Author: Madelief Johnston | Posted On: 17 Jan 2024

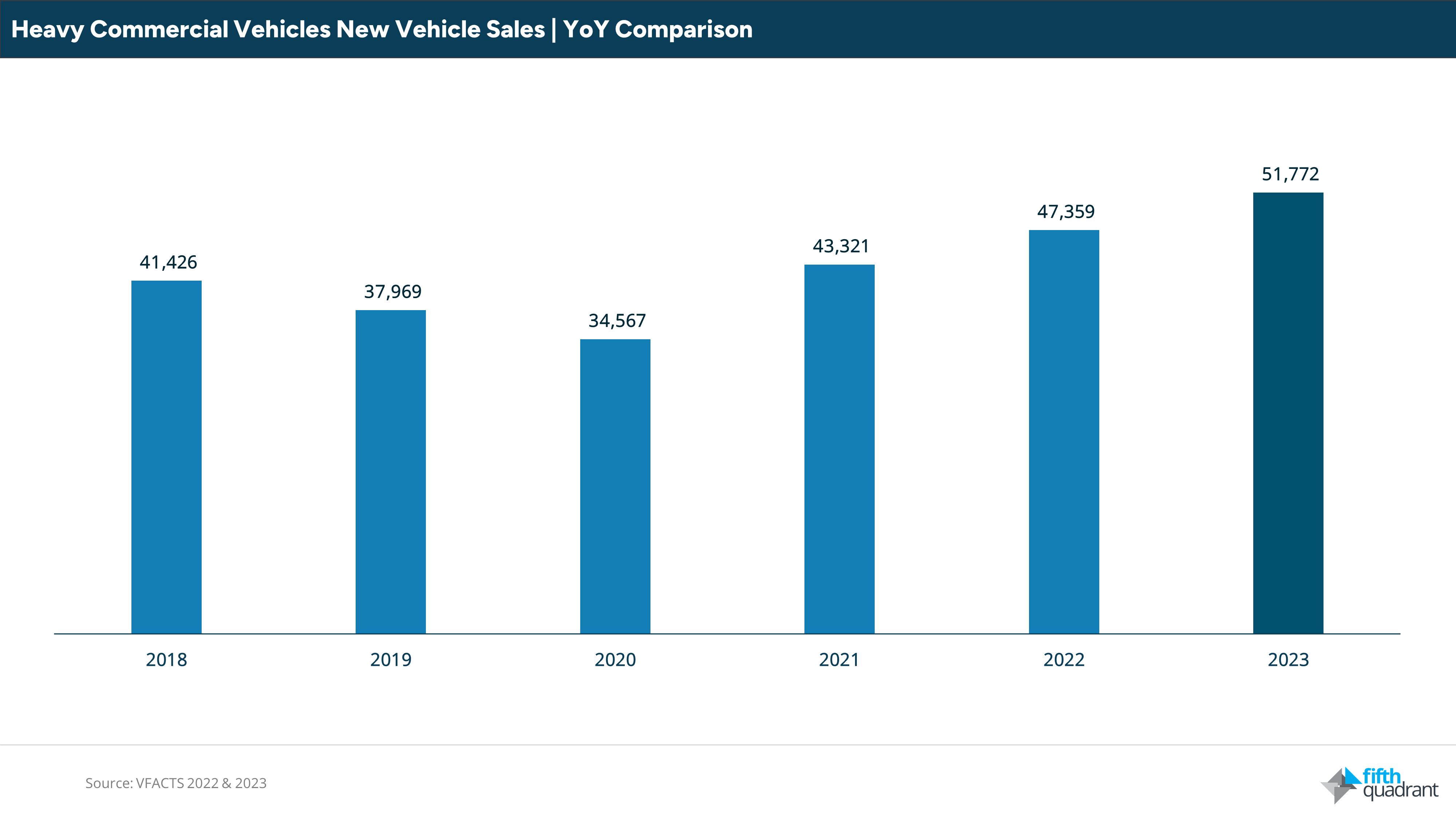

The Australian heavy commercial vehicle industry marked a record-breaking year in 2023, data from the VFACTS National Report shows. With an impressive 51,772 new vehicles hitting the roads, this sector has shown a robust increase in activity, significantly contributing to the nation’s overall sales figures, which soared past 1.2 million.

