Author: James Organ | Posted On: 11 Jul 2023

Updates to this research are published monthly. View previous wave.

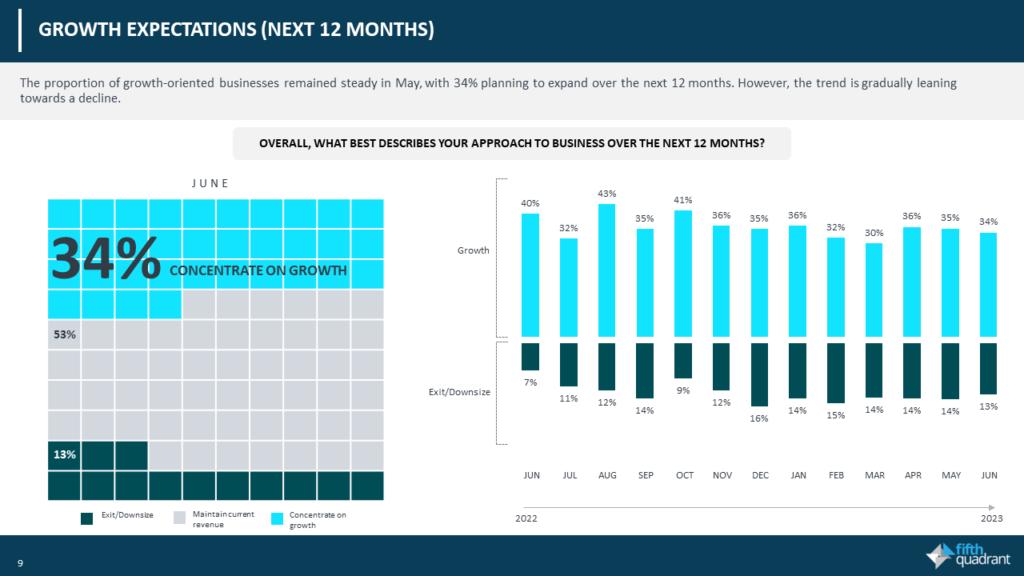

The latest wave of the SME Sentiment Tracker shows both positive and negative indicators in June. Notably, 37% of SME decision-makers reported a good performance in the 2023 financial year, compared to only 17% indicating it was a poor year. Additionally, 34% of SMEs are planning expansion in the next 12 months.

Table 1: growth expectations

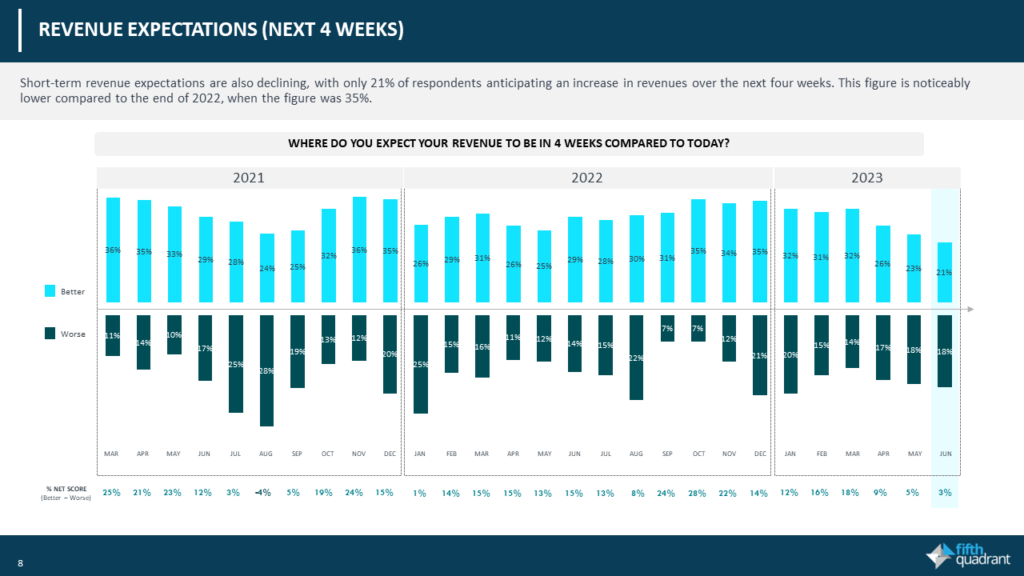

However, there are major concerns as year on year revenues continue to track down with 34% reporting less revenue than 12 months ago. Profitability has dropped to 46% in June from 59% in April. Furthermore, only 21% anticipate revenue growth over the next four weeks, a significant decline from 32% in March.

Table 2: revenue expectations

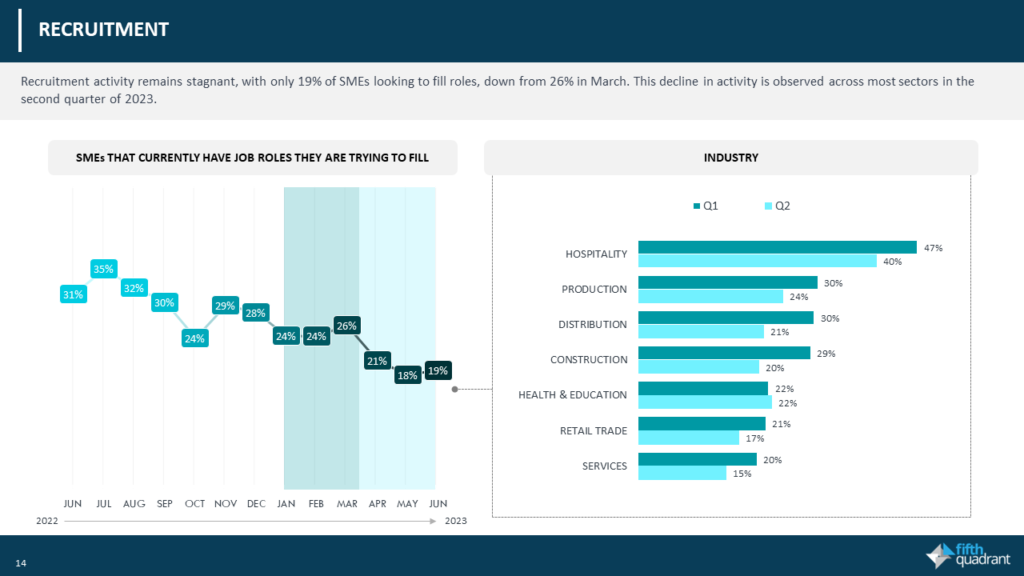

Additionally, 87% of SMEs are concerned about rising interest rates and 83% about energy costs. Accordingly, 40% of SMEs are not well positioned to withstand a recession, and 67% expect the Australian economy to weaken in the next three months. Recruitment activity is stagnant, with only 19% actively seeking to fill roles. 62% of these are struggling to find skilled applicants with suitable wage expectations.

Table 3: recruitment

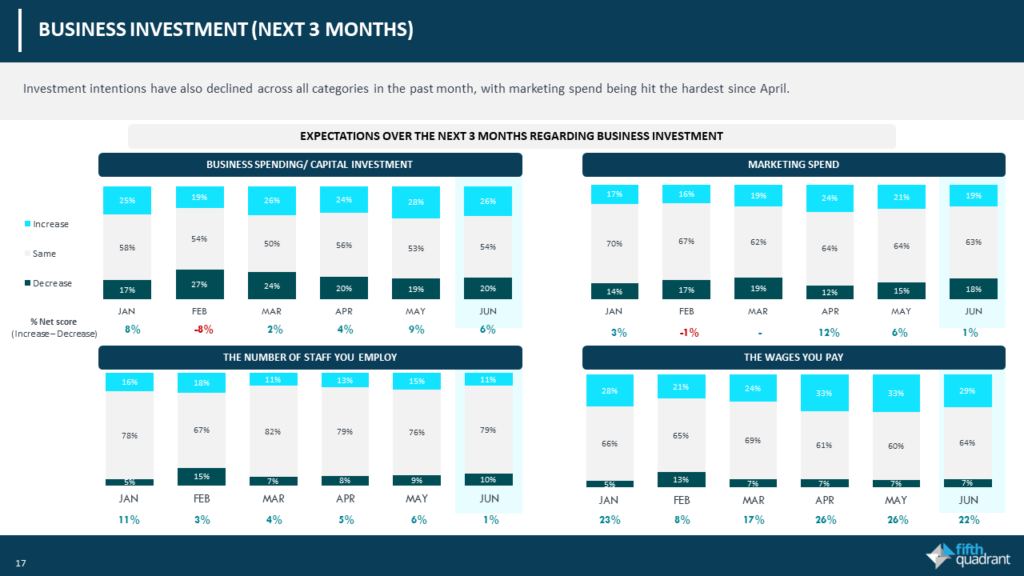

Consistent with these challenges, there is an increased demand for additional finance (15%) especially for working capital. However, investment in capital equipment and marketing are both expected to decline.

Table 4: business investment

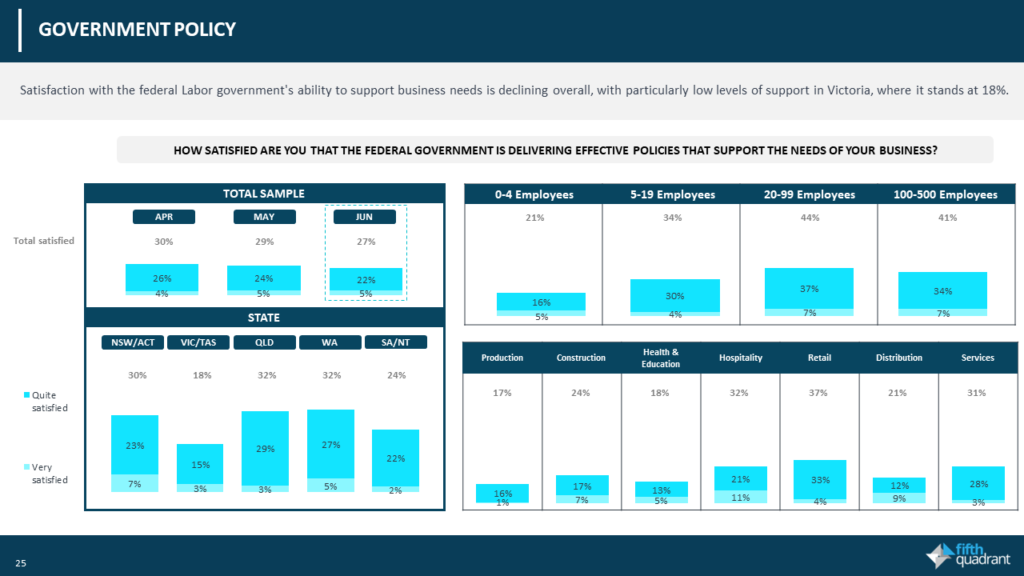

Accordingly, satisfaction with the federal Labor government’s ability to support business needs has declined to 27% overall, with particularly low levels of support in Victoria, where it stands at 18%.

Table 5: government policy

In summary, the June data paints a challenging picture. The increase in interest rates continues to dampen demand and the cost of doing business continues to rise, making it very difficult for SMEs to remain profitable. Accordingly, sentiment remains weak and recruitment activity soft. These indicators highlight the tough economic environment SMEs are navigating

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research will publish monthly updates of this research.

Posted in Financial Services, B2B, QN, TL