Author: Ben Selwyn | Posted On: 12 Dec 2023

Electric vehicles are on the rise in Australia. With one month remaining in 2023, we’re at 80,446 electric vehicles sold (vs. 28,326 at the same point last year). Based on current performance, we should see around 8,500 sales recorded in December, suggesting around 89,000 as the full year result.

Comparing back to our EV market forecasts, we had predicted ~84,000 electric vehicle sales this year, meaning the final result will likely be about 5-6% higher. This talks to the level of unmet consumer demand, but supply is also a critical part of the conversation, and we have seen new market entrants such as BYD building credibility much faster than has previously been the case.

New brands regularly enter the Australian market, but there is usually a period before they achieve any significant level of sales volume. This is even more challenging given the level of fragmentation in the Australian market, with more than 50 manufacturers currently competing for passenger and light commercial vehicle sales.

The transition to electric vehicles has however disrupted this, with Early Adopter and Early Majority consumers ready to invest in well-priced EVs that can meet their vehicle usage needs. In many cases, this means a small to medium sized SUV at a reasonable price point, putting BYD’s Atto 3 and MG’s ZS EV squarely on their shopping lists.

a new player enters the Australian EV market

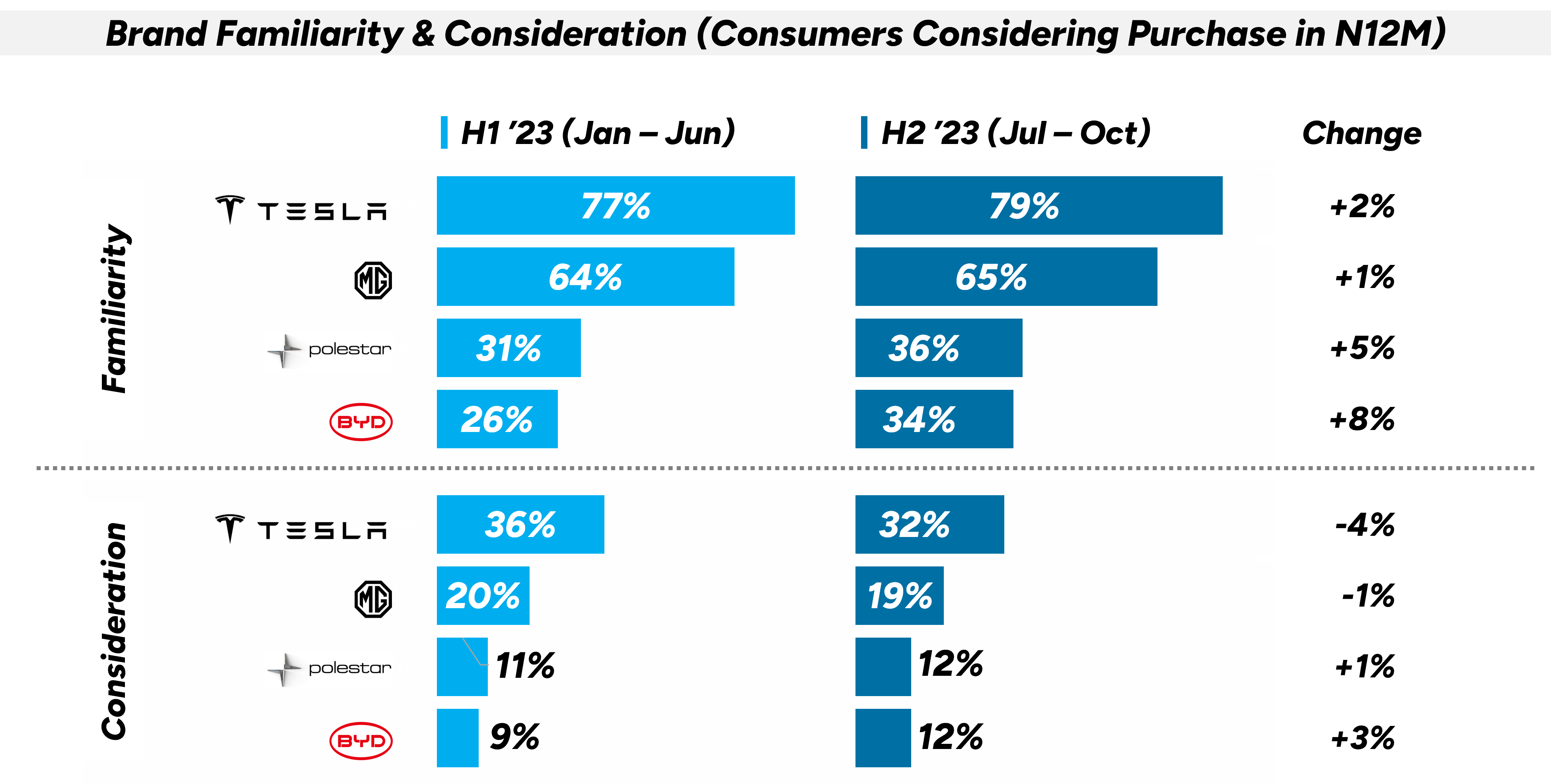

What’s particularly impressive with BYD though is how the business is leveraging this opportunity to entrench itself as a ‘known’ brand in the Australian automotive marketplace. Tapping into data from the Fifth Quadrant Consumer Insights Study, we can see that familiarity with the BYD brand among prospective vehicle purchasers has gone from around one in four in the first half of 2023, to one in three through the second half, while consideration is up by around a third to 12%. While this still leaves it well behind competitors such as Tesla and MG, BYD is approaching (and likely to swiftly overtake) other competitors such as Polestar.

