Author: Angus McLachlan | Posted On: 12 Dec 2023

As the holiday season approaches, Australians find themselves grappling with the delicate balance of festive spending amidst escalating cost-of-living pressures. For many households, the overwhelming concern of managing tighter budgets has the potential to dampen the anticipation and excitement that typically characterise this time of year.

However, as the Fifth Quadrant Consumer Insights Study revealed in September, gift giving remains a top priority for Australians, despite the current cost-of-living crisis. Australian consumers expect to spend $10.5 billion on gifts this Christmas, at an average spend of $578 per person.

As we found in the 2023 edition of CommBank Consumer Insights, the average consumer is redirecting $448.40 per month towards essentials and savings as a response to the rising cost-of-living. With household budgets stretched to the limits, many SMEs are now offering greater payment flexibility to accommodate the changing needs and expectations of consumers.

more SMEs are now offering BNPL

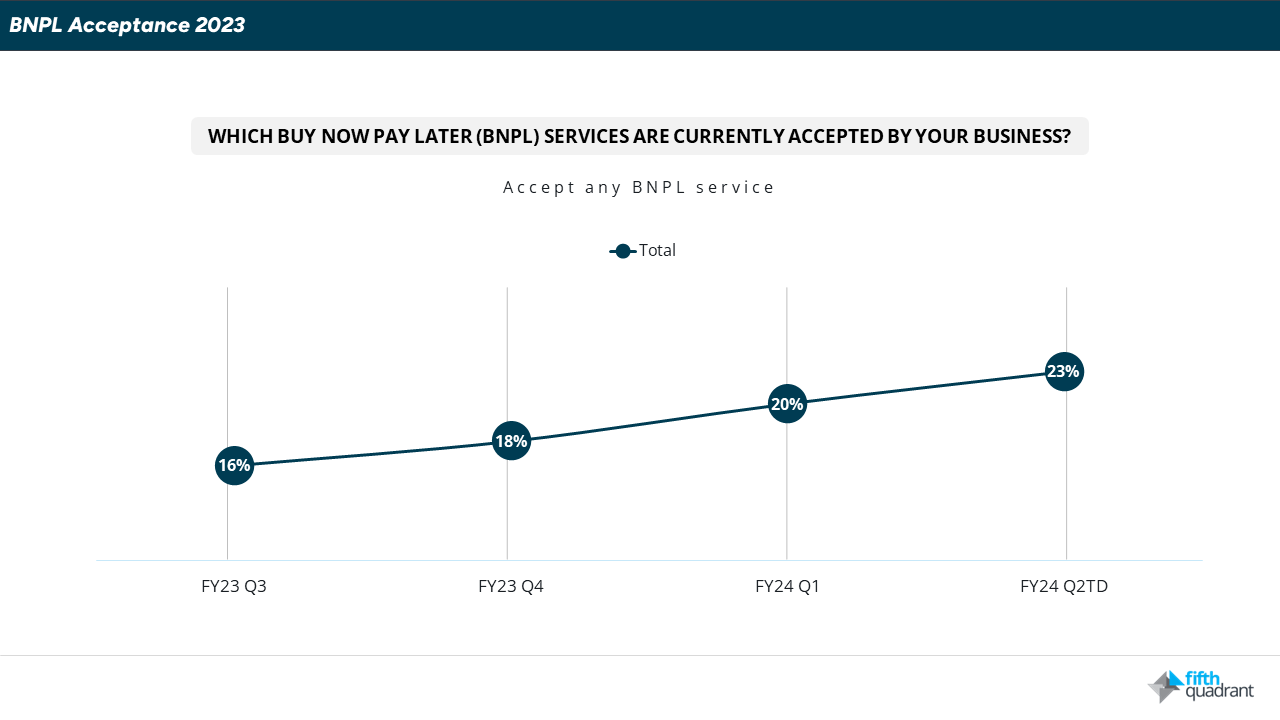

Our monthly Fifth Quadrant SME Sentiment Tracker found during Q3 FY23, 16% of SMEs accepted BNPL as a payment option. As the year has progressed, along with the current cost-of-living situation, this figure has jumped to 23% in Q2 FY24.