Reducing heavy commercial vehicle emissions is a key focus as we move into 2024, and the increasing emergence of electric challengers presents an intriguing challenge to the established order. Will these disruptors reshape the landscape, and how will fleet operators respond?

top takeaways from 2023: powering industry growth

- The Heavy Commercial Vehicle Boom: 2023 witnessed a staggering 9% increase from the previous year, bringing a total of 51,772 new heavy vehicles into the market.

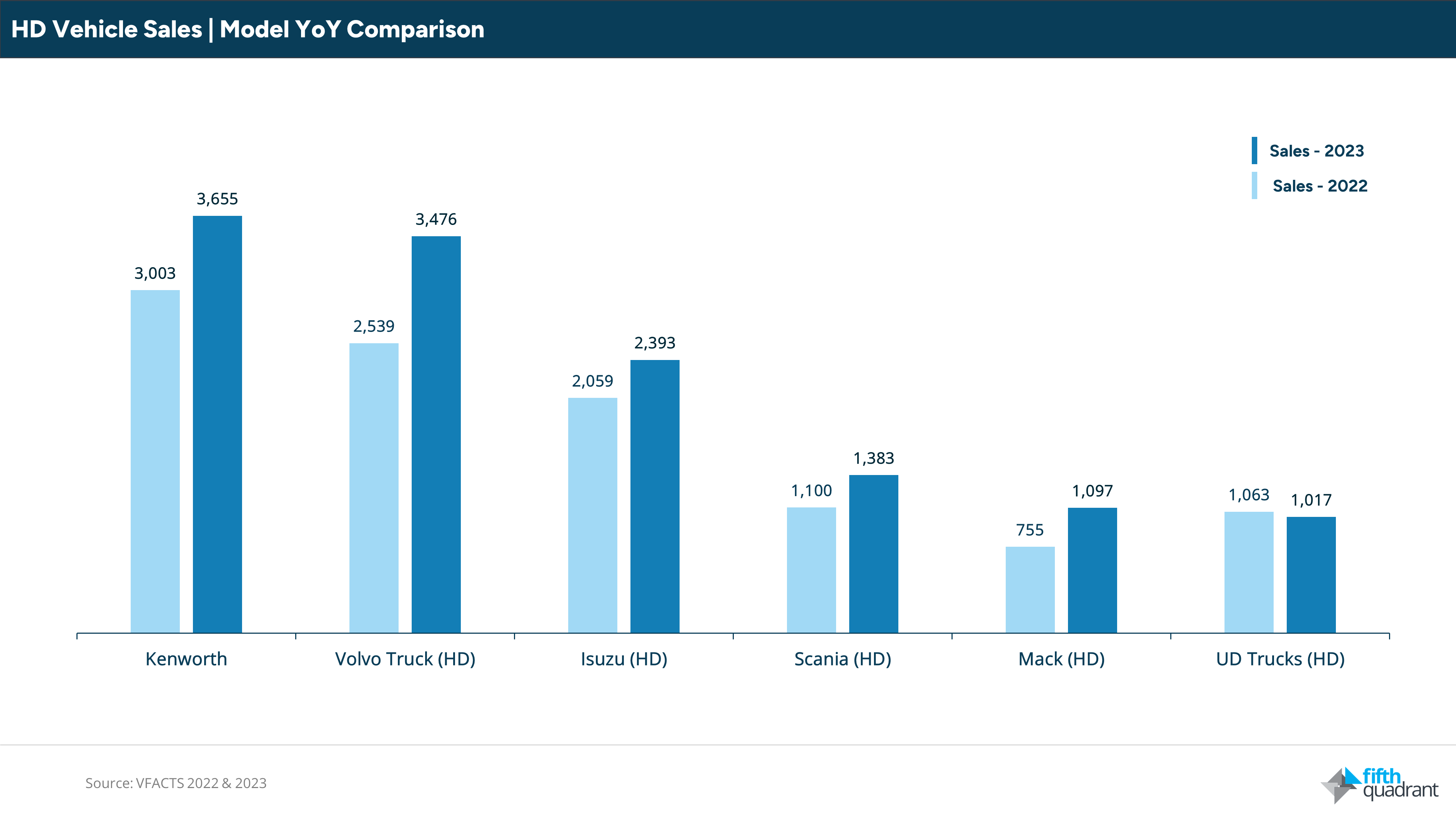

- Kenworth: The Uncontested Leader: Despite stiff competition, Kenworth retained its crown in the HD category, selling 3,655 new vehicles. However, Volvo is hot on its heels, narrowing the gap significantly.

- Mack Trucks: The Dark Horse: Despite only ranking 5th in the heavy-duty (HD) segment, Mack Trucks experienced a significant leap, ascending three places with a 45% sales boost, and nearing the 1.1k mark.

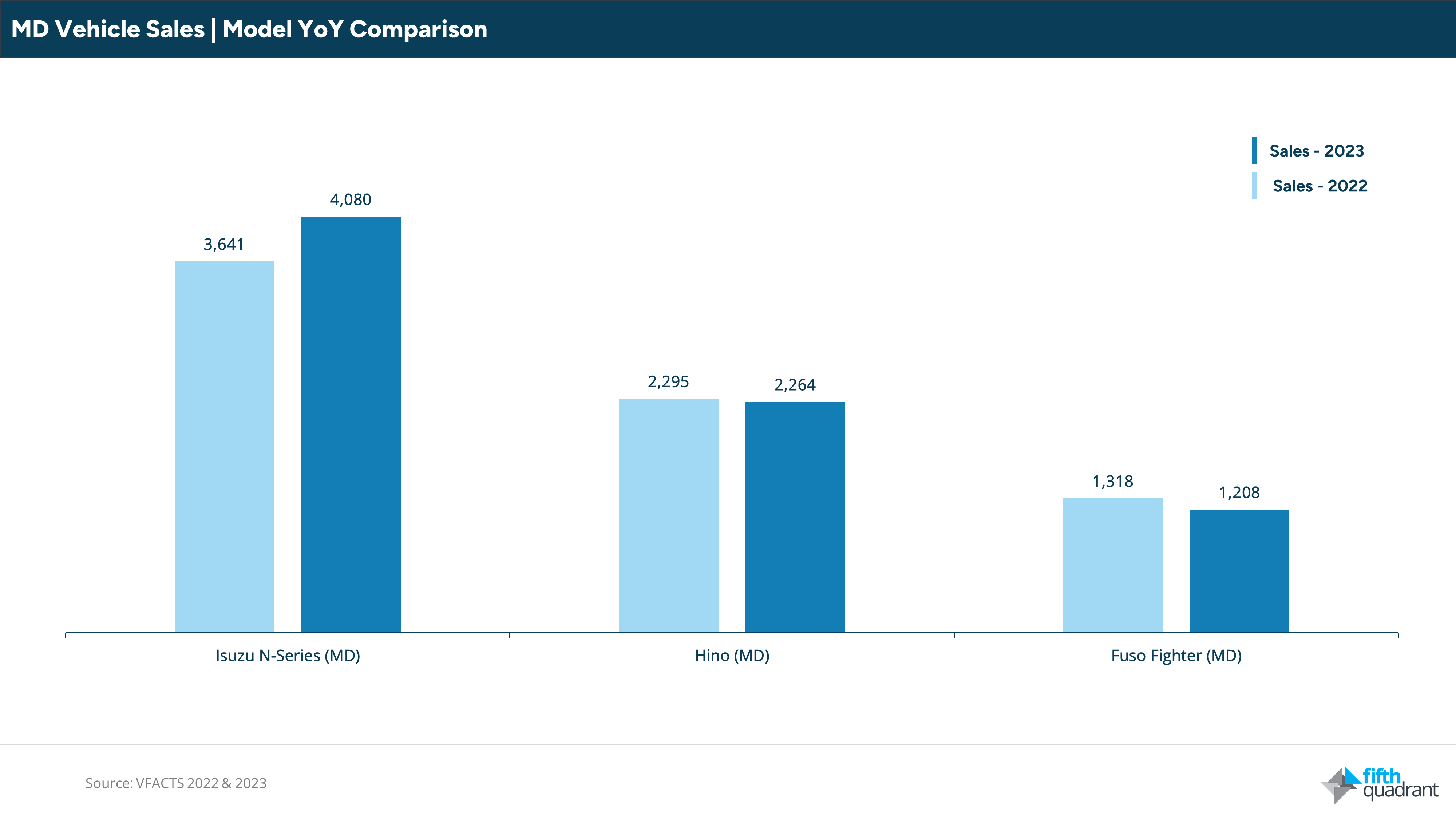

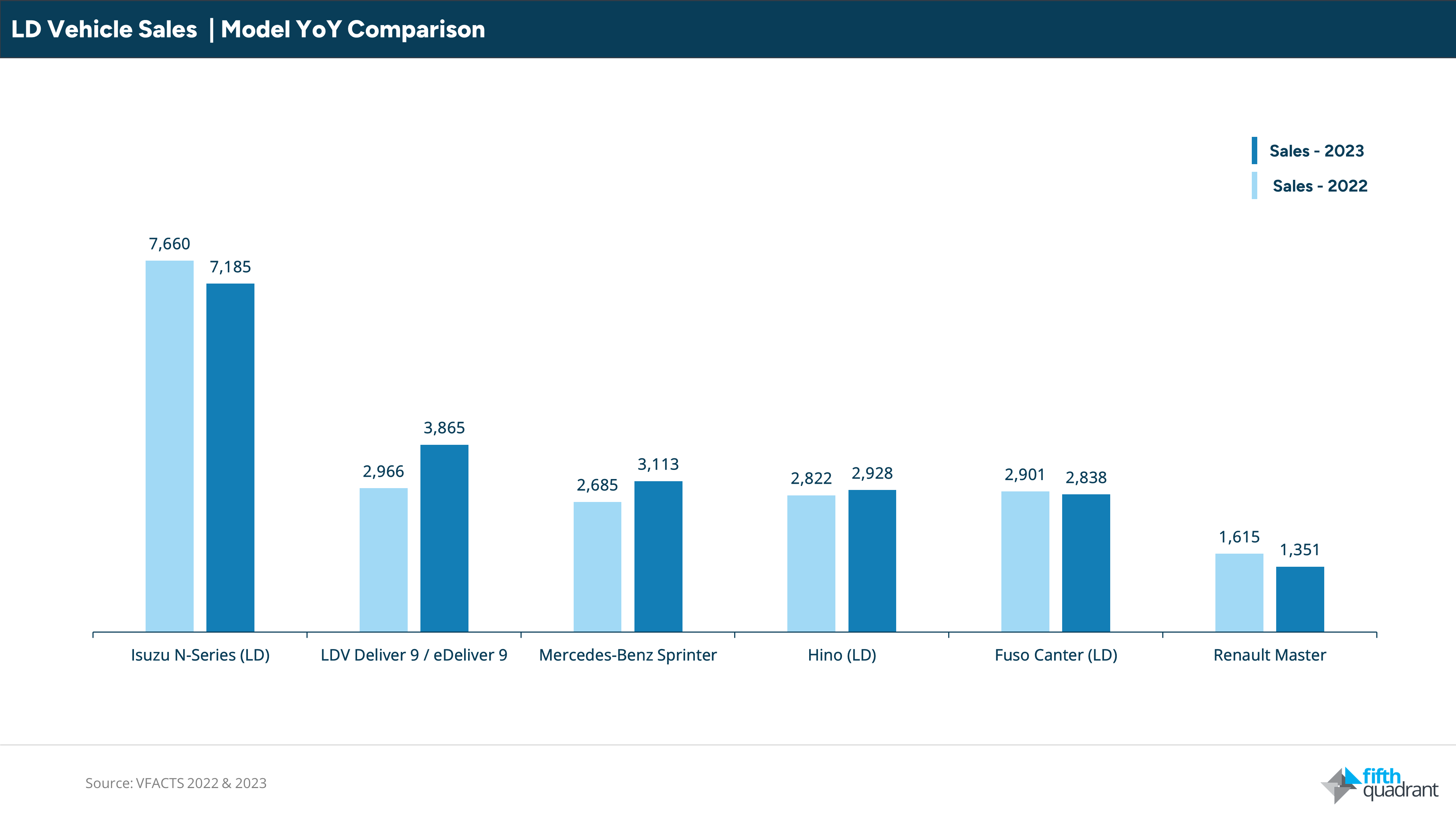

- Isuzu Shifting Sales to MD: While the Isuzu N-series (LD) continues to dominate with 7,185 sales, sales are down by almost 500 units year on year The bulk of these are however made up by growth in its MD sales (up from 3,641 sales in 2022 to 4,080 in 2023).

- The Rise of LD Electric Vehicles: The LDV Deliver 9 / eDeliver 9 (LD) saw a remarkable 30% spike in sales, to put it clearly in second in LD. While it can in part attribute this to its position as one of the early movers in the electric van space, more competitors are now here (and coming soon).

2023 YoY and MoM comparisons

The HD category enjoyed a 17% YoY increase, grabbing an additional 2% of the market share. Both medium-duty (MD) and light-duty (LD) groups witnessed notable growth, with sales increases of 4% and 6% respectively.