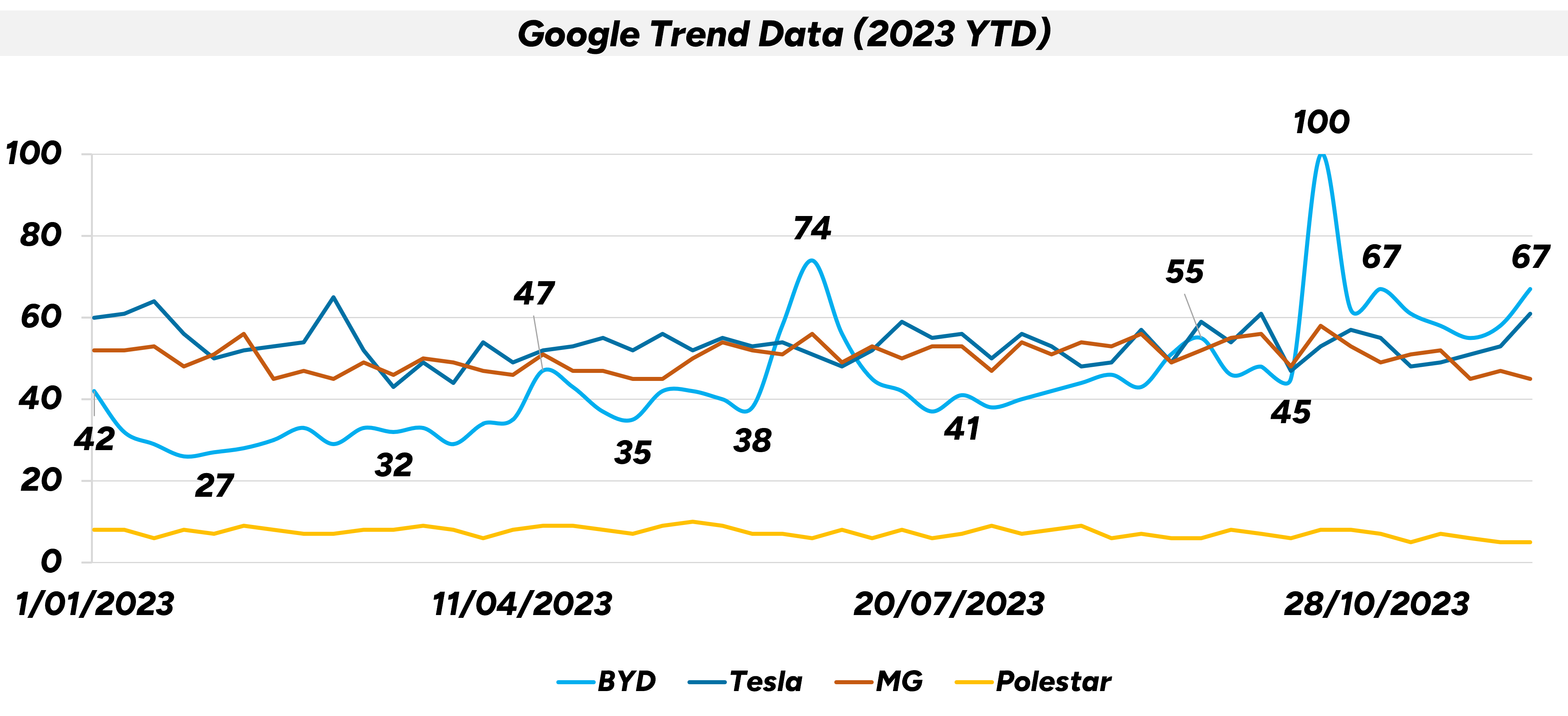

Coming at this slightly differently, Google Trend data suggests that BYD has already eclipsed Polestar, and is aggressively competing with incumbent brands in Tesla and MG. In fact, based on search traffic, BYDs announcement and launch of its new Dolphin and Seal models (as it expands into other segments of the market) has put it ahead of both other brands leading into the back end of the year.

Looking to the future, this tells us that the new vehicle market is going to change in the years ahead. Brands like MG and BYD are actively expanding their range, with a number of specialist EV brands actively considering entering the country. On the flipside, many legacy auto manufacturers appear more heavily focussed on European and American markets. From a consumer perspective, brand loyalty and traditional ownership models are naturally being disrupted, breaking historic ties, and creating opportunities for innovative operators.

If you’ve enjoyed this piece, keep an eye out for our regular updates on the Australian automotive industry.

Also remember that our consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized