Author: James Organ | Posted On: 10 Jan 2024

Updates to this research are published monthly. View previous wave.

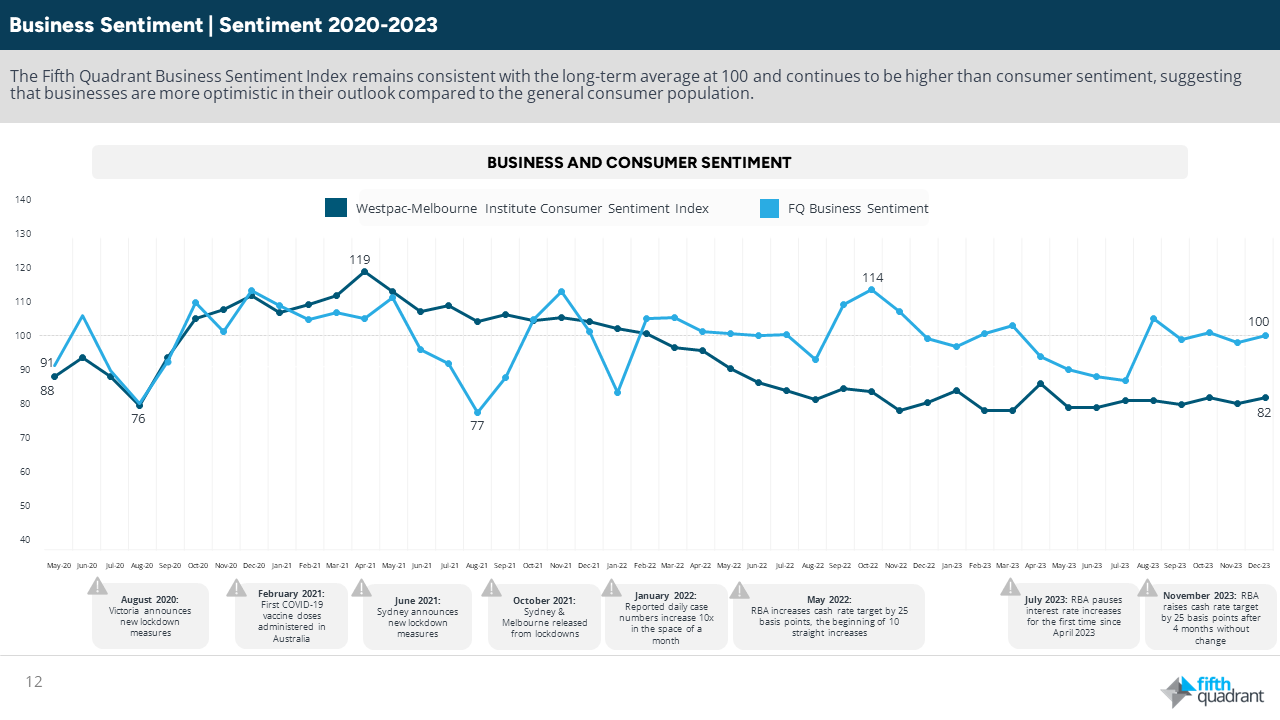

The latest wave of the Fifth Quadrant SME Sentiment Tracker shows business sentiment is stable, despite challenging market conditions. The Fifth Quadrant Business Sentiment Index remains steady at 100, consistent with the long-term average.

table 1: business sentiment index

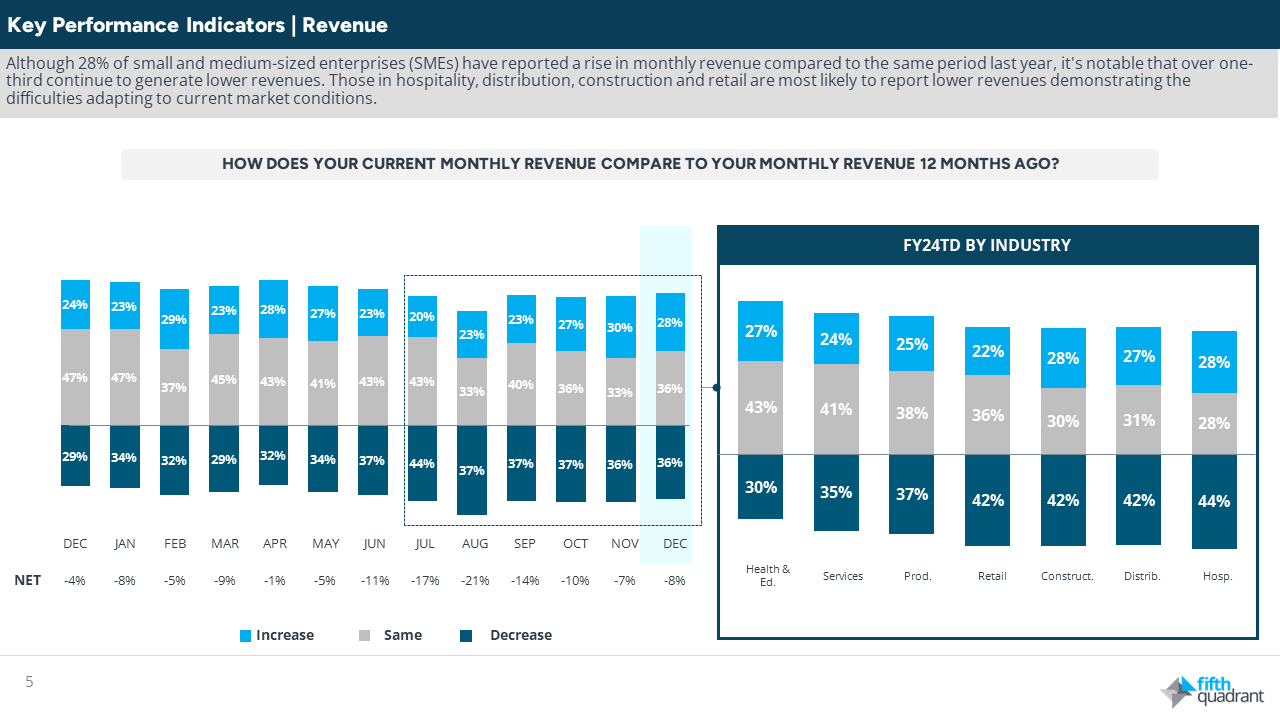

The December report highlights that while 28% of SMEs have experienced an increase in monthly revenue compared to the same period last year, over one-third continue to witness declining revenues. The most impacted sectors include hospitality, distribution, construction, and retail, underscoring the difficulties these sectors face adapting to the current market environment.

Table 2: revenue

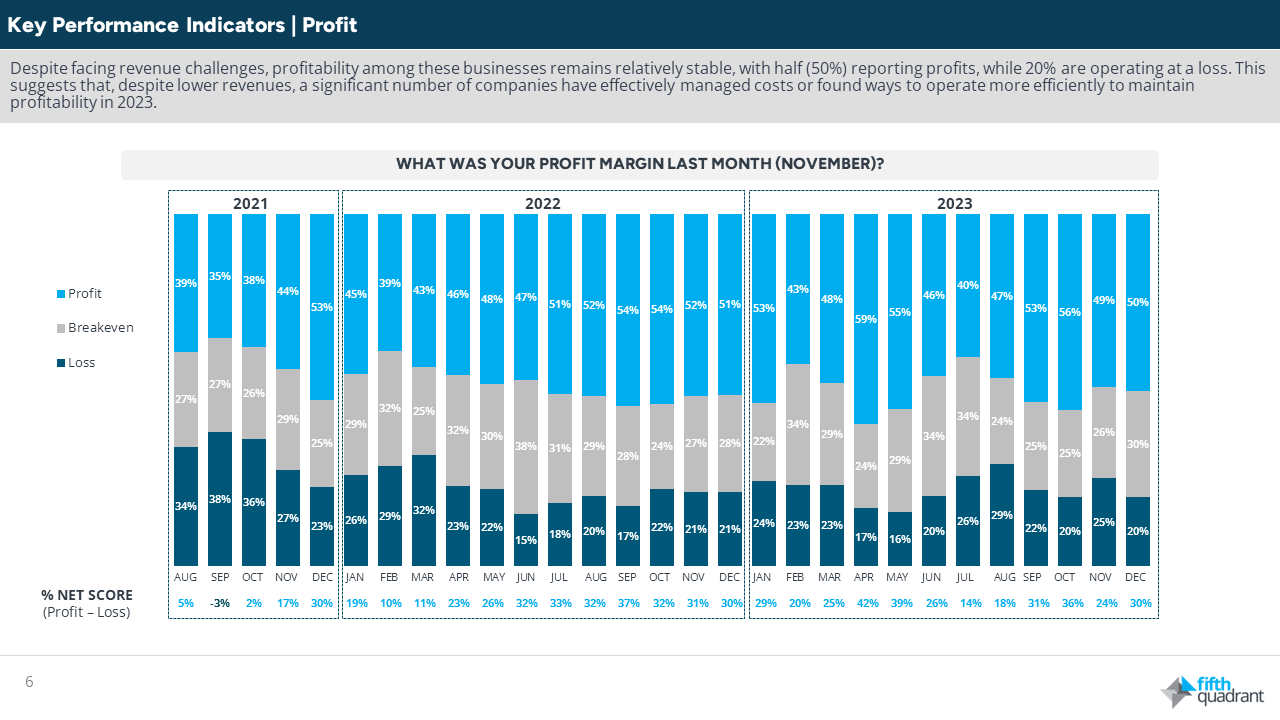

In an encouraging sign of resilience, profitability among these businesses remains relatively stable. Half of the surveyed SMEs report profits, while only 20% are operating at a loss. This resilience suggests effective cost management and operational efficiencies, enabling many companies to maintain profitability despite revenue challenges.