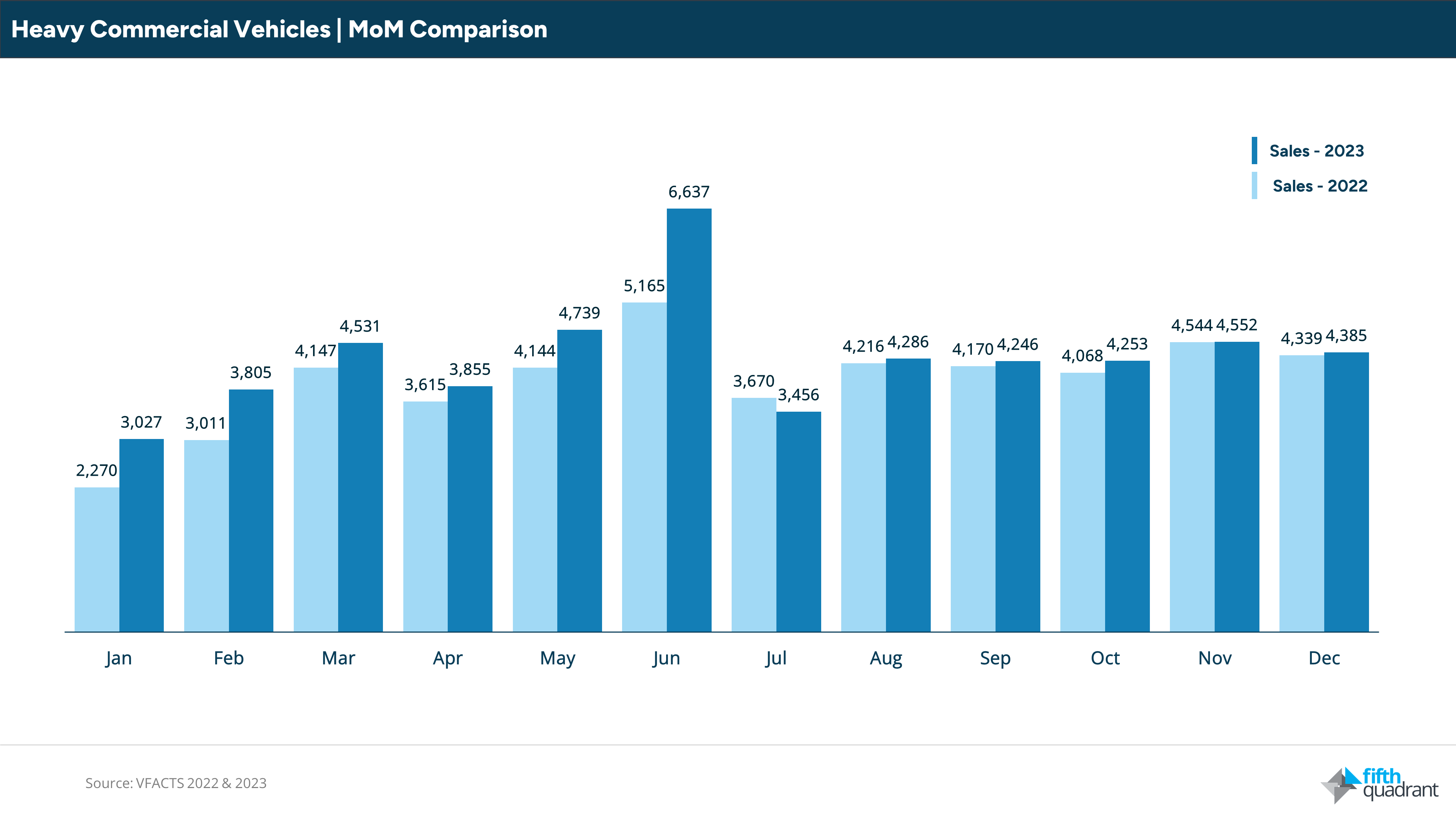

June 2023 emerged as a particularly strong month, with sales climbing by 28% compared to the previous year. This was driven by a particularly strong EOFY sales number, with the 19% surge in the first half of the year overshadowing the modest 1% increase observed in the latter half.

who were the stars in the HD, MD & LD categories?

The top 5 HD vehicles all recorded a sales uptick, with Mack and Volvo leading the charge at 45% and 37% increases, respectively. Despite Volvo closing the gap, Kenworth managed to maintain its top spot, recording a 22% rise in sales.

In the MD and LD categories, Isuzu’s N-series models led the pack with 4,080 and 7,185 sales, respectively. However, Hino (MD) and Fuso Fighter (MD) experienced slight dips in sales.

In the MD and LD categories, Isuzu’s N-series models led the pack with 4,080 and 7,185 sales, respectively. Isuzu’s MD product did this while recording 12% YoY growth, while both Hino (MD) and Fuso Fighter (MD) experienced slight dips in sales compared to 2022.

This year, 26,048 LD vehicles were sold, which gave the category a 50% share of Heavy Commercial vehicles sales (down 2% from last year). The Isuzu N-Series (LD) was the top-selling vehicle with 7,185 new vehicles, nearly double the next closest competitor, the LDV Deliver 9 / eDeliver 9 with 3,865 sales. Just 275 sales separated 3rd from 5th, with the MB Sprinter, Hino light truck and Fuso Canter in close competition.

looking ahead: what’s next for the heavy vehicle industry?

The Australian heavy commercial vehicle market experienced a landmark year in 2023, marked by significant growth and the exciting emergence of electric vehicles. As we venture into 2024, several questions loom over the horizon. Can the category sustain its current momentum amid economic uncertainties, will we see Kenworth unseated from its position at the top of the HD market, and how will electric models alter the industry’s trajectory?

If you’ve enjoyed this piece, you can download our year in review summary slides here, and don’t forget to keep an eye out for our regular updates on the Australian automotive industry.

Also remember that our b2b and consumer tracking research runs monthly. Click here to find out more, and feel free to get in touch if you’ve got questions that you’d like to answer.

Posted in Auto & Mobility, B2B, QN, TL, Transport & Industrial, Uncategorized