Author: Dr Steve Nuttall | Posted On: 19 Jan 2026

The World Economic Forum’s January 2026 Global Value Chains Outlook delivered a blunt message: Supply Chain Volatility is now permanent. Supply chain resilience in Australia and globally is no longer a crisis response. It is the new operating model. According to the report, we have entered an “era of structural volatility” where disruption is permanent, not cyclical.

For Australian businesses that spent the past five years treating supply chain challenges as temporary setbacks, this reframing demands attention. The question is no longer when things return to normal. The question is how to build organisations that thrive when normal no longer exists.

The data paints a clear picture

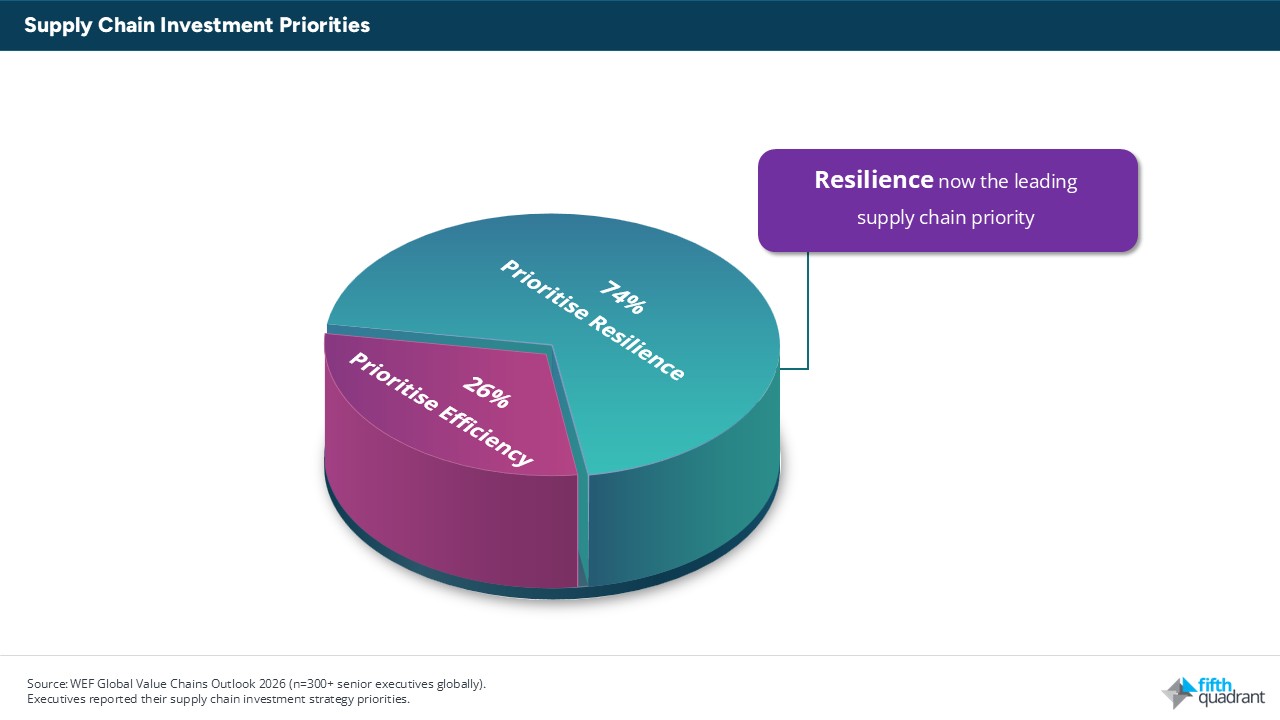

The WEF research, drawing on surveys of supply chain executives globally, reveals how dramatically priorities have shifted. Seventy-four percent of executives now prioritise resilience over efficiency, a reversal of the lean manufacturing orthodoxy that dominated for decades.

The numbers on sourcing diversification are equally striking. Seventy-seven percent of respondents have shifted sourcing away from China, while 93% are actively diversifying within Asia rather than concentrating in any single market. Buffer inventory levels have increased across 87% of organisations surveyed.

This is not a temporary hedge. It represents a fundamental restructuring of how global trade operates.

Why “structural” volatility changes everything

The distinction between cyclical and structural volatility matters. Cyclical disruptions (a port strike, a pandemic, a shipping container shortage) eventually resolve. Businesses can wait them out, absorb short-term costs, and return to previous operating models.

Structural volatility is different. The WEF report identifies several forces that are not going away: geopolitical fragmentation driving trade policy uncertainty, climate events increasing in frequency and severity, and technology transitions (particularly in energy and transport) reshaping demand patterns. Tariff escalations in 2025 alone reshuffled over $400 billion in global trade flows.

For Australian businesses, this creates a specific challenge. Geography has long been both an advantage (proximity to Asian growth markets) and a constraint (distance from traditional Western supply bases). In an era of structural volatility, that calculus shifts again. Proximity to diversifying Asian supply chains becomes more valuable. But so does the ability to hold inventory, maintain supplier optionality, and absorb cost fluctuations without passing them directly to customers.

Five shifts Australian businesses should consider

1. Treat resilience as a growth driver, not a cost centre

The old framing positioned supply chain resilience as insurance: necessary but unproductive. The WEF data suggests leading organisations now view resilience capability as competitive advantage. Businesses that can guarantee supply continuity command pricing power. Those that cannot lose customers to those that can.

2. Diversify within Asia, not away from it

The 93% diversification figure is instructive. Businesses are not abandoning Asian supply chains. They are spreading risk across multiple Asian markets. For Australian importers, this may mean developing supplier relationships in Vietnam, Indonesia, India, and Thailand rather than consolidating with Chinese manufacturers.

3. Build inventory strategically

Just-in-time inventory management optimises for efficiency in stable conditions. It fails catastrophically in volatile ones. The 87% of businesses increasing buffer stock are accepting higher carrying costs in exchange for continuity. The question for Australian businesses is not whether to hold more inventory, but which inventory categories justify the investment.

4. Invest in supply chain visibility

You cannot manage what you cannot see. Businesses with real-time visibility into supplier operations, shipping movements, and inventory positions respond faster to disruptions. Those relying on spreadsheets and quarterly supplier reviews discover problems only when shelves empty.

5. Scenario plan for disruption, not just demand

Traditional forecasting focuses on demand variability. Structural volatility requires equal attention to supply variability. What happens if a key supplier fails? If a shipping route closes? If tariffs double? Businesses that have tested these scenarios respond faster when they occur.

What this means for Australian businesses

The WEF’s “structural volatility” thesis carries particular weight for Australian SMEs and mid-market businesses. Large multinationals have the resources to maintain multiple supplier relationships, regional inventory hubs, and dedicated supply chain risk teams. Smaller businesses often lack that capacity.

Yet the same pressures apply. A sole-trader retailer dependent on a single Chinese supplier faces the same diversification imperative as a multinational. The difference is in how that imperative can be addressed.

For many Australian businesses, the practical response will involve trade-offs: accepting higher unit costs from diversified suppliers in exchange for continuity; investing in inventory management systems that previously seemed unnecessary; building relationships with secondary suppliers before the primary one fails.

None of this is comfortable. But the WEF data suggests the alternative (hoping volatility subsides) is no longer a viable strategy.

Fifth Quadrant works with Australian businesses navigating supply chain volatility, workforce challenges, and market uncertainty. Our SME Sentiment Tracker explores how Australian businesses are responding to these shifts in real time. Explore our B2B market research capabilities or get in touch to discuss your supply chain research needs.

Posted in Consumer & Retail, B2B, Technology & Telco, TL, Transport & Industrial, Uncategorized