Table 3: profit

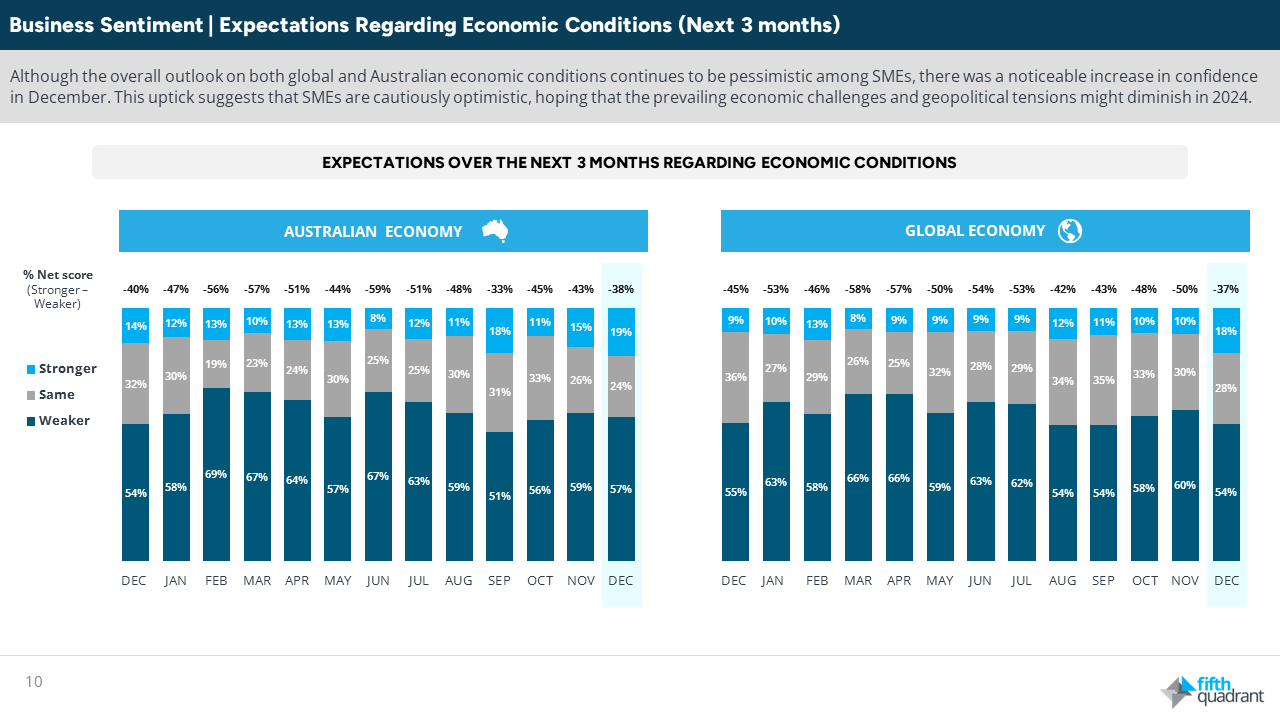

However, SMEs continue to voice major concerns over rising input costs, indicating expectations of continued inflationary pressures into 2024. The overall economic outlook among SMEs remains cautious, with prevailing pessimism regarding global and Australian conditions. Nevertheless, a noticeable upturn in confidence was observed in December, underpinning a level of positivity for the coming year.

Table 4: economic conditions

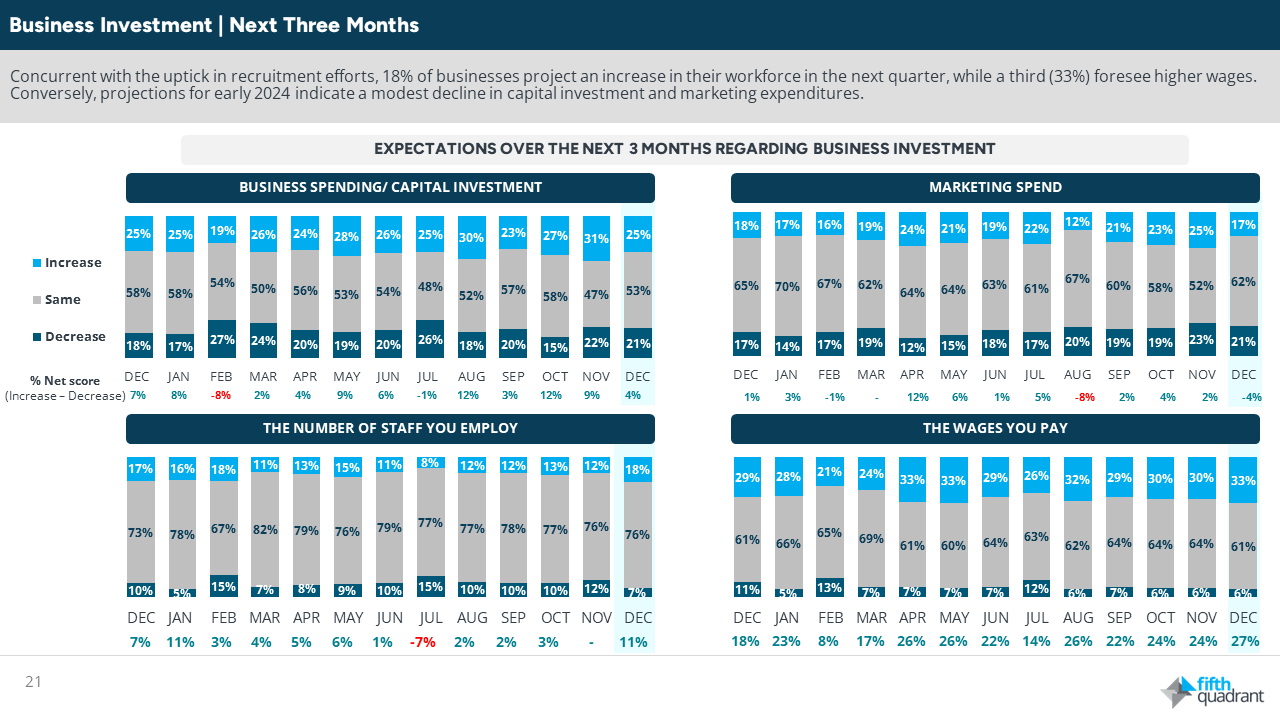

Looking ahead, short-term revenue projections for SMEs are also positive with one-third anticipating revenue increases in January. Furthermore, 37% of SMEs are setting their sights on growth in 2024, with a decrease in the number of businesses (13%) planning to downsize or exit. Additionally, 18% of businesses project an increase in their workforce in the next quarter, with a third foreseeing higher wages., However, projections for early 2024, indicate a modest decline in capital investment and marketing expenditures.

Table 5: business investment expectations

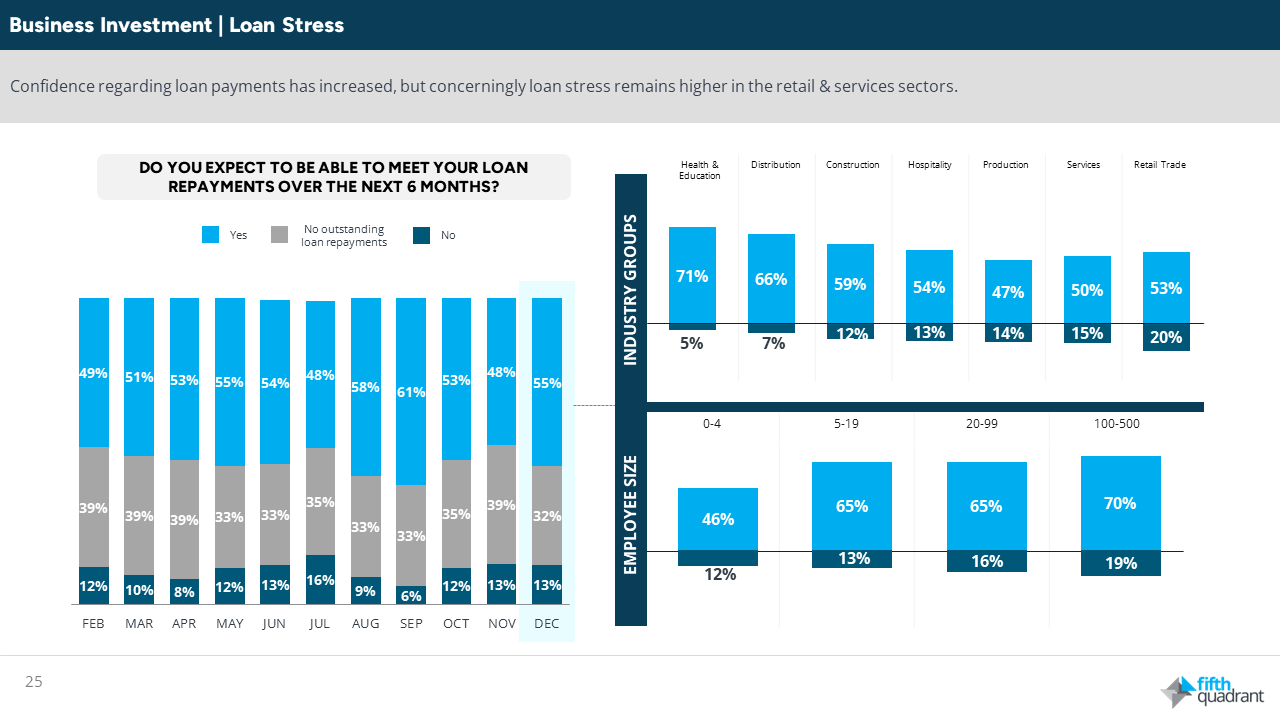

The demand for finance also spiked in December, with 20% of businesses indicating a need for additional funds to kickstart operations in 2024. However, while confidence in the ability to make loan payments has increased, loan stress remains a concern, particularly in the retail and services sectors.

Table 6: loan stress

In summary, heading into 2024, the sentiment among SMEs appears cautiously optimistic despite challenging market conditions. While revenue fluctuations persist, businesses continue to demonstrate resilience and effective cost management. Concerns over rising input costs and inflationary pressures remain, yet there’s a growing confidence in revenue growth and workforce expansion. In summary, many SMEs will be hoping for a brighter 2024, after another year of significant challenges.

Please click on this link to access the full report including subgroup analysis by industry sector, size of business and State. Fifth Quadrant and Ovation Research publish monthly updates of this research.

Posted in Financial Services, B2B, QN, TL