it that way will be best positioned to lead in a digital-first economy. Australians are demanding more transparency, more protection, and more reassurance at every stage of the purchase journey. Simply offering convenience is no longer enough.

For businesses, that means putting security at the heart of the customer experience. Those who invest in trusted payment options, visible protections, and clear communication will be the ones who earn confidence and build a strong and loyal customer base.

Cybercrime is a significant, ongoing issue. And the businesses that treat it that way will be best positioned to lead in a digital-first economy. Australians are demanding more transparency, more protection, and more reassurance at every stage of the purchase journey. Simply offering convenience is no longer enough.

For businesses, that means putting security at the heart of the customer experience. Those who invest in trusted payment options, visible protections, and clear communication will be the ones who earn confidence and build a strong and loyal customer base.

Need insights to help navigate consumer expectations in a digital-first economy? Keep up to date with Fifth Quadrant’s Though Leadership research here. For any questions or inquiries, feel free to contact us here.

Posted in Consumer & Retail, Financial Services, Technology & Telco, TL, Uncategorized