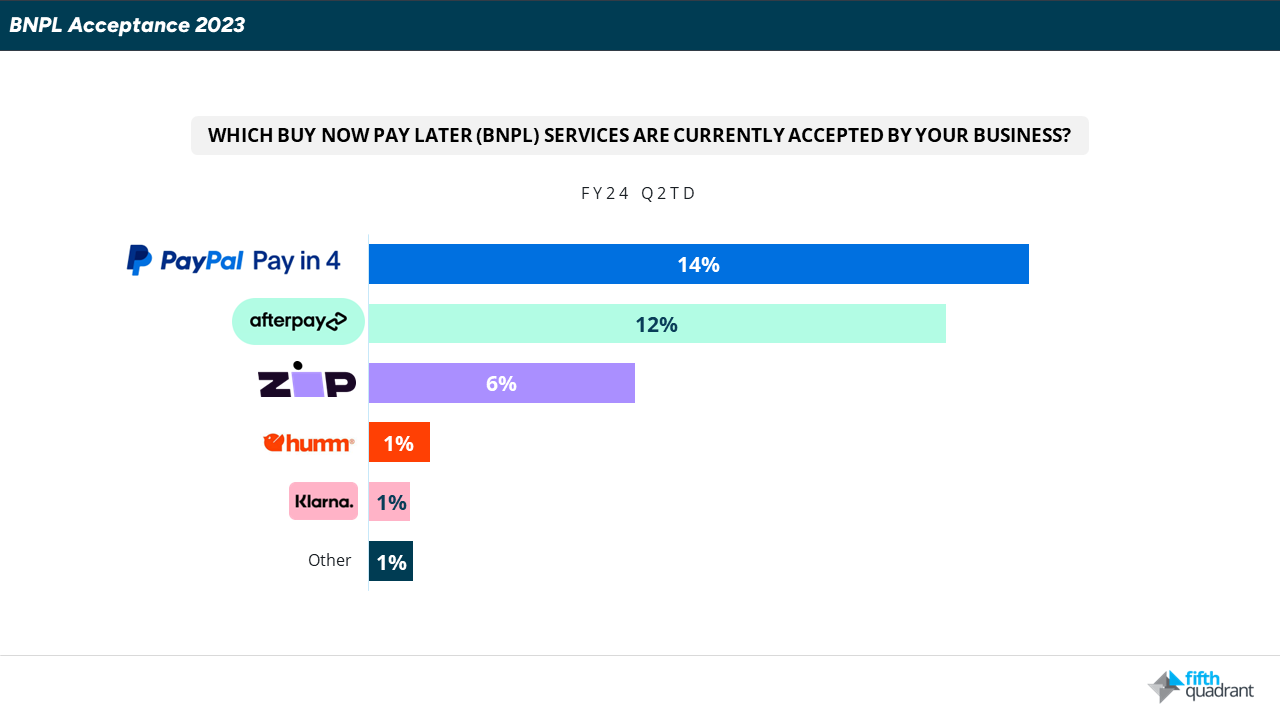

As we approach the festive season, PayPal Pay in 4 is the most commonly accepted BNPL service (14%), with Afterpay a close second (12%), followed by Zip (6%).

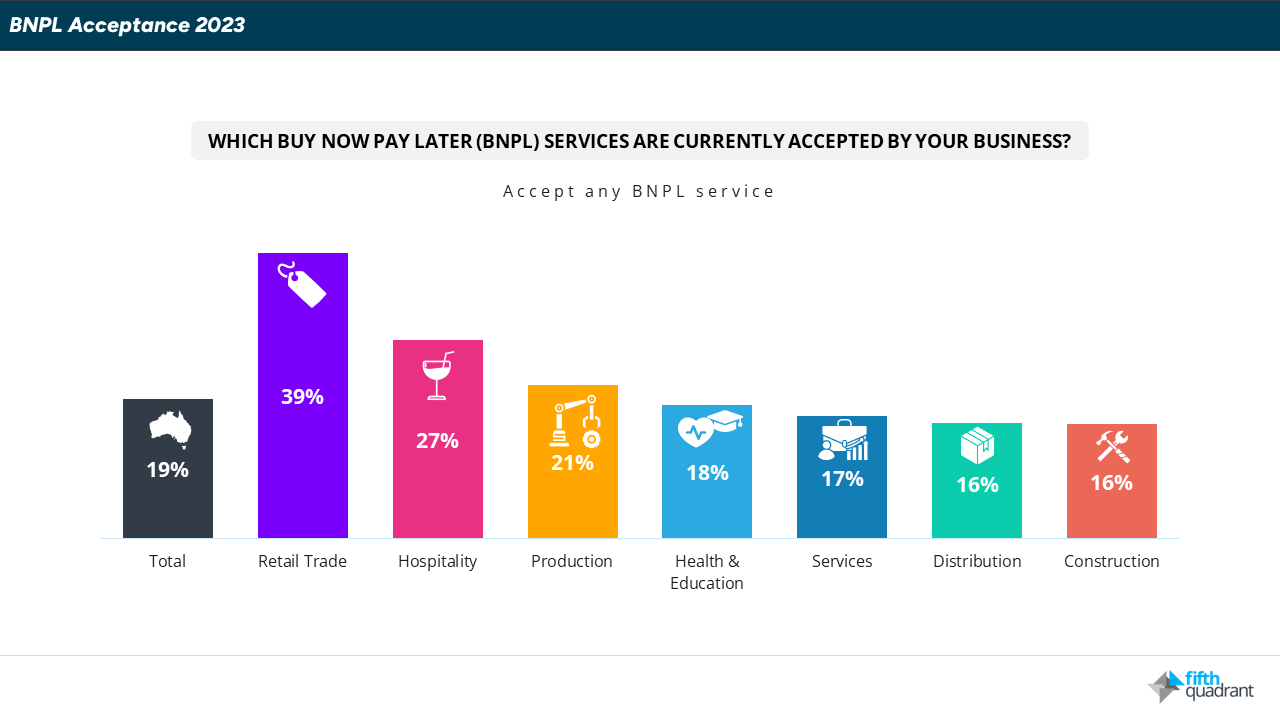

BNPL widely accepted across industries

SMEs across all industries have been quick to recognise the benefits of offering flexible payment options. The Retail sector unsurprisingly leads the way, with 4 in 10 (39%) retailers offering BNPL as a payment option. Over one quarter (27%) of Hospitality-based SMEs have become BNPL merchants in time for the festive season, as the summer months inspire many to eat, drink and travel.

BNPL merchants are more optimistic and growth oriented

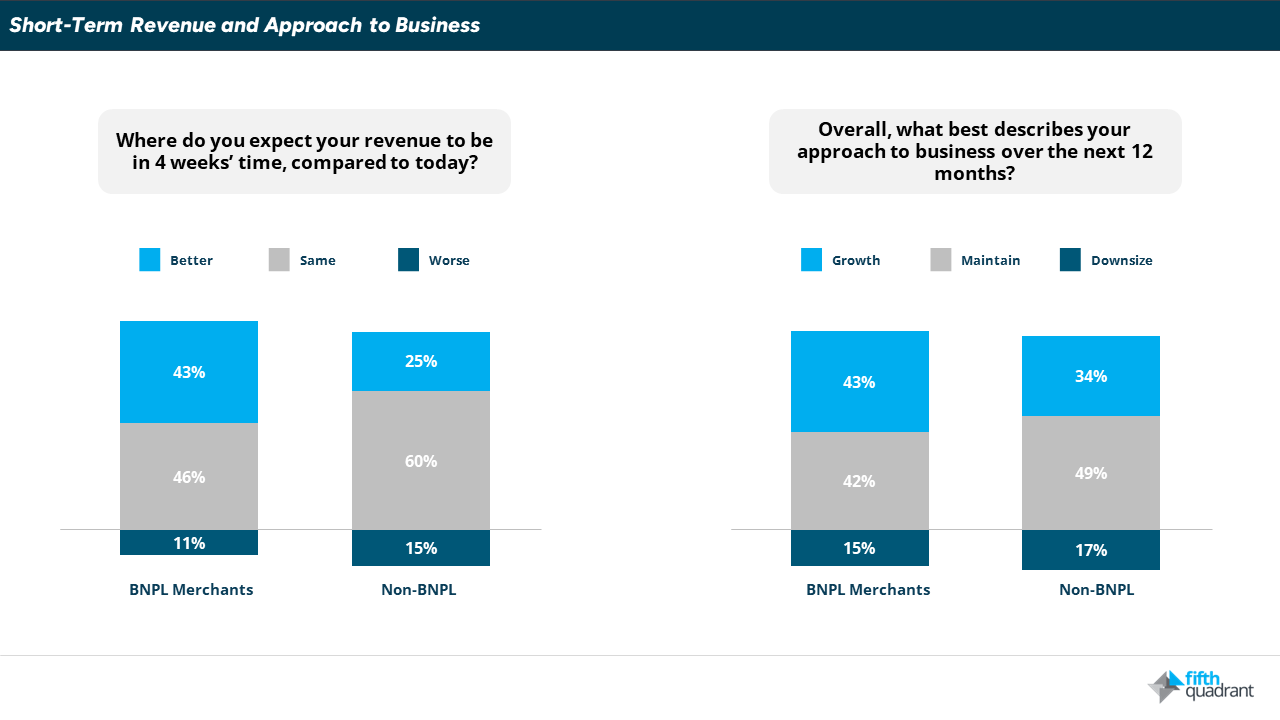

Heading into the Christmas period, BNPL merchants are highly optimistic about their short-term revenue prospects. Additionally, these SMEs are focussing on growth at a much higher rate than their non-merchant counterparts.

Currently, nearly half (43%) of all SMEs that offer BNPL expect their revenue to increase over the next month. 43% of BNPL merchants are also focussing on growth.

Evidently, SMEs who wish to win this festive season recognise BNPL as the tool for the job. For consumers who are unwilling to forgo generous gift giving this Christmas, even amidst a cost-of-living crisis, the ability to defer repayments into 2024 appears highly desirable.

Will BNPL merchants perform better this Christmas period? Revisit our Insights page in the new year to see the results.

To learn more about our monthly Business Sentiment Tracker, please contact us here.

Posted in Consumer & Retail, CX, Financial Services, QN, TL